Last year was a crazy market for many reasons, but one thing that really stood out was the IPO market.

The 2020 IPO landscape

The 2020 IPO market completely closed in the first part of the year as COVID uncertainty set in but then opened back up with resurgence in the second half of the year even as virus and economic risks remained.

The year actually closed out with IPOs accounting for over $300b raised globally and record-setting issuance in the US.

That was a significant and notable change compared to issuance just years ago. Back then, companies were choosing to stay private longer, opting instead to leverage venture capital and private equity dollars. In fact, according to a recent report out of Goldman, the number of US publicly traded companies in 2019 was at one of its lowest levels in twenty years.

So are we looking at a new era?

Maybe…especially as the public valuations of companies are soaring and we are hearing the dreaded “bubble” term popping up.

But wait, there’s more.

SPACs 101

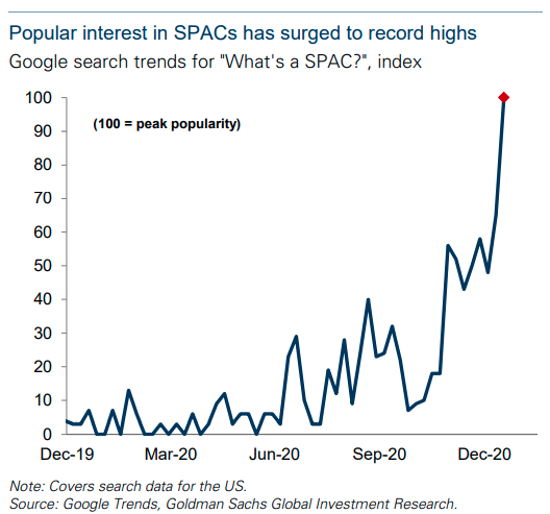

Adding to bubble talk are these things called “blank check” companies… or Special Purpose Acquisition Companies (SPACs). SPACs are existing publicly held investment vehicles, so essentially, they have already IPO’d.

A SPAC is set up to identify existing private companies, buy them (merge), and rapidly take them public. The rapid part is critical – since a SPAC is already public, the merger enables the private company to forgo the traditional and lengthy IPO underwriting process.

But for a SPAC to buy a company, the SPAC first needs to raise money from investors. This is where the term “blank check” comes from – they raise money in advance of finding a company to buy and are entrusted by investors to find a good deal.

Kinda like a Potluck Dinner.

The role of SPACs in 2020 and beyond

According to Goldman Sachs, SPAC “IPOs” comprised over 50% of the US IPOs in 2020.

A record.

And 2021 maintains the momentum since, in the first three weeks of 2021, 56 US SPACs have been brought to market.

With that background in mind, let’s address the “So what?” and if these are worthy of consideration in portfolios.

And of course, that depends – it always does.

If you are one of the pre-private merger investors in the SPAC, research out of both University of Florida and Stanford suggests these investors actually do well (on average).

BUT, if you are a post-merger investor…ehhhh, not so much. In fact, on average, these investors experience negative returns.

But look, there’s always the old “past performance is not an indicator of future performance,” and recent SPACs have indeed done better than those in the past. Still, I’m not sure they are a necessary component of an INVESTMENT portfolio.

Remember, wants and needs are two different things…and my opinion is that most investors don’t NEED them.

If you WANT them, ensure that you are buying them within the constraints of a designated “risk bucket” in your portfolio and consider naming it your “Luck Bucket.”

And as for us, well, we run rules-based portfolios, so if a model alerts us to sell something and surfaces a SPAC as a quality addition to a portfolio, we’ll consider it.

But don’t hold your breath…this chart speaks 1,000 words.

Keep looking forward.

This first appeared on Monument Wealth Mangement.

Related: Is Donating Stock To Charity the Way To Go? It’s Complicated