AARP has done several surveys on fees in 401 k and 403 b plans and has noted that 62% of participants are unaware of the fees inside their retirement plans. Why is that? Because the fees are hidden inside the performance of the fund. You know the saying “the devil is in the details”. This idiom refers to a catch or mysterious element hidden in the details. It might look simple at first glance but has complexity and takes more time and effort than you originally thought. This is certainly true when it comes to researching fees in your Retirement Plan and to reviewing the 403 B Plan Summary and Plan Document. A retirement plan seems simple on the surface: you contribute X amount of money per pay period, you invest in Y funds and it grows. What is the big deal?

For Employees

One of the most important documents for 403 b and 401 k plan participants, is the summary plan description or SPD. Per the Employee Retirement Income Security Act (ERISA), participants are required to receive this annually by law from the Plan Administrator. While it may seem boring to read or unnecessary, this document contains the following important information for you to know:

- When can you begin participating in the plan? (Is there a waiting period?)

- How does your plan calculate benefits and service? (contribution rates)

- When do your benefits become vested? (immediately, 3-or 5-year schedule?)

- What are distribution provisions? (loans, hardship withdrawals, rollovers?)

- How do you file a claim for benefits?

- What are the administrative, investment and other expense information?

- Performance data of the funds in the plan (1-, 5- and 10-year returns)

- If the plan changes, you must be notified through an updated SPD or through a “material change” notification

Most employees do not give much thought to these things until they need to make a decision relating to their benefits. The devil is in the details! I was reviewing various 403b statements and plan documents for one of my clients as we were looking to potentially rollover assets from their previous 403b plan to their current plan. I was shocked to learn the investment fees in one of his plans ranged from .78% at the lowest end to 1.56% at the highest, with an average annual fee of 1.15%. According to a 2017 article by Allan Roth of AARP, “Higher fees lead to lower returns. If you pay a 1 percent average expense ratio on a $250,000 portfolio, it could cost you more than $25,000 over the next decade, with compounding.”

"Higher fees lead to lower returns." ~ Allan Roth, AARP

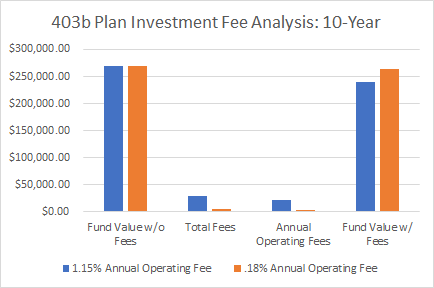

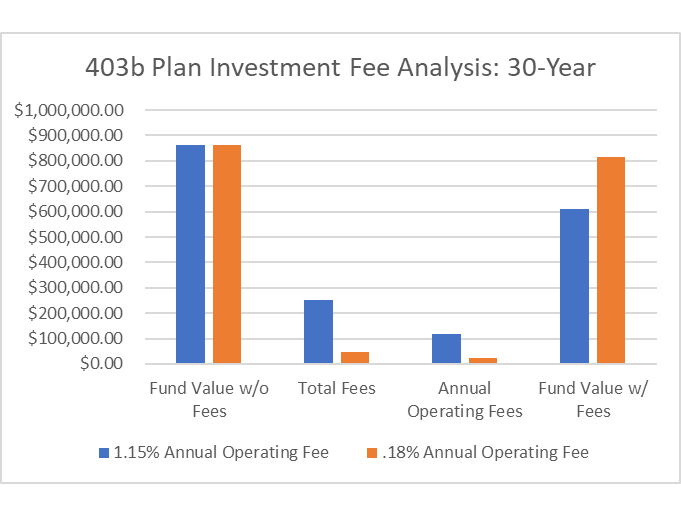

The client’s current 403b plan has fees ranging from the low end of .02% to .36% at the high end, with an average of .18% in fees. I decided to run a little comparison between the two plans as I wanted to know the impact over 10-year and 30-year periods for this client. The investment amount is $150,000 and we assumed a 6% annual rate of return using the average of 1.15% in annual investment fees for the old plan and .18% for the current plan.

Over a 10-year period, the $150,000 investment would have grown to $268,627 without considering the fees. This shows the power of compounding over time. Yet, it also shows the impact of fees over time as the 403b plan with the 1.15% average fees had an ending value of $239,285 once fees were considered, while the current plan had a value of $263,831. That is a $24,545 difference over time.

As you would expect the fees have an even greater impact over a 30-year time frame. The client’s ending value in the old plan would have been $608,930 versus $816,195 in the current plan. That’s a difference of $207,265!

The opportunity costs for the 10-year and 30-year time periods are respectively, $6,577 and $135,581.

