Written by: Eugene Steuerle

Since its initial enactment in 1975, Congress has beefed up support for low- and moderate-income workers through the earned income tax credit (EITC), but it has largely excluded childless workers and married couples with two earners. One proposal to rectify this situation would expand a very small credit for childless workers back to the temporary level it attained for one year in 2021 under the American Rescue Plan Act (ARPA). Researchers from left to right to center— the Center on Budget and Policy Priorities, the American Action Forum, and the Urban Institute, with which I am affiliated—have written favorably about this type of proposal.

Unfortunately, there is a major glitch. Simply expanding subsidies only for childless workers, as done in 2021, would not only continue to exclude most married couples with two low earners but impose significantly higher marriage penalties on many of them. In addition, it would create significant new marriage penalties for childless couples contemplating marriage that would be pretty apparent to them when filing their tax returns. As a result, it would further chisel in stone Congress’s long disdain for marriage among low-income families, particularly when two modest-income workers either marry or contemplate marriage.

In my view, higher wage subsidies for low- and moderate-income workers provide one of the best ways to mitigate some of the wage inequality prevalent in the modern economy. It avoids the high costs and inefficiencies of government efforts to subsidize particular industries, jobs, or regions. It reduces potential income losses for subsets of workers in a competitive economy engaged in international trade. It provides more work incentives than most other efforts within the social welfare budget. Finally, higher returns from work offer one way to address the growth in the share of single males who are adrift and have limited commitments to society—a particular focus of Richard Reeves and the American Institute of Boys and Men.

It is an open empirical question on the extent to which public policy negatively influences marriage rates and, thereby, drives some of America’s economic problems. This issue has received renewed attention due to Melissa Kearney’s recent book on the negative consequences correlated with the decline in two-parent families and related work by Raj Chetty and co-authors on how the presence of fathers in a neighborhood enhances economic opportunities for boys.

Even if you think that legislated marriage penalties have a limited effect on marriage itself, there are other reasons to worry about them. For one, they are penalties on marriage vows, not on living with others, and, so, violate simple standards of equal justice or what economists call horizontal equity by failing to provide equivalent levels of taxes and benefits to those otherwise in similar circumstances.

More importantly, if reformers fail to address the fundamental marriage penalty issue, they could easily threaten future public support for increasing wage subsidies to tackle the inequality, efficiency, work incentive, and family commitment issues noted above.

So, how did we get into this mess? As I often emphasize in this column, it is another case of how language and soundbites can badly drive policy.

Here’s how the soundbite trap was created regarding EITC expansion. EITC dollars now largely go to households with children. A childless worker working full-time year-round at a minimum wage job can’t even get an EITC. The simple assumption, therefore, is that if a decent credit were given to households without children, then, voila, the combined system would cover all low-earning families, whether they have children or not.

However, that conclusion is incorrect. As noted, the current design largely leaves out not just childless workers but many two low-earner households. Under current law, a marriage vow to a second earner often significantly reduces the credit that a single head of household, usually a woman, can otherwise attain.

What happens if Congress adds a more substantial credit for childless workers to this mix? If a childless worker marries another worker with children, the latter’s credit will likely be reduced under current law. But now the formerly childless worker loses a credit as well. Why? That worker no longer qualifies as childless.

That isn’t all. Marriage penalties now increase dramatically for two childless workers, whereas before, such penalties were largely non-existent. Those facing the penalty include not only those with long histories of low earnings but millions of young people starting out in the job market at modest wages. For the most part, the current EITC for childless workers is so small and unavailable that marriage penalties when no children are present are also small. However, under the 2021 expansion, a single childless person could now receive a benefit when working full-time at minimum wage. If that person married someone else with any earnings, the credit would be reduced and often eliminated for both of them.

