Written by: Scott Colyer | Advisor Asset Management

As the calendar changed from 2020 to 2021, I can’t help but find an environment that is truly surreal. We have a raging global pandemic on our hands that is getting markedly worse on a day-by-day basis, we have vaccines that are sitting in warehouses being administered at one-tenth the rate that is necessary to accomplish the task at hand and we have millions without a job with difficult prospects of getting one in the near future. Against that backdrop we have interest rates being held close to all-time lows, equity markets at all-time highs (in price) and, of course, margin borrowing close to all-time highs. How could all these events be happening concurrently and what can history tell us about the seemingly dissonance we are facing?

I am immediately reminded of Prince’s hit song – “1999”

The environment has a bit of a euphoric tenor just like we had in 1999. Could it be that we have somehow slipped the bonds of COVID-19 to experience a new and wonderful financial nirvana? Or, could it be that we are possibly in the final throes of a speculative bubble that could make 2021 look more like 2000?

We know the markets are giddy about the massive cash stimulus that has truly shattered all past records by a factor of many. The sheer size and scope of the fiscal and monetary policy support point to a much faster and broader economic recovery than many contemplate is even possible. However, beginning with the CARES Act in March, together with the unprecedented actions of the Fed literally flooding markets with liquidity measured in the TRILLIONS, the result should be something of an outsized economic expansion. That is exactly what we expect and what we believe will happen.

It is important to remember that financial markets discount the future. They don’t necessarily rise and fall coincidently but financial markets can act as a harbinger of things to come. It is important to keep one eye on the canary singing in the coal mine and the historic signs of exuberance that we normally see in the final years of a bull market.

To be clear we do not expect 2021 to be a down year.

We do not expect to experience a financial crisis this year. We fully understand that markets can and do overshoot to the upside and to the downside. What we postulate here are that some of the largest drivers of economic expansion that we have ever seen exist, but also there are also developments in the markets that give us pause and take us back to the heady days of 1998.

For our newly minted “Robinhood Millionaires,” please don’t be upset by the analysis in this article. We love the stocks you love, but we have lived long enough to understand that trees in fact do not grow to the sky and the margin clerk is not always your friend. We have no doubt that electric car-producing, social media and tech giants are real businesses and should continue to prosper in the future. We don’t wish to insult companies that support online meetings and virtual exercise classes or tele-doc shareholders, as we fully anticipate these companies to continue to grow long after the pandemic ends. However, there may be a few bumps in the road as they work to grow into their high valuations over the next few years. Every stock, and industry sector, has its season.

In short, 2020 was the year of price/earnings ratio expansion and we think that 2021 will be the year of earnings growth rather than price appreciation. Many of the “stay at home” stocks will attempt to grow into their stock prices with increased earnings that the market anticipated and priced-in last year.

Let’s start by looking at the economic tailwinds that we believe will propel a large and credible economic expansion in 2021. These include:

1. Vaccines – The record development and manufacturing of several vaccines that appear to have effectiveness well over 90% is being taken as a death blow to the pandemic. Successful deployment globally will add several TRILLION dollars of GDP in 2021.

2. Fiscal Support – Congress has been uncharacteristically quick and benevolent to shower both businesses and individuals with direct cash payments that have provided a valuable bridge for Americans that find themselves displaced by COVID-19. Although a bit slow on the recent wave of relief, a Biden promise to be quick with more has expectations elevated.

