We know the COVID-19 global pandemic has affected everyone in unique ways. Today we want to discuss how this health crisis has affected women, specifically financially.

As working mothers, we have felt the impact of these daily changes acutely. According to Goldman Sachs “single parents, parents with young children and parents who can’t work from home are the groups most at risk to stop working entirely because they have no child care.”

Pre-pandemic the US labor force was split roughly 50/50 between men and women. However, women’s participation rate has always been directly tied to accessible childcare and pandemic-related job losses have disproportionately impacted women. With most schools resorting to distance learning and many childcare options off the table, families are struggling. Many solutions include working mothers putting their careers on hold. According to a study by the US Census Bureau, women are 3 times more likely than men to have left their job due to child care issues during the pandemic. This has negative implications for both the economic recovery and women’s future financial health.

We already know women face unique financial challenges due to three main issues:

- Lower lifetime earnings and wages due to the gender pay gap

- Longer life expectancies

- Greater family care giving responsibilities

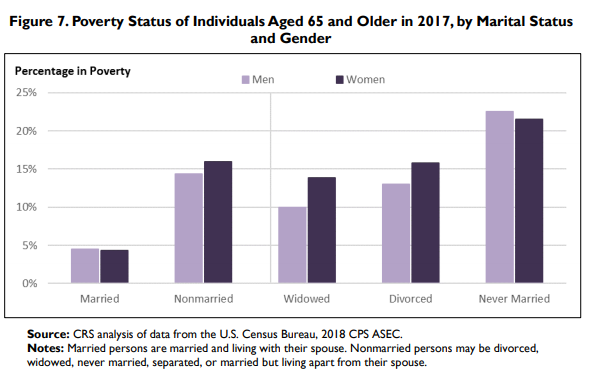

In the current health crisis, these disparities have had more severe implications for women of color and millennial women. Sadly, these financial differences compound over time and can have devastating effects. As women grow older, they are also more likely to face poverty. According to the Social Security Administration 17.3% of nonmarried elderly women are living in poverty today. The figure below illustrates the higher poverty rates women over 65 experience in almost every category:

An article in the New York Times posited that this “Pandemic Could Scar a Generation of Working Mothers.” If that happens it also has the potential to increase the pre-existing retirement challenges women face later in life. While these trends are discouraging, the stakes are higher than ever for women to take control of their financial futures. The current situation also presents new opportunities as companies are more open to hiring a diverse workforce outside their local network. This is one silver lining of the pandemic: companies now have an expanded talent pool to choose from. If your current employer does not allow the necessary flexibility, you may be able to find a better fit.

We recommend the following checklist to help you stay sane, maintain your earning power, and safeguard your finances:

- Have a financial plan in place

- Monitor your spending and budget

- Create, update or review your estate documents

- Fight for your job/flexibility if needed to help you manage job/household/kids/elderly parents

- Drop the ball: let go of the expectation that you must do it all

- Get emotional help/support from friends/family/professionals if needed

- Tune out the negative noise (news/social media/negative people)

- Invest in your future self and, if finances allow, hire additional help

- Find time to recharge – whatever that looks like for you

- Enlist your children in household chores

- Accept help when it is offered

We recognize there are no easy answers right now when it comes to meeting increased care giving demands while balancing career aspirations and financial stress. If you have questions about the best way to balance these changing demands with your long term financial goals, please contact us to speak with one of our financial advisors. We have four female advisors who are passionate about these issues and would love to help you position yourself for financial success.

Related: How Should I Position My Portfolio Before the Election?