Recent events in the U.S. banking system have led to rising concerns that any coming downturn may be more severe than expected. While we recognize that commercial real estate exposure is elevated across the small and medium-sized banks, lending standards are higher than they were prior to the financial crisis, with banks of all sizes far better capitalized. Moreover, many banks stepped away from riskier lending in the aftermath of 2008, creating an opportunity for private credit firms and other direct lenders to increase their market share. For example, as bank lending standards began to tighten last year, a growing share of both leveraged buyout (LBO) financing and highly leveraged loans have come from direct lenders and other non-banks. The results have been remarkable; non-bank lenders have raised an average of more than USD 250 billion per year over the past three years, sit on nearly USD 400 billion of dry powder, and accounted for nearly 80% of leveraged loan issuance in 2022.

It is no secret that as investors scoured the markets for sources of uncorrelated yield in the aftermath of 2008, direct lenders and private credit managers have enjoyed a spectacular run. Direct lending specifically has generated attractive returns and very low default rates, with many attributing this to the higher quality nature of these loans (as evidenced by the minimal share of covenant-lite loans relative to the broadly syndicated market). This higher quality has become particularly apparent in recent quarters, as downgrades in the broadly syndicated markets have outpaced upgrades by a ratio of nearly 3:1.

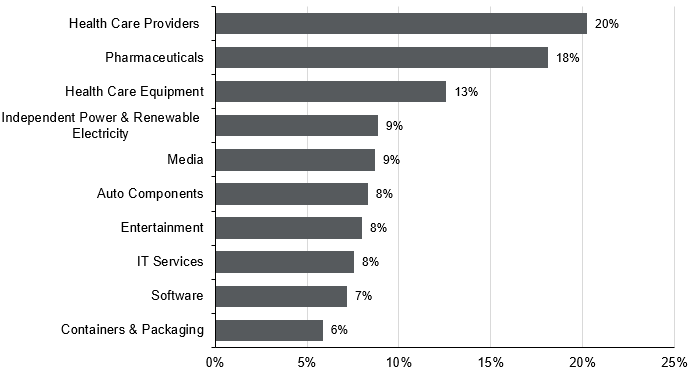

Private credit, however, is not immune to these broader trends; that said, direct lenders are often more willing and able to renegotiate the terms of a loan when the borrower is in distress, and the lower overall share of covenant-lite issuance suggests there is a degree of added flexibility. That said, distressed loan volumes have been rising, with much of the stress concentrated in health care and technology (specifically software, IT, and media). Health care and technology represent 15% and 21%, respectively, of the direct lending market, suggesting that this tension should not be ignored.

Despite these rising headwinds, we still see opportunity in private credit. Direct lending has historically provided high yield-like income with investment-grade levels of risk, and rising stress in credit markets broadly suggests an opportunity in distressed and special situations strategies may begin to materialize in 2024. With the Federal Reserve (Fed) unlikely to ride to the rescue in the way that was the case post-2008, markets will be more discerning between winners and losers; in this world, lenders who can pivot their strategy and provide flexibility are most likely to succeed.

Stress is materializing in health care and tech

Share of distressed leveraged loans by industry, February 2023

Sources: S&P LCD, Pitchbook, J.P. Morgan Asset Management. Data are as of April 25, 2023.

Related: Will the U.S. Dollar Go “Digital”?