If you have been tracking the torturous workings of the infrastructure bills working their way through Congress, consideration is now being given to a "billionaire" tax, focused on a extraordinarily small subset of Americans, and intended to raise tens, perhaps even hundreds, of billions of dollars in revenues, to cover the costs of the bill. I am constantly amazed by the capacity of legislatures to write bad tax law, but this one takes the cake as perhaps the worst thought-through and most ineffective attempt ever, at rewriting tax code. That is a little unfair, I know, because the details are still being hashed out, and it is conceivable that the final version will be redeemable, but given that the clock is ticking, I am not hopeful!

The Billionaire Tax: History and Proposal

To get a sense of why we are discussing a billionaire tax, you have to start with a historical context, beginning with a recognition of increasing wealth inequality and the perception (real or otherwise) that the wealthiest were not paying their fair share of taxes, continuing with promises made during the most recent presidential campaign and culminating in the last few months of legislative slogging to get a passable bill.

The Rise of Populism

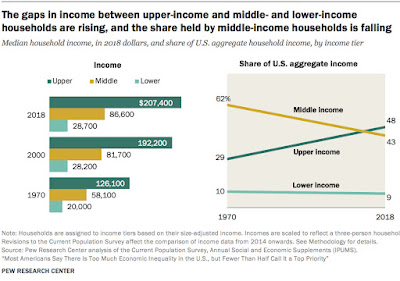

For much of this century, the big story in economics and politics has been increasing inequality, with the spread in income and wealth between the richest and the rest of society widening over time. The graph below, from the Pew Research Center, is a good starting point, since it highlight the shift in the share of aggregate US income flowing to upper, middle and lower income households.

While economists and politicians continue to debate the causes and consequences of this inequality, that income inequality is magnified when you look at the wealth levels different income groups, with the lowest income households falling even further behind. A rising stock market has augmented the wealth inequality, since the wealthiest hold the preponderance of equities in the market.

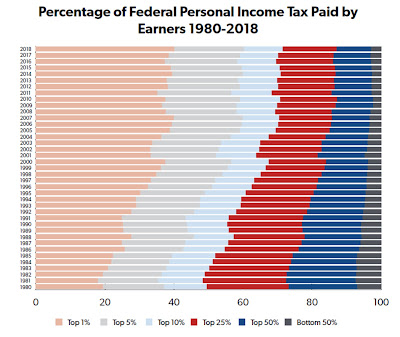

In conjunction with this widening inequality, the perception is building that the wealthy don't pay their fair share in taxes, even though the question of whether they are depends upon the prism you look through. If you focus just on federal tax dollars paid by each group, the wealthy are actually paying a larger share of federal taxes collected than ever before in history, undercutting the claim that they are welching on their tax responsibilities.

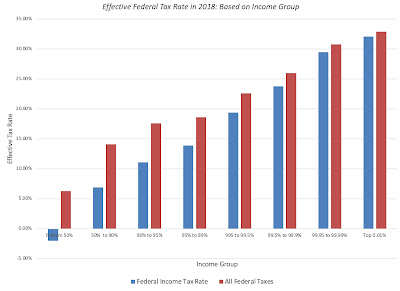

The pushback from progressives is that this graph misses key components, including other taxes collected by the government (payroll taxes, Medicare taxes, estate taxes etc.), and that it is the tax rate that is paid, not dollar taxes, that better measures fairness. In 2018, for instance, the federal effective tax rates paid by different income groups were as follows:

Clearly, while the richest are paying a higher percentage of income in taxes than the poorest, the argument made by some is that they are paying a lower percent of their taxes than they were 40 or 50 years ago (which is true) and that they can afford to pay more (which is debatable).

Elections and Infrastructure Legislation

To understand why the billionaire tax proposal has become one of the center pieces of the revenue side of the infrastructure bill, we have to retrace the path taken during the 2020 presidential election. During the presidential campaign, President Biden promised repeatedly that he would not raise taxes on anyone making less than $400,000 a year in income, effectively locking out 98.2% of income tax payers from any proposed tax increase. In conjunction, he also argued that the top 1.8% of the populace were not paying their fair share of taxes, and that corporations were also paying too little, and that any rewrite of the tax code would force them to pay their "fair share". In keeping with these two promises, the version of the big infrastructure bills that was initially promoted by the administration raised a significant portion of revenues from changes in tax rates for the wealthiest individuals (by raising the marginal tax rate from 37% to 39.6% for those in the $400,000 plus income range and by adding a surtax on capital gains for those making more than a million dollars in income) and by raising corporate tax rates from 21% to 28%. After months of back and forth between members, the House Ways and Means Committee approved tax provisions on September 15 that included many of these proposals, raising the corporate tax rate from 21% to 26.5%, while putting limits on interest tax deductions, and the individual tax rate to 39.6% (for income) and 25% (for capital gains).

Breaking the Logjam?

