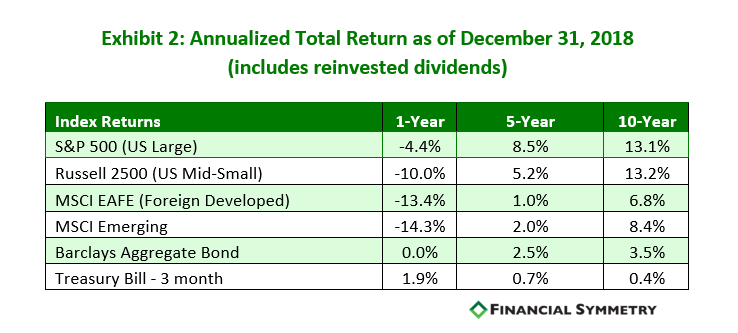

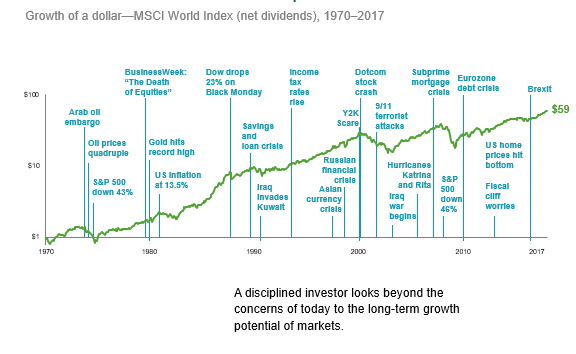

A common question I receive is now a good time to invest? Or what should I invest in? I don’t have a crystal ball so I can’t time the markets (quick tip: no one else does!). That said, over the long-term investors in stocks have been well rewarded (see Exhibit 3). It also depends on your personal situation and when you’ll need the money. Although I don’t have a crystal ball, below is our 2019 outlook that discusses our current views: Although 2018 was not a great year for US stock investors, the last ten years have been as outlined in Exhibit 2 below.

