So I proved 2 things with the above picture: that I can learn to use technology, and that I’m not very good at it. But hopefully you get the point. This week’s letter is about looking beyond the immediate, still very stagnant markets and out a few years. All while invoking the memory of a hit 1960 film, “Where The Boys Are,” which took place a short drive from where Dana and I live, in South Florida. Some of the infrastructure on Fort Lauderdale Beach including the “world famous Elbo Room” bar are still right there where the spring breakers in the movie left them.

While this is not exactly the spring break edition of ETFYourself.com, it is worth noting that investors seem to be on holiday, regularly. There continue to be eerie signs of economic distress, which I try to point out in the links in our Sunday edition. Shortly, we’ll be updating our “MOFO” (Market Outlook Factor Overview) report that ranks the top 10 things I think the markets are focused on. So I’ll leave the opaque macro picture there for now.

The further I get from my former career as a licensed fiduciary investment advisor and into my present and future role as an investment researcher and publisher, the more I get to interact online with so many self-directed investors. This is frankly new to me, since for 27 years I was not in a position to say anything to anyone, given my responsibilities. But now, I have the chance to create research sites like this one, respond to hundreds of comments each month on Seeking Alpha and interact with some fantastic industry peers at etf.com and Forbes.com. And from what I have learned, for many self-directed investors, the most frequently asked question is this:

What should I buy now?

First, to clarify, none of what we do here is intended to be what YOU should do. Investment research and publishing (Rob now), versus investment advisory (Rob from 1993-2020) is about sharing my personal thoughts and opinions about what I am doing and why, and letting our audience of do-it-yourself investors…do it themselves.

We finally got around to adding a tag line to this publication:

Learn to create portfolios, using ETFs, by yourself!

And, while I know “what should I buy now” is what many investors want, I also know I can’t eat pizza and ice cream every day and stick around very long, even if that’s what I want. Sometimes, we have to take a step back and thing of it like an athlete during a long game. You keep playing hard, you pace yourself, and you stay ready, since at any point you might have an opportunity to do some things, have some moments, where you can make moves that help your team win the game.

Investing is like that. As I’ve noted here regularly, there are times to act and times to think about how I’ll act and what will prompt me to act. THAT’s portfolio management. And, while many of our publishing peers “yell” constantly about what to buy (“best picks”), I’ve learned that successful results come from a few things the industry does not spend nearly enough time on:

How much to own, how long to own it, and when and why to replace it

Yup, that’s portfolio management. And I’ve seen too many people invest in a way that ultimately leads them with a “collection of investments” and not a portfolio. That works until it doesn’t, and one realizes that they held 20 different funds but 17 of them zigged and zagged together. When they are all going up, we’re hard pressed to convince ourselves we are not genius investors. Then, the life-changing events happen, and folks have no anchor, no process, no home base to get to during the market storm. THAT’s what we hope to teach here.

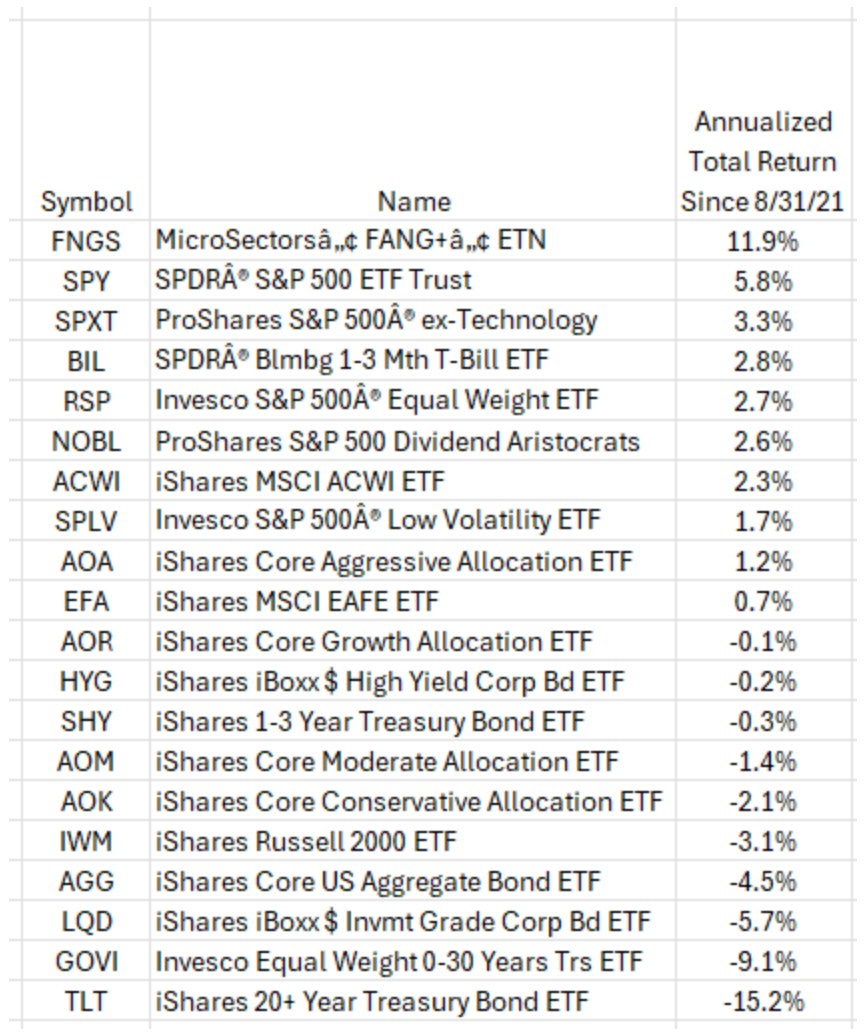

And this is a good time for that. Because for the past 2 1/2 years, much of what people bought has not produced sustained profits. And in several key markets, it has produced historic losses. That’s what this table shows. See below the table for my summary comments.

So if you happened to have all of your assets in “FAANG” stocks for the past 2 1/2 years, congratulations. That’s a great example of what I always talk about here: lots of risk taken, but in this particular case, that risk did not bite investors. Sure, there was a 50% “dip in FNGS” that lasted about 12 months out of the 30 month time range here. But in this snapshot of time, it worked out for those not shaken out along the way.

SPY gained a below-average 5.8% but that was the very best among the diversified equity and fixed income ETFs represented here. For the most part, I see negative numbers and positive numbers that have now fallen behind the resurgent asset class: T-bills

This is the past, but I do think it leads to 2 important conclusions:

-

Sometimes the best investment decision is to keep a lot of dry powder, rather than force things. The ROAR Score, which remains at 10 this week, has averaged in the 20-25 range over the part of this period that overlaps with the ROAR Score’s debut on 1/1/2022. For the several subscribers that have asked if we plan to back test the ROAR methodology to provide some historical context beyond the past 2 years, the answer is YES and soon.

-

Markets are at a crossroads, the likes of which we have not seen in about 15 years. Are we in the first 2 1/2 years of a much longer period of weak returns? Are inflation and higher rates a new dynamic that won’t go away as quickly as we would like? Or, is this period of stagnation in returns across many asset classes the ideal setup for a great 5-10 year run in many market areas.

I think these questions will be much clearer as 2024 rolls on. For now, I observe that the excitement about investing, trading and speculating is palpable. “Everyone’s doing it.” But like the kids in that movie referenced above, what is currently popular is not for everyone. It is OK to earn less than your neighbors and friends in frenzied markets if your goal is to pursue consistency and minimize worst-case scenarios.