Written by: Mike Eklund

Are you an above-average driver?

Well, the reality is that ~80% of drivers think they are above average, even though that’s mathematically impossible. And it is not limited to driving, as a number of studies show people rate themselves as above average in creativity, intelligence, dependability, athleticism, and honesty.

Why am I bringing this up in a financial planning blog post? It is because we see this same overconfidence effect in investing, but the data does not support the investors’ view.

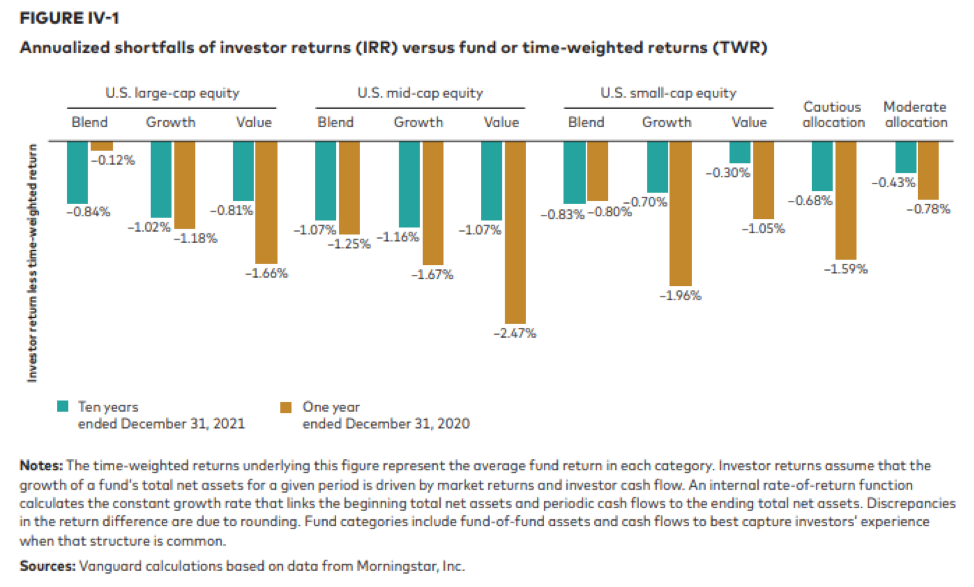

Morningstar and Vanguard regularly compare investor vs. investment returns in mutual funds and ETFs. To do this, they compare actual investor returns (internal rate of return) to fund-reported total returns (time-weighted returns) over the past ten years. What do they find from their analysis? The “average investor” trails their investments by ~1.5%-2.0% over a ten-year period. This is why I always say the key to long-term investment success is investor behavior.

Below are the investor vs. investment results by investment category from Vanguard. Morningstar’s results are very similar. The negative percentage in the figure below is the annualized amount the average investor trailed their investments over the ten years.

© The Vanguard Group, Inc, used with permission.

