This is a topic we discuss with our clients regularly. With an aging population comes increased options for retirement living, assisted living and nursing care options. Along with increased options come increased costs as well which can be exorbitant in some cases. For example, the average cost of a private nursing home room in North Carolina can be as much as $95,000 a year. For many families this is completely unaffordable which is why much care is provided by family members, and we have the social safety net of Medicaid for those without the resources to provide for their own care.Since the cost of care can be so high and the statistics show that many of us will need assistance with daily living at some point, this is a contingency we want to account for in our financial planning . When purchasing LTC insurance you are insuring against the risk of financial devastation if your or your spouse required long term care, but there is a trade off between that peace of mind and growth of your net worth. Purchasing insurance is just one way to manage this risk.

As with any risk, there are 3 main ways to manage:

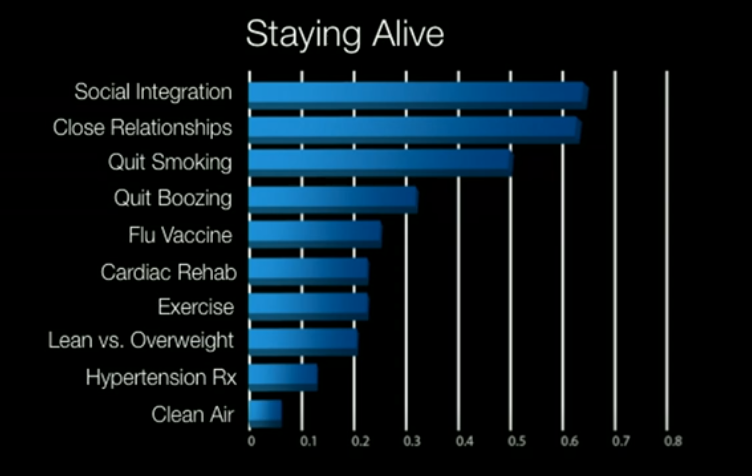

Source: Susan Pinker TED Talk: The Secret to Living Longer May be Your Social LifeWhile family members can provide care, the role of a caregiver can be physically and emotionally draining so many would rather not put their children in this position. Running through these scenarios can provide you with a framework for making decisions related to long term care. We also recommend our clients visit communities in their area to get a sense of where they might feel comfortable. Locally there is a great class at Duke that explores the implications of aging in place vs. moving to a CCRC and the relevant costs and considerations of each option.Related: 5 Financial Opportunities to Consider After the Death of a SpouseWith the exponential increases in LTC insurance premiums, some people might be better off saving the funds and building net worth rather than paying for the insurance coverage. Saving the funds instead of using them for insurance allows you to continue building net worth, which allows for flexibility in the event an LTC need presents itself and higher net worth/higher spending power in the event it doesn’t. A reverse mortgage or home sale can also be an option to fund long term care expenses.Once you have analyzed your personal health and financial situation, if you decide long term care insurance is appropriate it is important to review policy details closely as there are so many options available. It can be helpful to work with a broker who can write policies from a multitude of insurance providers vs. an agent selling only their company’s products. For example, premium costs tend to be higher for women as we have longer life expectancies. A broker may be able to find a policy offering unisex rates to reduce your overall premium cost. There is also a Shopper’s Guide available through the National Association of Insurance Commissioners that is very helpful for understanding the features and logistics of long term care insurance.As with most questions in financial planning the answer is really that it depends on your personal situation. An analysis of your personal financial and physical fitness can help you determine the best long term care plan to meet your needs.

Source: Susan Pinker TED Talk: The Secret to Living Longer May be Your Social LifeWhile family members can provide care, the role of a caregiver can be physically and emotionally draining so many would rather not put their children in this position. Running through these scenarios can provide you with a framework for making decisions related to long term care. We also recommend our clients visit communities in their area to get a sense of where they might feel comfortable. Locally there is a great class at Duke that explores the implications of aging in place vs. moving to a CCRC and the relevant costs and considerations of each option.Related: 5 Financial Opportunities to Consider After the Death of a SpouseWith the exponential increases in LTC insurance premiums, some people might be better off saving the funds and building net worth rather than paying for the insurance coverage. Saving the funds instead of using them for insurance allows you to continue building net worth, which allows for flexibility in the event an LTC need presents itself and higher net worth/higher spending power in the event it doesn’t. A reverse mortgage or home sale can also be an option to fund long term care expenses.Once you have analyzed your personal health and financial situation, if you decide long term care insurance is appropriate it is important to review policy details closely as there are so many options available. It can be helpful to work with a broker who can write policies from a multitude of insurance providers vs. an agent selling only their company’s products. For example, premium costs tend to be higher for women as we have longer life expectancies. A broker may be able to find a policy offering unisex rates to reduce your overall premium cost. There is also a Shopper’s Guide available through the National Association of Insurance Commissioners that is very helpful for understanding the features and logistics of long term care insurance.As with most questions in financial planning the answer is really that it depends on your personal situation. An analysis of your personal financial and physical fitness can help you determine the best long term care plan to meet your needs.