This year marks the 45th anniversary of deregulation in the domestic commercial airline industry.

If you’re of a certain age, you may remember what flying was like in the years prior. The U.S. government—or, more specifically, the Civil Aeronautics Board (CAB)—was responsible for creating routes and schedules, and it even set airfare. For most American households, flying the friendly skies was prohibitively expensive.

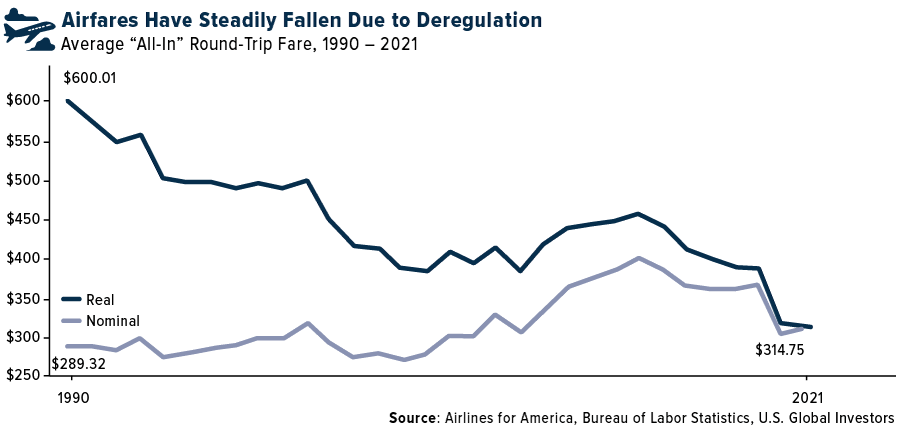

Things have mostly changed for the better post-deregulation. The average price of a round-trip flight in the U.S., adjusted for inflation, has steadily fallen over the years, even if it may not feel like it in nominal terms. This has allowed millions more people to afford the cost of commercial air travel than ever before—and the number continues to grow.

ChatGPT Enters The Chat…

To explore the benefits of airline deregulation further, I sought the help of ChatGPT. Since its launch in November of last year, the open-source content generator, which uses deep learning and artificial intelligence (AI) to mimic natural-sounding human communications, has been a smash hit with just about everyone I’ve discussed it with.

So I decided to put ChatGPT to the test, asking it to write me a blog post on the benefits of domestic airline deregulation. Below are the results, which I have not revised or edited:

Airline deregulation in the United States has had a significant impact on the aviation industry and has greatly benefited consumers. Prior to deregulation in 1978, the Civil Aeronautics Board (CAB) heavily regulated the airline industry, controlling routes, prices, and even the number of flights that could be operated. This resulted in high prices and limited competition.

Deregulation changed all of that. The Airline Deregulation Act of 1978 removed the CAB’s control over routes and prices, allowing airlines to compete freely in the market. This increased competition has led to lower prices for consumers and an increase in the number of flights and destinations offered.

One of the most notable effects of deregulation has been the growth of low-cost carriers, such as Southwest and JetBlue. These airlines have been able to offer lower prices to consumers by operating with lower costs and more efficient business models. This has also led to the creation of new routes and increased accessibility to air travel for many Americans.

In addition, deregulation has also led to the growth of the airline industry as a whole. The number of passengers traveling by air has increased dramatically since 1978, and the industry has become a major contributor to the economy. This has led to the creation of jobs and economic growth in the aviation and tourism sectors.

Deregulation has also led to greater innovation in the industry. Airlines are constantly looking for ways to improve their operations and offer new services to customers. This has led to the development of new technologies, such as e-ticketing and online check-in, which have made air travel more convenient for consumers.

In conclusion, airline deregulation has been a major success in the United States. It has led to increased competition, lower prices, more destinations and flights, greater innovation and overall growth of the industry. The deregulation of the airline industry in 1978 has greatly benefited consumers and the economy, and it continues to do so today.

What are your thoughts? Is ChatGPT destined to replace all content creators?

I’m of two minds. The grammar and punctuation in the passage above are flawless, and the structure makes sense. The facts also check out.

But is it “good” content? I’m not so sure. This might get you an A in an English composition class at the local community college, but it probably wouldn’t be accepted for publication in the New Yorker. Then again, not every piece of writing has to rise to that level to have merit.

Like Bitcoin and crypto in general, AI is still in the very early stages, and I expect to see startling leaps in the quality of human-like thinking and communications in the coming years. This will have huge, as-yet unimagined implications for education, art, science, law and much more.

North American Airlines Generated $39 Billion In Ancillary Fees In 2022

Back to airlines…

One of the biggest consequences of deregulating the airline industry was the creation of new revenue streams to drive profitability and offset volatile fuel costs. These are the ancillary fees I’ve written about so often in the past, and they include everything from seat changes and extra legroom to credit card cobranding and hotel accommodations.

This week, we got an updated snapshot of the global ancillary fee marketplace, as it were. According to CarTrawler and IdeaWorks, the experts on this topic, global airlines raked in an estimated $102.8 billion in 2022, with companies in the U.S. and Canada capturing the largest share of those fees at 38%, or $39 billion. This represents an increase of $15 billion over 2021. Europe claimed the number two spot, seeing $25 billion in ancillary revenues, or about a quarter of the total global amount.

Global Airlines’ Estimated Ancillary Revenue By Region, 2022

Source: CarTrawler, IdeaWorksCompany, U.S. Global Investors

Consumers may bristle at having to pay extra to get an aisle seat, but the fact of the matter is that these non-ticket items are here to stay. They’ve become more and more integral to airlines’ cash flow generation, and since carriers have such a strong moat built around them, passengers have little choice but to pay them. I believe this only enhances the investment case.

European Carriers On A Tear

Recently I shared a chart showing how shares of Asian airlines have jumped on the news that China has relaxed certain Covid-related travel restrictions. They’re not the only ones seeing huge gains.

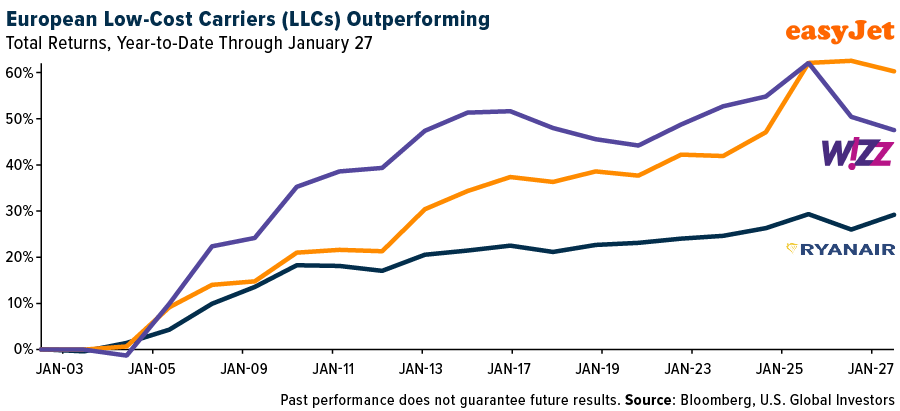

Take a look at the year-to-date performance of European low-cost carriers (LCCs). Ryanair has increased 29%, Wizz Air 47% and easyJet a phenomenal 60%.

Investors are responding positively to reports that leisure travel demand has returned to pre-pandemic levels. Families are ready to return to the skies after three years, and LLCs are often their preferred choice.