The opportunity cost is the future value of the fee had it been invested at the specified rate of return for the remainder of the holding period. Remain vigilant on the investment fees in your employee retirement plan. While you might not have much control over fees in your current plan, you can take control of former employer plans by either rolling them into your current employer plan (mindful of fees, of course) or you can take the opportunity to look at rolling these funds into an IRA rollover where you may have more opportunity to control costs.

Remember to research before you rollover your 403 b or 401 k plan. I have covered retirement plan distributions in a previous blog here, where I outline the benefits and drawbacks of each type of rollover.

For Employers

For those Chief Financial Officers who may have recently joined a business or nonprofit organization, you are likely now responsible for the plan. As you review the current plan, what are the important facts to know about the plan?

Contact your Plan Administrator and your Plan Advisor so you can be briefed on the plan. Documents you should have on file for your review are:

- Summary Plan Description and Plan Document

- From your administrator’s portal, you should be able to surmise size of plan, number of active participants, employer match contribution year-to-date, number of loans outstanding

- Form 5500 or 5500-SF filing for the most recent fiscal year

- A copy of the plan audit if your organization has over 100 employees (note the 80-120 Participant Rule)

- Retirement Plan Investment Policy

- Confirmation of the Fidelity Bond

- List of investment funds in the plan

- Documents and information relating to participant education

Unfortunately, we often find the retirement plan documentation is lost or partially complete when a new CFO, Director of Finance, Human Resources Manager or Executive Director comes on board. Yet, it is a good time to take stock of the benefits and potential liabilities that exist with the current retirement plan.

Here are a few areas to review:

1. Recordkeeping and Administration

Are you receiving the service and accessibility you need for the plan? We had one client whose previous Administrator could not properly set-up Plan Sponsor access for the new Human Resources manager. In addition, she was unable to obtain accurate reports or confirm how much they were paying in fees. It seems like a simple, easily fulfilled request, right?

However, the past 10 years has seen many acquisitions, mergers and changes in the Retirement Plan Administration business as large companies sell off portions of their retirement businesses (e.g., Empower acquired Mass Mutual’s Retirement Plan Business in 2020; Wells Fargo sold its Retirement Plan & Trust business to Principal Group in 2019; and PCS Retirement acquired Aspire Financial Services in 2019). Smaller companies and nonprofits (less than 100) are often lost in the shuffle during these changes and therefore the continuity with the Administrator and Recordkeeper is lost.

Is the platform easily accessible by employees? During the pandemic, it’s been especially important that retirement plan participants have easy, online access to their retirement plan. What are the recordkeeping and administration fees and how to they compare with the current marketplace?

2. Participant Education

Especially with the pandemic, many employers are finding the need for their employees to receive additional financial education. Has your current Plan Advisor or Plan Administrator met the educational needs of your employees? At Fairlight, we work with plans with under 100 employees. Therefore, we can offer a more customized training approach and service to employees. This includes annual one-to-one financial planning discussions with employees.

What type of digital, educational content does the Plan Advisor and/or Plan Administrator provide? Are there videos, blogs, research information on the investments available?

3. Investments

Review the investment line-up with your Plan Advisor. Are there too many investment choices for participants? Are there target date fund options for participants? Does the plan offer a Qualified Default Investment Alternative (QDIA)? This option in a plan defaults a participant into a target date or balanced fund in the absence of a participant directive. In other words, if the employee sets up a contribution but forgets to choose an investment option, he or she will be defaulted into QDIA.

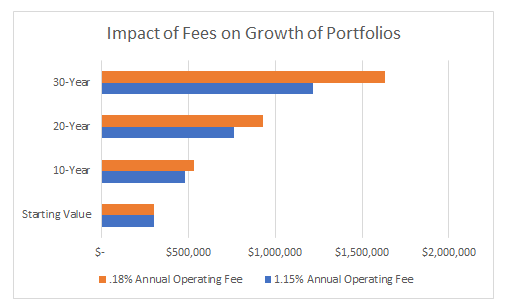

What are the investment fees in the plan? Are they reasonable? See the chart below, “Impact of Fees on Growth of Portfolios”, as an example of how investment fees inside the Retirement Plan can impact participants’ overall returns. Under the “For Employees” section of this article, we cover fees more depth.

Checkout the graph below: This was an initial investment of $300,000 and it shows the impact of fees on portfolio growth over a 30-year time period.

Have your employees asked about social impact or socially responsible investment choices in your retirement plan? For those mission driven businesses or nonprofits, it’s becoming increasingly important to select choices which reflect the organization. There are now more socially responsible or ESG investment options for Retirement Plans.

The devil is in the details when you peek under the hood of your plan. You can and should contact your Plan Advisor and your Plan Administrator for assistance in this process. At Fairlight, we are also here to help if you have questions or want to seek a second opinion on your plan.

If you like what you're reading, visit our blog here or follow our company page.

Related: Savings, Investing & 403 B Advice Rarely Changes: So Why Do We Forget it?