The life story of Charlie Munger, who passed away on Tuesday at age 99, serves as a shining example of the enduring American Dream, especially now at a time when many people doubt whether the promise of a better life is still intact. On the contrary, I believe that Munger’s journey, coupled with data from the updated Forbes 400 list, reaffirms that the American Dream still thrives.

Charlie Munger’s life began in a modest Midwestern town, far from the glamor of Wall Street. His early years were marked by hardships, including a marriage that ended in divorce, a rarity at the time, which left him with little in the way of assets.

But adversity was not done with him yet. Munger’s son Teddy fell victim to leukemia, and Charlie bore the financial strain of his son’s illness, paying for everything out of pocket. Tragically, Teddy passed away at the tender age of nine, devastating Charlie.

In the face of such overwhelming challenges—a failed marriage, financial ruin, the loss of his beloved son and then the surgical removal of his eye following a botched cataract surgery—I suspect it must have been tempting for Munger to surrender to the vices that many others have succumbed to.

Fortunately for him, it was around this time that the future billionaire’s path intersected with a quirky investor from Omaha, Nebraska, by the name of Warren Buffett. Together, the two value investors began buying distressed shares in an old textile company called Berkshire Hathaway. The rest, as they say, is history.

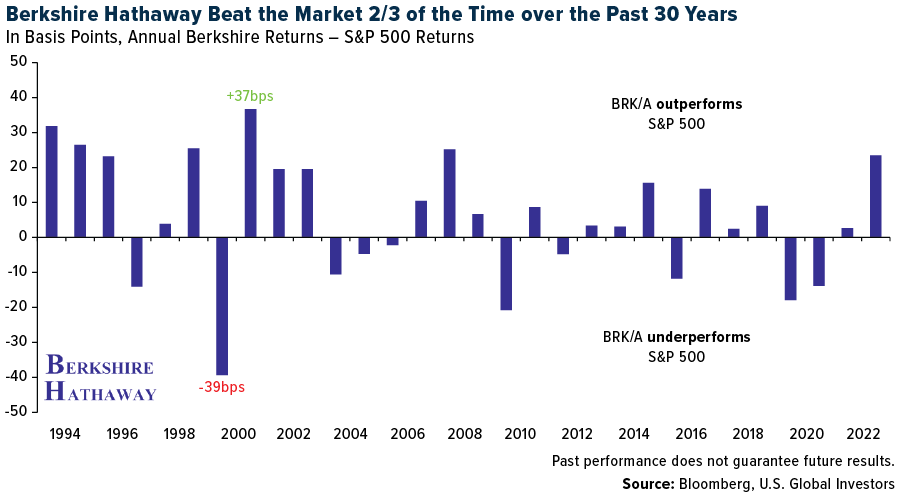

Between 1992 and 2022, Berkshire delivered a compound annual growth rate (CAGR) of 13%, beating the S&P approximately two-thirds of the time on an annual basis. Had an investor bought $100 of Berkshire shares in 1978, when Munger joined the company, that investment would be worth around $400,000 today. The chart below shows annual returns for Berkshire A shares minus annual returns for the S&P 500.

American Dream In Crisis?

James Truslow Adams, the Pulitzer Prize-winning historian who coined the term “American Dream,” defined it in 1931 as the “dream of a better, richer and happier life for all our citizens of every rank.” Does the dream still hold true? Today, many Americans can’t help but have second guesses.

