Twenty-one years ago, the Foundation for Fiduciary Studies published Prudent Investment Practices, the first handbook of fiduciary best practices. Of the handbook’s original twenty-seven best practices, it will only take eight to satisfy the requirements of the new DOL’s Retirement Security Rule.

So, what will procedural prudence look like under the new DOL Rule?

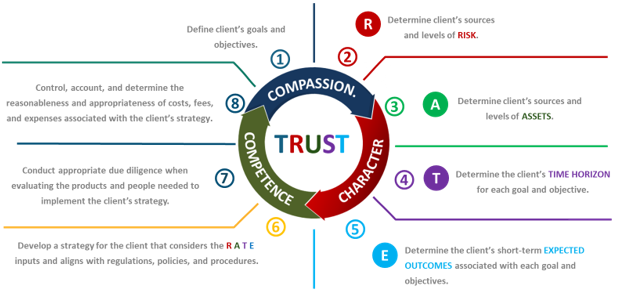

Copied below is a graphic that depicts the eight remaining fiduciary best practices arranged in a hierarchal framework. The language is universal so key decision-makers can substantiate the implementation of any investment product or strategy.

We have added to the framework the acronym RATE (Risks, Assets, Time Horizons, and Expected Outcomes) which can be used to identify the critical elements needed to develop a prudent strategy.

Since the new DOL Rule is intended to improve an investor’s trust in the advice received from an advisor or broker, we have added to the center of the framework the three behaviors that are critical to the formation of trust – compassion, character, and competence.

For more than three decades we have taught advisors and plan sponsors that a fiduciary standard has three unique features; it is…

- Based on best practices and accepted investment principles.

- Comprehensive – all facts and circumstances that may impact a client’s investment strategy are considered.

- Continuous – it is not intended to define a prudent process for a single point in time. What may be prudent today may be imprudent tomorrow if the client’s facts and circumstances have changed.

Considering these three features, what is the most glaring omission from the new DOL Rule? The fiduciary’s ongoing duty to monitor a client’s investment strategy.

Since the new DOL Rule does not meet the three-part test, it should be labeled a ‘de-minimus’ fiduciary standard. Better yet, it should not even be referred to as a fiduciary standard.

For advisors who adhere to a true fiduciary standard, they are going to have a difficult time differentiating themselves from the ‘de-minimus’ fiduciary. Now everyone will be a fiduciary…and yet…they will not.

As for investors, the new DOL Rule will not improve the management of investment decisions. And complexity associated with the Rule’s new disclosures will only increase the public’s lack of trust in advice being offered.

Related: Taking a Google Maps Approach to Professional Development