This post is part of our ongoing series about President Biden’s tax reform proposals and what they may mean for you. We’re also sharing the opportunities that may be worth exploring before tax laws potentially change.

On June 24, President Biden and a group of bipartisan Senators announced a deal on infrastructure spending. In order to fund this, the Biden administration seeks to reverse some of the biggest changes made by the 2017 Tax Cuts and Jobs Act (TCJA) and proposes additional changes to tax law for wealthy Americans.

The increase in the federal lifetime gift and estate tax exclusion amount was one of the biggest TCJA changes, and it could be reviewed as part of any new tax legislation.

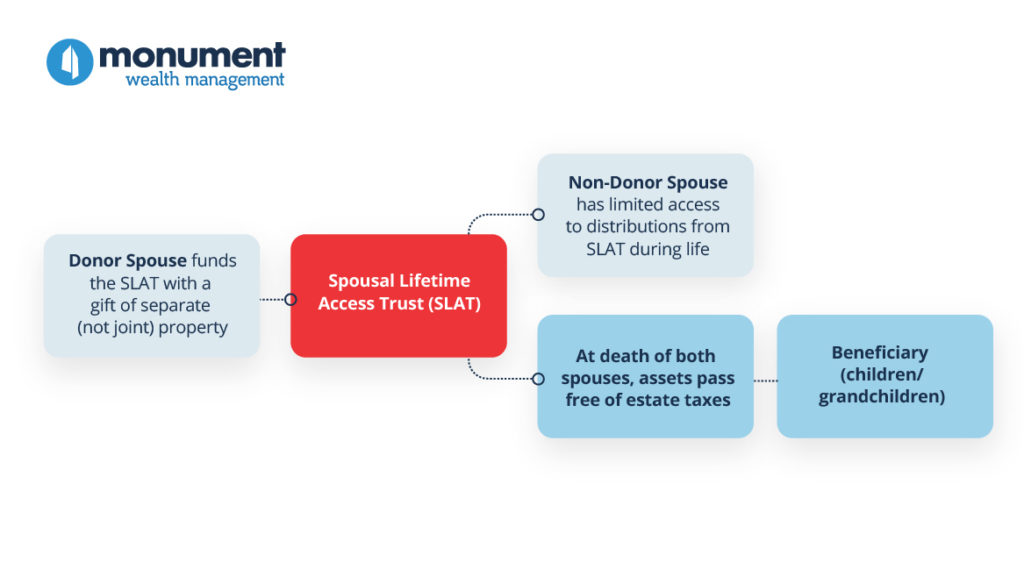

So, is there anything you should do before a potential tax law change? A Spousal Lifetime Access Trust (SLAT) is one idea you can explore with a qualified Trust and Estate Attorney. (Need a referral to a great attorney? Monument can help!)

What is a Spousal Lifetime Access Trust?

A SLAT is an irrevocable trust where one spouse (aka “Donor Spouse”) makes a gift into the trust that:

- Benefits the other spouse (aka “Non-Donor Spouse”), and

- Removes those gifted assets from their combined estates

Why use a Spousal Lifetime Access Trust?

A SLAT can be an effective tool for multi-generational wealth transfer because assets in a SLAT (and their growth) could be gifted to future generations without estate taxes.

Although a gift to a SLAT is irrevocable—meaning the Donor Spouse can’t take back assets they have given to the trust—the Donor Spouse may indirectly benefit from distributions the Non-Donor Spouse takes from the trust during life.

A SLAT is not a means of paying for a potential estate tax bill, but it is a way of decreasing the size of your taxable estate.

In gifting assets to the SLAT, the Donor Spouse is able to take advantage of the federal lifetime gift and estate tax exclusion, which is presently high—under current law, the exclusion is $11.7M per person, or $23.4M per married couple. Any appreciation of the asset will take place in the trust and be excluded from the estate of both spouses—and thereby will not be subject to federal estate taxes.

