Here’s the list of Trump and Harris’ economic proposals.

Increase the Child Tax Credit — Trump and Harris

Expand the Earned Income Tax Credit — Harris

Stop food-price gouging — Harris

Stop taxing tips — Trump and Harris

Subsidize first-time home buyers — Harris

Lower rents — Harris

Build new homes — Harris

Lower drug prices — Harris

Eliminate medical debt — Harris

Raise Obamacare subsidies — Harris

End taxation of Social Security — Trump

Impose 10-20 percent tariffs on China and other bad countries — Trump

Extend the Tax Cut and Jobs Act — Trump

“Drill Baby, Drill” — Trump

Let’s Get Real

Some of these proposals, like increasing the Child Tax Credit, are solid and important. Some, such as eliminating medical debt, will never see the light of day, thanks to the courts and political opposition. Others, like lowering rents and building new homes, are determined by market forces, not the fantasy lives of speech writers. Still others, like setting high, across-the-board tariffs, which would surely rekindle major inflation, will be seen for what they are — economic madness.

Yes, Vice President Harris, food-price gauging may be occurring. But I’ve heard nothing to suggest large food producers have been conspiring. If that were the case, why hasn’t the Justice Department’s Antitrust Division been on the case? Lowering grocery prices via Administrative action sounds like a return to price controls, which were complete disasters under both Nixon and Carter.

Earth to both candidates: Not taxing TIPS would lead to massive tax evasion. Every local service worker would ask to be paid solely in tips. And not paying FICA taxes on tips will mean collecting either zero Social Security benefits in old age or very low benefits. Most developing countries are trying their best to limit their informal sectors. A smaller tax base means higher tax rates for everyone else. Are you trying to produce a Latin American-style economic basket case?

Ending taxation of Social Security, as former President Trump proposes? Yes, it’s a terribly structured tax. It can put recipients into super high effective marginal tax brackets. And the thresholds beyond which first 50 percent and then 85 percent of benefits are taxed haven’t been adjusted for inflation, let alone for real wage growth, in 40 years. Hence, all our kids can look forward to paying federal income taxes and, potentially, state income taxes, on 85 percent of every dollar of their future Social Security benefits.

Were former President Trump advocating fixing Social Security the right way — by retiring the current system, paying, over time, all accrued benefits to current retirees and workers and setting up a modern, progressive, fully funded version of Social Security as outlined here — that would be great. But he’s not. In proposing to end the taxation of Social Security benefits, he’s advocating cutting trillions in Social Security revenue in a system that’s already $63 trillion in the red.

Retain President Trump’s Tax Cut and Jobs Act (TCJA)? The TCJA did more good than bad. But what both candidates should be advocating is radical fiscal reform. An example is a progressive cash flow consumption tax that could replace our entire hodgepodge of fiscal programs. Such a tax would be levied on world-wide consumption, including imputed rent on homes, boats, cars, and planes. This includes mansions, yachts, luxury cars, and private jets. Hence, the super rich would have a choice — either pay tax on all your worldwide consumption, explicit and implicit, or find another country to call home. To be clear, I’m not talking about soaking the super rich. I’m talking about making the super rich pay. their fair share.

TCJA, by the way, produced a relatively small reduction in most Americans’ net taxes. Its real importance lies in lowering the effective marginal corporate tax on investing in the U.S., providing better work and saving incentives, and significantly simplifying parts of the federal income tax. More investment in the U.S. means higher wages for workers. This is why I and most economists view the corporate tax as a hidden tax on labor.

