Those individuals responsible for the management and oversight of an employer-sponsored plan have personal liability according to the Employee Retirement Income Securities Act of 1974 (ERISA), because they make decisions on behalf of plan participants and their beneficiaries.

Helping your clients set up a committee to clearly define and document a process of plan oversight is an effective way to help them limit the liability associated with managing a 401(k) plan, and provide tremendous value.

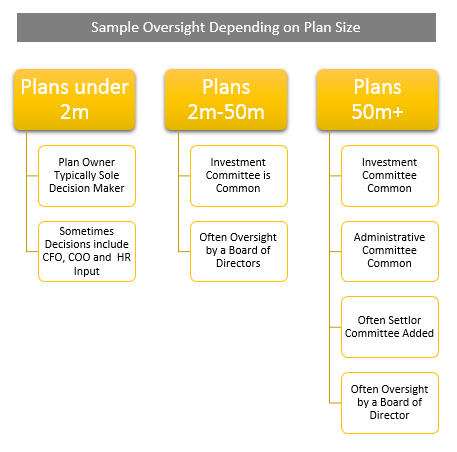

Plan Oversight by Plan Size

Many companies and benefit plans are small enough that creating a formal committee for plan oversight is not a viable option. As companies grow and plan assets increase, formalizing the committee structure makes more sense.

Depending on plan size, you might even consider helping your clients form one committee to oversee the administration of the plan, and another to oversee the investment responsibilities required. Some companies will often form a third committee for decisions that are considered “settlor functions” (company and/or business related decisions which are not subject to a fiduciary standard of care).

The following information provides a framework for helping your clients set up a formal governance process. When available, I’ve included links to sample documents mentioned.

Best Practices for 401k Committees

Forming an investment committee is optional and each committee set-up should be structured around the company’s capabilities and needs.

That being said, here are some basic suggestions for setting up and running an effective committee.

Regardless of whether a company sets up a formal committee or not, a basic set of guidelines can help plan fiduciaries understand their roles and help ensure participants’ interests are put first in all plan decisions.

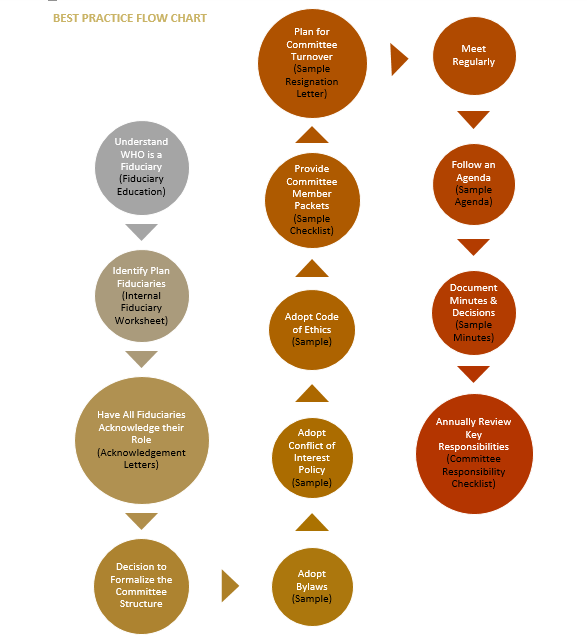

Fiduciary Formalization Flow Chart

The following flow chart follows a process that can help plan fiduciaries understand, formalize, and manage their responsibilities with documentation that demonstrates the decision-making process.

This chart can be summed up in three steps:

If you can help your 401k clients with the steps outlined above, they’ll be better prepared to demonstrate the prudent management and oversight of their plan.

Additional Resources

The documents listed in the flow chart (indicated in black words in parentheses) are all available through FSS, a division of fi360, Inc., in the 401k Service Solution Document Kits. The graphics in this blog post were taken from the Committee Formalization Packet found in the Quarterly Plan Compliance Kit that is sold on the 401kservicesolution.com website, which is a complete packet you can give your 401k clients that explains and provides documentation to help them formalize and document their plan oversight process.