NVIDIA reported financial results for the fourth quarter and full-year 2023 this week, and I’m still picking my jaw off the floor. The chipmaker handily beat Wall Street expectations, with annual profits increasing a staggering 769% on mounting enthusiasm surrounding artificial intelligence (AI).

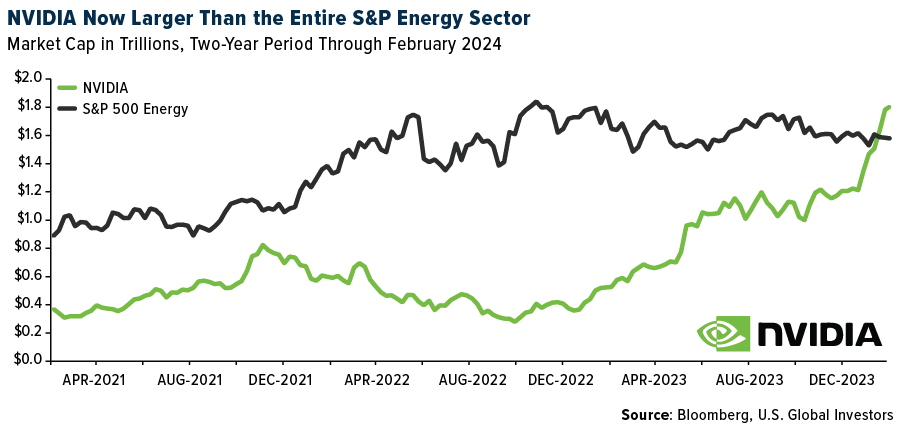

Already the world’s fourth-largest company by market capitalization ahead of Amazon, Alphabet and Meta, NVIDIA set another new record on Thursday when its market cap surged $277 billion, marking the biggest one-day increase for a single name in history, according to Bloomberg. It’s now valued at $2 trillion, which I was surprised to learn is greater than the combined market caps of all S&P 500 energy stocks.

Sparked in November 2022 with the launch of ChatGPT, the AI boom has supercharged demand for the kinds of advanced chips that NVIDIA produces, making the company a go-to “pick and shovel” play.

It’s a role the company should be accustomed to. For years, NVIDIA was known primarily as a gaming stock, having invented the graphics processing unit, or GPU, in 1999. The GPU introduced sophisticated, three-dimensional graphics to the home video game market, but today, that same technology is helping to power not just AI but digitization as a whole.

A $7 Trillion Plan To Secure Chip Supply

Jensen Huang, NVIDIA’s cofounder and longtime CEO, believes we’re witnessing the start of a whole new industry with AI, and particularly generative AI. Indeed, an increasing number of tech firms are rolling out their own generative AI platforms to remain competitive, with varying degrees of success. (This week, Google paused its Gemini AI image generator in response to complaints that it was too woke.)

With everyone tripping over their shoelaces to catch the AI train, demand for semiconductors and chips could very well outpace supply. The 2020-2023 global chip shortage—fueled primarily by pandemic-related supply chain issues—has largely evaporated, but it’s easy to imagine never-ending cycles of undersupply going forward if investment doesn’t keep pace with the technology.

Fortunately, the outlook for this year points to what the World Semiconductor Trade Statistics (WSTS) calls a “vigorous upswing,” with expectations of a 13% increase over 2023 in total industry market valuation. All major markets are forecast to expand this year, with the Americas growing the most at 22%.

![]()

Full disclosure, the WSTS made this forecast in November 2023, and since then, I believe conditions (and investor enthusiasm) have only improved and will continue to improve, starting with a more favorable monetary environment. In addition, earlier this month, the Biden administration announced a $5 billion investment in semiconductor R&D as part of the CHIPS Act, signed in August 2022.

If $5 billion is a lot, how does $7 trillion sound? That’s the dollar amount Sam Altman seems to have settled on to significantly increase global chip production and boost AI. The chief executive of OpenAI, maker of ChatGPT, has been on a fundraising tour as of late, trying to raise capital for a “wildly ambitious tech initiative,” according to the Wall Street Journal. Although it’s unclear how the unfathomable sum of $7 trillion would be deployed exactly, the United Arab Emirates (UAE) has reportedly signed on to Altman’s idea, announcing that it will spend heavily to become a global hub and testing ground for AI technology and regulation.

