This paper is forthcoming in the Journal of Policy Analysis and Management

The U.S. Fiscal System – Uncomfortable Truths

The U.S. fiscal system is unfair, distortionary, complex, and insolvent. It’s undermining our nation’s social cohesion, mobility, economic performance, and financial sustainability. Unfortunately, piecemeal solutions won’t suffice. Our entire fiscal operation needs immediate, radical reform.

Few Americans, including few of our nation’s leaders, appear to comprehend our country’s true fiscal condition. No surprise. The system comprises a vast array of federal and state programs that obscure its overall workings and impacts. Navigating this policy plethora is extremely frustrating. This explains continued, strong interest in tax simplification, such as adopting a national retail sales tax with a basic benefit that depends only on household composition.

Why, exactly, do we have so many complex fiscal programs? Politicians prove their worth by enacting new “reforms.” They do so, however, without acknowledging the impact on, and generally worsening of, the overall fiscal structure. There are, of course, lots of politicians. Congress has 535 members. Hence, small print in program rules is needed to provide sufficient fiscal space to accommodate large numbers of legislative “victories.” The small print contains claw back provisions, including income and asset tests, that take back with the left hand much of what is given with the right.

The Social Security system is a prime example of mind-numbing complexity coupled with claw backs. The program provides just 12 benefits, yet its Handbook has 2728 rules governing these payments. And its Program Operating Manual has hundreds of thousands of rules delimiting the 2728 rules. These rules within rules within rules within … are conveyed in an arcane language that few, including Social Security staff, can decipher. A remarkably large share of the rules has one purpose – to limit participants’ access to promised benefits.[1]

In short, our politicians have constructed a fiscal monster. Its economic damage can’t be eliminated piecemeal, for a simple reason. Each of our fiscal system’s programs contribute to all or most of the system’s problems. Hence, addressing, for example, work disincentives facing the poor can’t be done by eliminating one program’s work penalities when other programs with such penalties are left in place. In short, all aspects of the system need to be reformed in unison. This applies to fixing taxes – the main focus of this essay. Tax reform requires assessing the entire system and ensuring that changes to revenue collection fits properly into comprehensive reform that fully delivers overall objectives.

Our Fiscal Hydra

The U.S. federal tax system comprises the federal income tax, the federal corporate income tax, the FICA payroll tax, the federal estate and gift tax, and the federal excise tax – all specified in over 7,000 pages of federal tax code. But the states and localities have their own fiscal policies. Indeed, there are 42 (including Washington, D.C.) state income taxes, 45 general state sales taxes, over 11,000 local sales taxes, close to 5000 city, town, or county income taxes, 44 state corporate income taxes, 13 state estate taxes, and 6 state inheritance taxes.

As for benefit programs, the feds have Social Security, Supplemental Security Income, Medicare, Medicaid, the Affordable Care Act Act, Food Stamps, TANF, Section 8 Housing, Child Care Allowances, WIC, and more. But states have their own variants of Medicaid, Food Stamps, Housing Assistance, TANF, ACA, and other “federal” programs. Thus, there isn’t one Medicaid program, but 51. Nor is there one ACA program. Instead, there are thousands since ACA subsidies depend on local area ACA Silver Plan prices and out-of-pocket costs.

Moreover, our “tax” programs contain benefit programs and our “benefit” programs contain tax programs. Two examples. The federal income tax includes the Earned Income Tax Credit, of which there are 32 state versions, Child Tax Credits, of which there are 12 state versions, tuition subsidies, retirement account saving subsidies, etc. And Medicare includes the IRMAA Part B Premium, which, apart from its name, is simply a progressive tax on the elderly.