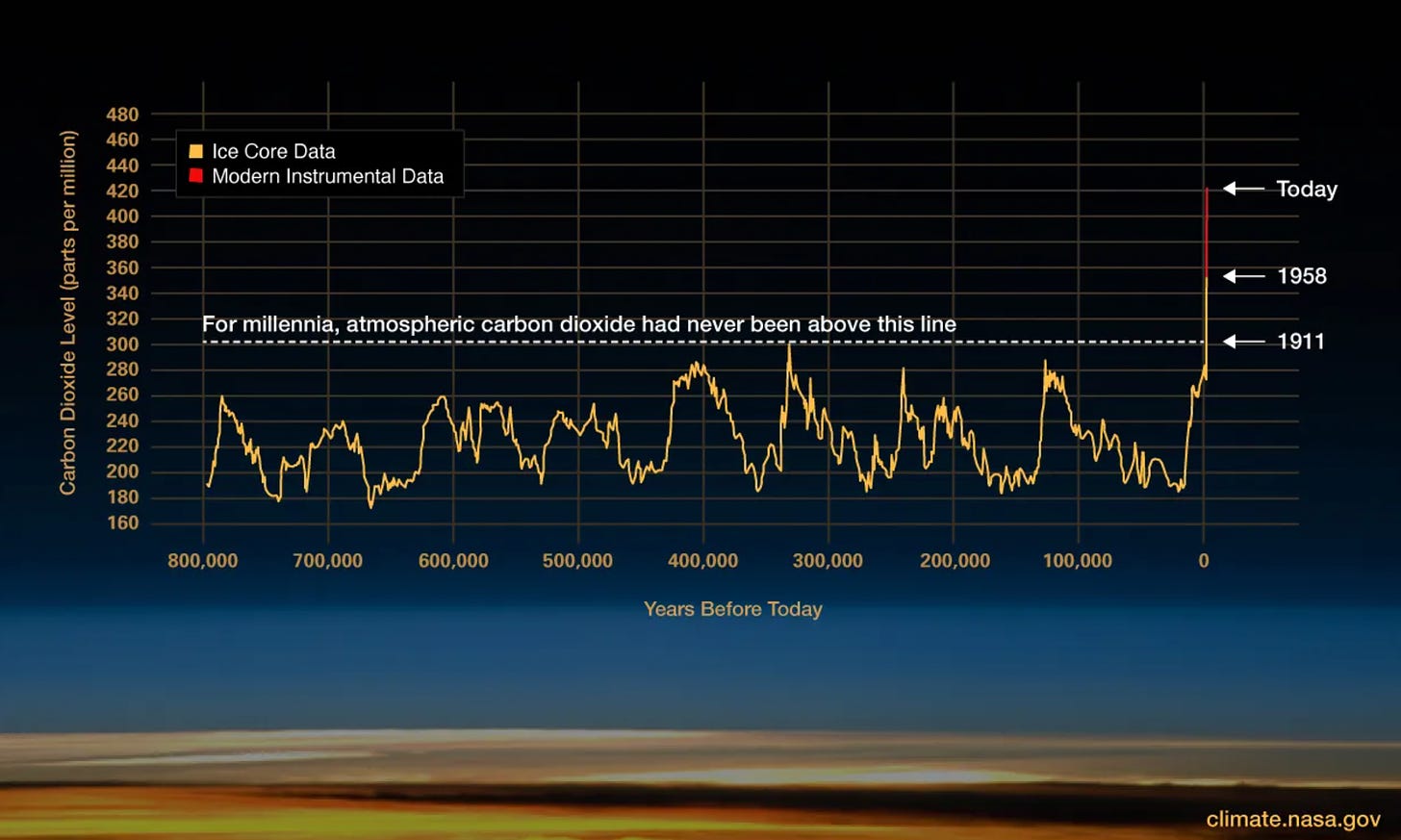

As for “Drill, Baby, Drill,” I suggest former President Trump consult with the experts at NASA on climate change. The figure below is the first thing he’ll see on their website. CO2 concentration has risen exponentially for over a century. The former President should also realize that, as smart as he says he is, no one knows for sure how bad climate change will be. Consequently, “Drill, Baby, Drill” is a prescription to place his and everyone else’s grandchildren at grave risk. That, in itself, provides a clear justification for very high carbon taxation, not doubling down on the risk.

Reality Check

Let’s suppose all the decent, legal, and politically feasible policies proposed by Harris and Trump were enacted. Would they make a dent in our country’s endemic poverty and inequality?

Absolutely not.