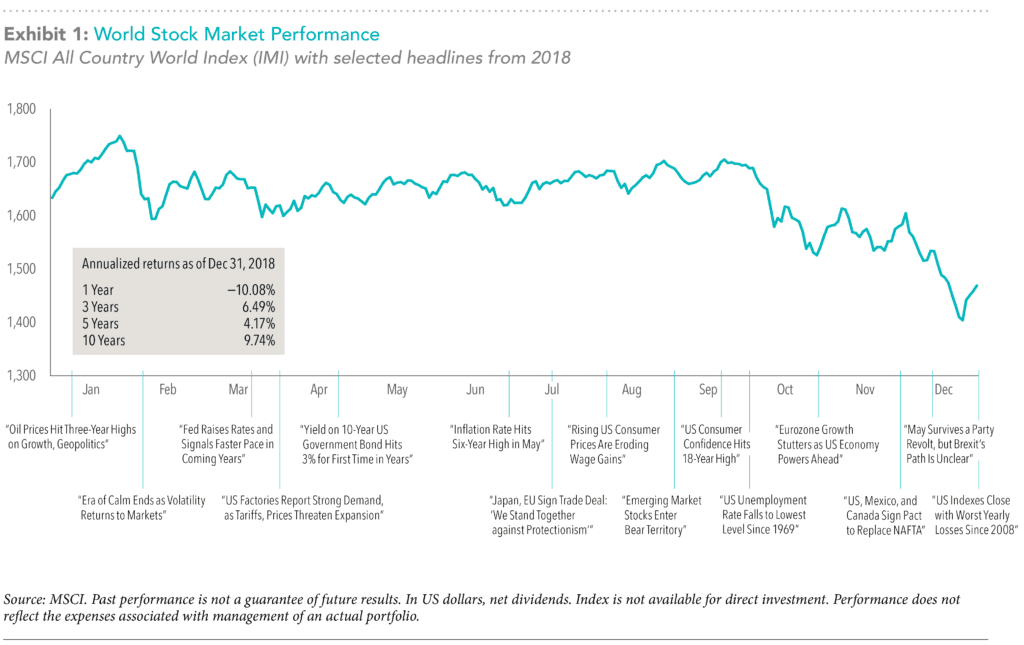

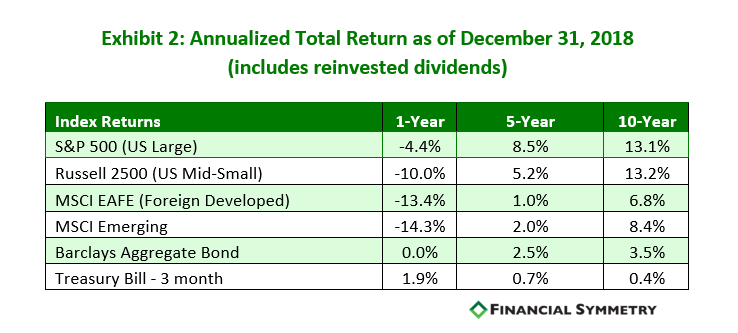

Although 2018 was not a great year for US stock investors, the last ten years have been as outlined in Exhibit 2 below. One might look at the exhibit and think why invest overseas given returns in the US have been so strong. Investors should remember that non-US stocks help provide valuable diversification benefits, and that recent performance is not a reliable indicator of future returns. It is worth noting that if we look at the past 20 years going back to 1999, US equity markets have only outperformed in 10 of those years—the same expected by chance. We can examine the potential opportunity cost associated with failing to diversify globally by reflecting on the period in global markets from 2000-2009, commonly known as the “lost decade” among US investors. While the S&P 500 recorded its worst ever 10-year cumulative total return of –9.1%, the MSCI World ex USA Index returned 17.5%, and the MSCI Emerging Markets Index returned 154.3%. In periods such as this, investors were rewarded for holding a globally diversified portfolio.

