Written by: Meera Pandit

We cannot predict what theme will dominate the markets in 2024, but we can control how we react to positive and negative surprises by having a measured approach to portfolios.

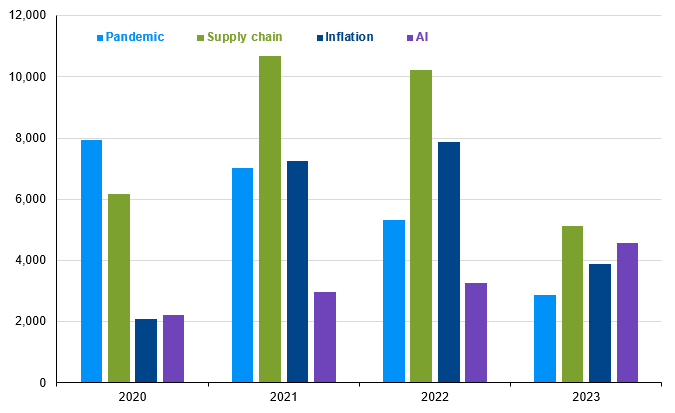

As 2023 comes to a close, newspapers, magazines, and social media outlets are littered with “Best of” lists and “Year in Review” pieces on social, cultural, political, and world events. Each year, there is also often a defining theme that dominates markets. In 2020, it was the pandemic. In 2021 supply chain issues plagued companies and consumers. By 2022, inflation hit a fever pitch. In 2023, markets were abuzz with enthusiasm about artificial intelligence (AI). Some of these market and economic drivers are positive, others are negative, but one thing is consistent: they usually fade and give way to the next big thing, reminding investors not to allow distractions to derail them from their investment plans.

The pandemic shocked the global economy in 2020, catapulting the unemployment rate to 14.7% in the U.S., as 22 million jobs were lost in two months. Equity markets fell 34% in less than a month. Real GDP contracted 28% q/q saar in 2Q20. However, the economy rebounded sharply, and markets swiftly recovered, reaching a new all-time high by the end of that summer. The unemployment rate now sits at 3.7% and real GDP growth has been above trend for five consecutive quarters.

Unfortunately, some aspects of the pandemic lingered, notably supply chain issues given strong demand for goods and constrained logistics capacity. The New York Fed began producing a supply chain pressure index, which showed a reacceleration in supply chain issues to all-time highs in 2021 after an initial brief spike during 2020 lockdowns. Pressures then declined substantially throughout 2022 and have now returned to pre-pandemic levels.

After barely being able to reach the Fed’s 2% target consistently since the financial crisis, inflation returned with a vengeance. Headline CPI rose from 1.4% y/y in January 2021 to 7.0% y/y by December, forcing the Fed to hike rapidly and steeply in 2022. Headline CPI peaked in June 2022 at 9.1%, but there were fears it would remain sticky and possibly reaccelerate. Markets were somewhat more sanguine in 2023 as inflation fell to 3.1% due to stabilizing supply chains, normalizing commodity prices (gas prices fell throughout 4Q23 to $3.12), and less demand for core goods, which have been deflating for the past six months.

Finally, the launch of advanced large language models (LLMs) in late 2022 powered an AI frenzy in 2023. Mentions of “AI” in company earnings calls grew 40% y/y, which doesn’t include the yet-to-be-reported 4Q23. Companies invested in productivity-enhancing, labor-saving AI tools, supporting capex and economic growth.

We cannot predict what theme will dominate the markets in 2024 (although “election” is a strong contender), but we can control how we react to positive and negative surprises by having a measured approach to portfolios.

Key themes in the market by year

Number of mentions in earnings call transcripts of Russell 3000 companies

Related: Will Surging Deficits Contribute To Higher Interest Rates in 2024?

Source: Russell, J.P. Morgan Asset Management. 2023 is through 3Q earnings season. Data are as of December 19, 2023.