Fiscal Sustainability

Our thousand-headed fiscal hydra is terrible to contemplate. The only good news is that it’s dying – for a simple reason. It’s financially unsustainable. The federal government’s fiscal gap suffices to make this point. This gap references the present value difference between all projected future federal outlays and receipts. By considering all such financial flows, no matter their politically chosen labeling, the fiscal gap puts all implicit government obligations and income sources on the books. Stated differently, it treats obligations that Congress declares as official (e.g., servicing Treasury bonds) no different from obligations it declares unofficial (e.g., paying retirees Social Security benefits).[2] The fiscal gap simply checks whether the government’s intertemporal budget constraint (IBC) – the condition that it pays, in present value for what it spends -- is satisfied.[3]

Our country’s fiscal gap is 7.7 percent of the present value of future GDP.[4] Closing it requires an immediate and permanent 41.3 percent increase in all federal taxes, an immediate and permanent 35.3 percent cut in all non-interest federal spending, or some combination of these awful alternatives. Unfortunately, this grim sustainability news is not predicated on casual projections of Uncle Sam’s future fiscal outlays and receipts. The numbers used to form the fiscal gap are the Congressional Budget Office’s long-term fiscal projections.[5]

Assuming no changes to fiscal policy, can we wait to raise taxes or cut spending? Yes. But so doing will force today’s and tomorrow’s children to pay even more of our bills. I.e., future tax hikes or benefit and discretionary (read public goods) spending cuts will be even larger. The only alternative to this dreadful tradeoff is achieving dramatic efficiency gains from completely changing our broken and broke fiscal enterprise.

Fiscal Progressivity and Inequality

Any major fiscal reform will surely run aground if it significantly decreases fiscal progressivity and, thereby, raises inequality. Apart from the ability of billionaires to legally avoid almost all taxation[6], the U.S. fiscal system is highly progressive. This statement is documented in Auerbach, Kotlikoff, and Koehler (2023).[7] Their study, which uses 2016 Federal Reserve Survey of Consumer Finances (SCF) data and incorporates all major federal and state fiscal policies, considers how much households pay in lifetime net taxes as a share of lifetime resources (human plus non-human wealth). Take forty-year-olds. The lifetime net tax rate of the bottom resource quintile is negative 44.4 percent. For the top quintile, it’s positive 30.7 percent. For the top 1 percent, it’s positive 34.7. The progressivity picture for other cohorts is similar.

As for inequality, the study’s focus is on remaining lifetime spending power (LSP). Consider, again, forty-year-olds. The richest 1 percent of this cohort owns 29.1 percent of cohort net wealth, but accounts for only 11.8 percent of cohort LSP. The poorest quintile owns just 0.4 percent of total cohort wealth, but has 6.6 percent of cohort LSP.

The fact that LSP is more equally distributed than net wealth doesn’t mean that U.S. inequality is moderate. On the contrary, the ratio of average LSP of those in the top 1 percent to the average of those in the bottom quintile is 36 to 1. Stated differently, the living standard of those in the top 1 percent is 36 times higher than that of those in the bottom 20 percent. In addition to achieving fiscal sustainability, reducing LSP inequality represents a second key goal of fundamental policy reform.

