Written by: Radu Gabudean, Ph.D. | American Century

The U.S. economy has resisted recession despite the Fed's aggressive interest rate hikes. But we're still months away from feeling the full effects of higher rates.

A Long and Variable Lag

Amid their most dramatic rate increases in more than 40 years, Federal Reserve (Fed) governors keep discussing the "long and variable lag" before policy changes take hold. They highlight that the Fed’s interest rate changes take time to work through the economy.

Today's Fed governors have Nobel Prize-winning economist Milton Friedman to thank for coining the phrase "long and variable lag" in a 1961 paper. Friedman's work confidently identified the lag but was less sure about its duration, noting that "the lag between action and effect [could] be four months or 29 months or somewhere in between."

In November 2022, Fed President Raphael Bostic argued that tighter monetary policy could take 18 months to two years or longer to affect inflation materially.

Suppose we assume that the economic impact is spread evenly over 18 months. In that case, we can understand how much of this historic tightening cycle is reflected in the economy and how much is still to come.

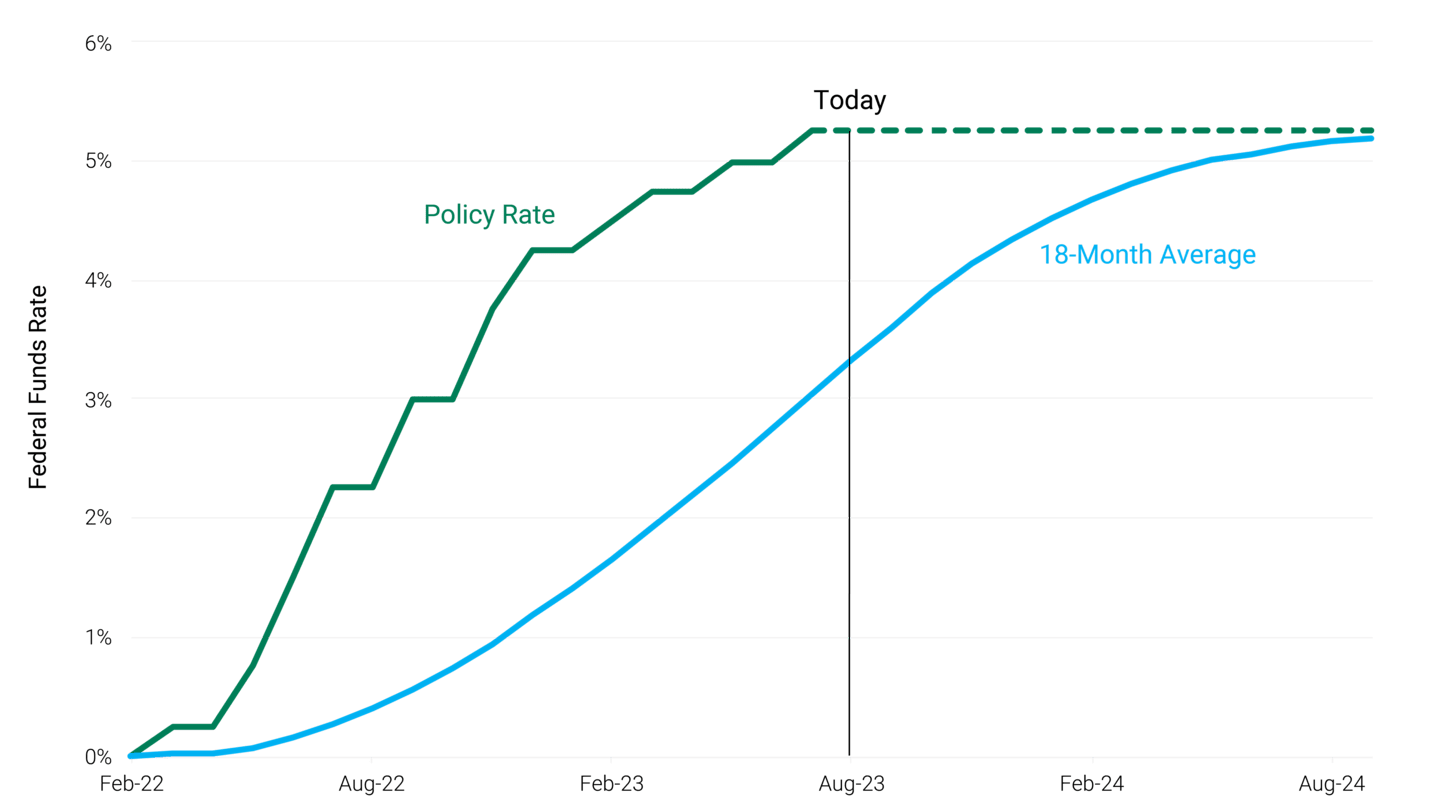

Figure 1 helps tell the story. The green line represents the Fed's policy rate, while the blue line represents the cumulative effect of these hikes to date by spreading the impact of each hike over 18 months. The black bar marks where we are today.

That's assuming no more rate hikes during this cycle. It's also worth pointing out that over the next several months, we will see the fastest increase in the monetary policy impact (the slope in the blue line is at its steepest).

Figure 1 | The Full Effect of Fed Policy Has Yet to Be Felt

Data from 2/28/2022-8/31/2023. Source: Federal Reserve, American Century Investments.

Why is this calculus important? Because it might help explain why the much-anticipated recession hasn't shown up yet. Pundits everywhere offer reasons and explanations for the economy's resilience in the face of the Fed's historic rate hikes. But the reality may be that we haven't yet felt the full effect of the hikes.

