The incredible uncertainties we are facing in 2020 have raised the stakes for both our government and our investment strategies. For investors, there seem to be more questions than answers.

- Are there signals in the movement of markets that we as investors should be taking advantage of?

- Who is better for markets? Republicans or Democrats?

- What if the election is contested?

- What about socialism?

- Are there specific market segments or industries we should focus on/move away from depending on the election outcome?

- Is this the same conversation we have every 4 years or is this time different?

The political heat and differences of opinion have been extraordinary this election season.

We addressed these common client questions and more in our recent webinar with Christian Newton from Dimensional Fund Advisors. Christian broke down what we can expect from the stock market in an election year from a historical perspective as well the social science evidence about how our brains work and how that influences our perspectives.

Reflections on Democracy and Capitalism

While democracy and capitalism do not require each other, they do go together like peanut butter and jelly. While they are complementary, there is something psychologically challenging about both. On some level they are both messy processes. Capital markets can feel chaotic. No one individual oversees where the stock or bond market should be. No one fully controls the ongoing auction of every share of every company that is for sale around the world. No one congress, president, central bank or other body controls the stock market. This lack of central control can lead to stress and anxiety. The same can be said for democracy.

The same is often said of capitalism. While capitalism is messy and sometimes disappoints us, it seems to be the best way to allocate resources in a successful way. A positive way to think about this is that both democracy and capitalism are dynamic, respond to pressure and forces in society, and benefit us as citizens and investors.

Who is better for markets? Republicans or Democrats?

