Many lawyers worry that their current retirement plan does NOT meet their retirement savings goals.

Attorneys, along with their partners, max out on their traditional 401(k) contribution. Even with the 401(k) Profit Sharing contributions they can max out around $64,000 and may not be enough.

They want to have accelerated retirement savings, larger tax deductions and continue to offer excellent benefits for employees with lower salaries.

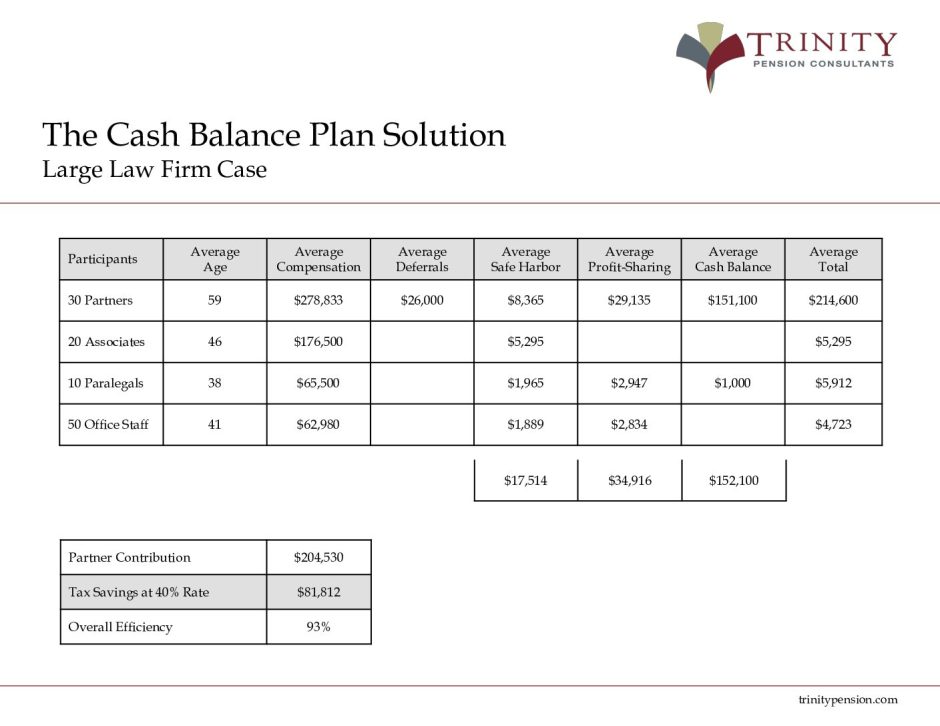

Case Study:

- 30 Partners

- 20 Associates

- 10 Paralegals

- 50 Office Staff

- 401(k) Profit Sharing Plan with Safe Harbor and added Cash Balance Plan

With this plan design, the attorneys, along with their partners, would achieve their goals and have larger tax deductions with accelerated retirement savings. One more advantage to point out is that ALL of the contributions to the plan are creditor protected.

Conclusion With a Cash Balance Plan:

- Cost efficiency and tax efficiency: ratio of owner/employee contributions works very well for small to mid-size firms. In a high tax environment, Cash Balance plans are a way to reduce AGI and lower the overall tax burden.

- Age-weighted contribution limits: ideal for older owners who have sunk most assets into the business and are behind on retirement.

- Asset protection (for lawsuit or bankruptcy).

- Attracting and retaining top talent (Cash Balance combo plans have greater appeal than DC only).

- Succession planning for family businesses.

If you are an attorney and are asking yourself how can we upgrade our current retirement plan for these larger tax deductions and accelerated retirement savings? Let us show you how.

Related: How Large Medical Groups Can Drive Down Their Tax Liability And Enhance Their Retirement Savings