How Bitcoin ETFs Have Fared One Month Later

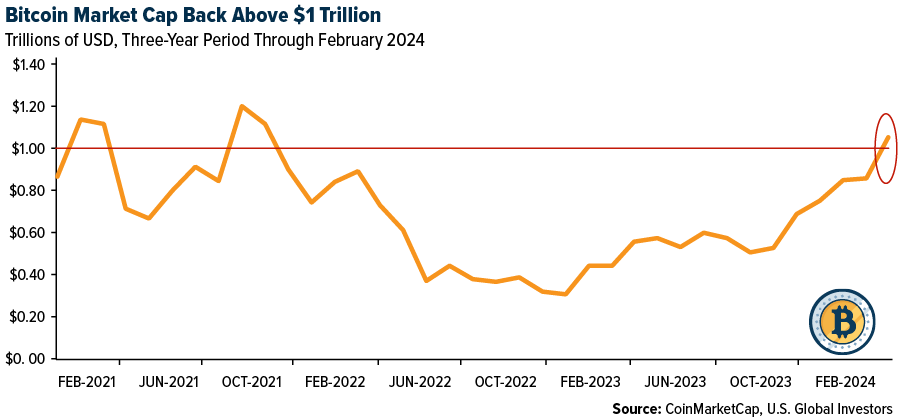

A discussion on the great digital transformation would be incomplete without mentioning Bitcoin (BTC). One month after the Securities and Exchange Commission (SEC) simultaneously approved a number of spot Bitcoin ETFs, the world’s number one digital asset is back above a $1 trillion market cap for the first time since December 2021.

According to one source, nine Bitcoin ETFs collectively accumulated over 250,000 BTC in less than a quarter, the equivalent of $12.8 billion based on today’s prices. And that’s not counting other major, institutional investors like Tether and MicroStrategy, the enterprise software firm that’s recently rebranded as the world’s first Bitcoin development company.

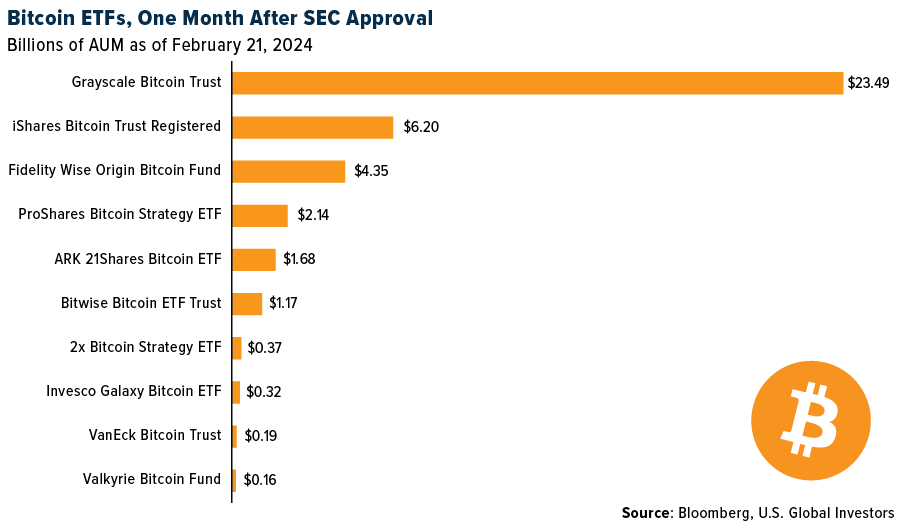

Below, you can see where the ETFs stand in terms of AUM. In the first month, investors poured an estimated $125 million into these products every day, according to CoinDesk. Grayscale leads the others with over $23 billion invested, but it’s also seen the heaviest outflows since the firm got the go-ahead to convert its Bitcoin trust into an ETF a month ago.

Just as AI has sparked insatiable demand for advanced chips, U.S.-based Bitcoin ETFs have helped goose investment in the underlying asset.

And like chips, BTC could at some point face a serious shortage. According to Michael Saylor, cofounder and executive chairman of MicroStrategy, demand for Bitcoin ETFs is 10 times the supply. I don’t know where this figure comes from, but I have no reason to question it.

Also affecting supply is the upcoming Bitcoin halving. The next halving is expected to take place in April, after which the reward for mining Bitcoin will fall from 6.25 BTC to 3.125 BTC. Currently, about 900 BTC are mined per day; this will drop to around 450. That means there will be even fewer BTC on the market for investors to bid on.

Plan accordingly.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 1.30%. The S&P 500 Stock Index rose 1.66%, while the Nasdaq Composite climbed 1.40%. The Russell 2000 small capitalization index lost 0.79% this week.

