Oh, and Does it Really Matter?

Whenever the stock market goes up for a long time without any sort of significant pullback, the natural question that we start to field is, “How much longer can this go on?” At this point, it would have been natural to expect a 5% pullback in the market, given how often they happen.

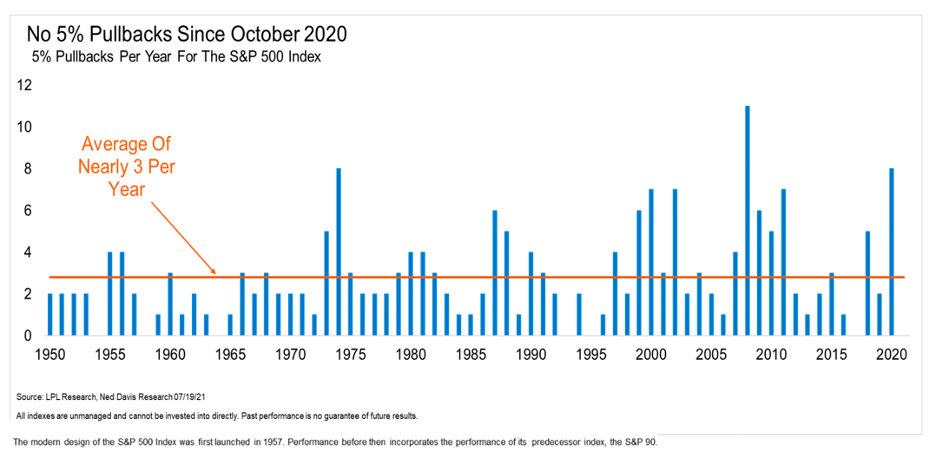

In fact, on average, we should expect a 5% pullback to happen three times a year. Yes, A YEAR.

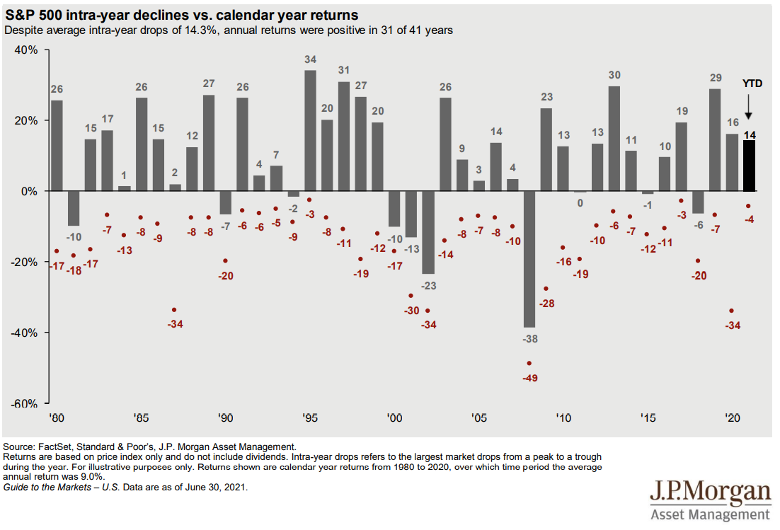

But remember, while “on average” is not the most useful statistic for an investor (or prognosticator), 5%, 10%, and 20% pullbacks do happen. Below is a decent chart that shows intra-year declines (red dots) for the S&P 500 over calendar years along with the actual calendar year return. With an average intra-year drop of around -14%, 75% of the 41 calendar years in the chart ended up with positive returns (Source: JP Morgan Asset Management).

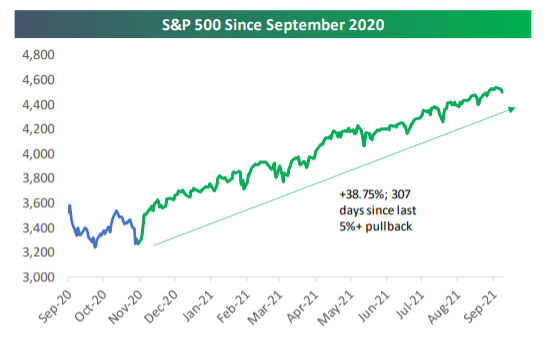

At this point, the S&P 500 has gone about 307 days without a 5% decline. And over those 307 days, it has advanced approximately 39%.

So 307 days without a 5% pullback resulting in an increase of 38%.

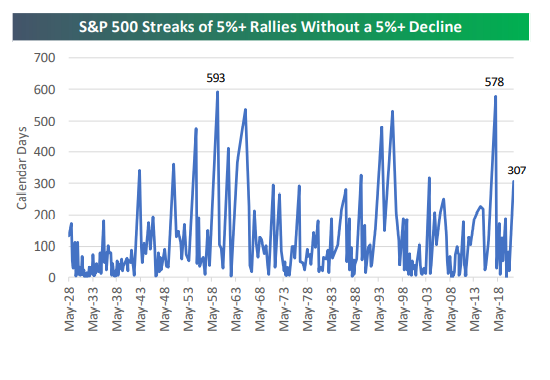

So, while 307 days is certainly a long time, it is also not without precedent. As early as 2018, investors enjoyed 578 days without a 5% or greater pullback, and the longest streak was 593 days, but you have to go back to the 50s to find that. Keep in mind that those two streaks are close to two times as many days as the one we are currently in.

So what?

You never know what you don’t know. Translation: your gut is not a good gauge for anything, so here are the things you should be doing now:

- Raise cash you think you may need over the next year. This allows you to ride out any market pullbacks without having to react—bonus points for feeling good that you raised cash near an all-time high and brag to your friends. (I won’t even ask for credit…just run with it and savor the glory.)

- Run a “Fire Drill”. If you had $1 million in a portfolio of stocks and woke up tomorrow to a 20% pullback, how pissed would you be on a scale of 1-10 (10 is the most pissed) at losing $200,000 overnight? Raise cash until the actual dollar loss would put you at a 4.9.

- Now double-check the dollar amount associated with your 4.9 and realize the portfolio will need to go up 25% to make you whole again. If your score went up, sell more to get back to 4.9

- Check your concentration. Are you exposed to a few big names in your portfolio that could cause you to lose more value on a percentage basis than the corresponding market pullback? Fix that, because, as the ice age proved (and no, Dean was not alive back then), you don’t need a lot of force to create a ton of damage.

- If you have corrected everything above or were all set and require no adjustment, there is still something you need to do…let compounding do its thing. Remember, compounding doesn’t depend on BIG returns. It simply needs sustained, unbroken GOOD returns over a long period of time. And unbroken means holding through the periods of pandemonium and turmoil.

- Finally – get the big things right. Preventing one big, mistimed mistake can do more for your lifetime of investment returns than getting dozens of small choices (guesses) right. For more on that, be sure to check out our upcoming Podcast where Jessica and I host Emily Harper on this topic.

This first appeared on Monument Wealth Mangement.

Related: The Wealth Comparison Game is Unproductive…Here’s Why.