Horizontal Inequality

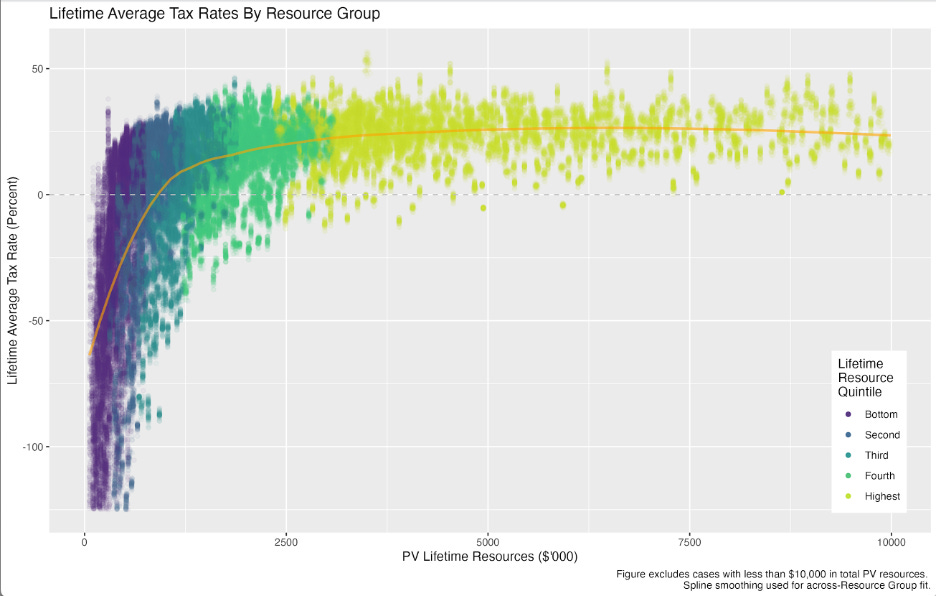

Another key fairness concern is horizontal fairness. Figure 1 plots average lifetime net tax (LATR) rates against lifetime resources. It shows very major differences in remaining LATRs for households with essentially the same levels of lifetime resources. Demographics play some role in this dispersion. But there are substantial horizontal differences in fiscal treatment even controlling for age, marital status, and the presence of children. Note that a household’s LATR represents its equivalent/effective remaining lifetime consumption net tax rate. Hence, apart from its impact on work and saving incentives, our fiscal system can be viewed as one that taxes/subsidizes the remaining lifetime consumption of households with very similar economic resources at very different rates.

Work Disincentives

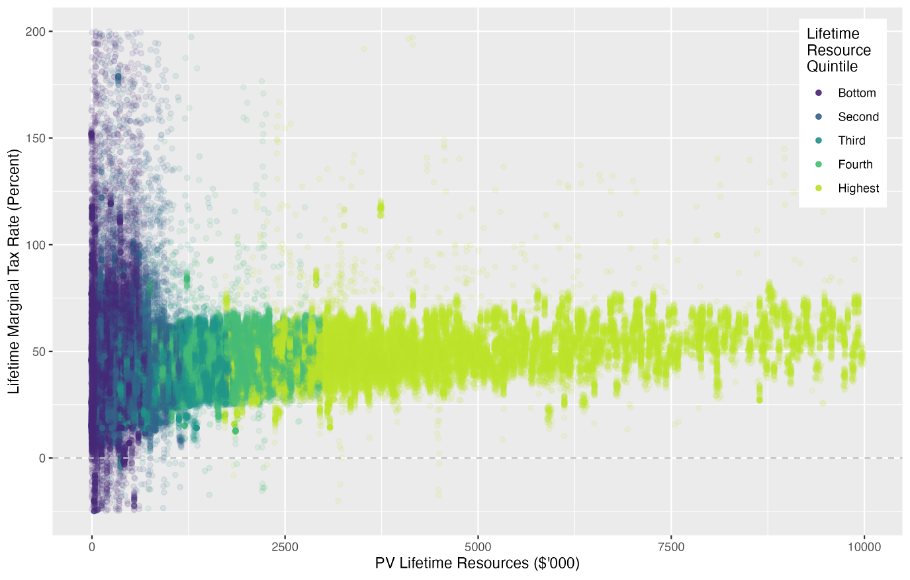

The plethora of fiscal policies underlying the U.S. tax/transfer system dramatically reduce work incentives. Indeed, many able-bodied Americans, particularly those with low hourly wages, face sky high marginal net tax rates. Figure 2 is based on a soon-to-be-released updated version of Altig, et. al. (2020). The update uses the 2019 SCF and incorporates households’ failures to participate in benefit program for which they are eligible. The figure plots lifetime marginal net tax rates (LMTR) facing able-bodied Americans ages 20-69. LMTR is defined as the present value of the additional lifetime net taxes a household head or spouse/partner would pay were they to earn an extra $1000 in the current year.[8]