If the lifetime federal estate tax exclusion is lowered in the future, there will be no clawback of funds the Donor Spouse gifted to the SLAT even if they exceed the new exclusion amount. This means that if the exclusion amount decreases to $5M per person (adjusted annually for inflation)—which it’s already scheduled to do on December 31st, 2025, but could be lowered sooner—you’ll have already “locked-in” the higher exclusion amount.

Who should consider a Spousal Lifetime Access Trust?

You should talk to a qualified Trust and Estate Attorney about the pros and cons of setting up a SLAT if:

- You and your spouse have a combined taxable estate of $12M or more. If your combined estate is well below $11.7M, it’s unlikely that you will need to worry about estate taxes. If you have $23.4M in combined assets right now, you’re in a tight scenario—you may have estate tax issues if you die in the next few years and the estate exemption amount reverts back to pre-2017 levels.

- You have not already used your full federal estate and gift tax exemption.

- You have individually owned assets. These are either titled in your name personally or in your Revocable Trust (assets owned jointly with your spouse can’t be gifted to a SLAT).

- You have assets that you expect to appreciate. Assets in a SLAT and their appreciation will be excluded from your taxable estate.

- You would have sufficient assets outside of the SLAT to maintain your lifestyle. Ideally, the Non-Donor Spouse will not require frequent or any distributions from the SLAT in order to maximize the value of the assets outside the estate. Spending down assets not in the SLAT can also be a means to reduce the value of the taxable estate.

- You would be able to pay the income tax liability for the trust. SLATs are considered a “grantor trust,” meaning that the Donor Spouse will personally pay the income tax liability for the trust, rather than the trust itself paying the income taxes.

What are the risks of a Spousal Lifetime Access Trust?

- If the Non-Donor Spouse passes away, the Donor Spouse no longer has indirect access to the funds in the SLAT.

- In the event of divorce, the Non-Donor Spouse could continue to benefit from the trust and the Donor Spouse will lose indirect access to the funds in the SLAT.

- If both you and your spouse are each setting up a SLAT to benefit each other, you will need to be careful you don’t violate the “reciprocal trust doctrine”—if the IRS thinks the trusts are too similar, this can lead to the trusts being “undone”.

- If the Non-Donor Spouse is the trustee of the SLAT, there could be risks if the trust’s distribution rights are too broad, including eroding creditor protection features of the trust and triggering the SLAT assets to be included in the Non-Donor Spouse’s taxable estate (thereby unwinding the intent of setting up a SLAT)—you might want to consider appointing an independent co-trustee to serve with the Non-Donor Spouse.

- Assets in irrevocable trusts (including SLATs) can quickly reach the top tax bracket (in 2021, if an irrevocable trust’s taxable income exceeds $13,500, the federal tax rate on this income is 37%)—this means that between federal and state taxes, you may pay significant tax on SLAT assets, particularly if the SLAT exists for a long period of time.

- Assets in the SLAT will not get a step-up in basis when you or your spouse pass away, meaning there could be high income taxes when the assets are sold by the trust beneficiaries—although a SLAT can be written to allow the Donor Spouse the power to swap personal assets of equal value with trust assets; this means the Donor Spouse could remove assets with a low basis from the trust and replace them with cash or assets with a high basis as a means to give heirs a step-up in cost basis on the low-basis assets when the Donor passes away.

Don’t rush into this.

Just because there is talk about changes to tax law doesn’t mean you need to take immediate action. It’s still unclear how much Congressional support there will be (even among Democrats) for all of Biden’s tax proposals.

Would you feel regret if you rushed to create and fund a SLAT and then the expected tax law changes weren’t enacted?

Spousal Lifetime Access Trusts are an irrevocable transfer, meaning you can’t change your mind and take those assets back later, so setting up a SLAT—or any other type of irrevocable trust—shouldn’t be done lightly. Careful thought and consideration must go into your unique financial situation and personal goals before you take action.

Want help thinking through your options? Need an introduction to a great Trust and Estate attorney? Monument can help! Reach out to our Team for personalized advice about your estate situation.

This first appeared on Monument Wealth Mangement.