Always fun to compare yourself to others. Are you a spending savant or a spending savage? Let’s find out! Start by comparing your expenses to the national average and look for improvements by spending category.

The Bureau of Labor and Statistics publishes monster-sized tables that show every kind of information about household income and expenses. The data can be useful as a quick comparison to identify areas of opportunity in your budget. Expenditures are broken down for various income levels and each spending category gets into excruciating detail. Right down to nuts, seeds and cooking oils. Those with plenty of caffeine can gorge on the details here. The rest of you are less likely to nod off by staying in the post with me.

Improvements by Spending Category

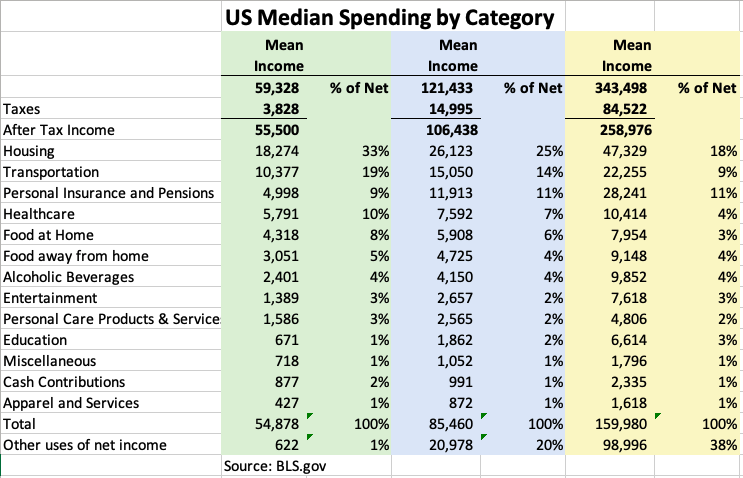

Here is a summary of the average expenditures by category:

US Median Spending by Category

Trust me, this is the simplified version! Down the left is the various categories of expenditure. The colored sections show the actual expenditures by various levels of income. The percent column shows the percent of the after tax income on each category. As an example, in the blue column, we are looking at spending for an average household income of $121,433. After taxes, this household would have available income of $106,438. The expenses are then shown as a percent of that available income.

A few things are interesting. Notice how the the lower income households (green) have only $622 left after their core expenses. The high income earners, however, have 38% of their income available for savings, investments or debt pay down. In other words, as income rises, expenses don’t scale as you would expect. This is consistent with The Millionaire Next Door, a book that outlined the spending habits of the wealthiest Americans. In other words, the wealthy are big savers, not big spenders. They could afford fancier cars and homes, but instead, they get their money working for them. That’s why they are wealthy. First lesson right there!

How do you compare?

Use your paycheck or your last tax return to determine your pre and post tax income. Then pick the column in the table that is closest to your income level. Calculate your expenses by listed category and see how you compare. This is most easily done using a dedicated budgeting tool like Mint or YNAB (You need a budget). You can also review a few months of bank and credit card statements and add up the expenses by category. Many bank and credit card companies allow you to easily categorize your expenditures. As an example, they can “learn” that gas bills and house insurance are part of your Housing category. And all of the Dunkin’ drive thru’s get tacked onto the Food Away From Home category.

To find improvements by spending category, focus on areas where your percentages are higher than the national averages for your income level. I broke out food at home and food away from home since they are frequent offenders. Spend extra time looking at the larger categories and look for ways to bring them back in line. Make some adjustments in your spending, then go back and review again in a few months.

Some key ways to find improvements by spending category

Let’s look at some adjustments in some of the major expense categories:

Housing

In some cities, it is almost impossible to reduce housing costs. For instance, I recently moved from Toronto to Cleveland where houses are less than 1/10th the price.In addition, many other expenses are also significantly lower. Read all of the details here. If you don’t have the ability to switch cities, consider some of these ideas:

- Renting on your own? Could you switch to a 2 bedroom and get a roommate?

- If you are a homeowner, can you create a separate rental suite?

- Have you looked for ways to slash your utility costs?

- Have you shopped your other home-related bills like insurance?

- Is there an opportunity to appeal your house taxes?

- Can you improve your credit rating and/or renegotiate your mortgage rate?

- Can you reduce the costs of home renovations?

Transportation

Looking at the blue column, transportation is the next largest expense at 14% of net income. There are lots of ways to lower this cost, here are a few to consider:

- Is there a way to live closer to work, shopping and recreation? As jobs change, kids move out and priorties shift, maybe you aren’t living in the right part of town any more. Could a move make sense?

- Could you make do with one less car? According to Fortune, cars spend 95% of their time parked. Expensive driveway jewelry! And interestingly, the largest parts of the costs are there whether you drive them or not: car insurance and depreciation.

- Can you incorporate more biking and walking? For instance, bike commuting to work can get in some health benefits while lowering your transportation costs.

- If you have the right number of cars, are they the right ones? Do you need 2 large cars, or could one large one handle the family trips and a smaller one cover the one person commutes?

- Look for ways to lower your commute costs. Especially in a world where you may be able to work from home, or work from home more than you did pre-pandemic. Each day of not driving makes a big difference on the expenses that do vary with mileage like gas, tolls, repairs and increased depreciation.

Life Insurance

Start by assessing how much insurance you need. There are lots of online tools to assess this or get help from a qualified insurance professional or financial planner.

- Reassess your needs over time. Your insurance requirements may reduce as your children become independent, your debts are paid off and your assets rise over time.

- Get the right kind of insurance for your needs. Term life insurance is usually much cheaper and provides better coverage that mortgage life insurance.

- Shop around for the best rates. Sites like policygenious let you quickly compare insurance rates

Healthcare

Healthcare can be a major expense and the options can be confusing. Here are a few thoughts to explore:

- Be sure to optimize whatever employment based healthcare you have in place.

- Outside of work-based healthcare, the Affordable Care Act can provide some significant savings in premiums if your income is low.

- Direct Primary Care is another option to consider. Check out the great post on this by Mr Money Moustache.

- If you lack drug coverage, most prescriptions can be had for far less than drug store prices. Take a look at how I saved 94% on my prescription drugs.

Summary

There is always a way to save on every category. A great start is to look at improvements by spending category. Use the percentages in the table to find any of your categories that are out of whack. What did you find with your expenses?