How real life experience can often trump training and education in preparing us for decisions. Decisions like determining if you should refinance your mortgage based on historically low rates.

When I was a teenager, my dad was not very smart. When I got out of college and started facing real life decisions, he got a little smarter. When I got married and we started having children, it is amazing how much more knowledgeable he became. And when I started my own business and needed counsel, it is amazing how wise my Dad had grown over the years! Of course, he was always wise...I was just immature and thought that I knew it all until I began having real life experience.

Have you ever heard the quote, “experience is what you get when you don’t get what you want”? Many years ago, I realized that training and education are great, but if I go into battle, it would be nice to be in a fox hole with someone who has been there before…and survived. Experience is like that. Unfortunately, our culture sometimes fails to honor our older, more experienced citizens. As Mitch Anthony1 says: “Gray hair means gray matter2.” In other words, experience matters.

I was reminded of this recently as I looked at mortgage rates. Earlier in my career (after I had completed a lot of education and obtained a lot of credentials), I knew that it made logical sense to have debt at low interest rates if I could invest and earn a higher rate. Paying down low interest rate debt with funds that could instead be invested at higher rates made no sense to me then. This arbitrage opportunity could result in greater wealth accumulation.

Since those early years, not only did I continue to study, but I received the best education of all: experience. Specifically, I counseled clients through the bursting of the Tech Bubble and the Great Recession when U. S. stocks earned a negative 1% annually compounded for 10 years. So much for arbitraging by investing at higher rates of return!

Those clients with the fewest fixed obligations (less debt) tended to be more sanguine (stoic) around market volatility and felt less stress. From an asset allocation standpoint, they could also handle a portfolio with higher stock exposure which historically has meant higher expected returns.

In the late ‘90s, I also grew in my faith journey and began studying biblical principles around finances. My “sophisticated, credentialed” self was surprised to learn how relevant these principles were to living a life of financial freedom. At the same time, I began learning more about the behavioral side of wealth management. To this day, I still believe that financial planning done well is life planning and our work is not just about return on investments but also about Return on LifeTM, another Mitch Anthony concept. In other words, financial peace, meaning, and enjoying the journey are the endgame – not just maximizing returns.

Just as the rich rule the poor, so the borrower is servant to the lender.

Proverbs 22:7

For these reasons and others, I continue to believe, in most cases, being debt-free during retirement (including mortgage-free) is ideal. The important phrase here is “in most cases”. This is where an experienced advisor can help. Every client circumstance is different. Like our fingerprints, every individual has unique goals, temperament, life experiences, biases, income sources, assets, liabilities, life expectancies, and philosophies. Here is just one example: if all of your financial assets are tied up in a pre-tax retirement account, it likely does not make sense to take taxable distributions to pay off a mortgage. Your plan should be as unique as you are.

The Big However

On July 30th, the Department of Commerce announced second quarter U.S. Gross Domestic Product fell at an annualized rate of 33%—the largest fall on record dating back to the 1940s. A recession triggered by the economic shocks from the pandemic has resulted in historically low interest rates.