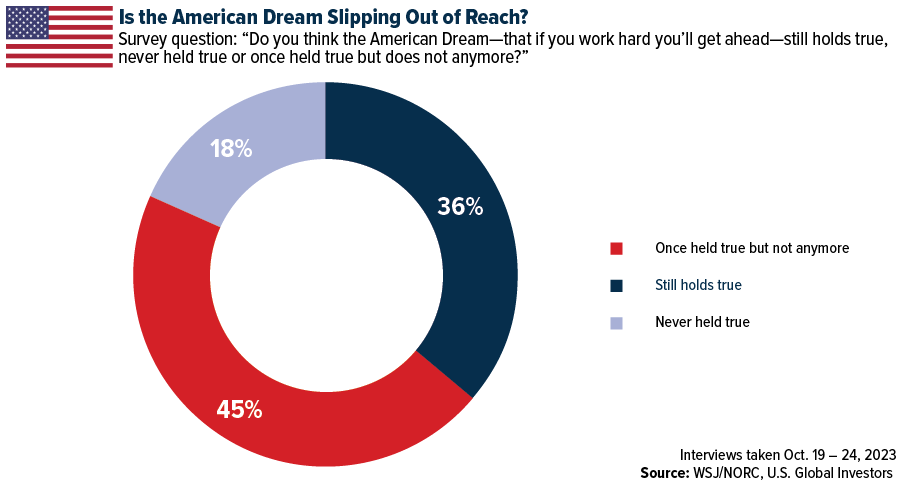

According to a recent Wall Street Journal/NORC survey, only 36% of American adults still believe in the American Dream, a significant drop from 53% in 2012 and 48% in 2016. Roughly two-thirds of respondents said that the American Dream either once held true but no longer or never held true to begin with. What’s more, half of people believe that life in the U.S. has worsened over the past half-century.

It’s undeniable that the U.S. faces historic economic challenges right now. Despite higher interest rates, inflation remains sticky, increasing 3.2% year-over-year in October. Homeownership is arguably the most important component of the American Dream, but due to sky-high mortgage rates, housing affordability is at record lows, as are pending home sales.

As dire as this sounds, I’m optimistic that the worst is behind us. Pain is temporary, and hope will prevail.

Self-Made Billionaires Embody The Dream

Don’t take it from me, though. The updated Forbes 400 list, released in October, reveals an encouraging trend. Over two-thirds of today’s billionaires are self-made, a remarkable increase from less than half in 1984. In 2023, an astonishing 70% of billionaires built their fortunes from the ground up.

Among these self-made billionaires, 29 earned a score of 10, indicating that they once lived below the poverty line or faced significant adversity during their journey to success. The list includes individuals like former Starbucks CEO Howard Schultz, who grew up in a Brooklyn housing project, and David Murdock, the former CEO of Dole Food Company and a war veteran who briefly experienced homelessness.

This diversity of backgrounds and stories within the ranks of the wealthiest Americans underscores the resilience of the American Dream.

Munger’s Legacy Lives On

In these times of doubt and uncertainty, Charlie Munger’s life story reminds us that the American Dream is not a relic of the past. It is very much alive, thriving, and within the reach of those who dare to dream, work hard and persevere through adversity. Munger’s journey from the depths of despair to becoming a billionaire and a revered figure in the world of finance speaks volumes about the opportunities that still exist in this great nation.

Let us draw inspiration from his legacy as well as the stories of self-made billionaires who continue to shape the landscape of American success.

Happy December!

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 2.42%. The S&P 500 Stock Index rose 0.80%, while the Nasdaq Composite climbed 0.38%. The Russell 2000 small capitalization index gained 3.10% this week.

- The Hang Seng Composite lost 3.72% this week; while Taiwan was up 0.87% and the KOSPI rose 0.34%.

- The 10-year Treasury bond yield fell 25 basis points to 4.214%.

Airlines And Shipping

Strengths

- The best performing airline stock for the week was EasyJet, up 16.7%. According to Bank of America, system net sales rose 0.4% for the week, ahead of the four-week average of -2.9%, likely reflecting strong holiday demand. The bank has heard numerous times from the airlines that demand for peak travel periods remains strong with softness in the off peaks. The recent themes in the airline bookings data are domestic stronger than international, leisure stronger than large corporate, and small business sales stronger than all other demand channels over the last four weeks.

- According to Bank of America, air freight rates were up 10% month-over-month in November as demand improved. Shanghai to North America rates were up 10% month-over-month while Shanghai to Europe rates increased 22%. Global air freight volumes increased 4% year-over-year in October, as per IATA data, higher than 2% in September.

