Written by: Emily M. Harper, CFP®

What will 2024 bring? It can be fun to make predictions about what’s to come (The Bear besting fan favorite Ted Lasso for outstanding comedy series? A Super Bowl without the Kansas City Chiefs & Taylor Swift?), but the thought of an uncertain future can also bring anxiety. Elections and the changes they may bring, along with ongoing geopolitical tensions and questions about the Fed’s interest rate policy and its impact on the economy are enough to invoke nerves in even the most confident investors heading in to 2024.

The good news is that our financial success over the long term doesn’t have to be determined by these externalities. Whether you are accumulating wealth for goals like retirement or creating a legacy, enjoying the lifestyle that your wealth enables, or you just want to be financially unbreakable, consistent behavior and a focus on what’s in our control is key. Read on for some things to consider as the new year unfolds.

1. Save & Invest No Matter the Environment

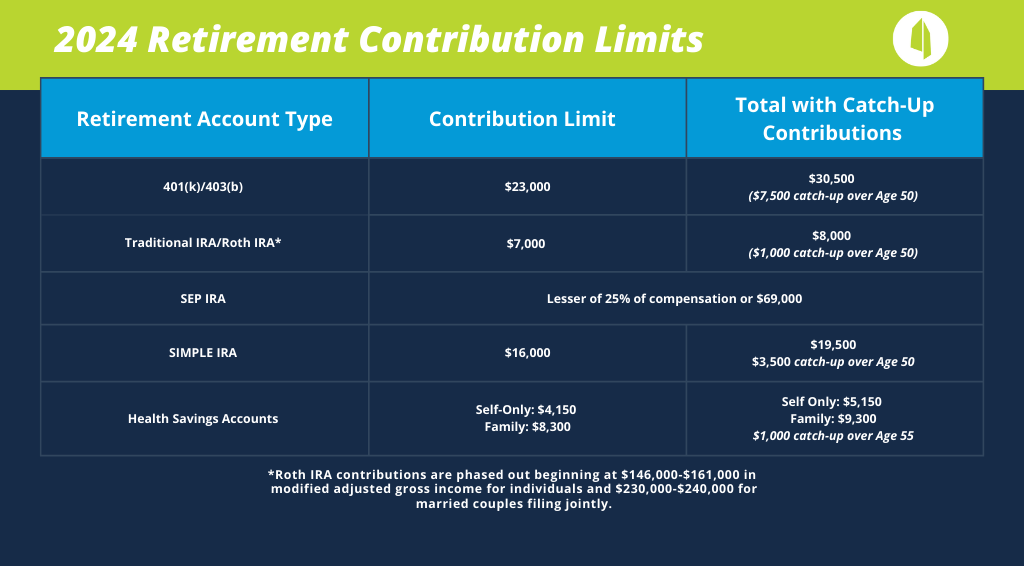

The start of the year is a great time to review current contribution limits for tax-deferred accounts like retirement accounts and Health Savings Accounts. Make sure you are set to effortlessly maximize these as you are able. Setting up regular automated contributions to retirement and even taxable investment accounts makes it more likely that you will continue investing and not get derailed when things get tough in the market. Automatic doesn’t mean “set it and forget it” though. Contribution limits change annually, and various provisions of the Secure Act 2.0 kick in over a number of years, changing the retirement savings landscape.

2024 Contribution Limits:

A few things to know from the Secure Act 2.0 in 2024 and beyond:

- Employers can start making Roth matching contributions to an employee’s 401(k). Previously, employers could only make matching contributions on a pre-tax basis. Not all employer plans have a Roth option – but this may compel more businesses to include this in their plan design.

- High income earners over 50 have a few more years before catch-up contributions to a 401(k) are required to be Roth vs. pre-tax. This provision was supposed to begin in 2024, limiting an opportunity for those whose wages exceeded $145,000 in 2023 to reduce their taxable income with pre-tax contributions beyond the standard 401(k) deferral limit.

- Catch-up contributions for IRAs and Roth IRAs will increase with inflation in $100 increments rather than remaining a flat $1,000/year starting in 2024.

- By 2025, catch-up contributions to workplace retirement accounts will increase even more for those between 60-63, allowing you to save more in what may be your highest-earning years. The enhanced catch-up will be the greater of $10,000 or 150% of the catch-up contribution amount from the previous year. Keep in mind that the Roth catch up rules will apply to those with wages above a certain amount (likely $145,000 adjusted for inflation).

2. Get a Handle on Spending & What’s Normal Beyond Inflation

It’s been easy to blame higher spending on inflation the past few years. However, inflation doesn’t tell the full story. Lifestyle creep happens very easily, especially as salaries increase each year. As you start to make more money, you likely begin spending more money without really feeling like things have changed. One of the biggest drivers we see when it comes to long-term success of a wealth design is spending, which is something we all have control over to some degree. If your income has increased over the years but your saving hasn’t, it may be time to take a step back and get a handle on where the money is going, making sure that it’s in line with your answer to the question “What’s the money for?” not only today but in the future. Higher spending isn’t necessarily a bad thing (and a latte here and there isn’t going to derail the high-income earner’s financial success no matter what popular media personalities tell you) – it’s just something to be aware of and understand how it impacts your ability to meet your goals over a lifetime.

