“Money makes the world go round,” as the saying goes… And, undoubtedly, we’ve all spent time worrying about our personal finances. Yet, how much time do we actually spend trying to learn ways to improve our financial situations? Too often, we fret about things, but fail to fully understand the bigger picture or take action to better the circumstances. So, let’s discuss some ways to jumpstart financial success.

First, look at your personal finances and consider options. This can be overwhelming for some because the expansion and complexity of financial issues has made understanding them more uncertain. Additionally, many financial advisors focus on helping people do specific things (i.e. reduce risk, provide income, plan for retirement, save money, etc.). They frequently focus less on growth, reasonable risk, and family issues. Therefore, they fail to understand your entire situation.

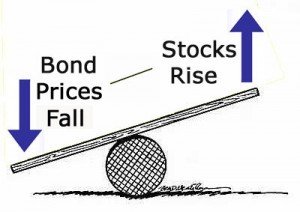

Consider this example: low inflation and interest rates have caused bond returns to be (2-4%) dramatically less than stocks (10-20%). Similarly, small businesses are getting more access to business loans at lower rates. Yet, many advisors continue to recommended high rates of investment in bonds, which basically dilutes an investor’s potential over time. If you have 10-20% returns in stocks for a few years, you are still better off in a declining period than earning almost nothing by investing in bonds or a savings account.

Also noteworthy: having a safety net might encourage people (especially young people) to spend rather than save. This is especially true if parents can provide a backup (either monetarily or in the form of housing) when they’re getting started.

One of the first steps in financial management is to understand the parameters especially as options and opportunities become more complex. For example, research the risk of investments and understand options like buying on margin, bitcoin, shorting stocks, Game Stop stock, etc. before making any decisions.

I am always reminded of a strategy meeting held several years ago. We were discussing using a venture capital firm and the presentation included several references to EBITA. One of our design staff spoke up and asked, “What is EBITA? It sounds like an animal.” After receiving an explanation, she suggested that outsourcing and importing could lower expenses and increase EBITA. The lesson is to always ensure we understand and explore all the elements of personal finance.

So, what now?

Gather all of your information and write it down. I recommend simple rather than elaborate analysis and be sure that you are involved in the process. Elaborate analysis can have wrong assumptions, can be too complicated to understand, and is often abandoned because it is too complicated and may utilize tools that aren’t appropriate.

There are a few basic elements of your information that should be reviewed, at least, annually:

- A balance sheet that includes all of your assets and liabilities. This would include securities, personal assets, debt, and long-term liabilities like mortgages. In short, how much are you worth including an estimate of things like pension and social security benefits? Keep it simple and, if needed, analyze select issues in more detail.

- An income statement and plan. How much are you earning and how much of that will you keep? This mostly includes the basic information from your tax return. Where does that income go in terms of expenses, debt payments, savings, etc.?

- How much debt do you have and what are the costs? Is it short or long-term and how is it changing?

Asset based loans (mortgage, car, line of credit) are much less expensive than credit card loans, payment terms, or other loans with 10-20% interest rates. For example, if you have several thousand dollars in stocks, a line of credit can be particularly attractive.

While assessing your situation, consider the values of assets like house ownership, life insurance, retirement benefits, and family assets. Consider gifts, inheritance, end of life expenses, and in-kind contributions like family vacations as part of your financial assessment. Generally, we are living longer and might want to consider giving gifts to young people before they are too old to really use it.

Identify and compare alternatives. Investing, saving, spending, types of investment, and time periods are all things that should be considered. Additionally, while evaluating your options, you need to consider the environment, personal preferences, and financial situation. I believe in, at least, reviewing alternatives even if you end up deciding against them. But, economic reforms and the decline of the pandemic should generate a strong economy in 2021.

Consider new alternatives rather than outdated standard tools. Tech platforms, Fin-tech, direct sales, the Internet etc. are driving the economy—not traditional manufacturing companies. Growth is more likely than recession and strategies like traditional companies and cash investments may be overrated.

Assess your personal situation in terms of job, monetary requirements, future expenses/needs etc. In particular, what are your passions, strengths, and constraints? I always come back to Sheryl Sandberg’s recommendation to consider, “What would you do if you weren’t afraid?”

The most important advice regarding personal finances is to just pay a little bit of attention. Consider opportunities and alternatives as well as challenges and constraints. That mindset should be supplemented by a continuous process of analyzing, measuring, and adapting to ever-changing parameters, programs, markets, and risks. Anytime we deal with money, there is potential for stress. But, we shouldn’t view personal finances as a daunting subject. Instead, look at it as an opportunity to learn, grow, improve your circumstances, and set yourself up for greater success.