Written by: Christian Simmons

Knowing the type of investor you will be working with is essential as a financial advisor. Knowing how somebody operates is the first piece of the puzzle — and the biggest corner piece is knowing an investor's risk tolerance.

Risk tolerance refers to how much risk investors tolerate in their investments or financial decisions and measures the uncertainty regarding the potential loss of their investment. Age, income, investment goals, and personal preferences all factor into an investor’s risk tolerance.

For example, younger investors with a longer time horizon may be more willing to take risks in their investments. In comparison, older investors closer to retirement may prefer more conservative investments with less risk. But what are the basics of risk tolerance, and why does it matter to you as a financial advisor? Let’s dive in.

What Financial Advisors Should Know About Risk Tolerance

Financial advisors must know that risk tolerance varies widely among individuals and should take the time to understand their clients' risk tolerance before recommending investments. Advisors should know that risk tolerance can change over time depending on age and financial status, so reevaluating risk tolerance is paramount to being a reliable financial advisor.

Some investors don’t even want a financial plan. This is why financial advisors must educate their clients on the risks associated with different investment strategies and ensure their clients' investment portfolios align with their risk tolerance and investment goals.

Why Risk Tolerance Matters

Risk tolerance significantly impacts investment decisions and finances. If an investor takes on too much risk, they may be exposed to significant losses if their investments do not perform well. On the other hand, if an investor is too risk-averse, they may miss out on potential opportunities for growth and higher returns.

Understanding an investor’s risk tolerance can help you make informed decisions that align with their personal preferences and financial goals. Financial advisors can help investors navigate the complex world of investing by guiding investors and recommending investment opportunities tailored to the individual — even helping clients during economic downturns.

Levels of Risk Tolerance

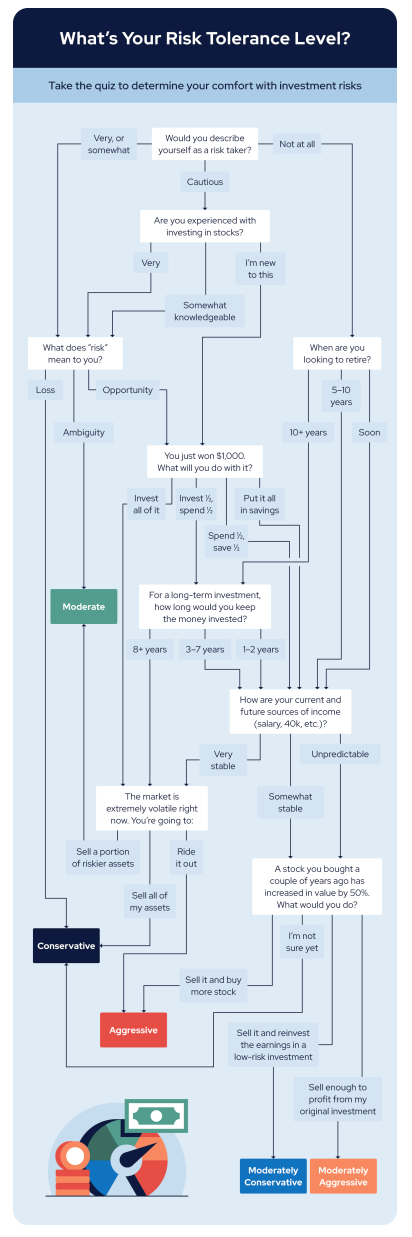

You can measure risk tolerance on a scale from “aggressive” to “conservative,” with areas of moderation in between.

Conservative Risk Tolerance

Conservative risk tolerance refers to an investor's preference for lower-risk investments with more stable and predictable returns. Investors with a conservative risk tolerance focus more on preserving their money instead of caring about higher returns. Because of this, they go out of their way to avoid risk and prefer stable investments with a lower potential for loss.

Moderate Risk Tolerance

Moderate risk tolerance means investors are more willing to accept slight investment risk for the potential for moderate — returns but are still risk-averse. They tend to accept moderate fluctuations in the value of their investments and may be comfortable with a mix of lower-risk and higher-risk investments. These investors typically take advantage of stocks or mutual funds that have the potential for higher returns over the long term, with greater volatility in the short term.

Aggressive Risk Tolerance

Aggressive risk tolerance refers to an investor's willingness to take on the most risk in their investments in exchange for the potential for higher returns. Investors with an aggressive risk tolerance often focus on long-term growth and may accept significant fluctuations in their investment value. These investors are comfortable putting money into stocks or options with high-loss opportunities.

Determining Risk Tolerance

As a financial advisor, it’s critical to understand an investor's risk tolerance. Financial advisors should take the time to educate their clients on the risks associated with different investment strategies and ensure potential investments align with their risk tolerance and goals. Check out the flowchart below to help determine risk tolerance. This will help financial advisors guide investors to make informed investment decisions so they can succeed.

Related: Fashion Frenzy for Birkenstocks Sees Company Step Towards a Listing on NYSE