This will not surprise you: men have more money saved for retirement than women.

Men averaged $123,262 in their defined contribution plans, compared with $79,572 for women , according to a new report by Vanguard based on its 2014 recordkeeping data.

But these figures hide a larger truth: women are actually better at saving for retirement.

“Overall, women are better at this but men earn more money so they have higher wealth accumulation,” says Vanguard researcher Jean Young, author of the new report, “Women versus Men in DC Plans.”

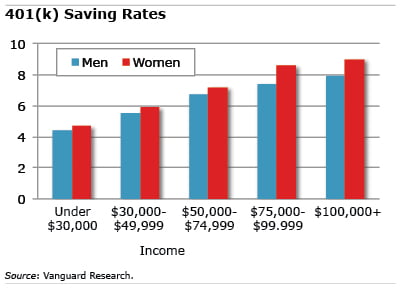

Young’s research found that women are 14 percent more likely to enroll in a voluntary workplace retirement savings plan. Women save 7 percent of pay, compared with 6.8 percent for men, controlling for wages, job tenure, and plan design. They also save at higher rates than men at every income level.

Her findings also refute the old wive’s tale that women don’t like risky investing.

Both men and women hold roughly three-fourths of their retirement accounts in the stock market. A possibly related finding is that women more often turn asset allocation decisions over to professionals or professionally managed Target Date Funds .

Since women save less in total, what does the Vanguard report say about how secure women are in retirement? What matters to a retiree is whether she has sufficient income to maintain the standard of living she had when she was working, and that standard is usually pegged to how much she earned – and women earn about 77 cents to a male coworker’s dollar.

While women “might not end up with as much wealth as a man,” Young concludes, their lifestyle adjustment in retirement also “is probably not going to be as harsh, because we’re better at this.”