You ever get the feeling things just aren’t right in America?

The cost of living is out of control. A small group of people seem to make most of the money, while the average guy can barely keep his nose above water.

None of this is new, of course. While it may be approaching a boiling point, this ugly trend has been entrenched for about 50 years, since 1971.

So… WTH happened in 1971?

Wtfhappenedin1971.com is one of my favorite websites. It’s a collection of dozens of charts showing that something undeniable and insidious was set in motion in America in 1971.

Here are three:

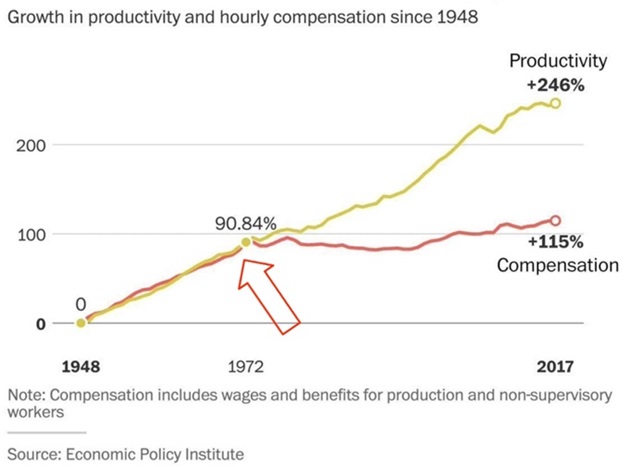

Wages detaching from productivity…

Source: Economic Policy Institute

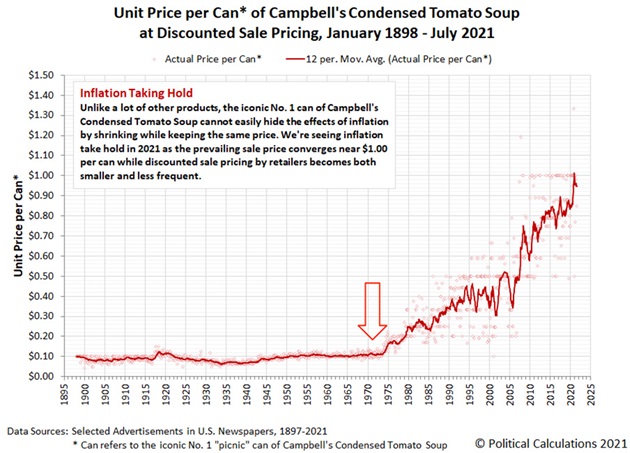

Endlessly rising prices…

Source: Political Calculations

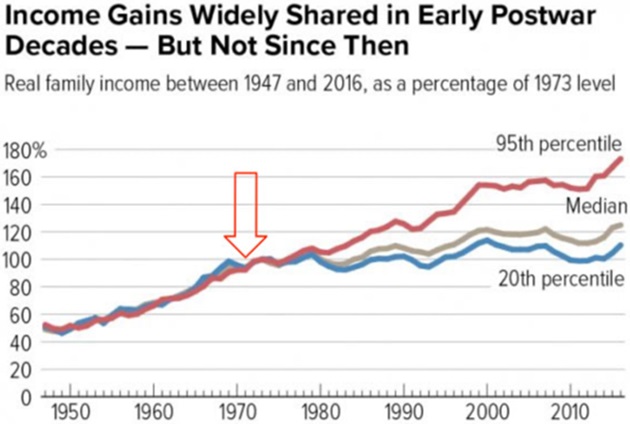

And the wealth gap…

Source: CBPP.org

These charts all show the same thing in different ways: Prior to 1971, Americans enjoyed shared prosperity—together. Then something changed. The rich started getting a lot richer, while everyone else stagnated.

The “wealth gap” shown in these charts largely defines American politics. I’d argue that Americans’ differing feelings on what’s causing this wealth gap got both Obama and Trump elected.

Now let me show you some newer, surprising data…

Did you know America’s poorer citizens have been getting a lot richer lately?

According to the Federal Reserve, real (after inflation) incomes are hitting new record highs.

FactSet data shows the net worth for the bottom half of Americans has grown 65% since 2020—more than double any other cohort. This has never happened before.

According to the Federal Reserve, the bottom 50% of Americans’ share of the overall wealth of the nation is rapidly rising after decades of decline.

And recent data from the Economic Policy Institute shows wages are growing much faster for high school grads than college degree holders.

To kick off the New Year, I’m sharing my thesis for what’s causing this.

I believe the forces that set the widening wealth gap in motion in 1971 are reversing.

If I’m right, the next 50 years will look radically different than the last 50 years.

If I’m right… you should put extra thought into the way you invest in 2024 and beyond. Because what “worked” in investing for most of our lifetimes is unlikely to produce strong returns going forward.

And if I’m right, our kids and grandkids will look back and ask, “WTF happened in 2023?”

This essay, which I’ll split into three parts, will be more of a “think piece” than what I usually write in The Jolt, where I try to keep it breezy.

Let me know what you think at stephen@riskhedge.com.

To start, let’s answer the all-important question…

WTF happened in 1971?

President Nixon took America off the gold standard in 1971.

For a full explanation of how this decision warped the American economy, I recommend Lyn Alden’s book, Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better.

Here’s a quick summary...

Before 1971, US dollars = a fixed amount of gold. After 1971, US dollars = nothing but a promise.

Once we went off the gold standard, prices started to rise rapidly. In the charts above, we saw the price of a can of Campbell’s soup take off. Asset prices began a dramatic rise, too.

Americans who owned stocks and real estate benefitted, or at least kept up. Everyone else suffered as inflation ate away at their savings and salaries.

Perhaps most important of all, the price of oil skyrocketed and became unpredictable.

Here’s the price of oil since 1946. Up until the early 1970s, it was pretty stable. The oil shock of 1973 caused the price to nearly triple overnight and ended the era of reliably cheap oil:

Source: FRED

It’s hard to exaggerate how important the price of oil is. Expensive oil doesn’t only make it more expensive to fill your tank and heat your home. It drives up prices across the board.

You need energy to grow food… harvest it… and then deliver it on gas-guzzling trucks. And how do supermarkets keep the lights on? Electricity… from oil.

Higher energy prices squeeze almost every corner of the economy. Especially manufacturing.

The early ‘70s was peak “Made in USA.” Many of our largest companies were manufacturers. One in four Americans worked in factories. These factories hosted millions of reliable middle-class jobs.

Suddenly, spiking oil prices made it a lot more expensive to make stuff. This was a gut punch to America’s largest companies. Profits plunged, leading to mass layoffs.

Thousands of manufacturers went bust. Most of those that survived abandoned the Rust Belt for cheap foreign labor.

America’s manufacturing base was hollowed out, and the country largely stopped producing most physical “stuff” for 50 years.

Until… 2023.

Spending on new American factories hit $205 billion last year… easily a record. Look at that “hockey stick” growth:

Source: FRED

“Made in the USA” is being reborn before our eyes.

Most of that $200 billion is being spent building computer chip plants and electric vehicle factories—technologies of the future.

How come no one’s talking about it?

On Friday, we’ll get into why this is happening… and what you should do about it.

Related: I Challenge You To Take This Pledge in the New Year