- On Sunday, TSA screened over 2.9 million passengers, which was the highest number to ever be screened through TSA on a single day. It is interesting to note that the travel throughput from November 26, 2019, is the third highest level of passengers shared by TSA since the group began sharing checkpoint travel numbers (the second highest being June 30, 2023). Overall, TSA throughput last week was up 4.2% versus 2019 and has been tracking up nearly 6% versus 2019 in the month of November.

Weaknesses

- The worst performing airline stock for the week was Hawaiian Air, down 4.1%. According to Cowen, ASMs for airlines, in the group’s coverage, are scheduled to grow 10.8% year-over-year and 8.2% year-over-year in the fourth quarter of 2023 and the first quarter of 2024, respectively. Capacity growth will be constrained by GTF engine groundings and airlines’ efforts to better align supply with demand. Domestic capacity is scheduled to grow 8% and 4% in 4Q and 1Q, while international capacity is scheduled to grow 21% and 22% in 4Q and 1Q, respectively.

- According to Stifel, the laggard is container shipping. The segment is usually not a beneficiary of a strong winter as peak season is normally summer and early autumn. Box rates are at levels which should barely cover operating costs for even the more efficient operators, and after a small improvement, are starting to head back down again. Box rates and liner performance decline first, with container ship charter rates lagging as the vessels come off contract over time, and cash-rich liners are slow to reduce the size of their fleets until they give up hope or run out of money.

- According to Cowen, while reported capacity is usually less than capacity quoted on Cirium, divergences between consensus capacity forecasts and published schedules can provide a signal for positive and negative surprises. Most estimates for the fourth quarter of 2023 are within Cowen’s historical percentage of published schedules. The biggest gaps for the first quarter of 2024 are for United, American, Delta, JetBlue, and Spirit. Schedules for 2024 are still being formalized by airline network planning teams. Cowen expects there could be a lot of swings given unknowns on the timing and duration of GTF engine groundings.

Opportunities

- According to Bank of America, United and American extended the suspension of service to Tel Aviv following Delta’s extension last week. American’s current schedules now assume a resumption of its New York-JFK to Tel Aviv route in mid-February, compared to early January resumption previously. The change contributes to a -2.2%/-1.8% reduction to Atlantic capacity in January/February. United schedules assume a resumption of Tel Aviv service from Newark in December.

- The cost of shipping fuels such as diesel across the Atlantic has soared to an almost 16-month high amid ongoing disruption at the Panama Canal. Shipping through the vital waterway — a shortcut between the Atlantic and Pacific oceans — has suffered as an El Nino-fueled drought reduced water levels to an unprecedented low. That is prompting shipping companies to pay large sums to jump ahead in queues or sail thousands of extra miles around South America.

- According to RBC, for Boeing, the group believes 2024 delivery estimates provide a relatively low bar. RBC currently models 535 2024 737 deliveries and believes the initial 2024 guidance will be for 500-550 737 deliveries. RBC agrees that the announced production rates from Boeing would suggest a number over 600 but expect 100 from inventory and stabilization at 38 per month for deliveries from production. The supply chain remains the key risk for BA, but they believe it will see improved supplier consistency into 2024.

Threats

- Cowen believes an overcapacity situation is developing in the North Atlantic that is likely to lead to lower air fares. The U.S. airlines were among the first to add back international capacity after the pandemic. European airlines are now aggressively increasing capacity for summer 2024. Cowen forecasts that airlines will grow capacity to Europe by 8.6% for the first nine months of 2024 versus 2023.

- According to Clarkson Research, so far in 2023, newly built capacity totals 1.912mn TEU and scrap volume totals 0.136mn TEU. Clarkson estimates newly built capacity in calendar-year 2023 will reach about 2.36mn TEU, exceeding 2mn TEU for the first time. The group is also assuming that newly built capacity in 2024 will reach 3.109mn TEU, topping 3mn TEU for the first time.