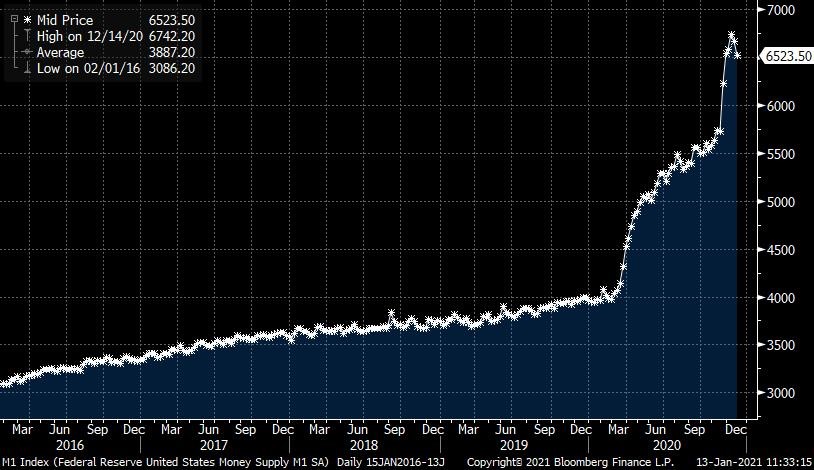

3 .Monetary Policy – The Fed has done a truly “Herculean” heavy lift to institute an almost immediate dose of bond buying that dwarfs their prior efforts in the Global Financial Crises of 2008-2009. They have publicly promised to stay on the sidelines and keep short-term interest rates at zero, as well as continue to purchase bonds using printed dollars. M1 – which is the sum of all available cash in circulation in demand deposit accounts – was up an astounding 66.67% since March 1, 2020! M1 rose from $4 trillion to $6.667 trillion as of the date of this publication (Source Bloomberg). It took 12 years to get M1 from $800 billion in 2008 to $4 trillion in 2020. It took merely nine months to add $2.6 trillion. All of this cash is available to deploy by business and consumers.

M1 Money Supply “Moonshot” – Source Bloomberg

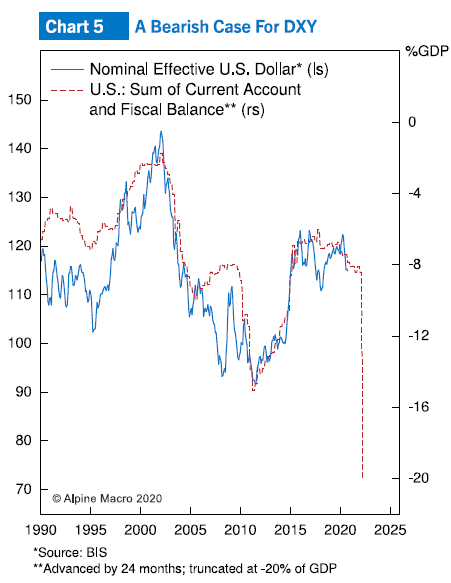

4. Weak Dollar – As a likely consequence of fiscal and monetary easing largess, the U.S. dollar’s value as measured against other global fiat currencies has weakened 13.37% since March. This is significant since it makes U.S. exports more competitive internationally and makes imports more expensive to consumers. The Fed has thrown out its own rule book on inflation and weakening the currency serves to jolt inflation expectations. A little inflation is a great thing; too much of it can be a problem.

5. Healthy U.S. Consumer – At a time when the physical health of Americans is being challenged by a global pandemic, the financial health of consumers is actually very strong. The pandemic scare has caused consumers to paydown and avoid adding debt to balance sheets as well as to spend less and save more. U.S. GDP is made up of almost 70% consumer spending. During the early days of the pandemic, government spending bridged the consumption gap. Now we find a very healthy consumer ready to return to normal life and normal spending.

History might not repeat itself, but it often rhymes. There are some rather large warning signs that a speculative bubble is forming in the financial asset markets. The end of these bubbles can be quite messy. We believe that we are not there yet as the punchbowl remains full. This is the canary we are watching.

1. Momentum Investing Returns Highest Since 2000 – Momentum investing is a method of buying stocks that exhibit upward pressure without concern for the underlying financial prospects of the company. Returns for momentum in 2020 was 42% which is the best since 2000 (Source Bay Crest Partners). What followed that record year? The Dot Com bear market.

2. Speculative Retail Participation in Markets – Charles Schwab reports that a trading gauge for call options doubled in 2020. Bloomberg notes that the 20-day moving average tracking average daily volume eclipsed 22.5 million contracts. This doesn’t include option action at other firms, but they report similar spikes by retail buyers. Generally, when the retail investor shows up to the party closing time is not far away.

3. Margin Lending Hits All Time High – Investopedia reports that investors are borrowing record amounts of money to chase momentum stocks, options, and exchange-traded funds (ETFs). This milestone has a history of marking the tops of markets. This signal successfully preceded the 2000 and 2008 market tops.

Let us be very clear: We do not expect a market crash anytime soon; however, we are saying that the tea leaves are telling us that our welcome in momentum land may be wearing thin. We see a normal broadening out of the go-go growthy stocks to value names which tend to be cyclical and provide significant opportunities in periods of economic growth. These include commodities, materials, financials, transports, industrials and energy. A weak U.S. dollar also energizes emerging markets and international markets. We note that the 2000 Dot Com blowoff in the markets gave way to a multi-year secular bull market in commodities. We suggest dusting off that playbook.

Good luck in 2021!