My middle school daughter assured me a boxslide on skis was a piece of cake. After all, she’d watched the pros do it effortlessly on YouTube.

As we stood atop the snow park run, I convinced myself I had what it took to “stomp” the trick, having skied for over four decades. No matter that I’d never tried anything like this before. Or that I was super tentative approaching the box (I’m leaning so far back!). Or that I was getting a third-hand tutorial from a beginner describing some random ski video.

I paid for my hubris and amateurishness with one of the most painful falls of my skiing experience.

So when I heard about everyday investors piling into trendy investments pushed by social media influencers, many with questionable authority and others with serious conflicts of interest, I was reminded of my misadventure on skis.

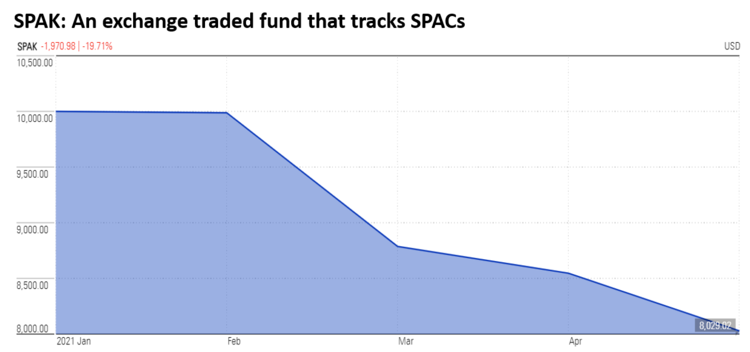

Take SPACs, Special Purpose Acquisition Companies. This out-of-favor vehicle has been having its great moment due to publicized sponsorship by well-known celebrities and high-profile billionaires touting the investment on podcasts and vlogs. A SPAC is a less onerous, back-door way to bring a private company public (for more details, check out this Wikipedia article). After much excitement in 2020, the recent news has not been great for SPAC investors, as demonstrated by the performance of the exchange traded fund (ETF) SPAK.

While I am concerned about the dangers of investors piling their life savings into investments they don’t fully understand, I am also concerned about the nonprofit that carelessly accepts a donation of a highly speculative investment for the organization’s endowment. Many of these risky investments fall into the category of “alternatives”, a broad class best defined by what they are not: stocks, bonds and cash. This list could include private equity, venture capital, hedge funds, real estate, derivatives, cryptocurrency, commodities and collectibles, to name but a few. Alternatives are favored by high-net-worth individuals or institutional investors due to their complexity and risk profile. For this reason, it is not uncommon for wealthy donors to offer alternative investments as gifts to their favorite nonprofits. Board members overseeing a small nonprofit endowment or foundation may also be seduced by the potential outsized rewards of alternatives and recommend the asset class for their endowment. What is a nonprofit to do?

Alternatives, if properly vetted and managed, can definitely add diversification benefits to a professionally-managed endowment portfolio. Some investors use alternatives, like venture capital, to express Environmental, Social and Governance (ESG) convictions by investing in startups that economically empower the underrepresented or address climate change, for example. In fact, the National Association of Colleges and University Business Officers (NACUBO) and TIAA found in their latest study that endowments they surveyed allocated anywhere from 10% to over 50% in alternative investments to reduce the volatility of returns. Because nonprofit leaders have a duty to their donors and, particularly, to the communities they serve, understanding how alternatives could help or hurt the organization is crucial in making the decision to accept a gift of alternatives or include them in the endowment. The list below describes some common features of alternatives nonprofit leaders should be aware of.

Low correlation with stocks and bonds

Low correlation with traditional investments is often the reason many experienced investors are drawn to alternatives. Correlation is a statistic that measures the degree one investment moves in relation to another. An alternative asset with low correlation might move in the opposite direction of the broad stock market, potentially dampening the losses of a significant downturn. Conversely, when traditional markets perform well, investors tend to forget that low correlated alternatives may lag, which is exactly what they’d be expected to do.

Hard to value and analyze the risk

Alternative investments like private equity, real estate or exotic instruments may require specialized knowledge to assess their value and risk to the endowment. This could be an issue for nonprofit organizations that do not have the resources to hire this expertise.

Less liquid than traditional investments

As we’ve explained in our video Nonprofit Reserves and Endowment Investing Overview, liquidity is the ease at which an asset can be converted to cash. Illiquid assets are those that cannot be quickly converted to cash and alternatives typically fall into that category. Some alternatives have what are called “lock-up periods” that do not let investors sell the asset within a certain timeframe. If your nonprofit is relying on a quick sale of the asset to access the underlying value in cash, alternative assets may not satisfy.

High cost to purchase, maintain or sell

Like many complex investments, they don’t come cheap. Purchasing and maintaining an alternative asset can impose fee rates into the double digits which eat into endowment returns. Some investments may require legal obligations the nonprofit is unaware of. Even the nonprofit hoping to sell an in-kind gift of alternatives for cash might find they are responsible for high redemption fees.

Lightly regulated

Alternatives do not have clear investment regulatory guidelines unlike traditional asset classes, mutual funds and ETFs. They are not overseen or monitored by the SEC which increases investors’ exposure to scams and fraud.

A strong gift acceptance policy can manage donor expectations around alternatives and guide board members and staff who solicit gifts. Considering the high risks associated with alternatives, nonprofit leaders should seriously question the timing of in-kind gifts of alternative investments. Is the donor just dumping a dog investment?

With much of the economy in disarray and traditional markets extremely volatile, investors are easily lured into innovative ways to make money. Or maybe they just want to be hip. The recent hype of newly created cryptocurrencies and back-door investments doesn’t change the fact that alternatives are not for the inexperienced investor. Especially if it’s trending on social media.