- The Hang Seng Composite gained 2.53% this week; while Taiwan was up 1.52% and the KOSPI rose 0.72%.

- The 10-year Treasury bond yield fell 3 basis points to 4.249%.

Airlines And Shipping

Strengths

- The best performing airline stock for the week was United, up 8.3%. According to Bank of America, Chinese New Year air traffic was 18% above 2019 levels, ahead of original CAAC expectations at positive 10%, while domestic ticket prices at positive 13% above 2019 levels was broadly in-line with expectations. International continues to lag, in terms of traffic (76% of normal) and pricing (at or below 2019 levels) given overcapacity in short haul.

- According to JPMorgan, sea freight rates have increased sharply in recent weeks, with SCFI increasing 150%, to around half the COVID peak. Freight rates quoted from Maersk have also risen sharply, though with some signs of peaking and decline, particularly in Asia-Europe. The bank’s current assessment is that SCFI quite accurately reflects Maersk quote levels.

- According to ISI, passenger throughput was up 5% year-over-year on flat year-over-year capacity. The group continues to flag favorable supply/demand trends and firming estimated load factors since late January. Business demand continues to gradually recover. International remains at an all-time high of 92.5, led by trans-Atlantic.

Weaknesses

- The worst performing airline stock for the week was Frontier, down 11.2%. According to Reportur.com, Mexican congressman, Juan Carrillo, presented an initiative to the Airports Law where airlines are forced to refund the amount corresponding to the Airport Use Fee (TUA) to users who do not board a previously purchased flight. This initiative would reform article 69 of the Airports Law, specifying that the concessionaires and permittees of the air transport service must return the full amount of the TUA to passengers who have not boarded. Lastly, the document states that the refund should not exceed 30 calendar days from the date of the flight in question.

- Following two weeks of improvement, the Evercore ISI Air Cargo Cos. Survey moderated from 51.5 to 50.2, as domestic activity moved down, while international activity was unchanged. International volumes slowed in the first half of 2023 before moving higher throughout much of the second half of last year. 2024 started slowly, before rising in the first two weeks of February and was unchanged at 51.3 this week.

- According to JPMorgan, for Qantas, the bank has indicated a few key negatives facing the company. These include industry costs expected to remain elevated over the second half of 2024 and customer investment costs of A$230M are to be spent in fiscal year 2024. In addition, freight results are softer on weaker international freight earnings.

Opportunities

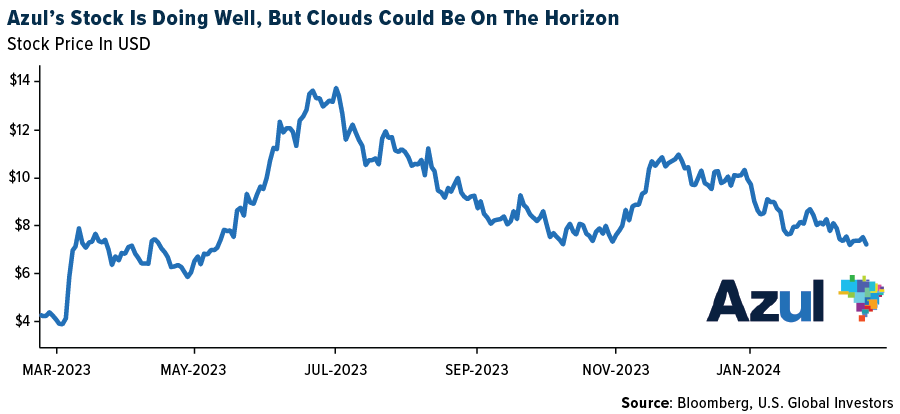

- According to AeroIn, Andorinha Aviation shared a preliminary route map that is similar to Azul’s route map from 2020. Moreover, the company is currently working on certification with ANAC to start operations at the end of this year or in 2025, with the goal of hiring 1,000 employees in 2024. Additional details of how the operation will be carried out were not informed by the company, but it stated that “not all cities in Brazil are supplied by an adequate air network.” Furthermore, CEO Higor Paulino reaffirmed that, despite all previous and current projections showing an Airbus A320, the company will have Embraer E2 and Boeing 737-700 jets, as was previously reported.

- The Evercore ISI Shipping Cos. Survey rose 10 points from 69.8 to 79.8 on better tanker and bulk activity. Recently, tanker rates had moderated, although rates overall remain strong for tankers and LNG ships. Customers appear cautious given slow growth globally, but the strength in product tankers is a positive for the chemical market as well.