- According to RBC, Air Transat and Porter announced a joint venture to integrate their networks through enhanced commercial collaboration. RBC views the expansion plan as a negative for Air Canada, as the combination of their respective networks at Toronto and Montreal directly competes with AC’s transborder growth plans. The strategy would have Porter’s domestic and transborder short- and medium-haul routes feed international medium- and long-haul traffic for Air Transat. Transat gets a domestic partner to grow Transatlantic leisure flights, which compete directly with Air Canada Rouge.

Luxury Goods And International Markets

Strengths

- Brunello Cucinelli was promoted to Italy’s FTSE MIB Index, which consists of the 40 most liquid and capitalized stocks listed on the Borsa Italiana, joining Moncler and Ferrari. Cuccinelli was listed in Milan in 2012 and since then the company’s shares have gained 850%, giving the firm a market value of about 5 billion euros.

- On November 13, a 1962 Ferrari 330 LM/250 GTO by Scaglietti sold for $51.7 million at an RM Sotheby’s auction in New York City. This beats the price of a 1967 Ferrari 412P Berlinetta sold by Bonhams on August 17 for $30.2 million. Ferrari is the most expensive car sold this year.

- Seoul Auction Corporation, Korea’s first and largest auction house, was the best performing S&P Global Luxury stock, gaining 35.4% in the past five days. Bloomberg reported no new news on the company.

Weaknesses

- China reported softer PMI data this week. The China Manufacturing PMI was reported at 49.4 in November versus 49.5 in October. The Service PMI dropped to 50.2 from 50.6 in the prior month. Surprisingly, the Caixin Manufacturing PMI crossed above the 50 level, to 50.7 from 49.5.

- Remy Cointreau reported disappointing quarterly results. First-half profits at the Company tumbled by 43% due to much weaker sales in the United States. America and China are the French Group’s key markets for cognac. The group said it did not expect a return to sales growth in the U.S. before the 2024-2025 financial year, while Europe, the Middle East, Africa, and China are expected to deliver only moderate sales.

- Farfetch Ltd, a specialty online retailer, was the worst performing S&P Global Luxury stock, losing 28.1% in the past five days. Bloomberg reported that the company is burning cash at an alarming rate and may be heading into bankruptcy.

Opportunities

- According to the latest data, inflation keeps coming down around the world. In the United States, the Personal Consumption Expenditures Price Index (PCE) of 0.0% came in cooler than the consensus of 0.1% and down from last month’s 0.4%. In the Eurozone, the preliminary November month-over-month inflation declined by 0.5% versus a correction of only 0.2% expected by Bloomberg’s economists. EU inflation declined to 2.4% from 2.9%, approaching the 2% desired by the European Central Bank.

- KKR & Co., a private equity firm, is purchasing the remaining 37% of Global Atlantic for about $2.7 billion in cash. This transaction, along with other strategic initiatives, is expected to boost after-tax distributable earnings per share by about 10% in 2024, according to the company’s presentation. Share gained on the news this week.

- Americans spent a record $12.4 billion in online purchases during Cyber Monday, up 9.6% from the last year. Online spending during the five days from Thanksgiving to Cyber Monday was up 7.8% year-over-year, totaling $38 billion. Christmas season shopping should be strong as well.

Threats

- Weaker manufacturing and service activities reported in China this week may put pressure on luxury stocks exposed to the market. LVMH, Kering, Richemont, and Hermes could be active in the luxury sector. BMW and Mercedes also have high exposure to the Asian nation. On the other hand, weaker data coming out of China could also put pressure on the Chinese government to provide additional support.

- After two years of waiting, the first Cybertrucks made by Tesla were handed over to their owners on Thursday from the company’s mega plant in Austin, Texas. The automaker also provided long-awaited pricing, revealing the cheapest option at $69,990, much higher than the price indicated four years ago. The battery range is set to be about 340 miles on a single charge, short of the more than 500 miles the company was talking about previously.