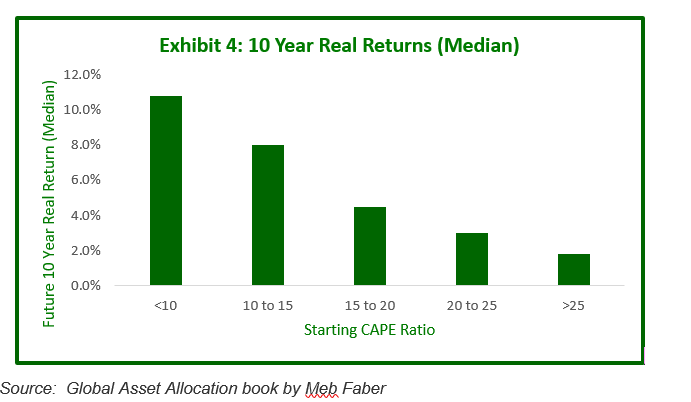

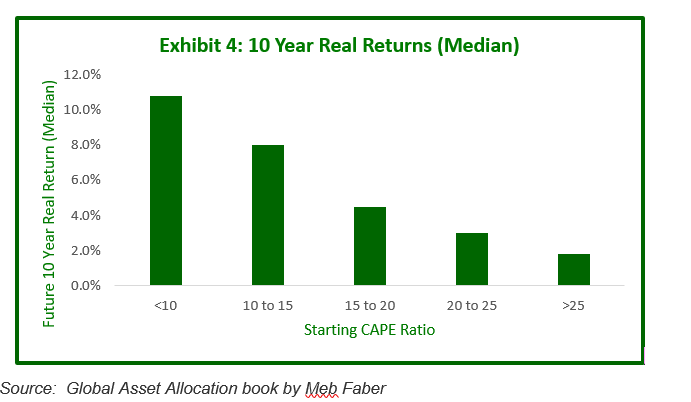

One might look at the exhibit and think why invest overseas given returns in the US have been so strong. Investors should remember that non-US stocks help provide valuable diversification benefits, and that recent performance is not a reliable indicator of future returns. It is worth noting that if we look at the past 20 years going back to 1999, US equity markets have only outperformed in 10 of those years—the same expected by chance. We can examine the potential opportunity cost associated with failing to diversify globally by reflecting on the period in global markets from 2000-2009, commonly known as the “lost decade” among US investors. While the S&P 500 recorded its worst ever 10-year cumulative total return of –9.1%, the MSCI World ex USA Index returned 17.5%, and the MSCI Emerging Markets Index returned 154.3%. In periods such as this, investors were rewarded for holding a globally diversified portfolio. History has found certain periods have resulted in higher returns than others. Part of this can be explained by starting valuation. Valuation is one of the best indicators of long-term returns (i.e. 10 years), but it is a horrible short-term timing strategy. One popular valuation metric we’ve discussed in the past is the cyclically-adjusted price-to-earnings (CAPE) ratio. Instead of dividing price by the past 12 months of earnings, the CAPE ratio divides price by the average inflation-adjusted earnings of the past ten years. The idea is to smooth out the good and bad years created by the business cycle.Is the CAPE Ratio a good predictor of future returns? According to a study by Research Affiliates titled CAPE Fear: Why CAPE Naysayers are Wrong, starting CAPE Ratio has between a 48% to 91% correlation to future 10-year returns across 12 countries. So yes, starting valuations do matter over the subsequent 10-year period.In addition, below Exhibit 4 is the average future 10-year real return based on starting US CAPE Ratio. As of December 31, 2018, below are the current CAPE ratios of the major equity markets:

History has found certain periods have resulted in higher returns than others. Part of this can be explained by starting valuation. Valuation is one of the best indicators of long-term returns (i.e. 10 years), but it is a horrible short-term timing strategy. One popular valuation metric we’ve discussed in the past is the cyclically-adjusted price-to-earnings (CAPE) ratio. Instead of dividing price by the past 12 months of earnings, the CAPE ratio divides price by the average inflation-adjusted earnings of the past ten years. The idea is to smooth out the good and bad years created by the business cycle.Is the CAPE Ratio a good predictor of future returns? According to a study by Research Affiliates titled CAPE Fear: Why CAPE Naysayers are Wrong, starting CAPE Ratio has between a 48% to 91% correlation to future 10-year returns across 12 countries. So yes, starting valuations do matter over the subsequent 10-year period.In addition, below Exhibit 4 is the average future 10-year real return based on starting US CAPE Ratio. As of December 31, 2018, below are the current CAPE ratios of the major equity markets: US Stock Market = 29 MSCI EAFE (int’l developed) = 15.5 MSCI Emerging = 12.5 Source: https://interactive.researchaffiliates.com/asset-allocation#!/?currency=USD&expanded=tertiary&group=core&model=ER&models=ER&scale=LINEAR&terms=REAL&tertiary=shiller-pe-cape-ratio-box&type=EquitiesAs noted in our recent blog, Crystal Balls and CAPE, when one market (US or foreign) was trading at a material premium (such as today), the other market stock market outperformed over the subsequent 10-year period. The summary is current stock valuations favor the international markets.

The summary is current stock valuations favor the international markets. Balance – diversification from equities Safety – capital preservation Income – interest payments Bond returns are largely driven by the term and credit quality of a bond. Long-term bonds experience bigger price movements for a given change in interest rates. Investor are expected to be compensated for taking that extra risk as a result. The same can be said for lower credit quality bonds such as high yield bonds. As the current time the spreads – the gap between the yield on credit and Treasuries – have remained narrow by historical standards. For bond investors, that means the compensation for taking on credit risk is relatively low, and the upside from here could be quite limited.Future returns of bonds are highly correlated to the starting yield. Therefore, as of 12/31/2018 the yield on the Barclays U.S. Aggregate Index was approximately 3.28% which is depicted in the exhibit below. Therefore, over the next 7-10 years investors can expect returns similar to starting yield levels as noted in Exhibit 5. Overall, bond yields have increased over the last couple years, but remain low compared to historical levels.Related: The 6 Habits it Takes to be a Successful Investor

Overall, bond yields have increased over the last couple years, but remain low compared to historical levels.Related: The 6 Habits it Takes to be a Successful Investor