Our country already has over 500 fiscal policies, almost all of which are designed to favor or help the poor. Adding a few more won’t matter much particularly if they come, as they will, with rules that say the more you earn the less you get.

Hold on!

Over 500 fiscal policies? That can’t be true!

It is.

We all know about the federal income tax. It sounds like one policy. It’s not. It includes the Child Tax Credit, the Earned Income Tax Credit (EITC), the taxation of Social Security benefits, high-income Medicare taxes on labor earnings and asset income, the Alternative Minimum Tax, the Child and Dependent Care Credit, Obamacare premium and out-of-pocket subsidies, the Savers Credit, the American Opportunity Credit, the Energy Tax Credit, the EV Tax Credit, 529 Plans, roughly 25 tax-favored retirement-account and pension plans, and the list continues.

Uncle Sam also has a special tax on Medicare recipients, called the Medicare Part B IRMAA “premium” levied, get this, on income received two years in the past. Then there’s Social Security’s FICA tax, its Supplemental Security Income program, its progressive Primary Insurance Benefit formula, its Earnings Test coupled with its Adjustment of the Reduction Factor, its Recomputation of Benefits, and, well, I could go on. Actually, I and my co-authors, Paul Solman and Phil Moeller, did go on — for the entire length of a NY Times bestselling book on Social Security!

Moreover, 42 states, including D.C., tax their residents’ incomes. And their income taxes generally include multiple programs. For example, 32 states have their own EITC, 10 states tax Social Security benefits, and 15 states have their own Child Tax Credit.

There’s more. Forty-six states tax sales. Plus all 51 states have their own Medicaid, Obamacare, TANF, and Section-8 Housing benefit programs. Even Food Stamps and Sun Bucks can differ by state. Yes, these are nominally federal programs, but their eligibility conditions and/or benefit levels are state specific. (Obamacare subsidies are actually local-area specific.)

Add all these programs up and you’re at 500 plus.

What Have Our 500 Plus Fiscal Policies Produced?

With help from the Federal Reserve Bank of Atlanta, the Sloan Foundation, the Goodman Institute, and my economics-based planning software company, Economic Security Planning, Inc., my co-authors and I have spent years coding each and every major federal and state fiscal policy. In the process, we have produced The Fiscal Analyzer (TFA)— a veritable Webb Telescope for viewing U.S. fiscal policy in its entirety.

We’ve used and are using the TFA to study inequality and fiscal progressivity, work and saving disincentives, the marriage tax and its impact on marriage, the interaction of inflation and the fiscal system, the degree to which retirees are screwing up their Social Security decisions, the adequacy of saving and insurance, the differential impact of the TCJA (Tax Cut and Jobs Act) on blue and red states, the impact on early retirees’ labor supply of Social Security’s Earnings Test, the potential to actually make America great again via radical fiscal reform, and more.

Note: External funding to support TFA-based support and its annual updating is in peril as the Federal Reserve System is under a severe budget freeze. If you are interested in supporting my and other academic economists’ TFA-based research, please contact me at kotlikoff@gmail.com. I am applying for non-profit and government grants, but they are uncertain and maintaining the TFA comes with a large price tag. So, please help if you can.

U.S. Inequality and Fiscal Progressivity

Here’s the good news. Ignoring any behavioral responses, our fiscal system is highly progressive. This paper (U.S. Inequality and Fiscal Progressivity), co-authored with UC Berkeley economist, Alan Auerbach, and my company’s CE engineer, Darryl Koehler, and published in June 2023 in The Journal of Political Economy, provides the first real picture of U.S. inequality and its mitigation through fiscal policy.

I say first because it’s the only study that incorporates all major federal and state fiscal programs, the only study that considers both households’ current and future taxes and benefits (i.e., double net taxation), and the only study that examines inequality by age group, thereby controlling for life-cycle effects.

Comparing, for example, the net wealth of an 80-year-old with that of a 40-year-old, when both may be identical except for their stage in the life cycle is nuts. But a host of studies by prominent economists examine cross-section wealth, income, or wage inequality. They not only compare 80 year olds’ wealth and income with those of 40 year olds. They completely ignore the fiscal system!.

