Written by: Jordan Jackson

The movement in bond yields so far this year has been…perplexing, to say the least. In what will undoubtedly be one of the strongest years in recent history from both a growth and inflation perspective, nominal 10-year yields are lower than they were just eight months ago. Moreover, rates have experienced some big swings recently, even though they have traded within a fairly narrow range over the past couple of months.

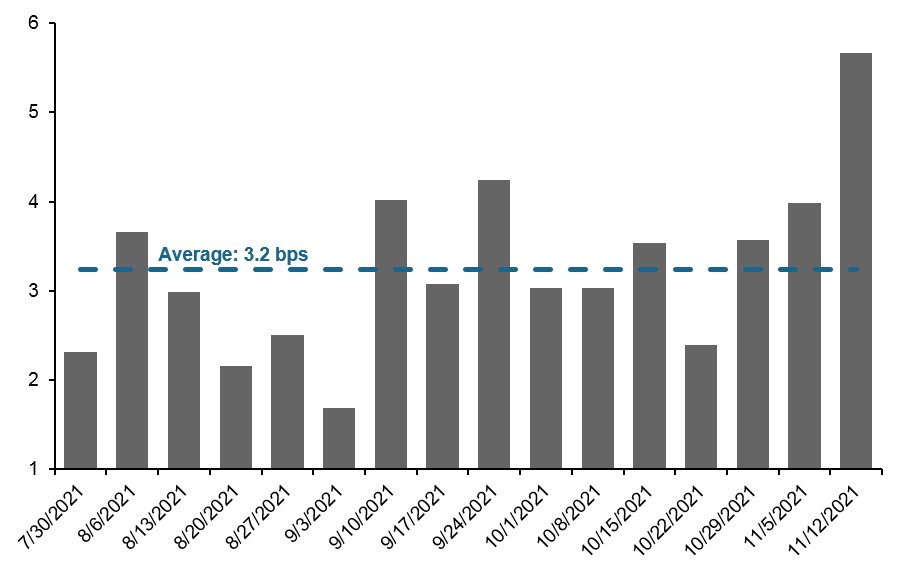

As shown, rate volatility picked up last week; daily changes in nominal 10 year rates – up or down – show on average yields bounced around +/- 6 basis points. For context, on 11/10, rates rocketed 11 basis points higher alone. We suspect volatility has picked up for a few reasons:

- Inflation has rapidly firmed to a three-decade high;

- markets are now pricing in more than two hikes next year from the Fed, an aggressive shift in rate hike expectations;

- Labor markets are showing continued signs of healing, with total nonfarm payroll gains averaging +440K in the past three-months.

These developments suggest nominal rates should be much higher, and while economists, professional forecasters, and policy makers alike expect growth and inflation to continue to run above-trend well into next year, long rates have struggled to break north of 1.70%, a level last seen in late March. As investors, how do we square this circle? While we acknowledge a confluence of technical factors are contributing to range bound rates, markets may be weighing potential economic scenarios in which:

- Fiscal policies have a net inflationary impact over the long-run, but drag on real growth; and/or,

- Inflationary pressures driven by supply chain issues persist while job growth languishes, leading to stagflation.

The continued divergence in real yields and inflation breakevens (real yields falling, inflation breakevens rising), suggest markets view these scenarios as very plausible outcomes. However, in our view, we are likely moving past peak inflation and growth should recover strongly from its third quarter slowdown. Given this, we still expect long nominal rates to gradually move higher in the months ahead driven by real yields realigning with above-trend real economic activity.

Rate volatility has picked up recently

Average daily change (+/-) in nominal 10 year UST yields, weekly, basis points

Source: Federal Reserve, Haver Analytics, J.P. Morgan Asset Management.

Data are as of November 15, 2021.