3. Maximize the Benefits of a Historically High Exemption for Gift & Estate Taxes

As of now, elevated lifetime gift and estate exemption amounts ($13.61M/person in 2024) are set to expire at the end of 2025 if Congress doesn’t act to extend them. I won’t opine on the likelihood of Congress passing anything to extend them, as it can truly be anyone’s guess. If you’ve accumulated significant wealth over your lifetime and you desire to see that wealth benefit the next generation with minimal tax impact, 2024 may be the year to take action or at least start developing a plan so that you understand how much your estate may grow over time and what options are available to you to reduce it in a way that allows you to balance your priorities.

- Annual gifting to loved ones while you are living can be a great way to reduce your estate over time while also seeing their enjoyment of the gift. In 2024, you can give up to $18,000 to any one individual ($36,000 for married couples) without filing a gift tax return.

- If providing funds for education for the next generation is important, 529 contributions can be a great way to earmark funds for that purpose and also make a sizable gift (5 years’ worth of the exclusion amount) all at once.

- Irrevocable trusts, such as Spousal Lifetime Access Trusts (SLATs), may also be an option for those whose assets exceed the exemption amount who also have sufficient assets to meet their personal spending goals without needing any assets transferred to a trust. These trusts can be complex and require deep thought when it comes to deciding how you want the funds to benefit your loved ones – getting started now will increase the likelihood that you and your attorney can execute a trust and fund it with time to spare before the end of 2025.

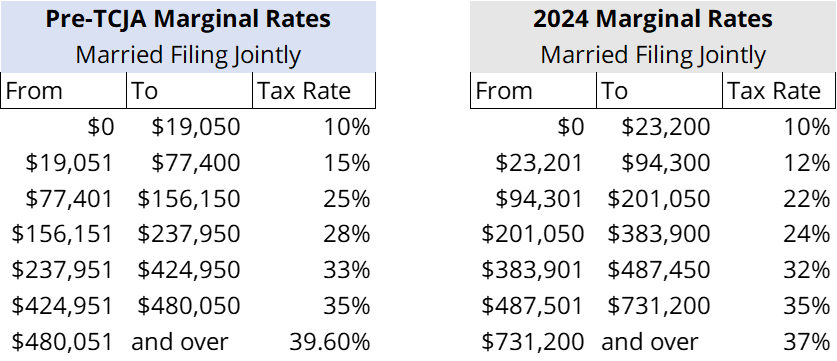

4. Start Planning for Higher Taxes

Similar to the higher exemption amounts, our current tax brackets are reflective of the Tax Cuts and Jobs Act passed in 2017 and are set to sunset at the end of 2025. While the pre-2017 brackets will be adjusted for inflation, it is likely that more of your income will be subject to higher tax rates than they are today by 2026. Someone in the 24% bracket today could easily see a good amount of their income taxed at 33% after we revert back to pre-2017 brackets, reducing the disposable income they’ve grown accustomed to with lower tax rates and impacting the amount of portfolio assets that are truly available for spending in the future vs. being a tax liability.

Pre-TCJA Brackets vs. 2024 Brackets:

- Higher rates aren’t the only piece of the puzzle – higher deductions may also be allowed after 2026 for those who have been limited to $10,000 in deductions for state and local taxes and property taxes (SALT), bringing overall taxable income down.

- Those who are comfortably in the 24% bracket now may want to consider converting pre-tax retirement money (Traditional IRAs and 401(k)s) to Roth, paying taxes at today’s rates on distributions vs. uncertain future tax rates. It won’t take much in retirement income to drive higher tax rates in the future if there isn’t an extension of current rates or some future tax reform.

- For those over the age of 70 ½ who don’t expect to need all of their IRA money for their personal spending, Qualified Charitable Distributions up to $105,000 may be made. This can help meet a charitable intent and also reduce the amount of taxable income that must be distributed from pre-tax retirement accounts.

- There’s no better time than the present to look at your investment portfolio and how it is managed to ensure tax efficiency if you are a high-income earner.

5. Review Risks Beyond the Market

Many people only think about stock market returns as a source of risk when it comes to meeting their financial goals. The reality is that everyday life presents risks that can change the financial picture overnight if they aren’t planned for and managed. While we can’t control what will happen to us, we can control how we protect ourselves against risk. If you haven’t looked at your insurance portfolio in a while (life, property, liability, disability, etc.) now would be a good time to brush off those policy documents and review them with a professional who has your best interest in mind.

- Inflation has driven up construction costs, and many people took on home improvement projects from 2020-2021 while interest rates were low. It’s possible that the replacement cost on your property insurance is insufficient and needs to be adjusted.

- Life happens fast and we don’t always take the time to step back and reassess our needs. If you’ve added children to your family, taken on liabilities, or experienced a significant increase in income that your family relies on, you may need to establish or increase your life insurance coverage.

Follow Your Own Plan & Path, Not Someone Else’s Predictions

Your vision and plans for the future are uniquely yours, but it can be tempting to act on the predictions that are no doubt flooding your inbox and assaulting your ears this time of year. Sticking to a wealth plan and focusing on the things that are in your control isn’t always fun or glamorous, but it will have a high probability of success for helping you get to where you most want to go, regardless of what’s going on in the world around you. Partnering with a wealth advisor who understands your big picture and the purpose of your wealth can go a long way in helping you gain the clarity to concentrate on the controllable aspects of your financial journey, paving the way for more favorable outcomes. I hope that 2024 brings joy, prosperity, and wellness. If anything here resonated with you, make 2024 the year that you prioritize actions that help you realize your wealth’s purpose.

Related: Do You Have a Crystal Ball for the Markets? Nobody Does.