Seeing U.S. Inequality for the First Time

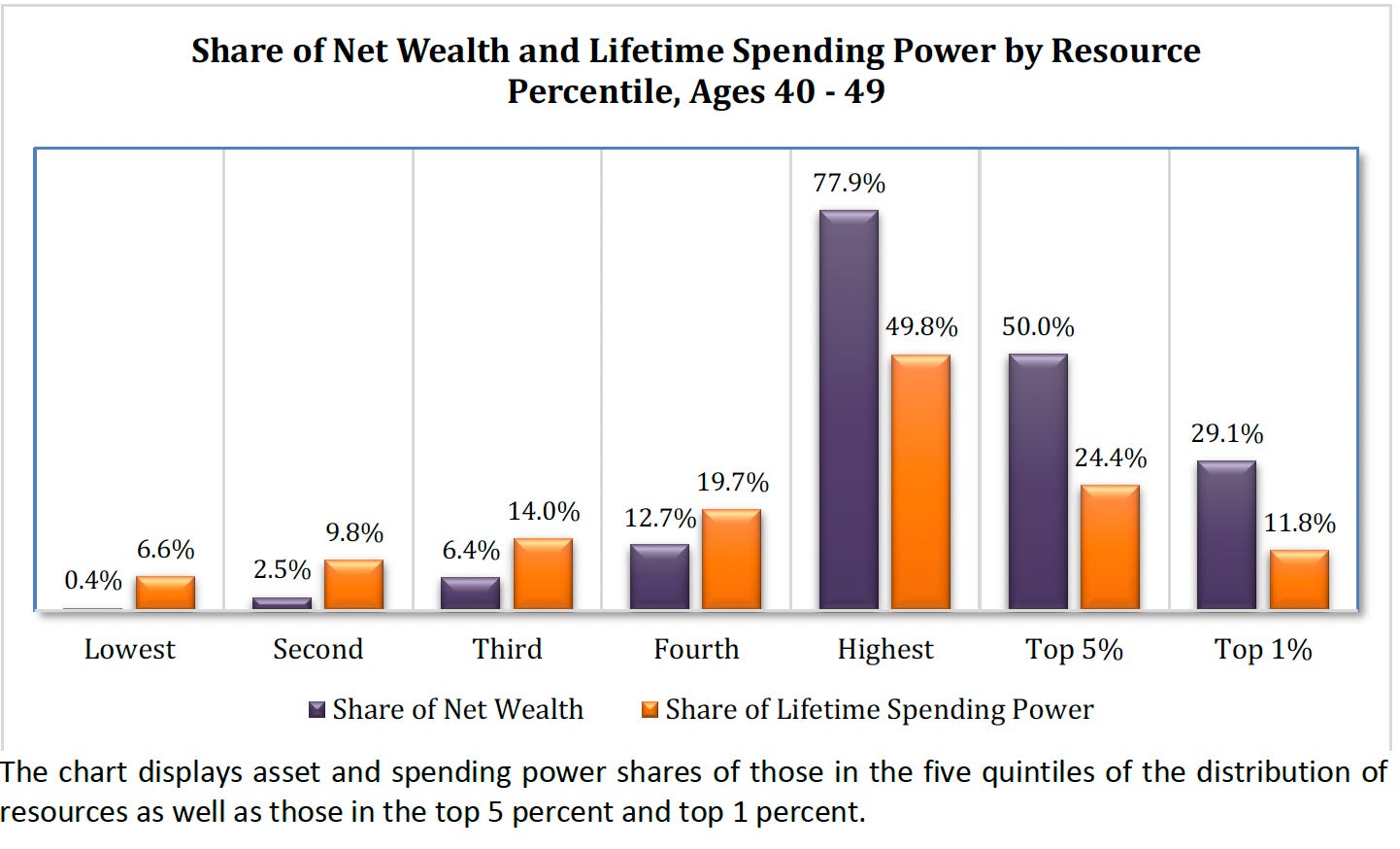

The figure below, taken from the above-referenced study, applies the TFA to the Federal Reserve’s 2016 Survey of Consumer Finances. It shows the share of the remaining lifetime spending of the age-40 cohort attributable to those with different resource levels.