- Morgan Stanley downgraded shares of Louis Vuitton to equal weight on Friday on concerns of weakening demand in the luxury sector. The broker also cut the company’s price target from EUR860 to EUR790, forecasting sideway trading in the next few months, but still seeing a 12% upside from the current share price.

Energy And Natural Resources

Strengths

- The best performing commodity for the week was coffee, rising 9.63%, on strong Asian demand. A new rule by the Intercontinental Exchange, however, now bans the resubmission of old coffee beans without being subject to age penalties. Inventories, thus, are expected to remain low in the near term. Nickel rebounded from its lowest close since 2021 this week, after a volley of warnings that prices could be prone to bursts of short covering. The metal used in stainless steel and batteries finished the week up over 3% on the London Metal Exchange, bouncing after dipping below $16,000 a ton on Monday.

- According to RBC, uranium extended last week’s gains, rising to the highest levels since January 2008, on the back of tight spot market supply met by demand driven by financial interest. In the news, the French government and state-utility EDF agreed on a deal for nuclear power prices that should help support nuclear build-out plans while tempering price volatility for consumers.

- Copper briefly touched a 10-week high after the closure of a major mine in Panama, highlighted future supply challenges for the red metal as the energy transition accelerates. Panama’s government said it will shut the Cobre mine owned by First Quantum Minerals, damping hopes that the company might be able to reach a new deal to keep it operating. The project, the subject of mass protests from environmentalists and labor unions, produces about 1.5% of the world’s supply of copper.

Weaknesses

- The worst performing commodity for the week was lithium carbonate, dropping 11.07%, as ample supplies in China are depressing the price. After First Quantum’s decision to shut down the Cobre mine over a port blockade, uncertainty persists, and with it the discussion over the merits of restarting the site does not abate. Linked to that, unions said that mine workers leaving the site on a bus were attacked by protesters. Again, the mine is supposed to contribute around 370Kt of copper to the market next year, which would keep the market in a 150kt surplus.

- Natural gas slid more than 5% lower this week on an unexpected gain in gas storage. In addition, warmer-than-average weather is forecast for the next 10 days across western and central North America. Over the past 30 days, the natural gas price is off nearly 25% while crude oil has only fallen about 7%.

- Workers at MMG’s Las Bambas copper mine in Peru began an indefinite strike on Tuesday, union leader Erick Ramos wrote. More than 400 members of the SUTEMLB union are participating in protests at the mine site and in nearby towns, Ramos added.

Opportunities

- Naarea, a three-year-old French nuclear startup, is looking to raise €150 million ($164 million) as it seeks to develop a small reactor that would meet growing industrial decarbonization needs from the start of the next decade.

- Uranium offers a perfect distillation of a world that is heating up and a world order that is breaking down. Plus, a market eager to capitalize on both. The metal at the heart of zero-carbon reactors and zero- civilization warheads has so far this year beat every member of the Bloomberg Commodity Index, except orange juice.

- Occidental Petroleum Corp. is reported to be in talks to buy out a private company, CrownRock LP, operating in the Permian Basin from Texas to New Mexico, reports the Wall Street Journal. Speculation on the transaction price is thought to be greater than $10 billion. For Occidental, the purchase comes on the heels of its last big purchase of Anadarko Petroleum Corp. in 2019. However, there has been a flurry of recent deals as cash-rich majors are buying out their smaller peers to secure new places to drill.

Threats

- Iron ore declined after its longest streak of weekly gains since January, hit by Beijing’s latest warnings about increased market supervision as it seeks to curb price rises. The steelmaking material lost as much as 1.8% in Singapore after the National Development and Reform Commission said in a statement late Friday that it had met with major port operators to discuss iron ore inventory and storage matters, as well as to seek measures against hoarding.