Similarly, this would explain why economists surveyed by the Wall Street Journal still see a greater than 50% probability of recession, even as the equity markets seem to have shrugged off the idea.1

Leading Economic Indicators Suggest a Much Weaker Outlook

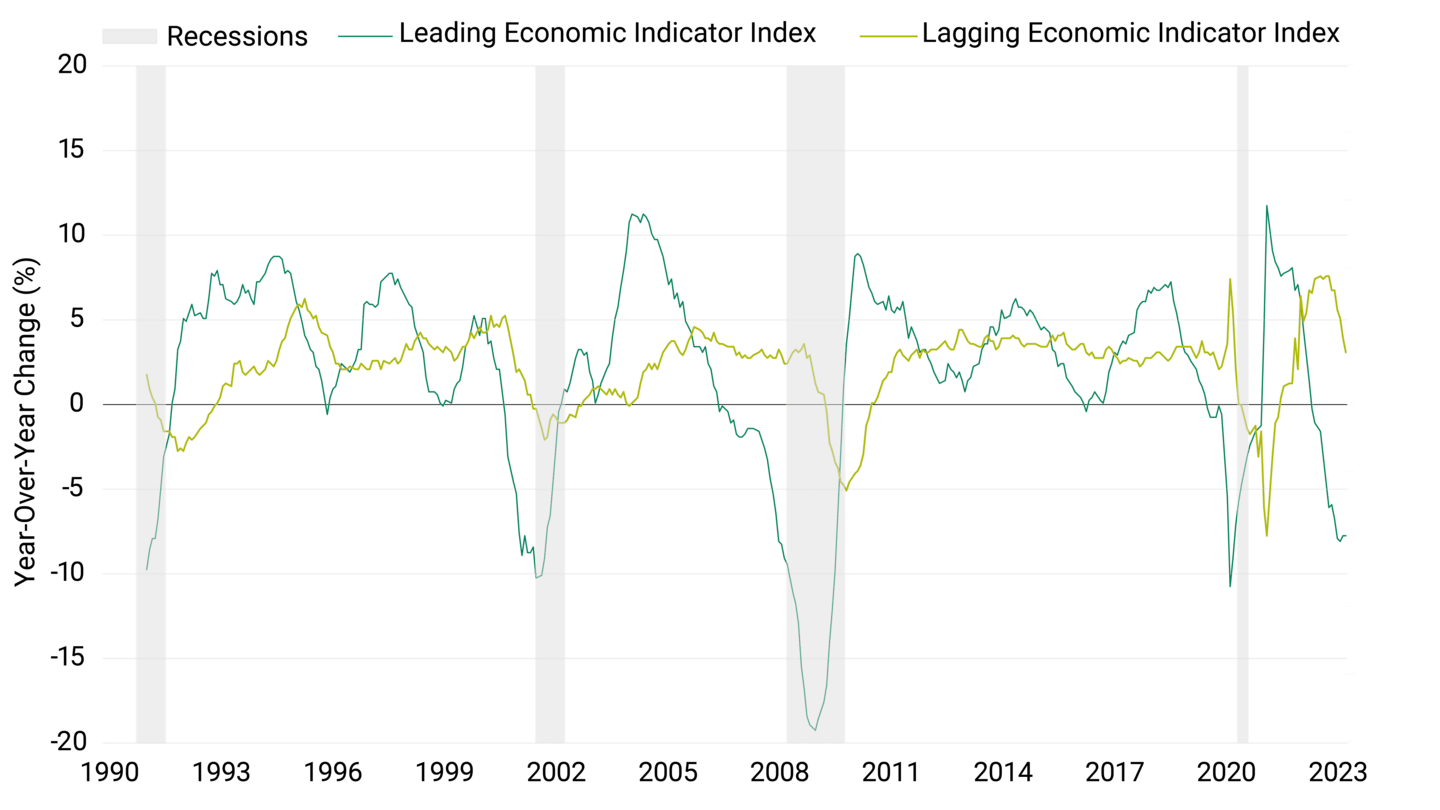

We can find support for thinking that the full effect of Fed rate hikes has yet to hit home by parsing economic data into leading, lagging and coincident indicators. Coincident indicators are measures that change simultaneously with the economy. For example, corporate earnings haven't been as bad as feared, and the job market remains surprisingly resilient. However, those are backward-looking and coincident indicators, respectively.

In contrast, the Conference Board's index of leading economic indicators (LEIs) reflects data correlated with future business conditions. Good examples include new manufacturing orders, building permits for new homes and the slope of the yield curve.

Figure 2 contrasts the LEI with lagging economic indicators (LAGs) through the latest quarter end. The LEIs (dark green line) are touching levels preceding past U.S. recessions (the shaded portion of the graph). LAGs (light green line) have also started to weaken recently but hold to the pattern they are known for — lagging.

Figure 2 | Leading Indicators Signal a Weaker Outlook

Data from 1/30/1970-6/30/2023. Source: FactSet. Conference Board's Leading Economic Indicator Index® (LEI) predicts the direction of global economic movements in future months. Conference Board's Lagging Economic Indicator Index® (LAG) is used to confirm and assess the direction of the economy's movements over recent months.

After considering all the factors, we believe the much-anticipated recession is yet to come as the economy slowly processes the Fed’s significant monetary intervention in the past year.

Related: Inflation Is Coming Down. Will Treasury Yields Be Next?