Note that the richest 1 percent of 40 year-olds, measured by resources (human plus non-human wealth), own 29 percent of the cohort’s wealth, but only get to spend 12 percent of total cohort lifetime spending (the present value of current plus future spending, including bequests). The poorest fifth of the cohort hold essentially no wealth, accounting for just 0.4 percent of the cohort’s total wealth. But their lifetime-spending share is close to 7 percent.

The fiscal system is largely to praise for these outcomes. On average, the top 1 percent face a 35 percent net tax rate on their resources, whereas the poorest 20 percent face an average negative 44 percent net tax rate. Still, the richest 1 percent of the population gets to consume, on a per person basis, almost 35 times the per person consumption of the poorest 20 percent. Yet absent fiscal policy, the richest 1 percent would consume 76 times more.

Locking the Poor Into Poverty

Well, hooray for our 500 plus fiscal programs!!! Hooray for every President, Administration official, Senator and Congressman/woman, and state rep who enacted this plethora of marvelous programs!!! And hooray for every low-wage American who has benefited from our wonderful country’s generosity!!!

Not so fast.

What if the 500 plus, soon to be 500 plus plus programs, are actually boomeranging? What if these programs are effectively telling their recipients

Here’s your benefits. Take them. But be careful. Earn too much and we’ll punish you either by cutting what you get or raising your taxes — a lot!

And what if this “generosity” is dramatically reducing the labor supply and saving of tens of millions of low-wage workers compared with, say, a very simple fiscal system that was equally or more progressive but had dramatically better incentives to work and save?

What if we actually enacted fundamental, radical fiscal reform?

In that case, U.S. inequality would likely be dramatically lower. In that case, most low-wage workers would likely have far higher living standards. In that case, most low-wage workers would likely be saving adequately. In that case, retirement might no longer represent decades of pinching pennies for roughly half of America’s elderly. In that case, our marriage rate, especially for single women with children, might be significantly higher. In that case, our crime rate might be dramatically lower. In that case, America’s poor might die with some money to leave their kids. In that case, …

If You Are on the Harris or Trump Economic Teams, Read This:

Our 500 plus fiscal policies, on top of which Harris and Trump want to layer their own “save-the-poor policies,” all come with major work and saving disincentives. Yes, there are some, like the federal Earned Income Tax Credit, that subsidizes labor supply over a range. But,

-

Earn too much and your EITC credit will be clawed back 21 cents on the dollar.

-

Earn too much and lose 20 cents or more on the dollar in Food Stamps.

-

Earn or save too much and watch your Medicaid go poof.

-

Earn or save too much and watch your Supplemental Security income go poof.

-

Earn or save too much and watch your Section-8 Housing voucher go poof.

-

Earn or save too much and watch your TANF benefits go poof.

-

Earn or save too much and move into dramatically higher federal tax brackets.

-

Earn extra money and pay more to your state in income taxes, sales taxes, or both.

-

Earn too much and watch your Obamacare subsidies fall.

-

Earn too much and lose some or all of your Child Tax Credit.

-

Earn extra money and pay 12.4 percent to Social Security for extra Social Security benefits of which you haven’t the slightest clue.

-

Earn extra money and pay 2.7 percent to Medicare for no extra benefits.

-

Earn too much as an early (pre-FRA-year) Social Security beneficiary and lose 50 cents in benefits for every dollar earned. Yes, the Adjustment of the Reduction Factor more than compensates for this. But Social Security keeps this a secret for reasons I doubt it even knows.

-

Earn or save too much starting at age 63 and face a dramatically higher Medicare Part B IRMAA “premium” two years later.

I could add more bullets. But you get the point. But here’s something the bullets don’t convey. If you save more, you may, in the years ahead, pay more taxes and potentially lose lots of benefits because your future taxes and benefits depend on your future asset income and, in some cases, the amount of your future assets, and, thus, on the amount of your current saving. You may have heard of Double Taxation. This is Double Net Taxation, since additional current labor earnings, when saved to whatever degree desired, will lead not only to higher future taxes, but also lower future benefits.