- According to Goldman, the ramp up of Chinese lepidolite and Africa spodumene lithium supplies not only weighs on the S/D balance of the global lithium market but is also reshaping global supply costs on both an absolute and relative basis. Over the next two years, Goldman expects lithium from these two supply groups to drive nearly one-third of global output additions, and to form the top 30% of the global cost curve for integrated lithium carbonate.

- Globally, liquified natural gas (LNG) trading is becoming a bigger part of the energy mix. However, with that increased use comes the risks of reliability of supplies. Remarks by the vice president of global LNG trading at BP Plc noted the Company’s and Shell Plc’s frustration with Venture Global LNG Inc. that is apparently selling their contracted gas into the spot market versus delivering into their contracted commitments, citing they are still in what appears to be a prolonged commissioning period for the plant, reports Bloomberg.

Bitcoin And Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Terra Classic, rising 60.27%.

- Bitcoin climbed back above $38,000 on Tuesday amid optimism that the U.S. central bank may be closer to lowering borrowing costs if inflation continues to decline, writes Bloomberg.

- MicroStrategy chairman and co-founder Michael Saylor placed one of his biggest bets yet, with the enterprise-software maker turned Bitcoin investment-fund proxy purchasing $593.3 million more of the largest cryptocurrency, reports Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Blur down 19.39%.

- SoFi Technologies, the fast growing one-stop shop for financial service products, is exiting cryptocurrency even with token prices surging, writes Bloomberg, due to increased scrutiny of the sector by banking regulators.

- Coinbase Global’s Chief People Officer sold $1.83 million worth of stock on November 24, according to Bloomberg.

Opportunities

- Michael Novogratz predicts that Bitcoin is poised to reach its former peak a year from now, as anticipation builds over the likelihood that the U.S. SEC will approve the first American exchange-traded fund (ETF) directly to hold Bitcoin, writes Bloomberg.

- Cathie Wood’s investment management firm ARK Invest sold a further $5 million worth of Coinbase stock on Wednesday while buying $2 million of shares in trading platform Robinhood and $1.5 million of online bank Sofi Technologies, according to Bloomberg.

- Bitcoin soared to its highest price so far this year as investors took on more risk ahead of comments from Federal Reserve Chair Jerome Powell, which could give guidance on whether the U.S. is closer to lowering interest rates. Bitcoin rallied as much as 2.87% to a high of $38,834 on Friday morning, reports Bloomberg.

Threats

- The Philippine Securities and Exchange Commission says it is working to block user access to cryptocurrency exchange Binance, adding that the company isn’t authorized to publicly offer securities in the country, writes Bloomberg.

- The U.S. Treasury Department is seeking new power from Congress to go after cryptocurrency and fintech platforms used by groups like Hamas, reports Politico.

- Cristiano Ronaldo was slammed with a $1 billion lawsuit for promoting crypto. The lawsuit accused the soccer star of acting unlawfully in his promotion of NFTs issued by Binance.

Gold Market

This week gold futures closed the week at $2,090.90, up $67.40 per ounce, or 3.33%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 8.13%. The S&P/TSX Venture Index came in up just 2.69%. The U.S. Trade-Weighted Dollar fell 0.18%.

Strengths

- The best performing precious metal for the week was silver, up 4.81%. Aris Mining is increasing the capacity of the Maria Dama processing plant within the Segovia Operations from 2,000 to 3,000 tons per day (tpd). The costs for the plant expansion are estimated at $11.0 million and completion is expected by early 2025. Aris Mining also reported a significant update to their reserves.

- Gold climbed to the highest since May as the dollar weakened ahead of Treasury auctions that are expected to indicate whether the U.S. bond market is set for a meaningful revival. Bond yields extended declines on Monday after weaker-than-expected U.S. new-home sales data, while gold held gains. Lower interest rates are typically good for non-yielding assets like precious metals.

- According to BMO, Dundee Precious Metals (DPM) reported an updated reserves and resources statement for its flagship Chelopech operation in Bulgaria, which resulted in mine life extension by another year to 2032. Furthermore, the reserve and resource update indicate a slight increase in gold and copper grades by 5% and 3%, respectively. The mine plan also includes a gold recovery increase of 5%.