Four things are immediately clear. First, there is the enormous heterogeneity in LMTRs facing Americans with essentially identical levels of lifetime resources.[9] Second, the dispersion in LMTRs is greatest among those in the bottom two resource quintiles. Third, a large share of Americans face very high LMTRs. Indeed, over half of working-age Americans face LMTRs above 43 percent.[10] Fourth, many Americans are facing confiscatory net taxes from additional earnings. One in ten SCF respondents in the bottom quintile face LMTRs above 70 percent, effectively locking them into poverty. For some would-be-workers, LMTRs exceed 100 percent. In fact, the study’s maximum reported rate equals 20,723 percent! Extremely high LMTRs reflect the complete loss of family benefits, in the current and future years, from programs, such as Medicaid. Medicaid ends benefits abruptly if one’s income or assets exceed specific thresholds by even one dollar. Thus, earning even one extra dollar can cost a worker thousands of dollars in benefits.

Taking Stock

One can convey more facts about the system, such as its distortions of saving and investment decisions. But the evidence just presented justifies repeating this essay’s first sentence: The U.S. fiscal system is unfair, distortionary, complex, and insolvent. Tinkering with the existing fiscal system, as exemplified by the Tax Cut and Job Act of 2017, falls miles short of the massive fiscal overhaul needed to achieve fiscal sustainability, intergenerational and intragenerational equity, and attractive work incentives for all able-bodied Americans, especially those with low wages. The challenge is great, but the stakes could not be bigger. Our country is on a fast track to Argentina, whose century-long fiscal malfeasance played a central role in transforming that country from developed to developing.

Fundamental Reform – An Outline

The most pressing reform issue is, of course, fiscal sustainability. Were our massive array of fiscal policies efficient, eliminating the U.S. fiscal gap would represent a zero-sum intergenerational game. Either we current adults would need to pay more over the rest of our days in net taxes or our children and grandchildren would face astronomical average lifetime net rates. Fortunately, our politicians have adopted policies that are wildly inefficient. Consequently, we can reorganize our affairs to cover most, if not all of the fiscal gap.

Fixing Healthcare

The prime example here is U.S. healthcare. We’re spending 18.3 percent of GDP on healthcare, yet rank 18th internationally in healthcare outcomes. Sweden’s healthcare system is the world’s 4th best, but costs 7 percentage points of GDP less! That’s almost as large as our nation’s fiscal gap. The Better Care Plan entails competitive universal health insurance with federal premium supplements to providers, who cannot deny coverage, based on their clients’ pre-existing conditions. The Plan is, effectively, Senator Sanders’ Medicare for All. But it’s built off the Republican Medicare Advantage option, albeit with strict standardization to prevent the cherry picking still prevalent in some aspects of that program. There are many ways to structure the Better Care Plan so that the basic premium payment represents the purchase of a private good, not a tax that distorts labor supply.[11] Since the Better Care Plan would replace Medicare, Medicaid, the ACA, and employer health plans, the labor supply distortions arising from each of these programs, particularly Medicaid’s income and asset tests and ACA subsidy claw backs, would be eliminated.

Fixing Social Security

Social Security reform represents another opportunity to dramatically reduce the fiscal gap as well as lowering workers’ LMTRs. The solution is to freeze the existing Social Security system in place. Retirees and current workers would receive all accrued benefits, i.e., all benefits owed to them at the time of the reform. But, at the margin, all workers, including those now in non-covered employment, would participate in The Personal Security System (PSS). The PSS is a fully funded, progressive, private, compulsory saving system. It invests all participants’ contributions in an identical market-weighted global index of stocks, bonds (government and private), commodities, real estate trusts, etc., guarantees a positive real return, and pays out all accumulations as inflation-projected pensions. The government makes progressive matching contributions on behalf of the poor, the disabled, and the unemployed. Contributions by married spouses are pooled, divided in half, and then contributed to each spouse’s account. Hence, a non working spouse who raises children accrues the same PSS assets as a working spouse. Best of all, the system can be run by a laptop at zero cost. Wall Street’s participation is neither needed nor permitted.