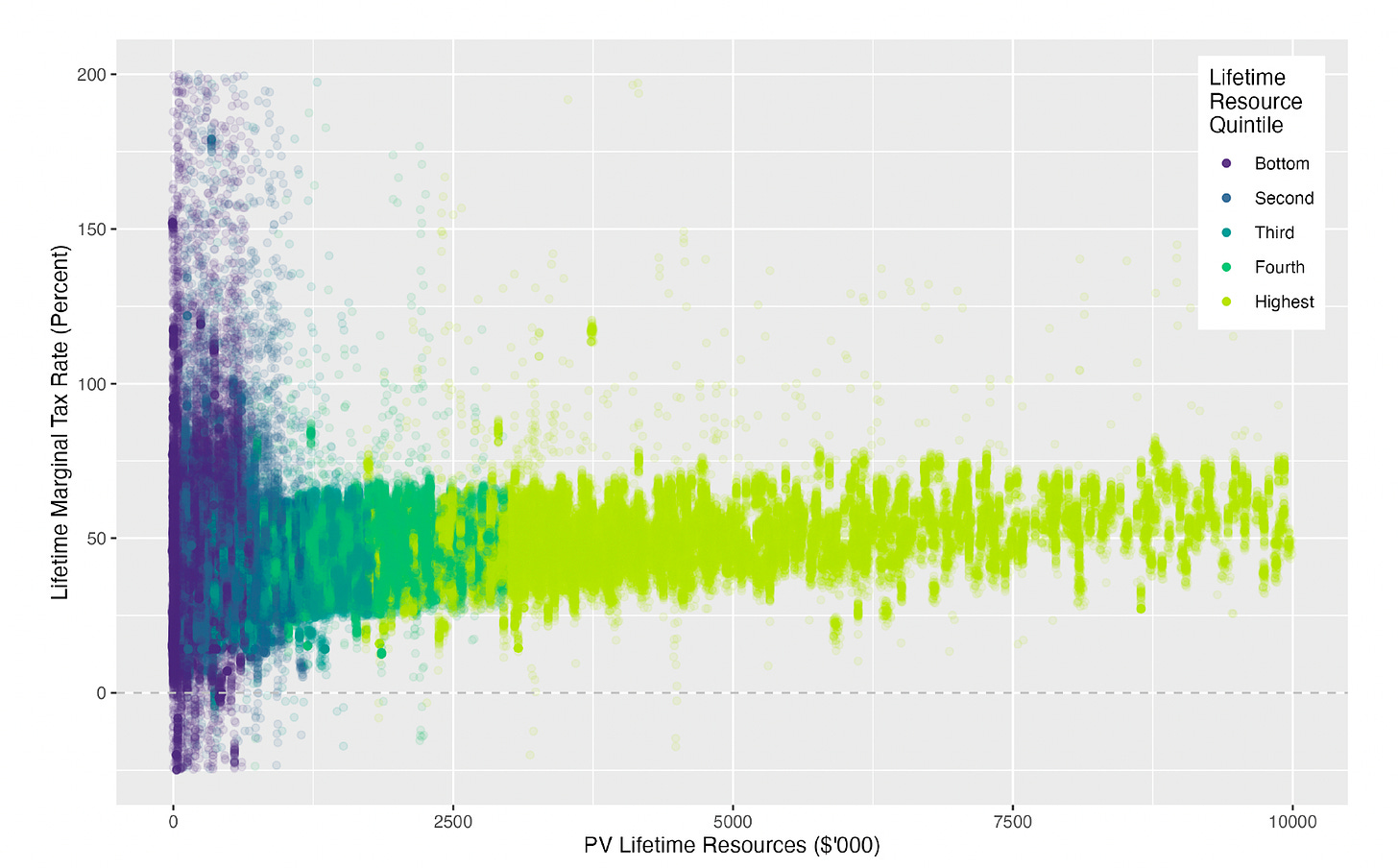

Lifetime Marginal Net Taxation of Americans’ Labor Supply

Here are two pictures from this TFA-based study (co-authored with David Altig of the Federal Reserve Bank of Atlanta, Alan Auerbach of UC Berkeley, Elias Ilin of Cornerstone Research, and Yifan Ye of Stanford University Digital Economy Lab) that every member of Congress and every economic advisor to the presidential candidates should pin to their walls. Both consider lifetime marginal net tax rates facing U.S. workers based on all major fiscal policies combined. Both show results for workers with different levels of lifetime resources (net wealth plus human wealth — the present value of future earnings).

(In forming the net tax rates we calculate the additional present value of spending that workers would be able to afford if they earned an extra $1000 this year. If that present value is $700, it means the lifetime marginal net tax is 30 percent.)

The first figure shows that most Americans are already being taxed to death when it comes to earning an extra dollar. For low-wage workers — those with low lifetime resources — roughly a quarter are in lifetime marginal net tax brackets of 60 percent or more.

And the figure is truncated at the top. There are workers in tax brackets exceeding 1,000 percent! The reason is that earning an extra $1,000 this year — the experiment we’re considering — can push workers over eligibility thresholds, wiping out thousands of dollars in benefits. Earning less means less wherewithal to save. Hence, the diagrams are also partially explaining why so many Americans are showing up in the retirement with so little savings.

