This could be the shortest blog I ever write.

When something is boring, it’s hard to stick with it, no matter what “it” is.

A movie.

A TV show.

A relationship.

A car.

A job.

A book.

We are humans and we gravitate toward being entertained. We all like stories.

And drama.

And especially competition.

So, these things are provided to you across various mediums – stories in search of an audience.

To most people, a reality TV show is more interesting, more “binge-able,” than a documentary about the different species of ferns.

Investing is boring. And it should be. But that means it’s tough to stick with it – especially when there are mediums exposing you to stories, drama, and competition.

Investors are not the real audience for CNBC, but they WANT you to tune in.

CNBC provides it all by parading talking heads that all seem to have control over the facts – control over predicting what WILL happen, control over-explaining what IS happening, and control over-explaining what DID happen…as if any of them really know.

If you are a true investor, someone who knows why you are investing in the first place and in complete command of your own goals, YOU ARE NOT CNBC’S AUDIENCE.

I’m not saying that you can’t watch CNBC…I’m just saying that as a REAL INVESTOR, you are not the audience and there is no idea that you can glean on the show that will give you some sort of edge over everyone else.

History is a more useful, albeit boring, guide.

Always know your need for cash over the next 12-18 months, have a liquidity plan for those needs, and have a reasonable investment plan for the rest. Then don’t mess with it because you think you have discovered an edge–instead invest in the future you by letting time work to your advantage.

Investing is hard for people who get bored easily – which, frankly, is most of us. It’s especially hard now with all the noise on the news and on CNBC. Having patience and discipline is hard and boring BUT THIS IS ALSO A GREAT TIME TO LEARN and reinforce that behavior as smart and savvy.

Despite what the noise may tell you, there are no patterns or facts that can help you tell the future. Use the TV for entertainment but do not base investing decisions on the excitement or “story” you are watching.

Be boring.

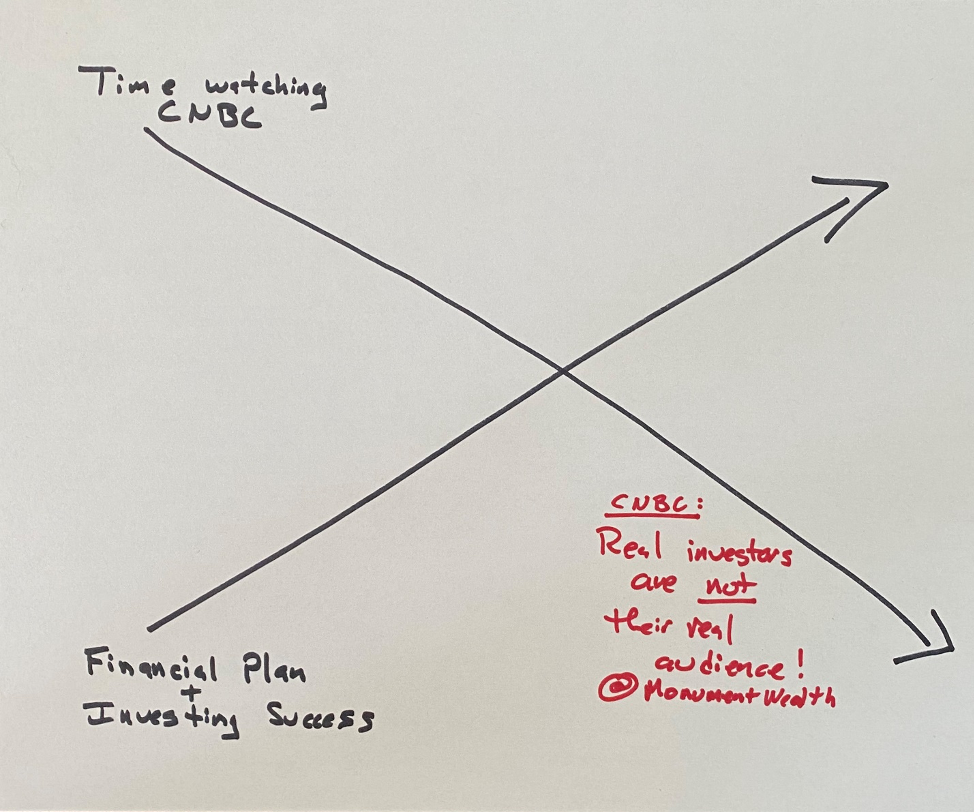

This is also all summarized in the chart I drew below.

Keep looking forward.

This first appeared here Why is boring so hard?

Related: How to Navigate Financial Decision Making in the Absence of Facts