Written by: Jordan Jackson

President Biden’s announcement on a set of changes to student loan repayment has generated several questions from clients. The most common boil down to: How will student debt relief impact consumers? Will the deficit impact lead to a further rise in inflationary pressures? And, is it likely to be passed?

First, the details:

- Cancel up to 10,000 USD of debt for federal student loan holders (up to 20,000 USD for Pell Grant recipients). Only households earning less than 250,000 USD per year (or 125,000 USD for an individual) will be eligible.

- Changes to the income driven repayment plan (IDR), most notably lowering the amount paid per month for all borrowers in IDR and reduce many lower-income borrowers’ payments to 0 USD.1

- An extension of the student loan payment moratorium, which was set to expire on August 31, to December 31, 2022.

How will student debt relief impact consumers?

While another extension on student loan payments would be welcomed by millions of borrowers and provide a boost to wealth, we don’t believe that this measure will have a material impact on aggregate demand mainly because loan payments have been paused since March 2020. Further, the estimated savings from the moratorium are somewhere around 3-4 billion USD per month, which accounts for just 0.2% of consumer spending. Moreover, many states have also said they will make it taxable income to the recipient.

Will the deficit impact lead to a further rise in inflationary pressures?

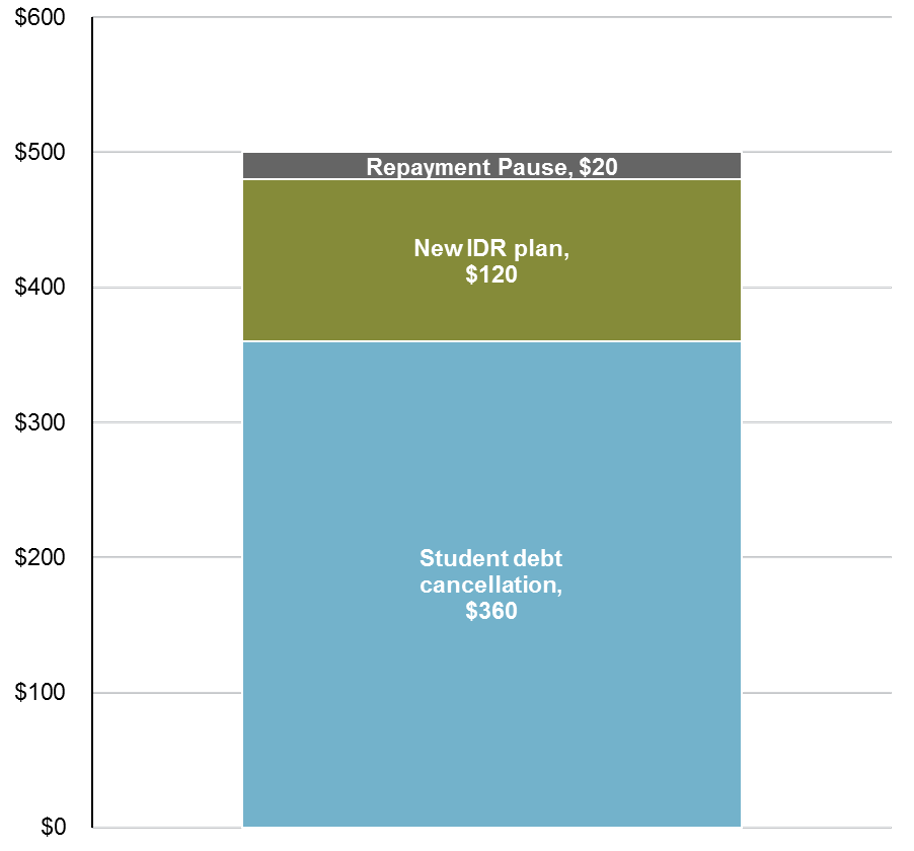

According to the Committee for a Responsible Budget (CRFB), the plan could increase the deficit by 440-600 billion USD over the next decade, more than neutralizing the deficit reduction of the Inflation Reduction Act.

From an inflationary perspective, the student debt changes would impact inflation in three ways – by reducing the amount of income households use to pay down debt over the next year, by increasing household wealth, and by putting upward pressure on tuition costs. The CRFB estimates these changes would boost inflation by 0.15% to 0.27% over the next year. While further inflationary pressures are certainly unwelcome, the aggressive stance from the Federal Reserve will counteract much of this suggested boost to aggregate demand.

Is it likely to be passed?

For context, the passage of the Higher Education Relief Opportunities for Students (“HEROES”) in 2003 with bipartisan support gives the Education secretary the authority to waive debt obligations amid a war or national emergency. The Biden Administration’s position is debt forgiveness is legal given the law covers a national emergency of which the coronavirus pandemic falls under.

That said, student loan forgiveness could face considerable opposition in the courts, and it may not come to fruition. It seems likely that a 6-3 conservative majority Supreme Court would rule that the move by Biden is unconstitutional.

For investors, it’s policies that matter for markets, not politics, and it seems legal challenges could stall any broad sweeping student debt relief package. Importantly though, families saving for college should not wait to do so under the expectation of loan forgiveness. College costs are rising, postponing or stopping investments in hopes of loan forgiveness could be costly, and new rules will reduce financial aid for many families. Given this, opening, and contributing to a 529 college savings plans is one of the best ways to prepare for future education related expenses.2

Cost of President Biden's Student Loan Relief Plan

USD Billions, ten-year cost projection

Related: Is It a Bad Idea To Invest in EM Equities During a Fed Rate Hike Cycle?

Source: Department of Education, Congressional Budget Office, Committee for a Responsible Federal Budget estimates, J.P. Morgan Asset Management. Data are aof September 8, 2022.

1 New Student Debt Changes Will Cost Half a Trillion Dollars - Committee for a Responsible Federal Budget

2 Explore College Planning Essentials, our all-in-one guide to tuition costs, financial aid, investing strategies, 529 plans and more.