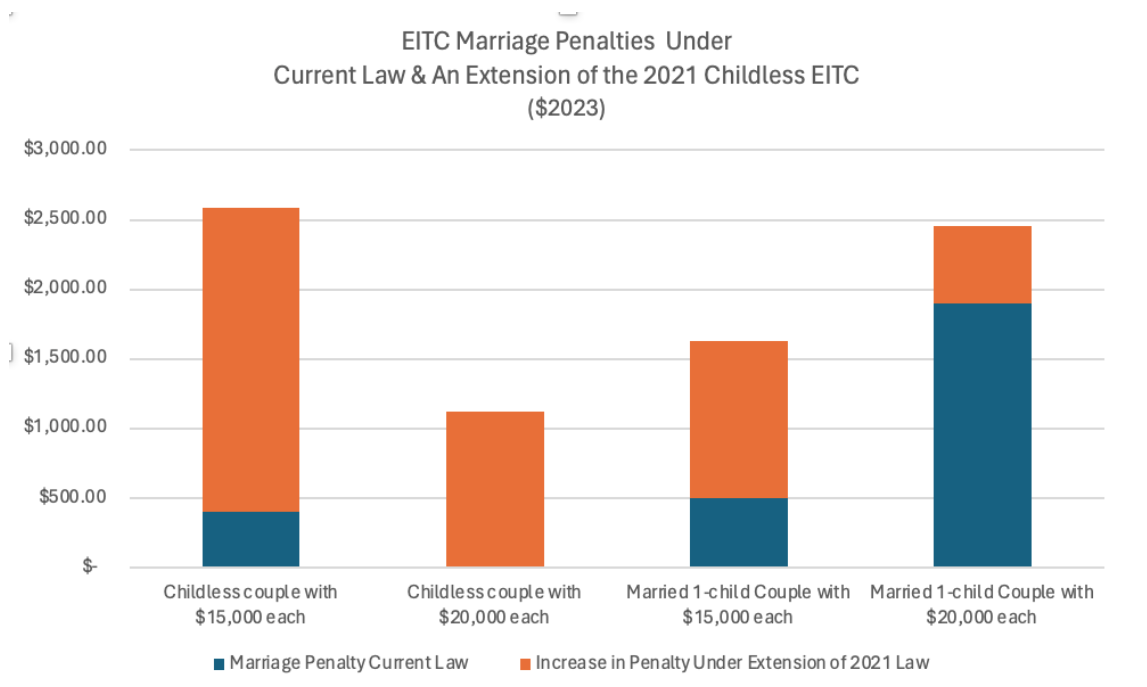

I realize this is a bit complicated. However, look at the graph at the top of this page and the increase in the marriage penalties (the highlighted red area of each bar) over and above existing marriage penalties (the highlighted blue area) under a simple extension of the 2021 law. I give four examples. The partners in one couple earn $15,000 each; in the other, $20,000 each. The couples either have no children or have one child between them. I compare marriage penalties in current law with the penalties that would be prevalent if the 2021 expansion were made available in 2023, indexed for inflation.

Start with the case where no children are present. Under current law, the childless couple loses only a few hundred dollars when they marry; they both lose small credits. Under the expansion, marriage forces them to give up a much larger credit, so their penalty rises to about $2,600. The childless couple with $20,000, in turn, each gets no credit under current law when unmarried, but they lose entirely what they would have received under the new law, leaving a marriage penalty of more than $1,100.

In the case where one child is present, the couple with $15,000 each in earnings lose about $500 by marrying under current law but more than $1,600 under the expansion. The couple with $20,000 each already faces about a $1,900 penalty for marrying under current law but lose almost an extra $600 under the new law.

Unfortunately, it is hard not to fall further into the trap created by Congress when it identified the childless worker, but not the married couple with two low earners, as defining the remaining group largely left out of receiving any significant wage subsidy.

In sum, if Congress merely beefs up existing credits in the same ways that they are currently designed, it adds significantly to penalties paid by many who marry and threaten many millions more contemplating marriage. Admittedly, I have not dealt with the tradeoffs involved with alternative ways to boost those wage subsidies, such as basing the credit on individual, not family, earnings. I have also focused mainly on two earners with modest, but not very low, earnings. I hope simply to establish that marriage penalties require more attention as wage subsidies receive higher priority within the nation’s social welfare system.

Related: The Economics of Compassion