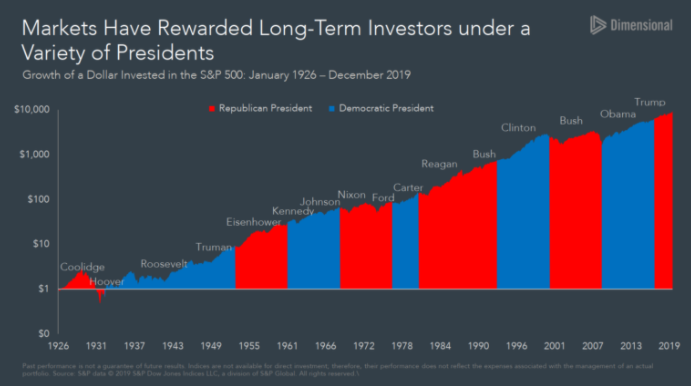

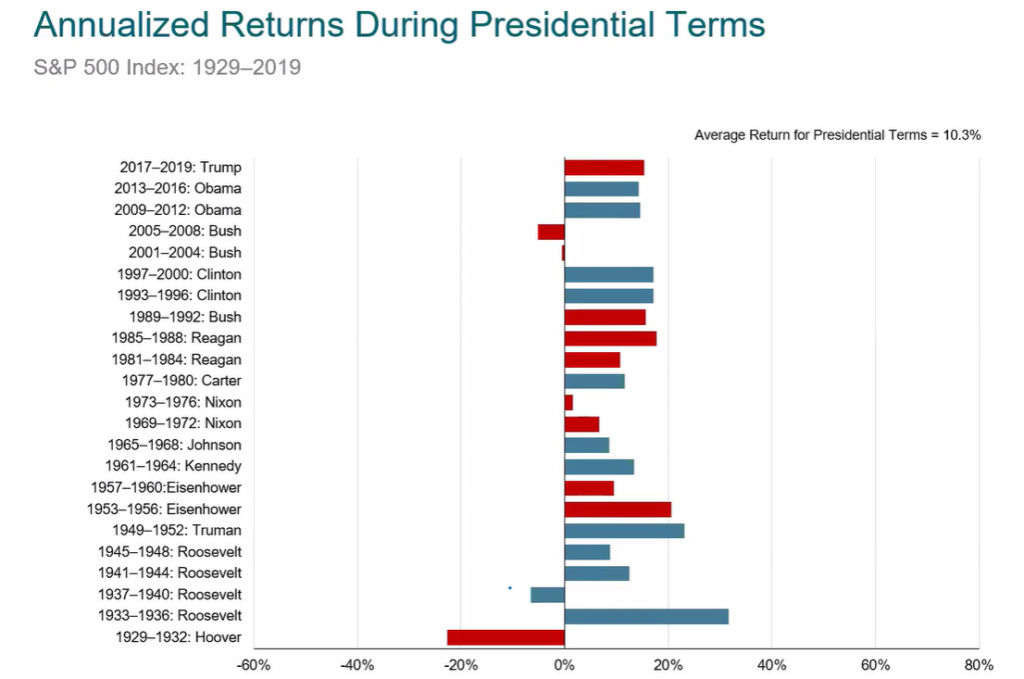

While there are a lot of theories about whether Republican or Democratic policies are better for the stock market, what we see in the data is that over the long term, the stock market has rewarded investors regardless of who is in office. There is not a dramatic difference. If we really want to choose a political party with better stock market results, until the end of 2019, democratic administrations have had a slight edge. Why is that? This is mostly a result of republican presidents governing through strong negative events such as the Great Depression, 9/11, and the Great Financial Crisis:

While political activity influences growth, the sum of the economy, GDP, and capital markets are way bigger than what any president, any congress, or any political party can control. Most presidents preside over strong market returns. For these reasons, we see no clear evidence around which to build a strategic investment thesis based on who will win the election.

Why doesn’t the market have a preference?

The daily auction in the markets reflect all future opinions-both informed and uninformed in the form of a value for all positions going forward. The net result is that the competitive market is so good at pricing assets it is the best repository of what is going to happen going forward. Those prices can be harnessed to give us a sense of what will happen going forward. This gives us the choice as investors of how we respond to the 24-hour news cycle. You can allow the market to price in all that uncertainty and maintain your investment plan despite it. That is a powerful choice.

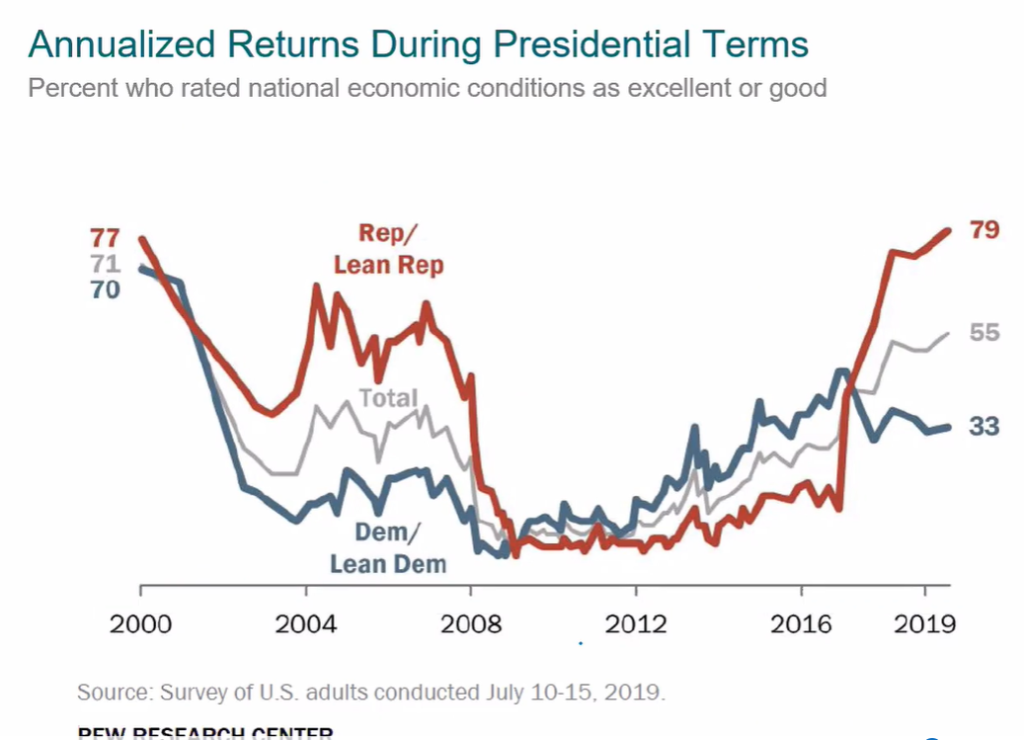

How do our political opinions color our views on the economy and investing?