Fixing Welfare

The claw backs arising under SNAP (formerly called Food Stamps) and the Earned Income Tax Credit (EITC) can, on their own, put low-wage workers into a roughly 40 percent marginal tax bracket. The Child Tax Credit and the Child Care Credits also phase out based on income, but starting at a much higher thresholds. Section 8 Housing assistance is also subject to claw backs.

Consider first how to eliminate the marginal taxation arising under SNAP. An answer is to replace the program with direct food distribution in low-income neighborhoods and the provision, in these neighborhoods, of free meals seven days a week in food pantries and public schools. Parents would be free to eat at the public schools for dinner and on weekends.

The same solution could be applied to housing. The government would provide free housing in low-income neighborhoods, including for those who are now homeless. This tagging to low-income neighborhoods as the only places to receive food and housing assistance would provide help to those needing it with no impact on their incentives to work. The tagging would dissuade those not needing assistance to not make use of it. Yes, like moving to Better Care and the PSS, this is a very radical departure from existing policy. But un-trapping low-wage workers from poverty has huge potential societal payoffs, including reducing LSP inequality and generating higher tax revenues. As for the EITC, Child Tax Credits, and Child Care Credits, these programs can be eliminated and replaced with a basic universal benefit per person.

Fundamental Tax Reform

Last, but not least, we need to reform the tax system. It needs to generate far more revenue, at least maintain current progressivity as measured by the distribution of LSP, eliminate horizontal inequality with respect to average and marginal taxation, eliminate the poverty trap, and ensure the superrich can’t evade taxation.

There continues to be strong interest in fundamental tax reform. Some advocate replacing all federal taxes with the FairTax – a federal retail sales tax coupled with a basic lumpsum benefit.[12] Others favor the Hall-Rabushka Flat Tax.[13] The Flat Tax is essentially a value added tax with exemptions based on family size. It achieves this structure by taxing business cash flow and wages at the same rate. Yet others like Herman Cain’s 9-9-9 Plan.[14] It entail a 9 percent income tax, a 9 percent retail sales tax, and a 9 percent corporate income tax. Then there is David Bradford’s X Tax, which is the Hall-Rabushka Flat except that wages are taxed at progressive rates with the top wage-tax rate equal to the business cash flow tax rate.

Retail sales and value added taxes are proportional consumption taxes. Many commentators view a move to consumption taxation as regressive. But mathematically speaking, a proportional consumption tax is the combination of a proportional tax on wages and a proportional tax on wealth. Imagine our government was simply taxing labor income at a proportional rate. In that case, switching to an equal-revenue proportional consumption tax would be a progressive reform. It would tax wealth and wages at a lower effective rate than was previously the case. The reason is the taxes on wealth would permit reduced taxation of labor income. But why does taxing consumption tax wealth in addition to wages? The reason is that wages, current and future, plus current wealth are used to purchase consumption. To see this, consider a billionaire with no labor income. Their every retail purchase would be taxed assuming the consumption tax were imposed as a retail sales tax.

The problem with the FairTax, the Flat Tax, and The 9-9-9 Plan is that none of these reforms would be as progressive as the current fiscal system and would, therefore, worsen LSP inequality. The tax rates under the FairTax and Flat Tax would also be quite high since all revenue would come from one source. As for the X Tax, it would require a higher business cash flow tax rate than the current corporate income tax rate. Raising the business tax rate after it was lowered in 2017 is not likely to appeal to those who championed TCJA.

My Preferred Tax Reform

My proposed reform is the following: Replace the corporate income tax, the personal income tax, the current FICA tax, and the estate and gift tax with a business cash-flow tax, a progressive personal cash-flow consumption tax (which the superrich could not avoid), an inheritance tax (with an exemption for spouses) above a floor, a new, progressive FICA tax, and a carbon tax.

