Written by: Ashley Perlmutter

Even though the coronavirus pandemic is not quite over, many retirement savings accounts are back to pre-Covid highs. Retirement account balances, which took sharp declines almost exactly one year ago, have now bounced back entirely, according to the latest data from Fidelity Investments, the nation’s largest provider of 401(k) savings plans.

Despite recent losses in the market, from January 2020 to the beginning of May, the S&P 500 has had an annual return of more than 20%. This has taken the average retirement account balance to record levels, surpassing even the previous highs reached right before the pandemic.

During this time, many more workers increased their contributions, more than any previous quarter, while a record number of employers also automatically enrolled new workers in their 401(K) plans. Additionally during this time, fewer savers tapered into their accounts to free up cash or pull from their emergency funds.

Individual retirement account balances were also higher — reaching $130,000, on average, helped in part by a spike in tax-deferred contributions ahead of the May 17 tax filing deadline. Thanks to a bull market and the boost in savings, the number of 401(k) and IRA millionaires hit a record.

The number of Fidelity 401(k) plans with a balance of $1 million or more jumped to a high of 365,000 in the first quarter of 2021. The number of IRA millionaires increased to 307,600, also an all-time high. Together, the total number of retirement millionaires has more than doubled from one year ago.

Inequality fueled by the stock market’s performance has been a hallmark of the pandemic recovery, marked by job loss for those at the bottom and soaring wealth for those at the top. This so-called K-shaped recovery has split the nation nearly in half, with the wealthiest faring even better than before, while millions more have faced setbacks.

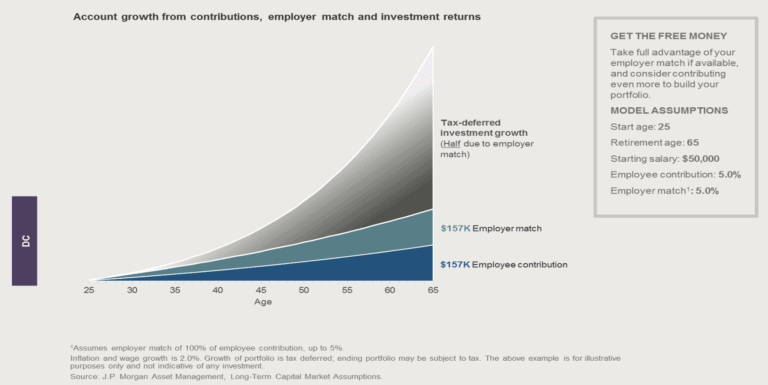

In an attempt to get yourself to these record highs, we want to share some great strategies to help you get there. As always, we recommend contributing at least enough to take full advantage of any employer match and opting into an auto-escalation feature, if your company offers it, which will automatically boost your savings rate by 1% or 2% each year.

Then, start early and create a separate savings account with emergency cash that will help you if you ever find yourself reaching a set back. We are thrilled to see an increase in funds and savings amongst Americans especially given the hard year we have had.

Related: How To Determine Your Debt Tolerance