- According to Morgan Stanley, citizen departures to international regions have turned out to be better than expected in January 2024, coming in up 8% year-over-year and up 17% versus 2019. Further, while the number of non-U.S. citizen international arrivals into the United States remains below 2019 levels, January 2024 is starting to close the gap and came in up 18% year-over-year and down 10% versus 2019 levels.

Threats

- Delta Air Lines cut domestic capacity by 26.4% and 32.8% in June and July, respectively. The reductions pressured system capacity lower by 16.5%/20.7% in June/July, with all other regions unchanged this week. While schedules remain fluid and summer capacity plans are not yet finalized, Delta’s second quarter 2024 capacity growth is now tracking toward positive 1.8%.

- Stifel expects the Suez situation to carry on for at least a few more weeks. Spot ocean freight rates have peaked but remain elevated some 200% above pre-pandemic levels. Ocean freight volumes from Asia into the U.S. remain strong while Europe still struggles.

- According to Bank of America, Singapore Air warned of building challenges ahead with year-over-year declines in passenger yields given ramping competition. Third quarter ex-fuel unit costs disappointed given higher ground and food unit pricing, maintenance timing, restoration of the pre-COVID passenger offering (more food, hot towels, etc.) and FX. The company warned that this higher third quarter ex-fuel unit cost base would persist with upside risk from ground handling contracts being renegotiated.

Luxury Goods And International Markets

Strengths

- Toll Brothers reported first-quarter earnings per share (EPS) and revenue that beat expectations. The company also raised its delivery forecast for the year, indicating strong demand. First-quarter EPS came in at $2.25 compared to the expected $1.78. Quarterly revenue was posted at $1.95 billion, surpassing the estimate of $1.87 billion.

- This week China cut its five-year prime loan rate by more than expected. A cut of 15 basis points was expected while the actual cut was announced at 25 basis points. The one-year prime loan rate was left unchanged.

- Sleep Number Corporation was the best performing S&P Global Luxury stock, gaining 28.4% in the past five days. Shares gained more than 33.0% on Friday after the company announced quarterly results, reporting sales that beat the average analyst estimate.

Weaknesses

- Electric car makers Rivian Automotive and Lucid Group both reported weaker-than-expected earnings per share this week. Rivian reported a loss of $1.58 per share while Lucid reported a loss of 29 cents per share.

- Europe’s largest economy, Germany, lowered its growth targets for 2024 citing weak global demand, geopolitical tensions, and inflation as major headwinds. This comes after the economy contracted in 2023, highlighting continued economic struggles.

- Rivian Automotive was the worst performing S&P Global Luxury stock, losing 38.2% in the past five days. The company’s shares declined more than 25% on Thursday and continued to sink on Friday after it posted quarterly results, announced a disappointing production forecast, as well as another round of job cuts.

Opportunities

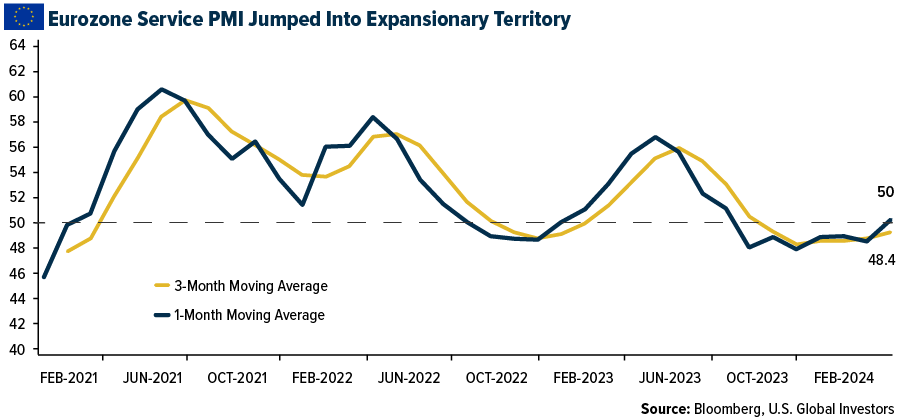

- The Eurozone’s Service PMI unexpectedly jumped into expansionary territory. Bloomberg economists were expecting the index to increase from 48.4 to 48.8, but it was reported at the 50 mark. The one-month figure is now above the three-month moving average, indicating further upside potential. A strong service sector will fuel consumer discretionary spending.