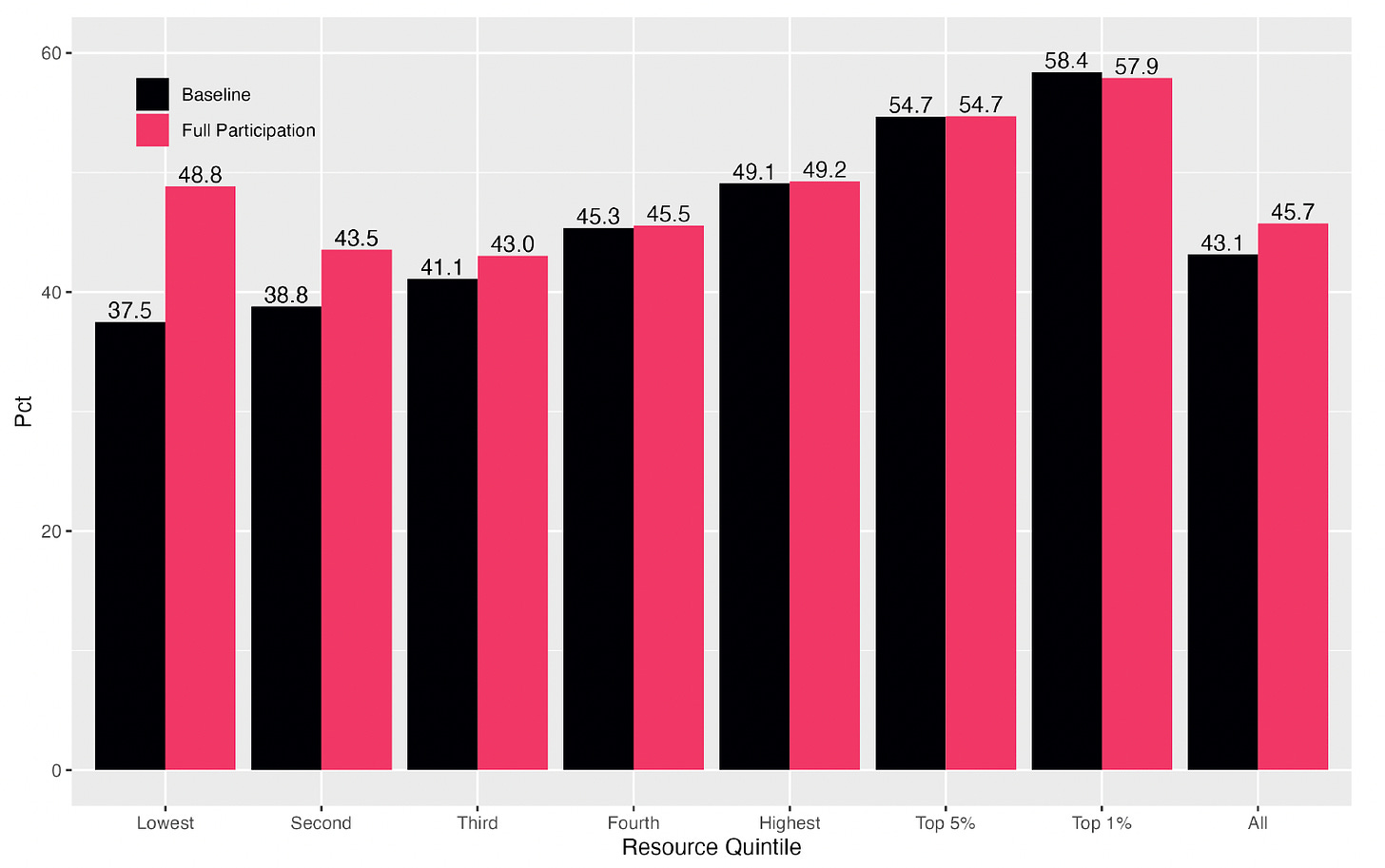

The second figure shows median lifetime net tax rates when all workers do and don’t participate in all welfare programs. (The figure above realistically imputes partial participation program by program.) The reason the median marginal rate is lower for the poor is that many of the poor choose not to participate in all benefit programs. Yet, as just indicated, even accounting for partial plan participation, a huge share of the poor are facing confiscatory taxation if they work more at the same wage or they get a higher paying job, work the same hours, and earn more.

American Workers’ Lifetime Marginal Net Tax Rates

American Workers’ Median Lifetime Marginal Net Tax Rates

Behavioral Response

The big question, on which I and two co-authors, Johannes Brumm (Professor of Economics at the University of Karlsruhe and Christopher Krause, Postdoc at the University of Karlsruhe), are now working is Americans’ behavioral responses to the massive, highly non-linear work and saving disincentives they face.

We’ve produced a truly astonishing breakthrough technology for studying this problem. It’s called The Global Life-Cycle Optimizer (GLO). So far we’ve looked at how workers would react to a very stylized fiscal system consisting of just three elements — our seven federal income tax brackets, the FICA tax, and a basic $10K benefit that’s available only to those earning less than $15K.

