Taxes. The word nearly reverberates every time it’s said or at least it feels that way. This is especially true if you’re a high-income earner. While the anxiety surrounding tax season may never quite go away, there are tax-efficient strategies you can employ to ease your concerns and soothe your stress levels when that time of year inevitably comes. However, please keep this in mind. Even though we have seen and learned a lot about taxes, these are general suggestions only and your individual tax situation may be unique relative to our ideas. We implore you to always seek the counsel of your tax professional as the final authority on any of our ideas below.

1.Take advantage of vehicles for future tax-free income.

In most cases here, you’re trading a current tax benefit in the form of lower taxable income now for a future benefit of tax-free income later. Despite being in a high tax bracket currently, you could be in an even HIGHER tax bracket in the future…even if you have lower income. Changing tax rates and brackets are always a possibility in our political environment–planning for this inevitability can alleviate anxiety surrounding future tax rates increasing above where they are now.

So, how can you navigate this?

Roth Conversions

Take advantage of the lower rates under the Tax Cuts and Jobs Act before they sunset in 2025. Pay taxes now at what may ultimately be lower marginal rates than you would be subject to in the future when you make withdrawals. This can help you build tax-free wealth for your future needs or for your heirs to inherit. Keep in mind:

- Traditional IRA withdrawals are taxable as ordinary income, but qualified Roth IRA withdrawals are tax-free. Generally, qualified Roth IRA withdrawals include those made after you turn 59½ and owning a Roth IRA for at least 5 years.

- You may convert an unlimited amount from your Traditional IRA to Roth IRA as often as you wish. The converted amount will be taxable as ordinary income in the year the conversion is done–spreading out conversions over multiple tax years can give you some control over your taxes.

Health Savings Account Contributions

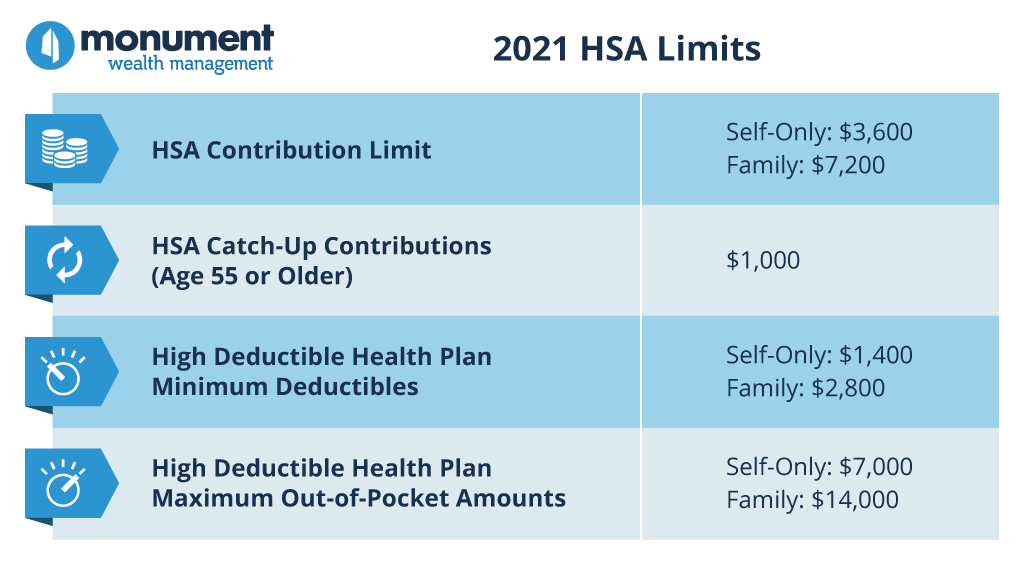

With a health savings account (HSA), you receive a triple tax benefit: tax-deductible contributions, tax-free earnings, and future tax-free withdrawals for qualified medical expenses! While the tax benefits are similar to a Roth IRA, HSAs allow higher contributions than a Roth IRA without income limitations for eligibility. Consider the following:

- You must have a high deductible health plan to be eligible. Even if you have great health benefits, it’s becoming more and more common for companies to save a buck by switching to high deductible health plans where employees bear more of the cost.

