Written by: Maryville University

The first step in achieving any goal is a good plan. When it comes to reaching financial goals, effective planning usually requires the assistance of a finance professional. In some situations, the best source for advice in setting and attaining financial goals is a financial advisor, who focuses on managing investments. In others, a financial planner, who takes a broader view of a client’s financial goals, is better suited.

While many similarities can be found in the work done by financial planners and financial advisors, the differences in each profession’s skills, experience, roles, and duties will determine the path that is the best match for people looking to pursue a career in finance. Examining the specifics in the financial planner vs. financial advisor debate helps to clarify the characteristics the two professions share and those that distinguish them.

Financial Advisor Description

Financial advisors are described as professionals who offer their clients advice and direction about the assets they choose to invest in. Anyone can claim to be a professional financial advisor, but true experts in the field hold specific certifications.

In particular, the U.S. Securities and Exchange Commission (SEC) requires that any financial professional or firm engaged in the business of giving others advice or issuing securities reports is acting as an “investment advisor” and must register with either the SEC or their state, depending on the type and amount of assets they manage.

Other titles for financial advisors include broker or broker-dealer, chartered financial consultant (ChFC), wealth advisor, asset manager, portfolio manager, and investment manager.

Financial Advisor: Roles and Duties

The U.S. Bureau of Labor Statistics (BLS) describes the typical duties of personal financial advisors:

- Determine the investments that best match the clients’ financial goals.

- Inform clients about investment options and potential risks.

- Recommend or select specific investments based on clients’ goals and preferences.

- Monitor clients’ accounts and recommend changes as conditions or client needs change.

- Research investment opportunities.

Financial advisors’ most important tasks are to closely monitor their clients’ investments and to keep clients apprised of the status of their financial holdings via regular reports. Financial advisors typically meet with clients at least once per year to review and update the clients’ investment strategy based on current and future market conditions and any changes that have occurred to the clients’ financial situation. Some financial advisors have their clients’ permission to make decisions about buying and selling stocks and bonds on the clients’ behalf.

Financial Advisor: Work Environments

The BLS estimates that there were about 263,000 jobs for personal financial advisors in the U.S. in 2019. The agency reports on the percentage of financial advisors working in various industries:

- Securities, commodities, and other financial investment service firms: 58%

- Self-employed financial advisors: 19%

- Credit intermediation services: 13%

- Insurance firms and related activities: 4%

- Corporate and enterprise management: 2%

Financial advisors typically work full time, Monday through Friday, but they may meet with clients in the evening or during weekends. As part of their marketing efforts, financial advisors may travel to meet with prospective clients, conduct seminars, or expand their professional and social networks.

Financial Advisor: Education, Certification, Skills, and Experience

A career as a financial advisor begins with an education and on-the-job training, followed by earning a relevant license or certificate from a state licensing board or the SEC. Advancement typically entails gaining experience in finance and investment specialties, such as wealth or portfolio management.

The BLS explains the education and certification requirements for financial advisors:

- The position requires at least a bachelor’s degree, preferably in accounting, finance, economics, business, or mathematics; a master’s degree improves chances for career advancement.

- Coursework should cover investments, risk management, taxes, and estate planning.

- Licenses are required to directly buy and sell stocks, bonds, and insurance policies, and to offer clients specific investment advice. The Financial Industry Regulatory Authority (FINRA) administers the Securities Industry Essentials (SIE) exam as well as a series of representative exams for certification as a general securities representative, securities trader representative, and other categories of financial advisors.

- North American Securities Administrators Association (NASAA) provides information about the state exams necessary to earn a license as a financial advisor, including Series 63, Uniform Securities Agent State Law Examination; Series 65, Uniform Investment Advisor Law Examination; and Series 66, Uniform Combined State Law Examination.

Financial Advisor Resources

- Investopedia, “10 Best Tools for Financial Advisors” — Retirement calculators, cloud-based portfolio management, and presentation tools designed specifically for financial advisors.