The current corporate income tax could, with a few tweaks, be transformed into a destination-based business cash flow tax. Such a tax is equivalent to a value added tax and, thus, represents a proportional consumption tax. The personal income tax could readily be transformed into a progressive personal cash-flow consumption tax by simply permitting deductibility of investments. Making the FICA progressive is also easy. One could exempt wages up to a limit and remove the wage ceiling on payroll taxation. As for taxing inheritances above an inflation-index threshold, doing so taxes the concentration of wealth, not the accumulation of bequeathable assets. And taxing carbon is far more efficient than our current policy of picking clean energy winners.

Let me suggest parameters that might work for this reform, which I’ll dub the SOK tax reform for Save Our Kids. The ultimate SOK parameters would need to be determined taking into account all of the above-mentioned reforms and the need to a) eliminate the fiscal gap, b) eliminate horizontal inequality in average and marginal taxes, c) at least maintain LSP progressivity, and d) provide much improved incentives to work and save – incentives that are horizontally equitable. I’d consider, for starters, a 15 percent business cash-flow tax rate, a 15 percent FICA tax above $50,000 in earnings (with the $50K threshold inflation indexed), a 15 percent increasing (starting beyond $250K) to 30 percent tax on annual personal consumption above $100,000 with the 30 percent rate being reached at $5 million of consumption, a 10 percent tax on inheritances received above $5 million, and a $100 per ton carbon tax rising in real terms at 1.5 percent per year.

The SOK tax reform together with the other reforms outlined above would eliminate our fiscal gap, improve LSP-measured inequality, effectively end horizon inequality, and lower and equalized (at a given level of resources) marginal net tax rates. The poverty lock would be history. Low-wage workers would face only a 15 percent net tax on their labor supply – miles below what so many are now facing. For middle wage workers with $100K to, say, $250K in consumption, the marginal labor tax would equal 30 percent (the 15 percent FICA tax, plus the 15 percent, lowest-bracket personal cash-flow consumption tax), and our highest wage workers would face a 45 percent tax (the 15 percent FICA tax, plus the 30 percent personal cash-flow consumption tax), which is lower than their current marginal tax bracket. As for the superrich, who consume out of their wealth, they would pay 45 cents on every dollar consumed (the business cash flow tax of 15 percent, which taxes consumption out of wealth, plus the 30 percent personal cash-flow consumption tax.)

Conclusion

Our country has enormous fiscal problems. They can’t be addressed simply by fixing what some people call the tax system. Indeed, tax reform needs to be done in concert with healthcare, Social Security, and welfare reform. Only then can we hope to eliminate our massive fiscal gap, equalize average and marginal taxation of Americans of very similar economic means, eliminate the poverty trap, improve work and saving incentives, ensure the superrich pay their fair share, preserve the progressive nature of our overall fiscal policy, limit, at least to some degree, the intergenerational transmission of inequality, and reduce our carbon footprint based on Kotlikoff, et al.’s (2022) calculated level of optimal global carbon taxation. In short, there are no shortcuts when it comes to fiscal reform. The entire system is so broken that piecemeal solutions are unacceptable. Fixing everything everywhere all at once is a very tall order, but the alternative is driving our economy as well as our children over a very steep and dreadfully close fiscal cliff.

Figure 1

2018 Lifetime Average Tax Rates, Ages 20-69

Figure 2

2018 Lifetime Net Marginal Tax Rates, Ages 20-69

References

Auerbach, Alan J., Laurence J. Kotlikoff, and Darryl Koehler. "US Inequality and Fiscal Progressivity: An Intragenerational Accounting." The Journal of Political Economy, forthcoming 2023.

Altig, David, Alan J. Auerbach, Laurence J. Kotlikoff, Elias Ilin, and Victor Ye. Marginal net taxation of americans’ labor supply. No. w27164. National Bureau of Economic Research, 2020.

Kotlikoff, Laurence J., Felix Kubler, Andrey Polbin, and Simon Scheidegger. Can today's and tomorrow's world uniformly gain from carbon taxation?. No. w29224. National Bureau of Economic Research, 2021.

Related: How Much Should You Be Saving?