- LVMH will produce movies and TV shows to promote the group’s 75 brands. The venture, named 22 Montaigne Entertainment after the address of the group’s Paris headquarters, will be managed by Antoine Arnault, the eldest son of LVMH’s billionaire founder Bernard Arnault, along with Anish Melwani, the chair of LVMH North America.

- The global market share by value of lab-grown diamonds increased from 3.5% in 2018 to 18.5% in 2023. New York-based industry analyst Paul Ziminsky believes it will likely exceed 20% this year. Machine-made diamonds were first developed in the early 1950s, but with technical advances, the process is now easier and rapidly growing. Indian lab diamond makers recorded a 42% increase in exports between April and October of 2023, while natural diamond companies in India reported a more than 25% drop over the same period.

Threats

- Bank of America strategists raised the European mining sector to Overweight and lowered the luxury sector to Marketweight. “After the recent outperformance, luxury goods is no longer overpricing global growth risks, leading us to lower the sector to market weight,” the firm explained.

- China banned major institutional investors from selling equity holdings during the opening and closing hours of trading. This new regulation was introduced under the newly appointed Chairman of the China Securities Regulatory Commission (CSRC), Wu Qing, reflecting a significant tightening of control over market activities.

- The European Central Bank (ECB) released its one- and three-year inflation projections this week, increasing the one-year CPI expectation to 3.3% from 3.2% and leaving the three-year projection unchanged at 2.5%. Inflation might prove to be more stubborn than projected, potentially taking longer to bring down to the ECB’s target of 2%.

Energy And Natural Resources

Strengths

- The best performing commodity for the week was nickel, rising 6.54%. Aluminum and nickel surged on speculation that a fresh wave of U.S. sanctions against Russia may target the metal and potentially disrupt supplies. U.S. President Joe Biden said the U.S. plans to unveil a “major” sanctions package against Moscow on Friday, although he was not specific about which industries would be affected. Traders have been on the lookout for new restrictions on Russian metals, which had escaped broad sanctions until the UK announced its own curbs in December.

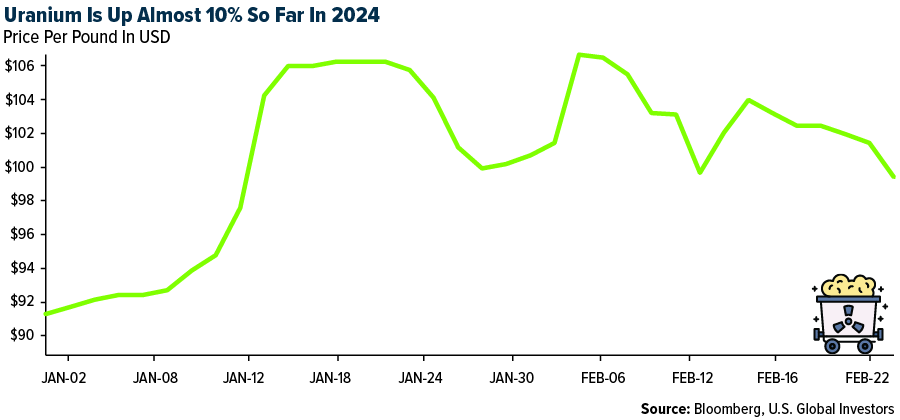

- Limited global supplies and a resurgence of atomic power spiked uranium prices, which traded near the highest since 2007, but have settled back to find support. The lift in prices should boost the price level for new purchase contracts in the future. Despite concerns over the safety of nuclear power, the combination of higher energy costs and an urgent push for a reliable zero-emissions power source is prompting nations including Japan, China, South Korea, France, and the UK to revive or expand their fleets.

- Copper gained for a third day to trade near the highest intraday level in three weeks as fresh support for Chinese markets aided sentiment, with market watchers predicting that the metal faces a global deficit. Futures rallied almost 4% last week amid expectations that Chinese demand would pick up after the Lunar New Year break, with additional stimulus possible at next month’s annual parliamentary meeting.

Weaknesses

- The worst performing commodity for the week was uranium, as proxied by the Sprott Physical Uranium Trust, dropping 12.38% after nearly eclipsing the last 17-year high in prices set in 2007. According to BMO, the decline in spot HRC prices accelerated over the past two weeks, with prices dropping 15% to $900 per ton. The recent decline is primarily attributed to limited spot activity as buyers have largely remained on the sidelines on expectations prices will decline further.