The proposals to raise revenues, from the While House and the House committee ran aground, because of objections on raising tax rates from Senator Sinema last week, leading to a rethink of the revenue side. As higher tax rates were taken off the table, the congressional committees had to look elsewhere, and the billionaire tax proposal seems to be gaining traction, as the replacement. Since almost everything we know about the proposals comes from unofficial sources or news leaks, and talks are still continuing, everything could change in the next couple of days, but here is what the proposals look like on Monday, October 25:

1. Targeted Taxpayers: The tax will be targeted at individuals who own more than $1 billion in assets or have had income of more than $100 million for three consecutive years. That is pretty elite company, and it is estimated that less than 1000 taxpayers in the United States would be affected.

2. Taxable Items: The tax would apply to a wide array of assets, including stocks, bonds, real estate and art. I am assuming that closely held businesses are not covered by the tax, or if they are, they will be dealt with differently, but since the proposal is still in the process of being written, we just don't know.

3. The Proposal: The changes in values of these assets will be subject to tax, even though the individuals continue to hold them, making this a tax on "unrealized" capital gains. There is talk that taxpayers will be allowed to deduct "unrealized" capital losses as well, though the details remain fuzzy.

4. The Tax Rate: It is not clear what tax rate would apply on these changes in value, i.e., whether it would be an extension of the capital gains tax rate to these unrealized capital gains, or some other rate, and also whether the tax rate will be the same for all assets, irrespective of liquidity.

In conjunction, corporations will also face a corporate minimum tax rate, putting a floor (at least in theory) on how low they can make their effective tax rates. I will leave it others to discuss that aspect of the tax code, which at least has a defensible basis, but I find the billionaire tax to be problematic at multiple levels.

The Worst Tax Code Change Ever

As I noted earlier, there may be changes that happen between now and when this gets voted on that help make it better, but as it stands, this is an extraordinarily bad tax proposal, and for many reasons:

1. Micro targeting: Since very few of us to like paying more in taxes, but don't seem to mind seeing others paying more, the political payoff from targeting very few taxpayers is that you minimize the backlash. I know that each of us probably has a billionaire that we hate, and may take secret pleasure in watching that billionaire pay more, but if you view the prime role of taxes as generating revenues for governments, it is dangerous to focus raising tax revenues from this small a number. As a general rule, taxes that are broad based and affect most people are more likely to deliver predicted revenues than those that affect a narrow subset of the population, and the billionaire tax is about as narrowly focused as tax law gets. You may have little sympathy for the seven hundred or so billionaires affected by these taxes, but you should also recognize that these individuals also have the most resources to find ways to minimize the impact of these laws. In fact, not only is an army of tax lawyers, accountants and investment vehicles being created while the law in being written, but I would not be surprised if they are providing input on its actual form. As a final note, as some readers have pointed out, it is worth remembering history. In 1969, Congress added an alternative minimum tax to the code, ostensibly to force less than 200 families that were not paying federal taxes, to pay taxes. Fifty two years later, that abomination stays in the code and ensnares millions of taxpayers, a lesson that what starts as "targeted at a few" very quickly becomes a loose cannon, affecting many more.

2. Taxing capital gains (and losses): The basis used for computing taxes can have implications for revenues from the tax code, and that basis can range from sales (with value added and sales taxes) to salary/wage income, to capital gains. Rather than get into moralistic arguments about whether salary income is more virtuous than capital gains income (or unearned income, as its critics like to call it), I will focus on tax revenue reality. Taxes based upon revenues/sales will yield more predictable revenue for the government than taxes based upon salary income, and taxes based upon salary income will yield more stable revenues than taxes based upon capital gains. Capital gains come from stock price changes, which are far more volatile, than income earned by taxpayers, and that income, in turn, changes more on a year-to-year basis than the value of the assets they own. Without passing any judgment on which approach is better, consider tax revenues collected by California, a state that not only taxes all capital gains as ordinary income, but is also more dependent on capital gains than almost any other state, with tax revenues collected by Florida, a state without taxes on individual income:

|

| Federal Reserve Data Base (FRED) |

California's tax revenues are significantly more volatile than Florida's tax revenues, and capital gains are a big reason why that is the case. If you are in finance, and you were measuring the risk of different tax revenue sources, capital gains tax revenue would have a "higher beta" than "income tax revenues or sales tax revenues. It is true that prudent governments can find ways to put aside big portions of the capital gains tax revenues, in years of plenty, to cover shortfalls in years where capital gains tax collections are low, but when was the last time you saw prudent governance?

3. Including "unrealized" gains: The new feature of this law is its attempt to tax unrealized capital gains on assets. The problem with taxing "unrealized" gains or income is that since they are unrealized, and taxes have to be paid with cash, the question of how to come up with the cash becomes an issue, making it a central challenge for any plan, built around it. In fact, there are two practical problems with the proposal, at least as described in the press.