This limited tax/benefit system suffices to produce huge reductions in labor supply among low-wage workers, in some cases by as much as 50 percent! This is based on preferences about working and consuming routinely assumed by economists — preferences in which labor supply is entirely unaffected by linear net taxation. So, were our hypothetical fiscal system comprised simply of a basic payment regardless of earnings plus a 30 percent tax on all earnings, workers’ labor supply would change not one iota. Hence, the non-linearity of our stylized system, particularly losing $10K if you earn more than $15K, is the source of the major labor supply reductions.

Our research goal is to marry the GLO with the TFA. This will let us determine how the fiscal system is impacting the work and wealth accumulation of 6,0000 plus household respondents to the 2022 Federal Reserve Survey of Consumer Finances. These findings will, in turn, tell us whether the fiscal system is significantly reducing aggregate labor supply, the nation’s capital stock, and GDP. It will also identify the fiscal system’s impact on inequality taking account of behavioral responses. But the real promise of this GLO/TFA tool will be the ability to study radical fiscal reforms taking all factors into account.

Bottom Line — Think Big

Vice President Harris and former President Trump need to stop playing small ball and think big when it comes to domestic economic policy. Our government is borrowing at an unsustainable clip, our Social Security system is more than two years of GDP in the red, our healthcare system is providing third-rate outcomes at an astronomical cost, our education system is failing, and we are, whether intentionally or not, using seemingly progressive fiscal policies to lock low-wage workers into poverty.

Related: Steve Brown, John Hancock’s Legendary CEO, Reveals the Secrets of His Amazing Success