Written by: Stephen Duench, CFA® | AGF

It wouldn’t be right to say dividend stocks were a losing proposition for investors last year, but they weren’t exactly a boon for them either. In the U.S., for example, the S&P 500 Dividend Aristocrats Index –which tracks companies that have increased their dividend in each of the past 25 years – gained more than 8% in 2023 yet underperformed the S&P 500 Index by 18 percentage points (or more than double what it earned).

And while the S&P/TSX Composite Dividend Index in Canada fared better than its U.S. counterpart, its return of nearly 10% last year was still almost two percentage points lower than the S&P/TSX Composite Index’s gain over the same 12-month period.

So, what’s in store for dividend stocks in 2024? If anything, the next 12 months may end up being a turnaround year of sorts, particularly if central banks begin to cut rates as expected. After all, the reason why dividend-paying equities underperformed last year was largely related to the increase in interest rates over the past few years that resulted in government bond yields that were higher than dividend yields on average and much more attractive than they’ve been in a very long time, relatively speaking.

In fact, after lagging for most of 2023, the S&P/TSX Composite Index now has a trailing dividend yield that is slightly higher than the yield on a Canadian 10-year government bond and could tick even higher if bond yields continue to fall in anticipation of interest rate cuts this year.

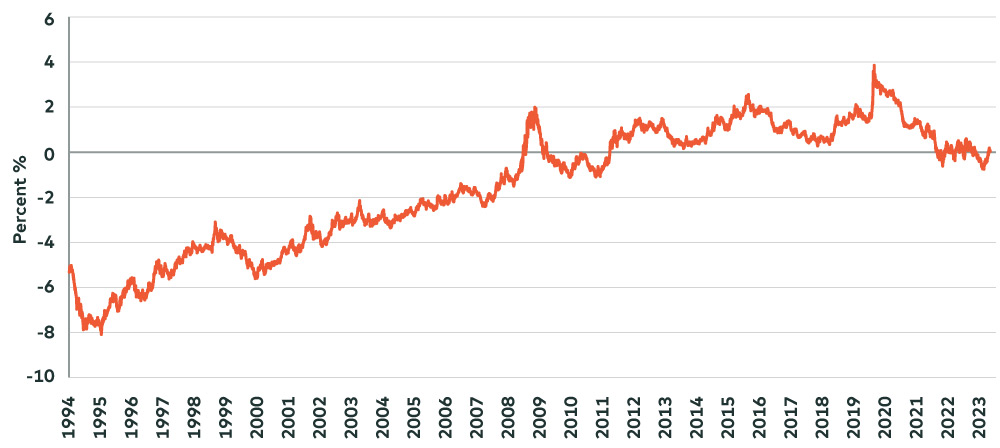

Relative Spread of S&P/TSX Composite Index Trailing Divided Yield Versus Canada 10-Year Government Bond

Source: Bloomberg LP as of January 3, 2024. Relative spread is calculated by subtracting the Canada 10-year government bond yield from the S&P/TSX Composite Index trailing divided yield. Past performance is not indicative of future results. One cannot invest directly in an index.

Of course, higher relative yields could be a catalyst for income-generating stocks in and of itself, but perhaps even more so than normal given how much ownership in them has dwindled in comparison to the broader market.

Again, using Canada as a proxy, Morningstar data shows that Canadian focused equity fund managers are underweight several sectors typically associated with dividends, including banks, pipelines, Communication Services, Real Estate and Utilities. As such, all of these sectors could stand to benefit from more attractive dividend yields going forward, with those that are more defensive in nature (i.e. Utilities) possibly being the most well-positioned for additional inflows.

This is largely because the business models of many “defensives” are inherently more leveraged to interest rates than other stocks, meaning they are more negatively impacted by higher rates and, by turn, more positively impacted by falling rates. Moreover, many of these same names tend to be sought out by investors during recessions, which may end up being the necessary precursor to central banks loosening policy later this year.

That’s not to say dividend stocks are automatically set to outperform the broader equity market this year. But if central banks truly are done raising rates, the next 12 months could end up being an improvement on the 12 months that just passed.

Related: Inflation Bump Surprises the Market, and Inflationary Threats Loom