- Diamond Consultants, Tools & Resources — An infographic overview of the wealth management industry as well as a career-planning decision matrix and “gut check” tools for advisors who are suffering career malaise.

Types of Financial Advisor

While most professional financial advisors earn a pertinent certification or license, NerdWallet points out that the title “financial advisor” doesn’t connote any specific training, credential, or registration. Two characteristics distinguish licensed or certified financial advisors: They have a fiduciary duty to act in their client’s best interest rather than their own or their employers; and they are paid on a fee-only basis (directly by the client) rather than on a commission basis.

These are among the most common types of financial advisors.

- Investment advisors: This category includes registered investment advisors (RIAs) who usually focus solely on securities rather than other types of investments. Investment advisors who manage more than $110 million in client assets must register with the SEC, while those managing less than $110 million in client assets must be licensed by their state’s securities regulator.

- Brokers/broker-dealers: These are individuals or companies that buy and sell stocks, bonds, mutual funds, and other forms of securities on behalf of clients (brokers), themselves (dealers), or both. In addition to registering with the SEC, brokers and dealers are usually members of FINRA. The type of securities they can sell depends on their license. For example, passing the FINRA Series 6 exam qualifies them to sell mutual funds, variable annuities, and similar products.

- Portfolio, investment, and asset managers: All three manage their clients’ investment portfolios, but portfolio managers and investment managers may also provide other kinds of financial services. Because the positions entail giving clients investment advice, they must be registered as investment advisors with their state or the SEC.

- Wealth advisors/personal bankers: In most cases, advisors in these positions work with very wealthy clients with portfolios worth millions of dollars to guide their investment strategy and offer other financial advice. This may include tax planning, retirement planning, and charitable giving, all areas that are generally the province of financial planners.

