It does amaze me how many people in banks and technology firms talk about Cloud, Big Data, Artificial Intelligence, Fintech, Blockchain, Apps, 5G, Analytics, APIs and more as though they are all buckets. They are buckets of technology, but in each bucket is a use case and, in many, hundreds or even thousands of use cases. In other words, none of these technological developments are a thing – a single thing – they are instead developments that have encouraged many things.

Take Fintech as an example. We know that most Fintech start-ups focused on payments and lending at the start but, even there, those are smaller buckets as there are many variations of payments and lending innovations from peer-to-peer to buy-now-pay-later to merchant checkout to tokenization and digital wallets. None of these areas are a homogenous bucket of technology. It’s all about the granularity and detail of the individual use cases that comprise them.

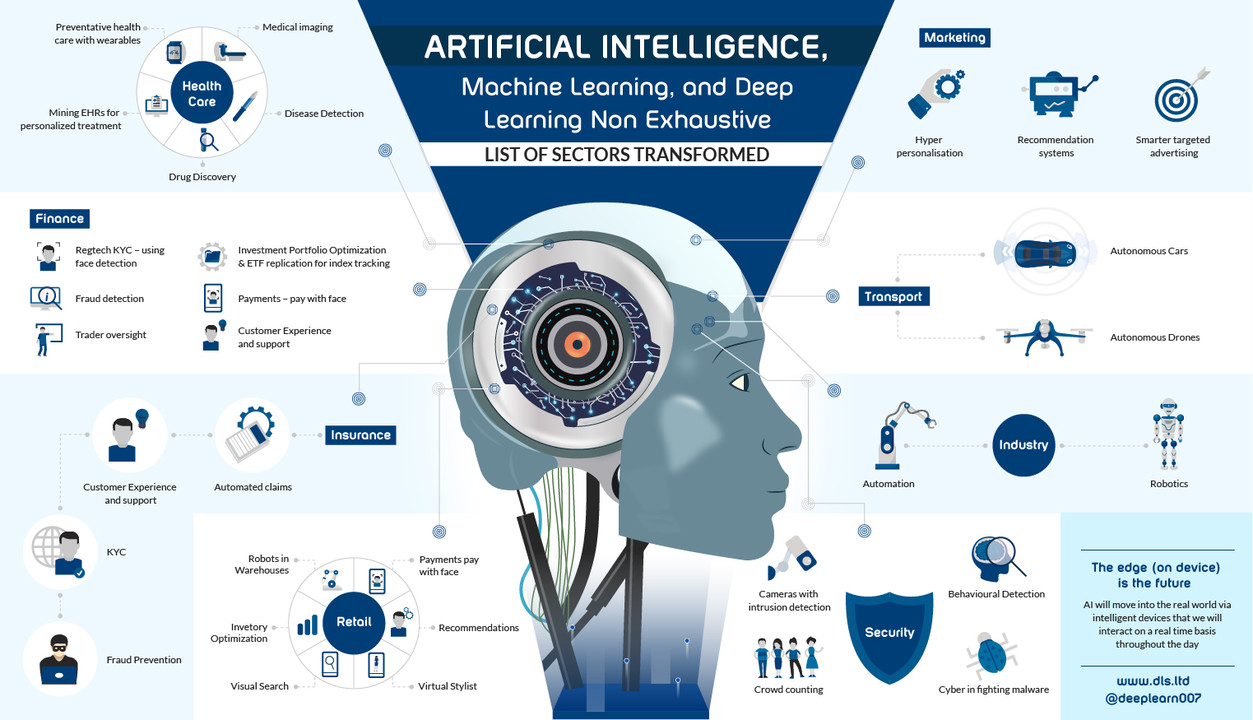

The same applies to AI.