- BHP Group Ltd.’s first-half net income slumped 86% from the year before, after oversupply in the nickel market forced the world’s biggest miner to write down the value of key assets. The company announced last week it would take a $2.5 billion impairment on the value of its Australian nickel assets, which could be mothballed later this year following a review. Global supplies of the metal — which has become key to the energy transition due to its use in electrification and batteries — ballooned after Indonesia quickly ramped up production, causing benchmark prices to crater and the closure of at least six nickel projects in Australia in the past year.

- Iron ore slumped to a three-month low despite extra support for China’s housing market as investors fretted that steel demand would not stage a strong recovery after the Lunar New Year break. Futures sank more than 5% in Singapore to hit the lowest intraday price since early November, following a drop in the week’s opening session.

Opportunities

- According to Bank of America, as to copper, BHP highlights that copper “ended calendar 2023 on the front foot, with the inflation–interest rate nexus having tilted in a pro–growth, pro–risk direction, and supply challenges coming to the fore once again.” Looking into 2024, BHP outlines that, “We now see refined copper in deficit and a very tight situation in copper concentrate.”

- Fertilizer prices have come off their record highs of 2022 but are still elevated on a historical basis. That is helping prop up food inflation as farmers pay more to keep crops healthy. Crop nutrient companies Mosaic Co. and Nutrien Ltd. reported earnings on Wednesday and providing investors with fresh details on the outlook for 2024 which included a forecast of tight supplies and strong farmer demand that will likely spur a rebound in profitability this year. Shares of both companies are trading near multiyear lows and surged on the updated outlook. CF Industries Holdings Inc., the world’s biggest producer of nitrogen fertilizer used for corn and other crops, last week posted sharply lower quarterly profit and sales amid the tumble in prices.

- China’s coal boom is slowing as top mining regions limit growth and steer investment to the clean energy that will replace the dirtiest fossil fuel. Seven straight years of rising output, including a 10% surge in 2022 after nationwide power outages crippled the industry, have produced a glut of coal. That has kept prices low. But record production, which reached 4.7 billion tons in 2023, has incurred other costs, from increased fatalities among miners to poor financial performance at mining companies.

Threats

- Nickel miners remain under pressure, as recent statements from BHP and South 32 highlight. Both companies also note that the challenging operational backdrop will likely persist. Looking at the tonnages involved, given the magnitude of oversupply form Indonesia, through investment by China, the nickel industries in New Caledonia, Australia and Canada could all disappear and that would restore some normalcy on the market, if Indonesia/ China do not cut supply.

- Oil slipped from near the highest level in over three months as prices cooled from the high end of the band they have been trading in all year. Brent traded near $83 a barrel after three days of gains, while U.S. crude also retreated. Tensions in the Red Sea continue to simmer, but there have been few clearcut supply-and-demand catalysts, leaving crude futures trapped in a tight $10 range since the start of the year.

- China’s supply of tin — used in everything from packaging to circuit boards — has been dealt another blow after a key mining region in neighboring Myanmar raised export taxes, reports Bloomberg. Wa state, an autonomous area in Myanmar controlled by an armed ethnic group, has placed a tax in kind of 30% on all tin concentrate exports from Feb. 7, according to a notice from its economic planning committee viewed by Bloomberg. Previously, only better-quality concentrate was subject to the tax, while poorer grades were charged less onerous cash duties, researcher Mysteel Global said.

Bitcoin And Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was SingularityNET, rising 114.48%.

- Fairshake, the crypto super political action committee that’s raked in millions in recent months, raised $4.9 million from billionaire twins Cameron Winklevoss and Tyler Winklevoss, according to its latest federal fillings, writes Bloomberg.

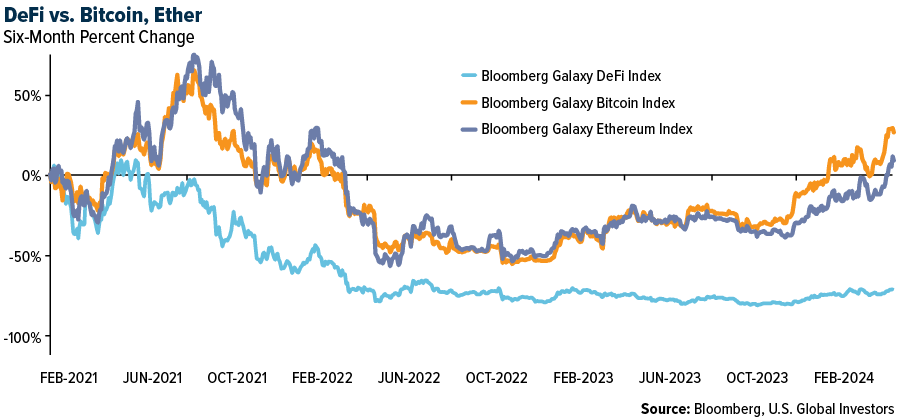

- The Bloomberg Galaxy DeFi Index of digital coins involved in decentralized finance rose 8.8% this week.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Helium, down 16.86%.