2018 Review

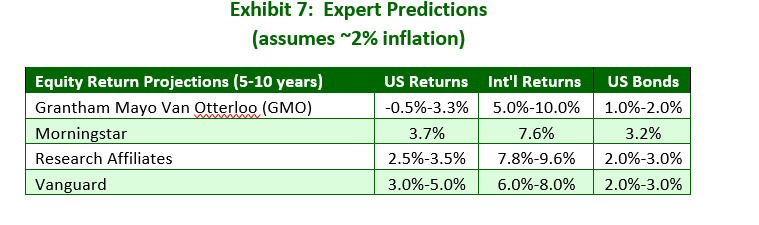

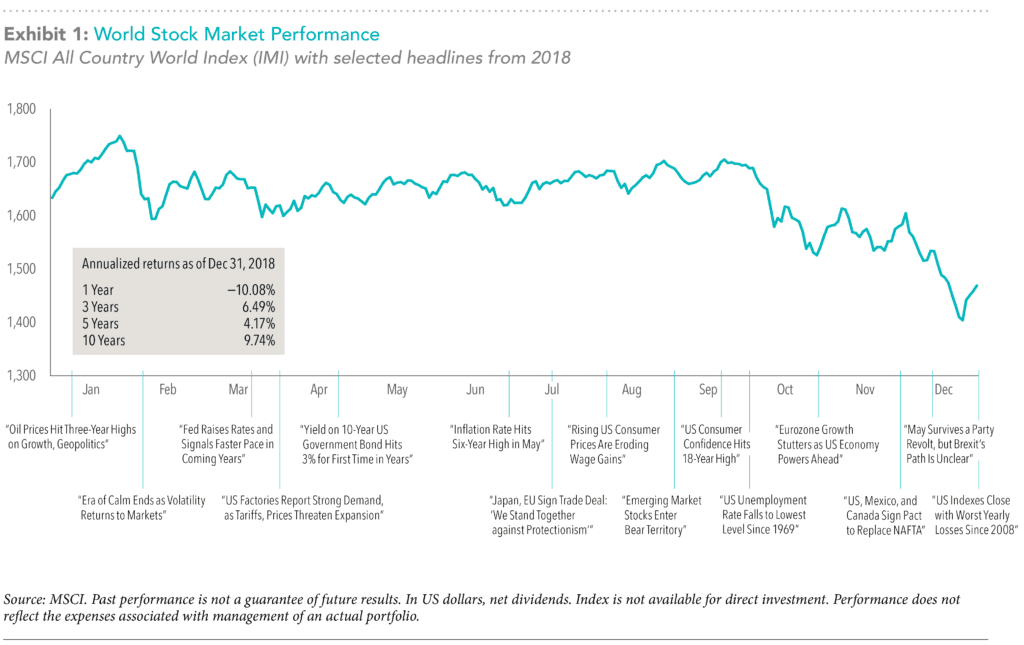

After logging strong returns in 2017, global equity markets delivered negative returns in US dollar terms in 2018. Common news stories in 2018 included reports on global economic growth, corporate earnings, record low unemployment in the US, the implementation of Brexit, US trade wars, and a flattening US Treasury yield curve. See Exhibit 1 below that highlights some of the year’s prominent headlines and performance of the global stock market.Exhibit 1

Although 2018 was not a great year for US stock investors, the last ten years have been as outlined in Exhibit 2 below.

Although 2018 was not a great year for US stock investors, the last ten years have been as outlined in Exhibit 2 below.Exhibit 2

One might look at the exhibit and think why invest overseas given returns in the US have been so strong. Investors should remember that non-US stocks help provide valuable diversification benefits, and that recent performance is not a reliable indicator of future returns. It is worth noting that if we look at the past 20 years going back to 1999, US equity markets have only outperformed in 10 of those years—the same expected by chance. We can examine the potential opportunity cost associated with failing to diversify globally by reflecting on the period in global markets from 2000-2009, commonly known as the “lost decade” among US investors. While the S&P 500 recorded its worst ever 10-year cumulative total return of –9.1%, the MSCI World ex USA Index returned 17.5%, and the MSCI Emerging Markets Index returned 154.3%. In periods such as this, investors were rewarded for holding a globally diversified portfolio.