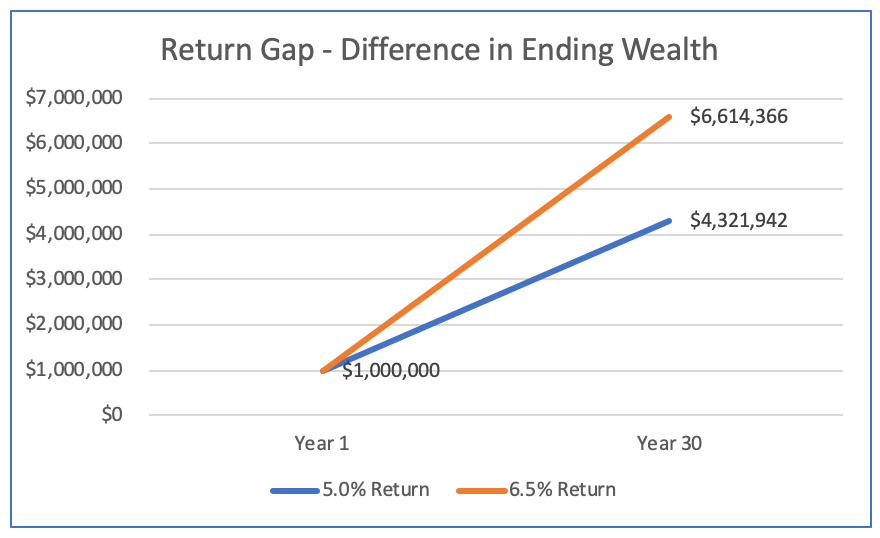

You might say this return gap is a small percentage and it doesn’t matter much. I’d disagree as the difference in final portfolio value for a couple starting with $1 million over 30 years is ~$2.3 million(1). I don’t know about you, but I think that is a considerable sum.

Why Does This Happen?

Investors tend to buy what has done well lately and sell what has underperformed (buy high and sell low). This is the exact opposite of what investors should do (buy low and sell high) which is why this return gap exists. Did anyone buy tech stocks in the late ’90s, real estate in the mid-2000s, or meme stocks/crypto recently?

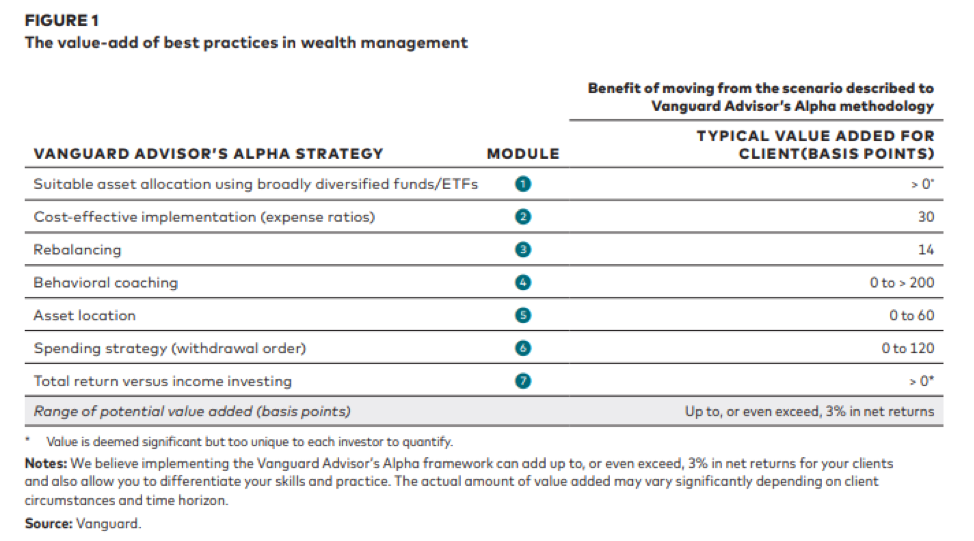

Additionally, the Vanguard Advisor Alpha report shows an advisor can also add value in other areas of your portfolio including rebalancing, asset location (tax strategies), asset allocation (stocks vs. bonds mix), and withdrawal order of accounts. Below is the summary output from Vanguard’s report.

© The Vanguard Group, Inc, used with permission.

This analysis doesn’t even include the benefits of the other financial advice on retirement planning, tax planning, education, risk management, estate planning, etc. which many holistic wealth management firms like Financial Symmetry provide as part of their service.

To summarize, be honest with yourself whether you are really above average. If not, the consequences in lifetime wealth can be significant as noted above. Consider speaking with one of our fee-only advisors to help you close that “return gap” and reach your financial goals.

Additional information on Financial Symmetry’s investment strategy and wealth management service can be found below.

• Financial Symmetry’s Investment Strategy and Client Results

• Financial Symmetry’s Wealth Management Service

• “What to Expect from a Financial Advisor” Podcast Episode

(1) Assumes $1,000,000 starting portfolio with one earning 6.5% annually and the other 5.0%. No future contributions or withdrawals.