- You’ll receive a current above-the-line tax deduction for any contributions you make to your HSA. This lowers your adjusted gross income (AGI), which may benefit you because your AGI is used to determine the threshold for some below-the-line deductions and tax credits–meaning more potential tax savings!

- Your earnings compound tax-free.

- Withdrawals are tax-free for medical expenses (or any purpose after you’re 65). Think about the compounding potential when contributions are invested and remain untouched until retirement!

As a high-income earner, you may feel comfortable about your ability to cover out-of-pocket medical costs. Don’t discount the wealth-generating potential and flexibility an HSA can afford you, from lowering your current taxable income now to creating a tax-free source of money for an uncertain future.

Roth 401(k) vs. Traditional 401(k) Deferrals

Many people like to lower their current taxable income in the form of pre-tax, or Traditional, 401(k) deferrals from their paycheck directly to their employer-sponsored retirement plan. This is a choice that reflects the belief that taxes will be lower in the future when money is withdrawn in retirement than they are today. Saving for retirement in any form is a good thing–but there might be a better option for you to consider in the form of a Roth 401(k) as a high-income earner.

There is no income-limit eligibility for a Roth 401k (unlike a Roth IRA) and it also offers a higher contribution limit of $19,500 (plus a $6,500 catch-up if you’re over 50). This won’t lower your taxable income now but your future self will thank you for the control this will give you over how much taxable income you’ll realize year-to-year in retirement. Because you have already paid taxes on the money contributed to a Roth 401(k), you are able to withdraw those contributions AND earnings tax-free in retirement. This is a great opportunity to build a substantial source of tax-free income to tap into in the future when you may in fact be in a higher tax bracket or have more taxable income than you thought you would in retirement from the portfolio your wealth has built.

2. Pay attention to taxes in your portfolio and minimize where possible.

No one ever thinks to themselves, “Hmm, how can I pay more in taxes this year?” Optimizing your tax strategy is always the name of the game which is why tactics like Tax-Loss Harvesting and utilizing tax-efficient vehicles can present a number of creative opportunities to leverage.

Tax-Loss Harvesting

“Loss” doesn’t have to be a four-letter word when it comes to your investment portfolio. It creates opportunities to reduce taxable realized gains. The idea of tax-loss harvesting is that you’ll be able to apply these losses against any realized gains and up to $3k in ordinary income on your tax return to help lower your tax bill while maintaining an optimal asset allocation.

Example: Rory’s investments performed very well last year and she sold them while they were up. By selling her investments at a loss according to a specific set of tax-loss harvesting rules, she realized she could offset her realized gains. Pro tip: If you have more losses than gains, you can also cancel out up to $3k in ordinary income. Now that’s some sweet lemonade.

You may have been burned before and lost money in past sell-offs. Tax-loss harvesting is not the same thing as taking a loss and never having an opportunity to recover. By selling a security at a loss and replacing it with a similar security, you maintain market exposure AND reduce your tax bill on realized gains elsewhere in your portfolio.

Tax-Efficient Vehicles

Individual stocks are low-cost and tax-efficient–which means YOU control the timing of realized gains.

Vehicles like active mutual funds, and to a lesser extent, ETFs, pass capital gains realized at the FUND level through to investors each year. These don’t depend on whether you sold shares of YOUR investment…investors in these vehicles have less control over the amount of taxable income attributable to their portfolio in a given year.

Mutual funds and ETFs may still have an important place in your diversified portfolio, however. But including individual stocks is a good way to control your tax picture AND take advantage of tax-loss harvesting opportunities. Keep in mind that not every stock in an index will be performing the same and rising together–by using individual stocks vs. an index ETF or fund, you’ll have more opportunities to lock in valuable losses for tax purposes without losing control over realizing gains.

