How much teenagers must borrow for college often depends on whether their parents can help foot the bill – and how much they can afford.

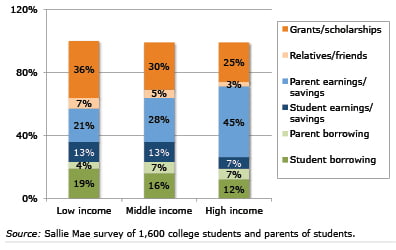

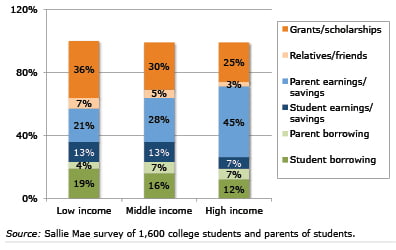

Fresh data from a survey by Sallie Mae , the private college lender, shed light on how low-, middle- and high-income families find the money to pay for a college education. The data break down how much of students’ total costs – tuition, plus books, room and board, fees, living expenses, and transportation – come from earnings, savings, borrowing, grants or other sources.

Here’s what stands out in the data, which are displayed in this chart:

In low-income families, the students themselves take responsibility for saving, earning or borrowing money to cover 32 percent of their costs, and middle-income students pay 29 percent. Students from high-income families cover just 19 percent of their costs; they tend to pay more for their education, so their total dollar costs are higher, which somewhat narrows the dollar difference between what students in each income group pay. High-income parents, not surprisingly, pay a much greater share of their children’s college costs. Their borrowing and cash payments combined cover 52 percent of the total, compared with 35 percent for middle-income students, and 25 percent for low- income students. Lower-income students get somewhat more help from grant and scholarship funds, which cover 36 percent of their total costs. This compares with 30 percent for middle-income and 25 percent for high-income students. Other relatives outside the immediate family are pitching in more. Between 2014 and 2015, the share coming from these other family members rose from an average 4.3 percent to 5.2 percent of total costs.

The data, which are based on a random national telephone survey of 1,600 students and parents, provide a glimpse of who’s paying for the ever-rising cost of a college education.