The chart above demonstrates the spread in sentiment and how quickly and dramatically change can take place based on who is voted into office. Almost as soon as an election changes the controlling party, the patterns of optimism revert. The economic data did not dramatically change overnight, but we can see how one’s political beliefs color economic perspective.

Why is this?

Many of our strong opinions are reinforced by the media and news sources we choose to consume. We tend to select media sources that support the biases we already hold. For this reason, Christian suggests digesting all “free” media sources, including online and cable news, with a grain of salt since it has so much influence on how we interpret the behavior of our leaders and view what would seem to be relatively objective data on the economy and capital markets. “If media is only in the business of catering to advertisers, you are not reading the product, you are the product.” You can view the leaning of your preferred news source on this Interactive Media Bias Chart.

What can we know for certain?

Research indicates that our thoughts about the past, present and future tend to be distorted. When we look to the past, we can acknowledge that we have changed a lot, but when we look forward into the future, we cannot fathom that our preferences will change. This is true at every age. It is difficult for us to look forward and acknowledge that the same pace of change will continue. This can be change at the personal level as well as the political, governmental and societal level. As investors, we are being compensated for embracing this ongoing uncertainty. However, as humans we are not great at thinking through the risks and potential returns. Therefore, it is critical to have an investment strategy in service to a long-term financial plan. This helps avoid the opportunity cost of missing the market’s long-term positive returns.

How much should we worry about Socialism?

This is a valid investor concern we have heard frequently this election season. For a reasonable perspective on the balance between capitalism and socialism Christian recommends viewing this as a sliding sale. The Index of Economic Freedom published by The Heritage Foundation is a good tool to gauge the degree of capitalism and socialism across the globe. Many investors will be surprised to learn that the United States is not in the top 10 in this index. Singapore is currently number 1 and the US sits at 17. It is also important to note that while Capitalism and Socialism feel like binary states, the degree to which they are adopted in modern societies happens on a large, slow moving spectrum depending on the level of social safety nets and risks to laborers and entrepreneurs. There is a wide array of experiences and by design the US constitution is designed to make decisions relatively slowly. Therefore, there is typically a reasonable limit on how far the pendulum can swing at any one time.

Is there any overlap between politics and investing?

While diversified investors typically do not need to worry about political change influencing their long term expected return, some business owners and highly compensated employees may have a much higher exposure to this risk. If you have that kind of human capital risk, there may be choices that you have to make. There may also be new tax strategies to evaluate and other considerations for your overall wealth. However, there is a big opportunity cost to making significant change inside your investment plan. While it may feel good to sit out of the market while your team is not in office, if at the end of that period the market has not suffered, you have lost money on that trade. Emotionally you may have felt better, but you paid the price in the form of lower lifetime wealth.

What if the election is contested or there is not a peaceful transition of power?

While it is worth being concerned about an election that is not called on cable television at 10 pm election night, it can be helpful to take a longer-term view. As long as we think the companies we know and love (Apple, Tesla, Amazon, Walmart, Netflix) will still be in business in the next 6 months and that the constitution and federal government will not be dissolved, we can choose not to respond to the short term volatility that may ensue. We have a fairly recent example of a contested election in the Bush/Gore race in 2000. It was very controversial and market performance over that time was volatile, but nothing deeply taxing occurred for investors.

Is this the same conversation we have every 4 years? Or is this time different?

When we are in the fever of an election, it is easy view today as the most intense period ever. While political opinions are extremely far apart right now, this is the not the first time this has happened in our history. Capitalism has always kept going. There are no indicators to believe the country is on the verge of something dramatically problematic. Capitalism encourages people to make careful, safe decisions that benefit themselves and good things tend to happen even with volatility. Nothing in today’s political noise would suggest Warren Buffett’s sentiment that the US is a great place to invest is wrong.

What should we do next?

While we have made the case that the current situation does not warrant significant investment changes, often in periods of tumult and volatility it is helpful to focus our attention on areas where we can have the most positive impact:

We will be here patiently awaiting the election results and understand that you may have concerns about the current environment. Please contact us if you would like to discuss how these events impact your personal financial situation.