- The operator of the $28 billion USDC stablecoin, axed support for the Tron blockchain created by crypto entrepreneur Justin Sun. The decision arose from a “risk management framework” that continually assesses the suitability of all blockchains for the stablecoin, writes Bloomberg.

- Bitcoin is still a pernicious phenomenon with no intrinsic value despite its U.S. approval as an asset for inclusion in ETFs, two European Central Bank staff members wrote. The blog post on Thursday by Ulrich Bindseil, the Frankfurt institution’s market infrastructure and payments director general reiterated the group’s long-held view that the digital currency presents risk to both society and the environment, writes Bloomberg.

Opportunities

- Trading volumes of VanEck’s HODL ETF surged over 2,200% on Tuesday in a move driven by individual traders. HODL traded over $400 million in volumes on Tuesday, a 22-fold jump over its daily average of $17 million, writes Bloomberg.

- Japan inched closer to allowing venture capital firms and other investment funds to hold digital assets directly, after Prime Minister Fumio Kishida’s administration agreed to submit a revised bill to implement the change, writes Bloomberg.

- Korea Digital Asset (KODA), the largest institutional crypto custody service in South Korea, announced Thursday that the value of crypto assets under its custody expanded by nearly 248% in the second half of 2023, writes Bloomberg.

Threats

- High Court ruled to extradite former crypto mogul Do Kwon to the U.S. Kwon, 32, was arrested nearly a year ago in Montenegro on an international arrest warrant in connection with a $40 billion crash of Terraform Labs’ cryptocurrency. “Do Kwon’s extradition to the U.S. has been approved, whereas the request by South Korea was rejected,” High Court spokeswoman Marija Rakovic said by phone, and as reported by Bloomberg.

- Nigeria ordered telecommunications companies and other internet service providers in the West African nation to block access to cryptocurrency trading platforms, a presidential spokesman confirmed, Bloomberg reports.

- The crypto industry is ramping up attacks on anti-crime legislation from Senator Elizabeth Warren, arguing that its passage would effectively kill the sector in the U.S. “This bill, if passed, will erase hundreds of billions of dollars in value for U.S. startups and decimate the savings of countless Americans invested in this asset class legally,” said Perianne Boring the founder of the Chamber of Digital Commerce trade group.

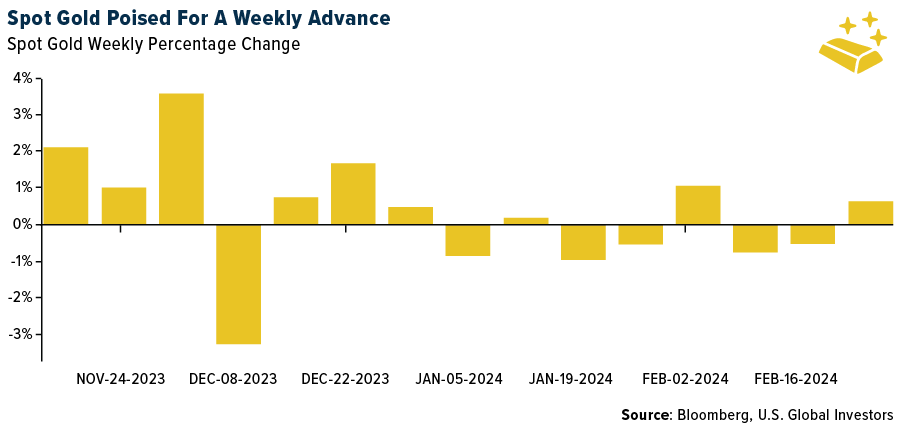

Gold Market

This week gold futures closed at $2,046.30, up $22.20 per ounce, or 1.10%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 1.12%. The S&P/TSX Venture Index came in off 1.55%. The U.S. Trade-Weighted Dollar fell 0.31%.

Strengths

- The best performing precious metal for the week was palladium, up 2.68%, perhaps on speculation of mine production falling with the recent spate of layoffs. According to Scotia, Alamos Gold reported its 2023 year-end Reserve and Resource update, which included a 2% increase in reserves compared with year-end 2022 after depletion. Alamos indicated slightly higher grades for 2023 reserves (+1% overall) compared with 2022 due to higher-grade additions at Island Gold and Puerto del Aire (PDA), and growth at Lynn Lake.