One might look at the exhibit and think why invest overseas given returns in the US have been so strong. Investors should remember that non-US stocks help provide valuable diversification benefits, and that recent performance is not a reliable indicator of future returns. It is worth noting that if we look at the past 20 years going back to 1999, US equity markets have only outperformed in 10 of those years—the same expected by chance. We can examine the potential opportunity cost associated with failing to diversify globally by reflecting on the period in global markets from 2000-2009, commonly known as the “lost decade” among US investors. While the S&P 500 recorded its worst ever 10-year cumulative total return of –9.1%, the MSCI World ex USA Index returned 17.5%, and the MSCI Emerging Markets Index returned 154.3%. In periods such as this, investors were rewarded for holding a globally diversified portfolio.Stocks

Are their risks today to invest in the stock market? Yes. Have their been risks in the past? Yes. Through all these risks the global stock market has gone from $1 to $59 from 1970 to 2017 as noted in Exhibit 3 below.Exhibit 3

History has found certain periods have resulted in higher returns than others. Part of this can be explained by starting valuation. Valuation is one of the best indicators of long-term returns (i.e. 10 years), but it is a horrible short-term timing strategy. One popular valuation metric we’ve discussed in the past is the cyclically-adjusted price-to-earnings (CAPE) ratio. Instead of dividing price by the past 12 months of earnings, the CAPE ratio divides price by the average inflation-adjusted earnings of the past ten years. The idea is to smooth out the good and bad years created by the business cycle.Is the CAPE Ratio a good predictor of future returns? According to a study by Research Affiliates titled CAPE Fear: Why CAPE Naysayers are Wrong, starting CAPE Ratio has between a 48% to 91% correlation to future 10-year returns across 12 countries. So yes, starting valuations do matter over the subsequent 10-year period.In addition, below Exhibit 4 is the average future 10-year real return based on starting US CAPE Ratio. As of December 31, 2018, below are the current CAPE ratios of the major equity markets:

History has found certain periods have resulted in higher returns than others. Part of this can be explained by starting valuation. Valuation is one of the best indicators of long-term returns (i.e. 10 years), but it is a horrible short-term timing strategy. One popular valuation metric we’ve discussed in the past is the cyclically-adjusted price-to-earnings (CAPE) ratio. Instead of dividing price by the past 12 months of earnings, the CAPE ratio divides price by the average inflation-adjusted earnings of the past ten years. The idea is to smooth out the good and bad years created by the business cycle.Is the CAPE Ratio a good predictor of future returns? According to a study by Research Affiliates titled CAPE Fear: Why CAPE Naysayers are Wrong, starting CAPE Ratio has between a 48% to 91% correlation to future 10-year returns across 12 countries. So yes, starting valuations do matter over the subsequent 10-year period.In addition, below Exhibit 4 is the average future 10-year real return based on starting US CAPE Ratio. As of December 31, 2018, below are the current CAPE ratios of the major equity markets:Exhibit 4

The summary is current stock valuations favor the international markets.

The summary is current stock valuations favor the international markets.Bonds

Our belief is that high quality bonds in your portfolio provide the following benefits:Exhibit 5

Overall, bond yields have increased over the last couple years, but remain low compared to historical levels.Related: The 6 Habits it Takes to be a Successful Investor

Overall, bond yields have increased over the last couple years, but remain low compared to historical levels.Related: The 6 Habits it Takes to be a Successful InvestorCash

