The last few days have been something else! Coronavirus news came out several weeks before the market decided to do something about it. These big moves encourage investors to “tune in”, which is one of the worst things investors can do.

In this post, I highlight some key points to help you maintain a consistent message and keep the upper hand with your clients. With so much going on in such a short period of time, it can be easy to lose our vision/message as we seek to help clients. But remember, pandering to speculation and those things beyond our control is not helpful; it can actually be quite harmful. You dictate the dialogue with clients, not the media.

Points to Consider

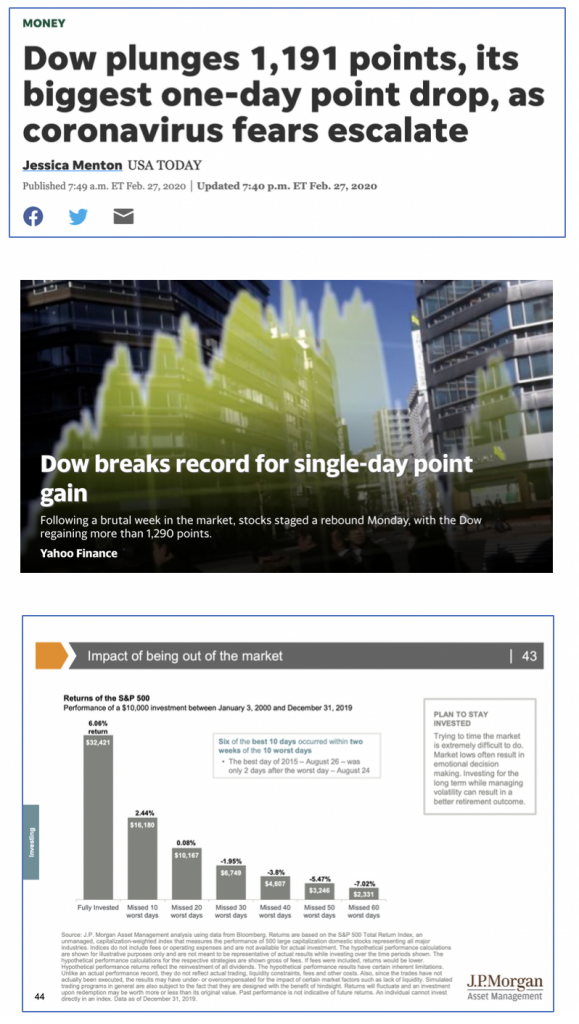

We recently got evidence of JP Morgan’s “best days occur near worst days”. This could be helpful to share with clients as a reminder that big moves don’t foretell the future, both the big loss and subsequent gain say nothing about what may happen over the next week/month/year, despite what the “experts” are saying.

A few online brokerage firms experienced outages on Monday due to clients logging in. Some of these clients claimed they wanted to buy. OK – but the problem is still the same. It is a knee jerk reaction and not based on a thoughtful plan. Buying low is always a good idea, but one should have a plan. If an investors goes “all in” with the markets down 13%, they have no more dry powder if the markets go lower.

And this goes into a core feature of your message. What are you going to do about the movements? The amygdala wants to do something. Irrespective of Coronavirus or any event that causes a drawdown, what are you going to do about it? Whether you practice tactical or strategic allocation, be sure to verbalize the action plan to clients, or they may be influenced to follow feel good action of “sell low”.

Antidote to Fear

The best antidote to fear and uncertainty is a consistent message and a plan of action. Craft your message, identify your plan of action and promote it consistently to clients, because the media and behavioral biases are working 24/7 against thoughtful decision making.

Interested in trying out behavioral finance content for your practice (no obligation or credit card)/? Apply Here. I only allow five trials per month.

Related: The Most Successful Investors Share Two Characteristics