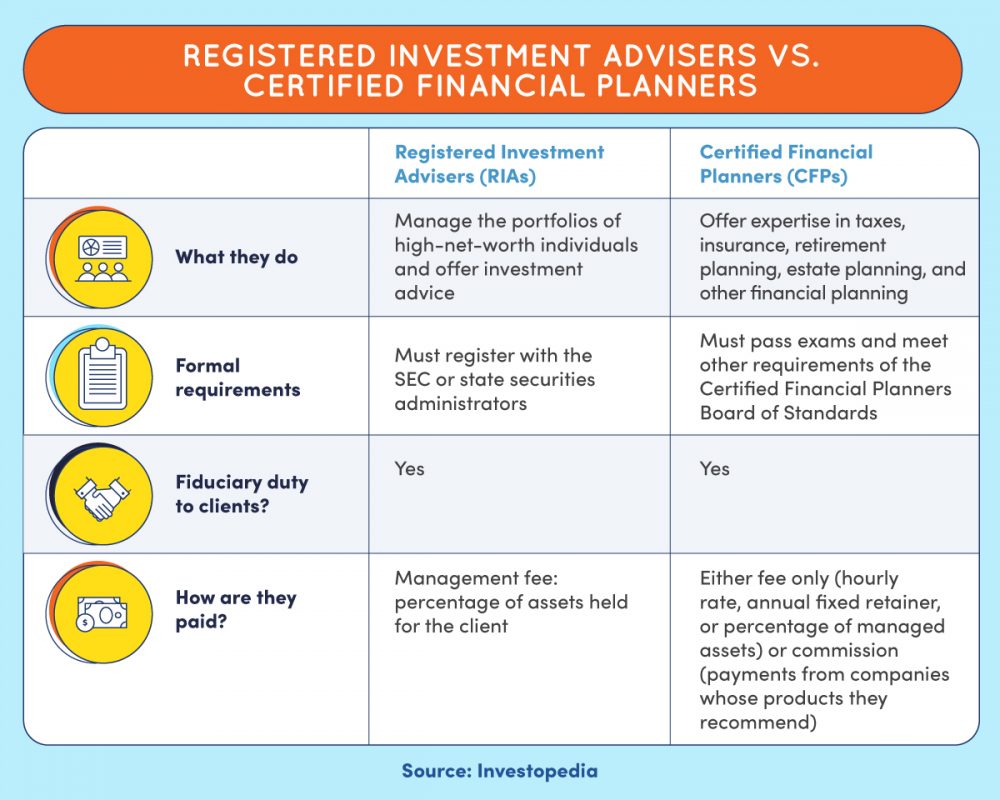

Registered investment advisers (RIAs) manage the portfolios of high-net-worth individuals and offer investment advice. RIAs must register with the SEC or state securities administrators. They have a fiduciary duty to clients, and they earn a management fee, or a percentage of assets held for the client. Certified financial planners (CFPs) offer expertise in taxes, insurance, retirement planning, estate planning, and other financial planning. CFPs must pass exams and meet other requirements of the Certified Financial Planner Board of Standards. They have a fiduciary duty to clients, and they are paid either by fee only (hourly rate, annual fixed retainer, or percentage of managed assets) or by commission (payments from companies whose products they recommend).

Financial Advisor Salary

The BLS reports that financial advisors who work for financial services firms or are self-employed generally earn a percentage of the value of the assets they manage for their clients, although many also charge an hourly fee or receive fees based on the stock and insurance purchases they make on clients’ behalf. They may also receive a commission based on the financial products they sell.

- As of May 2019, the median annual salary for personal financial advisors was $87,850, according to BLS figures.

- The BLS further reports that those working for securities, commodities, and other financial investment firms earned a median annual wage of $95,540, while those working for insurance carriers and related areas had a median annual salary of $71,280.

- The salary survey site PayScale notes that financial advisor salaries vary based on location. For example, in New York City, financial advisor salaries were about 27% higher than the national average as of February 2021, while salaries for financial advisors who worked in Houston were about 9% lower than the national average.

- Certain skills can boost a financial advisor’s salary, according to PayScale’s analysis. Among these in-demand skills are oral and verbal communication (99% higher than the industry average salary), counseling (73% higher), tax consulting (53% higher), and data analysis (51% higher).

Financial Planner Description

When it comes to financial planners vs. financial advisors, the primary difference between the two roles is the scope of the financial advice they offer to clients. While financial advisors focus on managing their clients’ investments in securities, a financial planner description encompasses working with clients on tax planning, retirement planning, insurance protection, and planning for big-ticket purchases and life events such as weddings and educational expenses.

As with financial advisors, anyone can offer financial planning services and call themselves a financial planner without earning a specific license or certificate. The exception is when they serve in a regulated capacity, such as when buying and selling securities as an investment advisor, as explained above. However, financial experts recommend that people work with certified financial planners (CFP), who have met specific education requirements and have passed the CFP exam given by the Certified Financial Planner Board of Standards.

Financial Planner: Roles and Duties

Financial planners help their clients evaluate their current financial status, understand the tax implications of their income and current investments, confirm that they are adequately insured, create an investment plan, clear any outstanding debts as quickly as possible, and strike the optimum balance between risk and asset protection.

These are some of a financial planner’s duties, and how they differ from a financial advisor’s:

- Examine clients’ financial situation from a more holistic perspective rather than simply managing investments.

- Manage clients’ investments in the broader context of how the investments fit into their complete financial picture.

- Provide financial planner specialty services such as tax, retirement, and estate planning in addition to investment management.

- Help clients plan for education expenses, retirement, and other life events.

Areas of personal finance that financial planners address with their clients include the following:

- Cash management is the flow of funds in (income) and out (expenses). Financial planners help clients estimate their current and future expenses, and then devise a strategy for ensuring sufficient income to cover expenses, setting aside funds for emergencies, and reaching other financial goals.