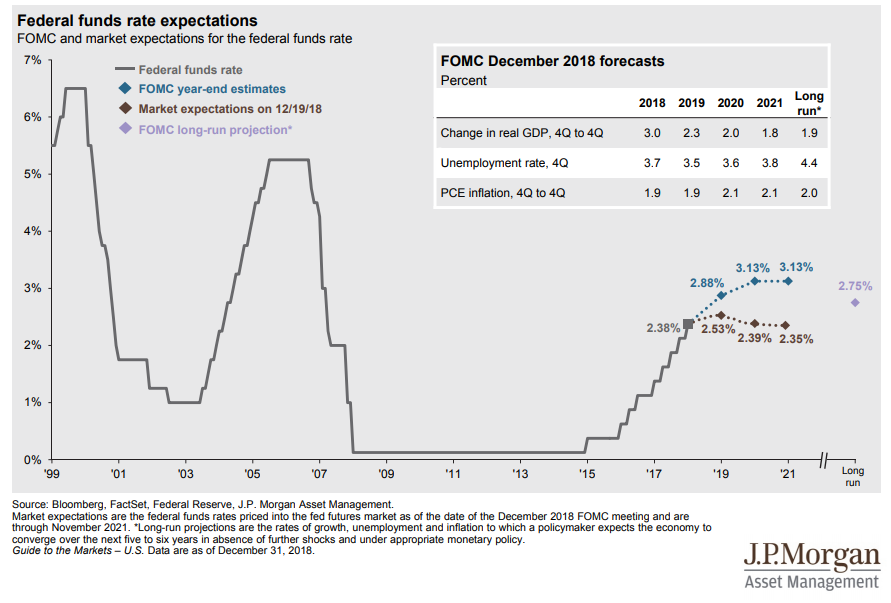

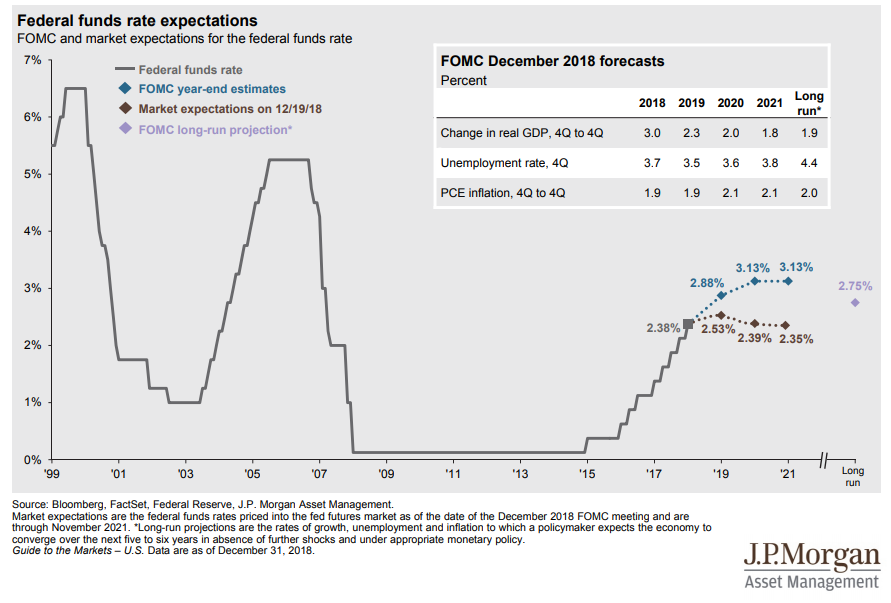

The Federal Reserve raised rates four times in 2018 and nine total adjustments over the past four years. The benchmark interest rate is in a range of 2.25% to 2.5%. The benefit of this is many investors have seen higher returns from their bank accounts but borrowing costs have also increased. What will the Federal Reserve do next? I have no idea, but below are the current market/Fed expectations as of December 31, 2018. You’ll notice the Federal Reserve and market is not expecting material rate increases from this point forward.Exhibit 6

What to Expect

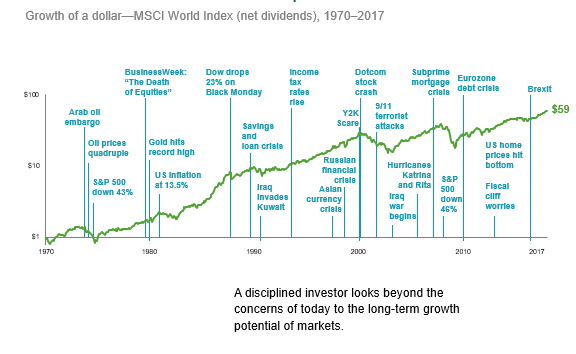

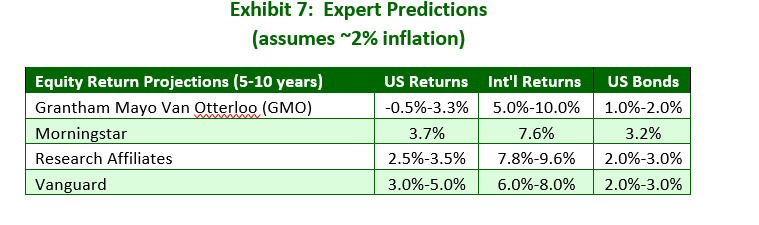

See Exhibit 7 below for projected returns over the next five to ten years from various industry experts for US stocks, international stocks and bonds. Note all sources expect higher returns for international stocks than US stocks or bonds. Although we have not listed the specific expectations for Financial Symmetry, our views are similar.Exhibit 7