Now that you have made it through the retirement danger zone with your financial plan intact, what’s next?

This season can be full of opportunities, both personal and financial. At this point, you may face some difficult decisions around relocating and/or how best to spend or steward the wealth you’ve worked hard to accumulate.

In these middle years of retirement, your children are likely off the family payroll, you may have started Social Security, and you are taking or approaching required minimum distributions from your retirement accounts. These years bring a new set of considerations.

Life Expectancy May Be Longer than You Anticipate

If you are 65 years old now and in good health, chances are, you could live past age 90! Now that sequence of returns risk has decreased, you will want to evaluate your plan for other risks. One that remains a concern for many retirees is how they might handle a long-term care event.

A good first step to understanding what kind of long-term care you may need as you age is to evaluate your family health history and risks for diseases.

There are a variety of care options available at vastly different price points ranging from full-time long-term nursing care facilities to aging in place at home. Duke University has an excellent resource–a class called Stay Put or Move On that can help you navigate the complexities of this decision as you consider your final years.

Tax Benefits are Still Available

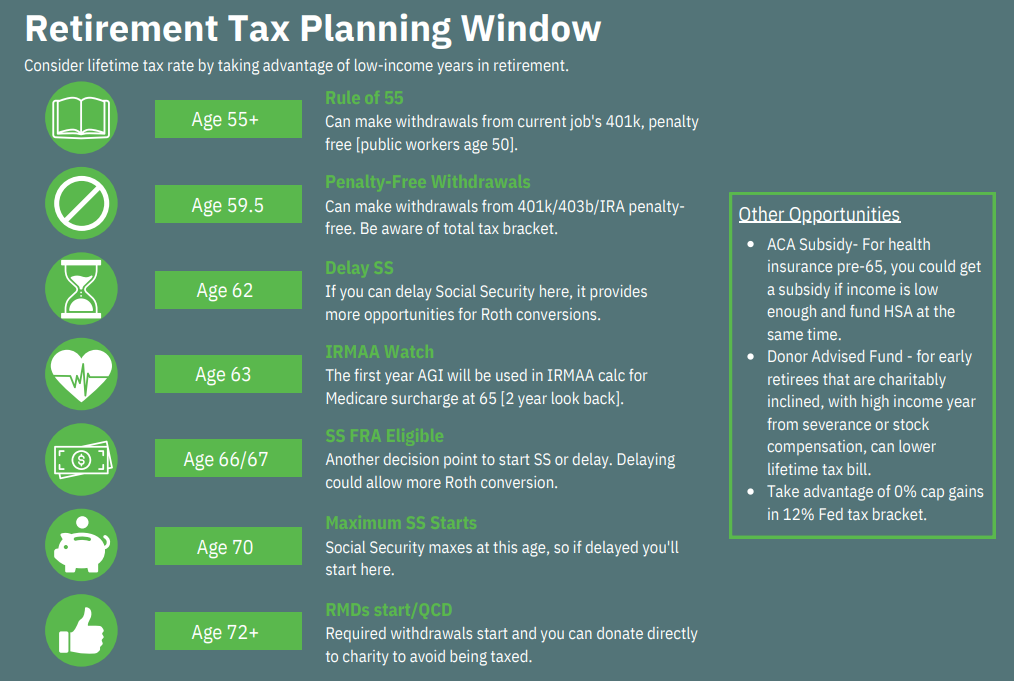

Eventhough the retirement tax window is closing, you still have opportunities for tax savings in these middle years of retirement.

Many retirees will use a combination of these strategies in their planning:

- Qualified Charitable Distributions

- Roth Conversions – You now may be evaluating your current tax brackets compared with your heirs as a primary motivator for this strategy.

- For couples: Consider the impact of extended single tax rates on your surviving spouse vs. the married filing joint tax brackets you have now.

- IRMAA Impact: Consider options to keep your income below these thresholds.

Estate Planning in the Middle Years of Retirement

This is also a good time to look at estate planning options and talk with your heirs to prepare them for what they can expect. In addition, utilizing qualified charitable distributions can save you on your taxes.

Having a financial advisor as an accountability partner and guide through this retirement journey can increase the odds that you are optimizing the strategies and resources available to you in each stage of retirement.

Outline of This Episode

- [0:46] 101 Additional advices

- [2:59] Next steps once you reach the arrivement phase of retirement

- [6:51] Consider your life expectancy

- [13:08] Address your scarcity mindset

- [15:23] Tax benefits to take advantage of