2018 gave us a December to remember (and not the Lexus kind ), with the S&P 500 index losing 9% for the month, locking in the worst December performance since 1931. From the last peak to the most recent bottom, the S&P 500 has fallen more than 20%, marking the first bear market since 2008-09. Now the bear market is here, are you prepared to deal with it? Does the drop have you worried? Did you prepare for the bear market beforehand? On this episode, we clue you in on the tricks for surviving a bear market. You’ll learn what a bear market is, the questions people typically ask when the markets drop, how to prepare for a bear market, and how to recognize a bargain when you see one. The markets are always changing, are you ready for what’s ahead? Listen to this episode to help you weather the storms that bear markets bring.

What do people ask when the markets drop?

In long and strong bull markets, overconfidence is plentiful as positive returns inflate our perception of our investing skill-sets. But when the markets drop, we are quick to question our investment strategy. People ask themselves, should I be doing something different? Should I be buying? Should I be selling? Should I buy cryptocurrency or gold? We feel the need to act when we see our nest egg evaporating. The biggest question people ask is: what do I need to do to preserve my money? If you feel like you need to sell and go to cash then you could be taking to much risk. Risk tolerance can be thrown out the window when things are going well. It’s when things go south, you learn your true risk tolerance levels. A poor decision in a bear market can often take years or even decades to recover from. Listen to this episode to help you learn how to make the better decisions in a bear market.What is a bear market?

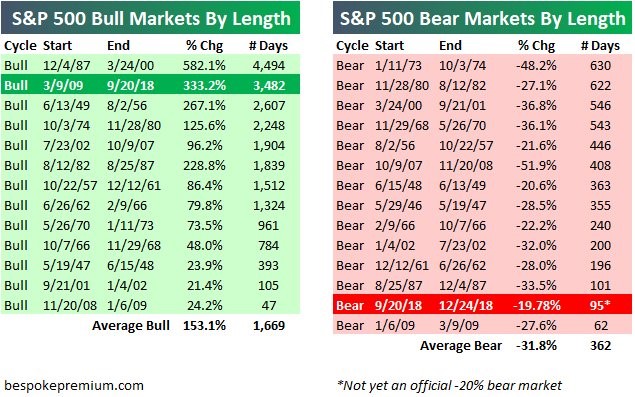

A bear market occurs when there’s a drop of 20% in a particular stock market. This differs from a recession which is declared after there are 2 consecutive quarters of negative GDP. Many people think there must be a recession to have a bear market, but not every bear market results in a recession. However, they do tend to work together. There’s about a 50/50 chance of having a bear market coincide with a recession. As painful, as bear markets can feel, they do happen much quicker than bull markets. The average length of your typical bear market is a year, contrasted with the average bull market at 4.5 years as you can see from this Bespoke chart: Related: Crystal Balls and Cyclically Adjusted Price-Earnings

Related: Crystal Balls and Cyclically Adjusted Price-Earnings