- Insurance planning becomes a key part of the financial plan because insurance serves as both a safety net and an investment clients make in themselves. In addition to having sufficient coverage for current health, life, home, and vehicle needs, clients have to update their policies as their circumstances change.

- Tax planning is intertwined with investment planning because many investment decisions are influenced by the tax advantages of various investment options. Timing is essential when determining the optimal strategy for maximizing gains without taking on too much risk based on a client’s stage of life.

- Retirement planning is often paired with financial planning for the client’s children. The sooner clients begin planning for their retirement and their children’s future, the more likely they will have the funds they need to retire comfortably and meet their children’s educational and other needs.

Financial Planner: Work Environments

While many financial planners work in investment firms or banks, Investopedia reports that about 40% of personal financial planners are self-employed; they may also work in small, independent practice groups. However, as in most other professions, the work environment for financial planners is and will continue to be influenced by shifts and advances in technology.

The Financial Planning Association notes that personal finance service models are evolving rapidly as younger generations demand transparency, fairness, and a lack of conflicts in pricing for financial planning services. Young people prefer paying subscriptions rather than fees based on assets under management. Financial planner work environments will shift as sophisticated financial planning tools automate much of the research and analysis, allowing planners to spend more time working directly with clients.

These are some common job titles for financial planners:

- Self-employed financial planner

- Financial planning and analysis manager

- Retirement and estate planner

Financial Planner: Education, Certification, Skills, and Experience

These are the four key elements to becoming a financial planner:

- Earn at least a bachelor’s degree in accounting, economics, finance, or a related field, although many advanced and senior positions require a master’s degree.

- Earn CFP certification. Alternatively, financial planners can be certified as a chartered financial analyst (CFA) by the CFA Institute, or a chartered financial consultant (ChFC) by the American College of Financial Services. In addition, certified public accountants (CPAs) can apply for the add-on certification of personal financial specialist (PFS) from the American Institute of Certified Public Accountants.

- Develop strong analytical skills and interpersonal communication skills to ensure a positive working relationship with clients.

- Gain a solid understanding of different financial instruments and investment options. This allows financial planners to serve clients at all stages of their careers and throughout their lives.

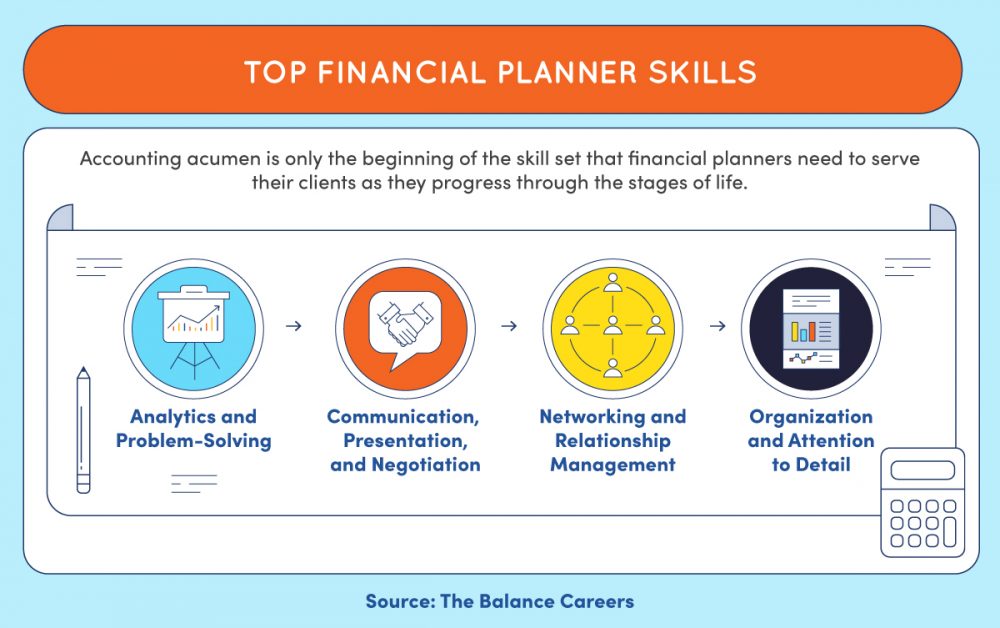

Accounting acumen is only the beginning of the skill set that financial planners need to serve their clients as they progress through the stages of life. These skills are key: analytics and problem-solving; communication, presentation, and negotiation; networking and relationship management; organization and attention to detail.