For benchmark-conscious investors, using individual stocks also allows for Direct Indexing, which is essentially owning a basket of individual stocks to replicate a benchmark index’s performance and risk profile instead of owning a single ETF or mutual fund. This type of tax-loss harvesting over a long period of time can enhance overall performance in the form of potentially higher after-tax returns.This can’t be done effectively with mutual funds or ETFs.

It’s worth noting that it’s important to take a rules-based approach to investing in individual stocks to avoid the behavioral pitfalls we can occasionally fall victim to.

Our advice: Remove emotion from your investment decisions. This is where an advisor will add a ton of value in keeping you honest.

3. Rethink your charitable giving strategy.

Checkbook giving is common–it’s simple and convenient. But you may be leaving something on the table by not considering other ways to give. Your charitable giving strategy deserves the same customized attention paid to other areas of your financial life, especially when it comes to tax savings opportunities.

Donate Appreciated Stock

Eliminate future capital gains on stock you’ve held for at least a year AND get a deduction if you itemize. Limited itemized deductions of up to 30% of AGI are permitted for donated appreciated stock–you may carry any excess above the 30% AGI threshold forward into future years. While this is less than the AGI limit for cash donations, there’s a current and future tax benefit. It’s smart to take advantage of this given uncertainty surrounding future capital gains tax rates for high-income earners.

If you have a significant position in your company’s stock, this is also a great way to reduce concentration risk without a tax hit and have some control over where your wealth goes.

Donor-Advised Fund

If you find yourself in an especially high-income year (maybe you sold your business or had a valuable restricted stock vest), you might want to consider a Donor Advised Fund. With this kind of vehicle, you can spread grants out to organizations over time or allow the money you’ve donated to the Fund (which itself is a 501c3) to continue to grow tax-free for future transformational giving. Also, this is a great way to get your family and the next generation involved in giving–a DAF can serve as a source of legacy that you establish.

4. Defer taxes on realized gains where it makes sense

While it makes sense to hedge against future tax rate increases by building up tax-free income sources, it may also make sense to avoid paying unnecessary taxes now on realized gains if you anticipate that your income will be drastically lower in the future.

1031 Exchange

Maybe you want to upgrade your vacation home or rental property, which you bought decades ago at a great price in a great location that’s now worth much more. However, you’re finding that it no longer meets your family’s needs.

You have likely taken a depreciation deduction on your taxes, which goes a long way in reducing taxable income while you own the property. But when you try to sell, this can provide an unexpected tax bill as those deductions lower your cost basis and increase the amount of gain subject to taxes at a higher rate.

Structuring the sale of the current property and rolling those proceeds immediately into the purchase of another could be done through a tax mitigating vehicle called a 1031 exchange. This would allow you to defer the realized gain on the original property and avoid paying taxes until you sell the newly purchased property in the future.

This can be very powerful for families who intend to keep a property in the family for their children to inherit in the future–the property receives a “step-up” in cost basis when inherited, meaning that deferred realized gain is eliminated. These exchanges can be done with any investment property but can also be complicated and costly, so they must be considered very carefully.

Qualified Opportunity Zone Investments

The 2017 Tax Cuts and Jobs Act established the Qualified Opportunity Zone (QOZ) program to provide a tax incentive for private, long-term investments in economically distressed communities.

Investors in these programs are given an opportunity to defer and potentially reduce tax on recognized capital gains if those gains are invested in a QOZ within 180 days. In addition to deferring the realized gain into 2026, when income may be lower, there’s another sweetener: REDUCTION of a portion of the realized gain assuming certain criteria is met. This benefit was greatly reduced after tax year 2019, but is still valuable through December 31, 2021. If realized gains are invested in a QOZ by December 31, 2021, you may reduce the amount of your gain that would have been subject to taxes by 10%.

Additionally, growth on the QOZ investments itself is tax-free. These vehicles aren’t without risk–they’re illiquid and may be speculative. Very careful consideration should be given to your liquidity needs and whether this sort of investment is in line with your risk tolerance and your unique goals and objectives.

This first appeared on Monument Wealth Mangement.

Related: Should I Sell My Business?