Weaknesses

- The worst performing precious metal for the week was palladium, down 6.60% on oversupply, and substitution from platinum, which has been cheaper to acquire. Palladium is down 40% this year while platinum had dropped about 13%. According to Bank of America, in its latest monthly, the World Gold Council (WGC) noted physically backed gold ETFs saw continued outflows in October. This trend was most pronounced in North America, where selling totaled $2 billion (28 tons). In Europe, selling totaled $622 million (11 tons). It seems the rise in interest rates has shifted Investor preferences away from the yellow metal to higher yielding assets in the western nations while Asia and India have picked up their purchases of gold. Global ETF outflows have totaled 225 tons year-to-date, making 2023 the second largest year for ETF outflows.

- According to Canaccord, Westgold Resources lowered its FY25-31 production forecast at Murchison by 5% on average to account for the tie in of the long-hole open stoping (LHOS) operation with Big Bell’s existing cave. The combined operations account for 45% of production at Murchison hub over this period.

- Following a winder rope incident at the start of last week, Impala Platinum announced 12 fatalities at Rustenburg’s 11 Shaft. A further 74 employees were injured in the accident and 10 remain in critical condition. The accident is under investigation as regulations are clear concerning the regular safety checks and inspections.

Opportunities

- Goldman Sachs sees an environment developing for gold with a fattening in right-tail price risk into next year. The potential upside in gold prices will be closely tied to U.S. real rates and dollar moves, but they also expect persistent strong consumer demand from China and India alongside central bank buying to offset downward pressures from upside growth surprises and rate cut repricing. On net, they would expect any selloffs to be limited in scale due to a dovish Federal Reserve, slowing wage growth, and resilient central bank purchases and tactically would view a sell-off in gold as a buying opportunity. They maintain their 12-month gold target at $2,050/oz.

- Moneta Gold and Nighthawk Gold have announced an at-the-money merger whereby Moneta will acquire all the Nighthawk issued and outstanding shares. Each share of Nighthawk will receive 0.42 shares of Moneta in exchange and the overall ownership post the transaction is expected to 34% Nighthawk and 66% Moneta.

- According to Canaccord, gold is up 12% this year yet the S&P/TSX Global Gold Index is up only 4% and the VanEck Vectors Gold Miners ETF 9%. They also note that roughly 50% of their coverage universe is down 20% or more from their 52-week highs. The last four times the gap between gold and gold equities have been this wide (dating back eight years) has resulted in an average 25% subsequent rise in the gold price and 100% average increase in the S&P/TSX Gold Index.

Threats

- According to Bank of America, as the U.S. yield curve flattens, the gold price tends to rise; and as the U.S. yield curve steepens, the gold price tends to fall (or rise more slowly). The U.S. rates team is calling for the yield curve (i.e., 2s10s) to dis-invert in H2’24, reaching a positive slope by the end of 2024 (vs. sharply negatively sloped currently). They wonder if this might act as a damper on the gold price even if the Fed is cutting its rate.

- According to Bank of America, demand for palladium and the wider platinum group metals complex is under pressure as the world transitions from internal combustion engines (ICEs) to electric vehicles (EVs). They model a palladium surplus of 1.4 Moz in 2024. To balance the market, cuts will likely be required. Which mines are most “at risk”? In their view, the palladium rich mines of North America, Sibanye Stillwater (Sibanye, SSW) and Impala Canada (Impala, IMP). They also see potential to rationalize higher cost mines in South Africa; they believe that Impala will take further write-downs on Royal Bafokeng Platinum (RBP) carrying value.

- Bloomberg expects platinum to remain in deficit throughout the rest of this decade, while palladium and rhodium will shift to surplus and stay that way for the foreseeable future. As the EV transition continues, the 90% of demand for palladium and rhodium that comes from ICEs will weaken demand for both metals.

Related: Commodities in 2024: An Opportunity for Growth With PSPFX