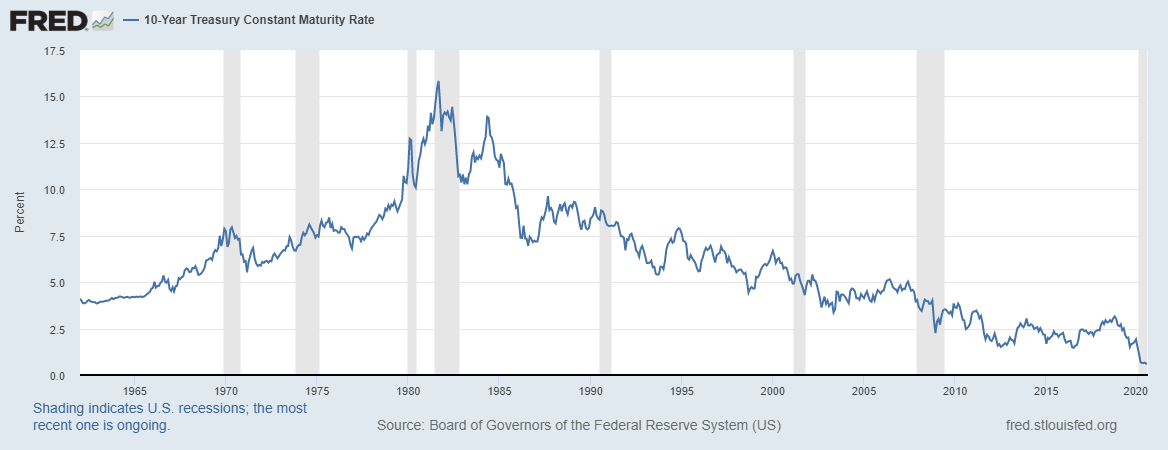

With experience, I more fully appreciate the efficiency of markets and the futility of forecasting. I doubt many people would have predicted interest rates, and therefore mortgage rates, at these levels. Instead of making futile attempts to forecast the future, wise planning requires that we act on the world as it exists. And right now, the market is pricing debt at attractive rates for some. “Don’t waste the crisis” is a term that you have probably heard and we’ve used recently including in our Zoom in on Your Health and Wealth blog earlier this year.

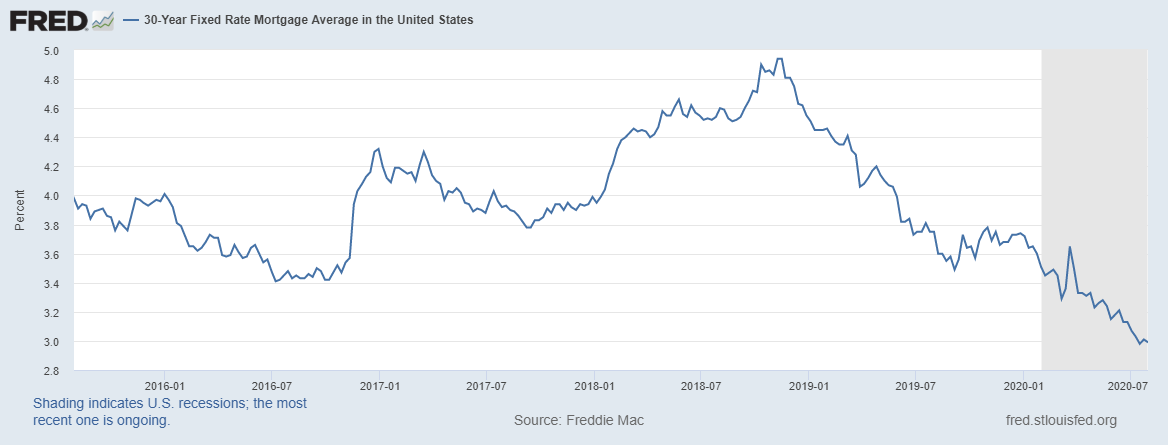

If you do have a mortgage or if you have many more years to work (your human capital), this is the best time in 50 years to refinance mortgage debt:

Refinancing with a lower interest rate could save you thousands of dollars across the term of your loan. It is more common than you might think – about 64% of mortgage activity is made up of refinancing applications. If you were contemplating buying a home or delayed plans to do so because of the pandemic, these record low mortgage rates might make 2020 an opportune time. Of course, this is provided you have job stability and the mortgage amount is reasonable given your resources and financial planning goals.

At these rates, logic might argue to get the lowest rate possible for the longest terms possible. If inflation increases, you will be paying back debt with dollars that are depreciated. A highly disciplined saver could invest the monthly savings from refinancing into financial assets with potentially higher expected returns than today’s rates. (Do not forget the previous comment about possible risks of this strategy! And, as previously mentioned, remember every circumstance is different. Be sure to speak with your financial advisor.) Despite the mathematical logic of long terms at low rates, if you refinance I tend to advise refinancing to lower rates but keeping the term of the loan similar to your existing mortgage. In other words, do not extend the term. In my opinion, the goal of being debt free in retirement is still a worthy goal.

Avid readers of this blog will know that we are passionate about a holistic approach to wealth management. Like most things in life, there are many trade-offs and choices that come with financial decisions like refinancing debt or taking out a mortgage to purchase a home. A strategic financial plan that address both financial and emotional aspects of your life can go a long way in helping you create clarity and confidence. As always, please let us know if we can help.

Related: Don’t Waste the Crisis: Focus on Your Health and Wealth

1 Mitch Anthony is a leading speaker and author in the financial services industry. To hear more of his wisdom, check out The Money and Meaning show episode, Exploring your “Retirementality” with special guest Mitch Anthony here.

2 Grey matter (or gray matter) is a major component of the central nervous system, contains most of the brain’s neuronal cell bodies involved in muscle control, and sensory perception such as seeing and hearing, memory, emotions, speech, decision making, and self-control.