Source: Imtiaz Adam

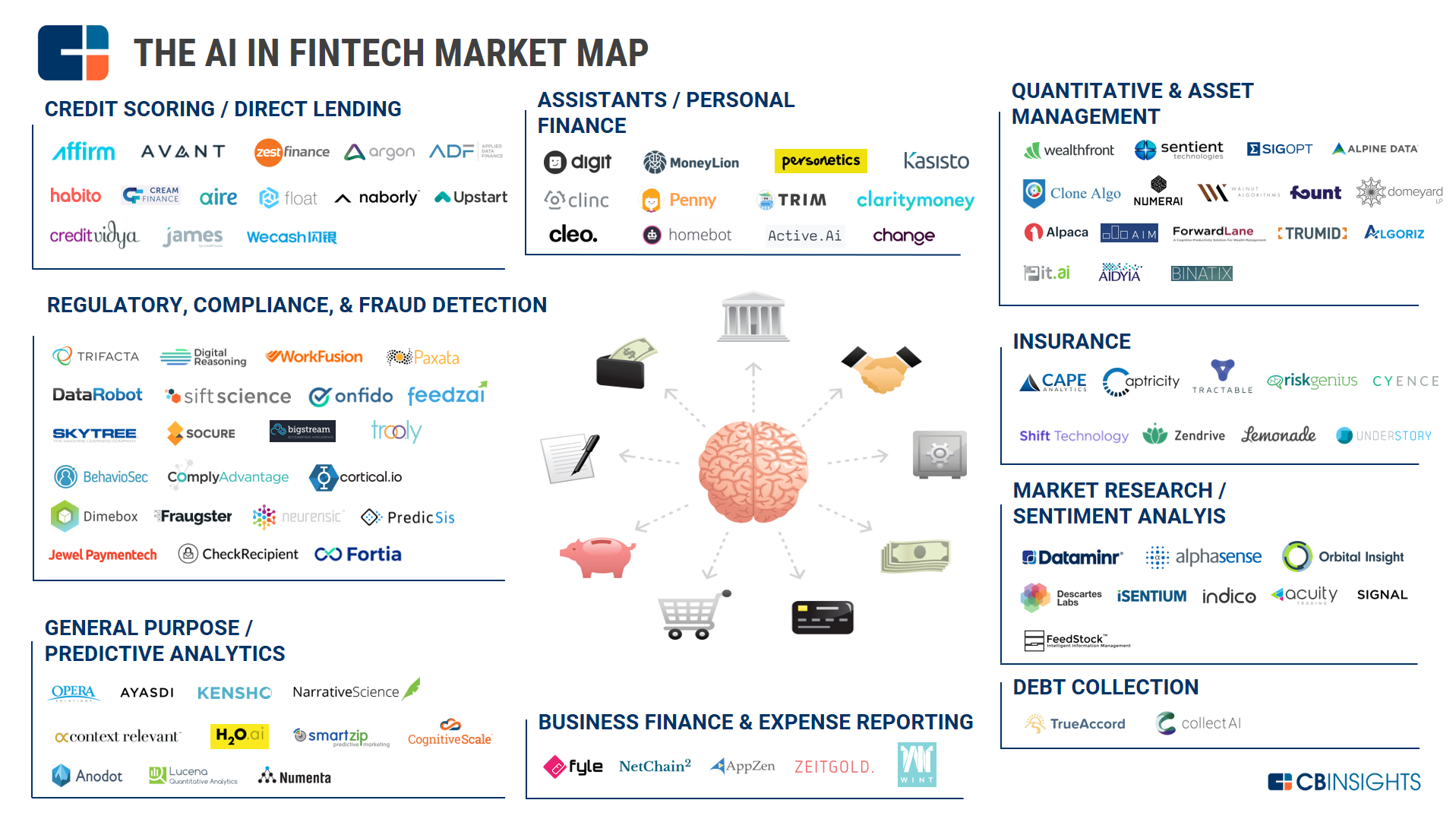

And then you have the AI in Fintech market map.

Source: CB Insights

This is why I find it amusing to see fintech colleagues debating this anomaly. The anomaly being that bank CxO leaders think AI is a thing, and tell their people they have to be at the front of this thing. The thing is that it’s not a thing. It’s a whole bunch of things.

For example, Ron Shevlin, Chief Research Officer at Cornerstone Advisors, notes that “AI refers to a number of different types of technologies. Lumping everything under a single label is a huge mistake”.

Equally, I find a lot of financial executives are excited about all of these technologies but have little understanding of what they really mean. If I walk into a boardroom and they mention AI, I’ll ask what LLM stands for; or if they mention cryptocurrencies or blockchain, I’ll ask them what DLT stands for.

Now, I’m a hater of TLAs (three letter acronyms) – as regularly stated – but if a company cannot understand the landscape of emerging technologies, they should make sure they hire someone who does … and I don’t mean a consultant. In fact, consultancy companies are very good at coming up with TLAs to ensure people are confused and non-plussed, but keen to keep up.

The main way to keep up is to understand that technology and its many buckets of progress from AI to Cloud are just like banking and its many buckets of progress from investing to lending.

In fact technology and finance have an awful lot in common. At the granular level of banking are many TLAs also, from your BMACH to your IMOs.

So, if you’re a CxO in a financial organisation and hear the technologists buzzing about AI and Cloud, just remember that the buzzwords and irrelevant; it’s what you can do with them that counts.

On that note, there’s a very good article by Igor Tomych, CEO of DashDevs, that explains seven key use cases of AI in banking which, if you have ten minutes, is well worth the read.

Related: Is Digital Banking Done?