- Liquidity questions: If the billionaire tax is going to apply on assets like real estate and fine art, and not just on stocks and bonds, the idea that you can sell some your holdings in the open market and get the cash that you need to pay taxes does not apply as easily, since these non-traded assets are often illiquid and cannot be sold off in small parts. It will also mean that taxpayers who own non-traded assets will need appraisers to revalue these assets every year, great for the appraisal business, but almost guaranteed to create a hotbed of litigation around the appraised values.

Losses and Gains: After a decade of rising stock and bond prices, I guess that many have forgotten that not only can what goes up come down, but also that you can have extended periods where assets stagnate or drop in value. While there is airy talk of being allowed to claim unrealized losses as deductions, how exactly would this work? Put simply, if stocks are up 20% in 2021 and down in 2022, would taxpayers get refunds on their taxes paid in 2021? It is also not clear what the tax code writers are assuming about what the market will do over the next decade, when they estimate that this tax will deliver about $200 billion in revenues, but are they assuming that the good times will continue? Stock and bonds have a really good run, but history suggests that there will be not just bad times, but extended bad times for markets:

|

| Damodaran Online |

There may be no revenues at all from this tax code change, if the market has a decade like the 1970-1979 or 2000-2009, and if that happens, what are the contingency plans for the expenditure that is being funded by these revenues?

4. With side effects for other tax revenues: There is another point that I still have not seen a response to, and that is the effect that this billionaire tax will have on revenues from other parts of the tax code, particularly estate taxes. If paying the billionaire tax changes the tax basis for assets, as it should since they are being marked to market, and taxed, that will also mean that when these stocks are inherited, and ultimately sold, there will be less capital gains taxes collected. Even if this proposal is an attempt to get around the inheritance step-up windfall, it is a ham handed and a selective one that does not fix the core problem. If all that the billionaire tax code change is doing is moving forward the collection of taxes to earlier, rather than later, there is a time value benefit to the government, but it has to be a net benefit. In other words, the lost future taxes will have to be netted out against the $200 billion that it is expected to bring in revenues over the next decade.

5. It is a wealth tax, albeit on incremental, not total wealth: For a few years, progressives led by Senator Warren have argued for a wealth tax, and its pluses and minuses have been debated widely. The administration is trying hard to avoid using the words "wealth taxes" to describe this proposal, but that is sophistry. Janet Yellen's claims notwithstanding, this is a wealth tax, albeit on incremental wealth, rather than total wealth. Put simply, this proposal is biased towards people with inherited wealth, invested in non-traded assets and mature businesses, and against people invested in publicly traded equities in growth companies, many of which they have started and built up. If that is the message that the tax law writers want to send, they should at least have the decency to be up front about that message, and to defend it.

Side Costs

If the history of tax law is that there are always unintended consequences, the problem with this law is that the consequences are entirely predictable and mostly bad, and you and I, even though we are not in the billionaire club, will face them.

1. Price Effects: If there is a billionaire tax on unrealized gains, some or even many of these billionaires will have to sell portions of their asset holdings to pay taxes dues. There is no way that an Elon Musk would have been able to pay taxes on the unrealized gains on his Tesla holdings in 2020, without selling a portion of his holding. While there may be enough liquidity in a stock like Tesla to absorb that selling, there are other assets where the liquidity effect is going to be larger and more permanent.

2. Founder/Managers: One reason that investors prefer companies that have founders with substantial stock holdings running them is because they believe that there is less of a conflict of interest in these firms, than in those run by professional managers with little or no shareholdings. If this proposal is pushed through, and especially if the tax rate is set at capital gains levels, founders will have no choice but to reduce holdings over time, both to pay taxes and to shift to less traded assets.

3. Public to Private: As I said earlier, I am not sure how privately held businesses will be treated, for computing the billionaire tax, but if there is indeed a carve out for these businesses, I will predict that there will be more companies where rich founders will choose to take the company private again.

For those who view the tax code as an instrument to deliver pain, the only consolation prize will be that punishment is being meted out to those who "deserve" it the most, but I am afraid that it is a booby prize. With the billionaire tax, the intended targets will pay far less in taxes than you think they should and now that the door to unrealized profits being taxed has been opened, how do you know that you are not next on the target list?

Conclusion

I understand that those working on these tax code changes face a tough task, given the constraints that they have on them (not raising tax rates, not taxing people who make less than $400,000), but these are constraints that they imposed on themselves, either because too much was promised on campaign trails or because they are working with paper-thin majorities, where one hold out can stop the process. The problem with the billionaire taxes is that it will be ineffective at collecting tax revenues, and I am willing to wager that a decade from now, we will find that it collected only a small fraction of its promised revenues. Good intentions about creating a better social safety net cannot excuse the writing of tax laws that are inefficient at collecting revenues, ineffective even in their punitive intent and potentially dangerous for the rest of us, in terms of side costs.

Related: Triggered Disclosures: Escaping the Disclosure Dilemma