Your financial life doesn’t always move in a straight line. You might want events to unfold like your spreadsheet projections but money doesn’t behave that way. In reality, money is messy.

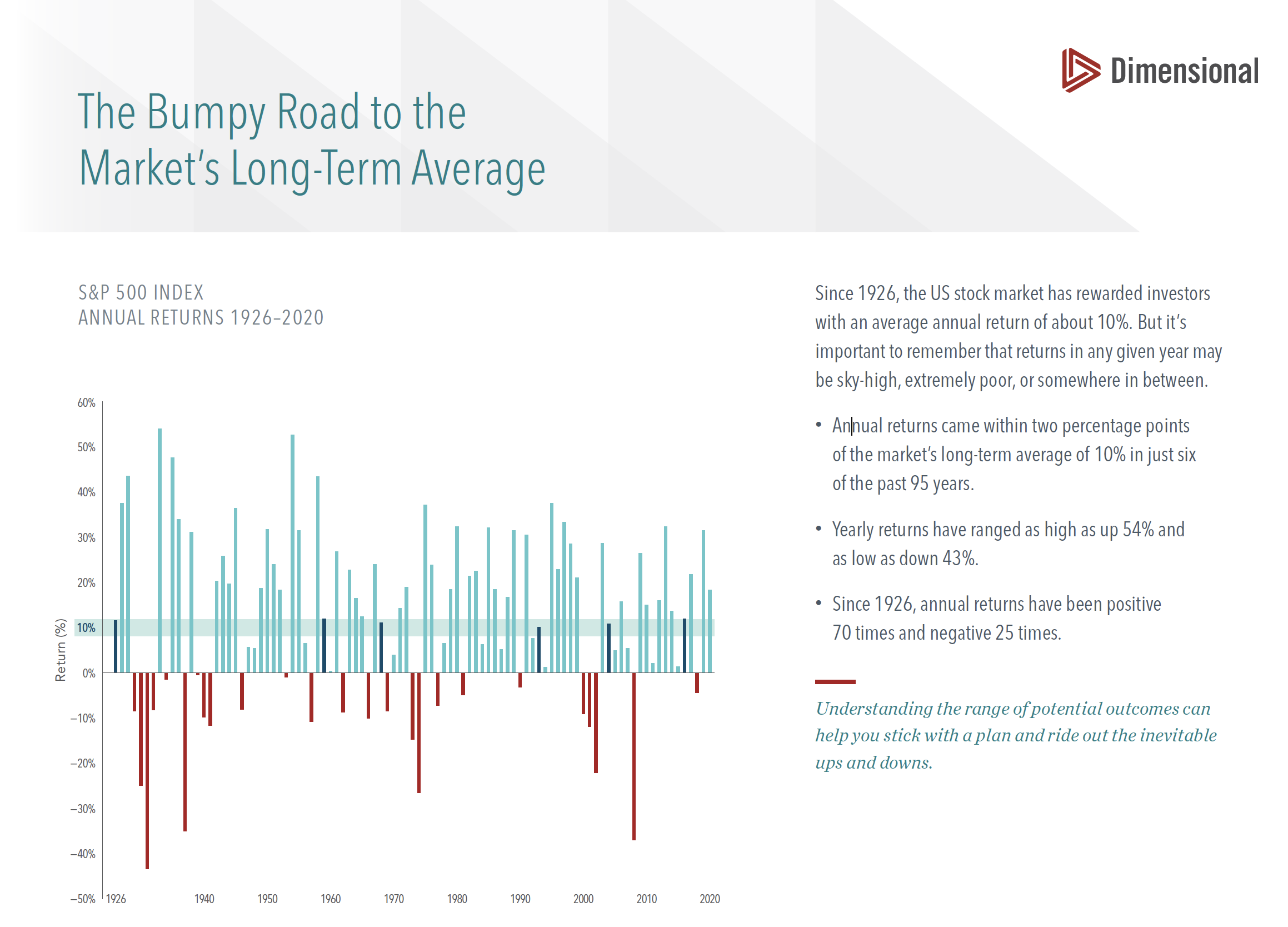

The graph below depicts the wide range of returns for the S&P 500 since 1926. In 96 years, there have only been a half dozen periods where annual returns were within two percentage points of the long-term market average. Investment returns are messy too.

Source: Dimensional

HOW TO CONNECT WITH REALITY

One of our major communication themes this year is to connect clients with reality. Bumpy roads are reality. You money usually operates outside the lines.

A few years ago, Roy and Vicky came here thinking they had their future neatly planned out. Their financial life depended upon stable investment returns and controlled spending. A couple of rocky stock market years on top of helping their son financially through a costly divorce brought reality front and center. Their financial life had been decoupled from their previous reality and they didn’t know how to respond.

Roy and Vicky failed to recognize that money often behaves in ways you don’t expect. You sometimes need to change your financial plans to reflect current reality.

20th-century author/chemist Orlando Battista wrote “An error doesn’t become a mistake until you refuse to correct it.” Failing to make mid-course corrections when needed can derail even the best financial plans.

Tweaking previous money decisions is necessary precisely because your money won’t stay inside the lines.

WHY MONEY PSYCHOLOGY WINS OUT

It’s easy to think about personal finance and money in ways like physics with ironclad rules. In reality, money involves emotions and nuance; the lens of psychology, not physics, is a more appropriate way to view your money.

Money psychology addresses your perceptions about your financial life compared to others. You can see houses, cars, and other material things. What you can’t see are the underpinnings of these outward elements of wealth; you can’t always see the stress and anxiety that your co-workers, friends, and neighbors carry alongside their wealth.

You never know exactly what motivates other people and what their long-term financial goals might be. The best you can do is to clearly articulate your particular goals and take small steps each day in the direction of those goals.

Money is full of surprises; you can never know for certain what comes next. The world changes – your purpose and aspirations change too.

Most investors want a financial life without surprises because that makes planning easy. Your financial future, however, largely rests upon your acceptance of uncertainty. Anticipate, expect, and imagine your money outside the lines. Start there.

Related: How to Develop a "No White Knuckles" Investment Philosophy