- According to Bloomberg, gold is trading at perhaps the largest premium to modelled values on record. Rather than suggesting that a sharp decline is in store for the metal, it is perhaps worth considering whether the demand function has changed, with regime change affecting the data. They favor a simple regression-based gold valuation model, with the Bloomberg Dollar Index, U.S. 10-year real rates and ETF bullion holdings as the independent variables. It has remarkable success in forecasting the price direction — yet now, based on data since 2007, it shows gold is more than $400/oz too expensive. And what is more, it has been at a premium consistently since the end of 2022. The lift in central bank buying is likely one driver that has changed the market dynamics.

- Gold shipments from Europe’s key refining hub soared to 207 tons in January from 107.9 tons in December as sales to China and Hong Kong increased, according to data on the website of the Swiss Federal Customs Administration. Shipments to India rose 73% to 14 tons, and sales to China more than doubled to 77.8 tons.

Weaknesses

- The worst performing precious metal for the week was silver, down 2.18%. After a strong showing in the prior week, the metal fell in price for the first four days of the week, only to get a bounce on Friday with the strongest move of gold. According to JP Morgan, since a local peak in April 2022, total gold ETF holdings have decreased by around 24 million ounces, a 22% drop. Moreover, in COMEX futures, money managers are currently only 34,000 contracts net long, less than 15% of the peak net length in 2019 and 2020

- According to Scotia, SSR Mining has reported that the Turkish Ministry of Environment, Urbanization and Climate Change has cancelled the Çöpler mine’s environmental permits because of leach pad material sliding towards the nearby Sabırlı creek, one of two non-permanent creeks in the area that drain into the Euphrates River. All operations at the site remain suspended as search and rescue efforts continue for the 9 missing employees. Separately, SSR reported that eight Çöpler mine employees have been detained as part of an investigation by local authorities.

- Burkina Faso’s junta has suspended export permits for gold and other minerals from small-scale and semi- mechanized miners after a drop in output in recent years. The suspension follows a need to clean up the sector and to better organize the “marketing of gold and precious minerals,” Energy and Mining Minister Yacouba Zabre Gouba said in a statement on Wednesday.

Opportunities

- According to JP Morgan, gold has remained more resilient than expected over the recent Federal Reserve repricing, prompting them to mark their 1H24 forecasts modestly higher. They maintain their bullish forecast with an upside target of $2,300/oz as the onset of a Fed cutting cycle is expected to open asymmetric upside convexity in gold prices as U.S. real yields fall over 2024 and 2025.

- Newmont, the world’s top gold producer, will seek to sell six mines and two projects in a set of divestitures aimed at generating $2 billion in cash. The Denver-based company said Thursday it intends to divest three Canadian gold mines — Éléonore, Musselwhite and Porcupine — along with Cripple Creek & Victor in the U.S., Akyem in Ghana, and Australia’s Telfer mine. It also plans to sell two “non- core” projects, Havieron in Australia, and Coffee Gold in Canada.

- RBC expects a relatively neutral reaction from shares of Dundee Precious Metals following the announced superior bid received by Osino Resources, which comes two months after DPM’s original acquisition offer. The new all-cash bid of C$368M via a foreign-based mining company represents a 32% premium to DPM’s original offer and DPM has provided notice that it will not be exercising its right to match during the five-day match period.

Threats

- Anglo Platinum looks to lay off staff at its operations. Meanwhile, the market for platinum-group metals also remains under pressure (these are predominantly used in cars with a combustion engine), with Anglo Platinum noting that the company “responded rapidly throughout 2023 to reposition the business to address both the global and local challenges that currently face the PGM industry. However, that the extensive range of actions we have already taken do not go far enough.”

- SSR Mining rescue efforts to reach to nine workers trapped under the soil have been stopped in a gold mine incident in eastern Turkey on concerns of a new landslides, state-run Anadolu Agency reported, citing Interior Minister Ali Yerlikaya.

- For 2024, Wheaton Precious Metals is guiding to production volumes of 550,000-620,000 gold equivalent ounces (GEOs). At constant metal prices, the range implies production volumes that will be -6 to +6% versus 2023 production volumes. (Consensus is 720,000 ounces). They are citing the suspension of operations at Minto and the temporary halting of production at Aljustrel as a driver, as well as lower production from Salobo.

Related: Increasing Economies Propel Growth in Worldwide Shipping and Trade