Financial Planner Resources

- Certified Financial Planner Board of Standards, Resources for Your Clients — Brochures and publications describing the roles and duties of CFPs as well as their ethical responsibilities and other professional expectations.

- S. News & World Report, “5 Professional Organizations for Financial Planners” — An exploration of the benefits of membership in a group where professional financial planners can connect with peers and expand their network of professional contacts.

Types of Financial Planner

Most financial planners eventually adopt a specialty. While CFP certification is considered the “gold standard” for financial planners, according to the Motley Fool, many other lucrative and rewarding practice areas for financial planners are available.

- Chartered financial consultant: The ChFC designation is similar to CFP certification, but while a CFP requires taking seven courses, a ChFC entails completing nine courses, two of them application-based. Also, a CFP must pass a single board exam that covers all seven topics, while a ChFC must pass a separate exam after each of the nine courses.

- Financial coach: This is often an entry-level position for financial planners who work with clients primarily to instruct them on the basics of financial management and planning. The goal is to help clients amass wealth that an investment advisor will help them maintain in the future. NerdWallet explains that financial coaches focus on their clients’ financial behaviors, patterns, and money decisions.

- Chartered life underwriter (CLU): This type of financial planner specializes in advising clients about life insurance and estate planning. Investopedia explains that CFPs may add a CLU credential by passing a series of courses and exams. The CLU designation is conferred by the American College of Financial Services.

- Financial risk manager (FRM): The Global Association of Risk Professionals (GARP) awards this designation to finance professionals who possess specialized skills in assessing risk. FRMs typically work for banks, asset management companies, accounting firms, insurance companies, and regulatory agencies. As Investopedia explains, many FRMs specialize in determining credit or market risk.

- Enrolled agent: These professionals are authorized by the S. Internal Revenue Service to represent clients before the agency. The designation requires passing a three-part test on personal and business tax returns; it is also available to former IRS employees with the appropriate experience. Enrolled agents have unlimited practice rights, so they may represent clients in all tax-related matters.

Financial Planner Salary

Just as many roles and duties overlap when comparing financial planners vs. financial advisors, the salary ranges for the two positions overlap depending on the area of practice. PayScale estimates the median annual base salary for financial planners was about $64,000 as of February 2021, excluding bonuses, profit sharing, and commissions, and reports the following:

- Midcareer salaries for financial planners (with five to nine years of experience) were about 11% above the average for all professionals in the category, while late-career salaries (10 to 19 years) were approximately 30% above the average, and experienced financial planner salaries were about 60% above the average.

- The skills with the most impact on financial planner salaries were sales (17% above the average salary for all financial planners), portfolio management (15% above the average), cash flow management (14% above the average), and data analysis (8% above the average).

- Location also impacts salaries. For example, the average salary for financial planners in San Francisco was 36% higher than the average for all financial planners, while it was 8% lower than average for those working in Houston and 14% lower than average for financial planners in Atlanta.

Meeting Clients’ Financial Needs in Two Distinct Ways

For most people, how well or poorly they manage their money is a major source of stress. When an individual or family has a clear picture of their financial situation and has a plan in place for achieving their financial goals, everything else in their lives seems to go more smoothly. Financial planners and financial advisors go about their work in different ways, but the result of their efforts is the same: clients whose financial houses are in order. Helping people help themselves is one of the most rewarding careers anyone can have.