Written by: David Lebovitz

School buses are back on the roads, the bookbags are filled and lunches are being packed. That’s right, it’s time to go back to school! But with many parents (and investors!) taking the end of summer to be with their families and go to the beach one last time, kids are not the only ones who need a refresher before they head back to the classroom; in today’s blog, we try to help parents get ready to go “back to school.”

The best place to start is the labor market. The Job Opening and Labor Turnover Survey (JOLTS) highlighted that job openings fell to a level of 8.8 million in July, the lowest level since March 2021. Additionally, quits and layoffs both increased; while all three of these metrics are elevated relative to pre-pandemic levels, they are beginning to signal that the labor market is moderating.

Further confirmation of this moderation could be found in the August employment report, which saw nonfarm payrolls increase by 187,000 and the unemployment rate rise to 3.8% due to an increase in the labor force participation rate. However, both the June and July employment numbers were revised lower, which alongside weaker than expected growth in average hourly earnings, points to waning labor market momentum.

While we are seeing signs that the labor market is cooling, other economic data released last week reinforced the idea that economic growth may have accelerated in the third quarter relative to what was observed during the first half of the year. Real consumer spending remained strong in July, growing 0.6% month/month. Services and goods spending picked up as well on the back of a declining savings rate. At the same time, nominal construction spending picked up in July, with particularly strong growth in private residential spending.

Looking ahead, recent softness in the labor market, coupled with a downward trend in inflation, should be enough to keep the Federal Reserve on hold at the September meeting. Whether this trend persists going forward, however, remains to be seen, as there is a tension evolving between better economic activity and cooler inflation data. Either growth will roll-over and inflation will continue moving lower, or growth will prove to be resilient and, as a result, inflation will be stickier than expected. Either way, high quality fixed income assets continue to look attractive, as does the idea of bringing portfolio duration back to a more moderate stance.

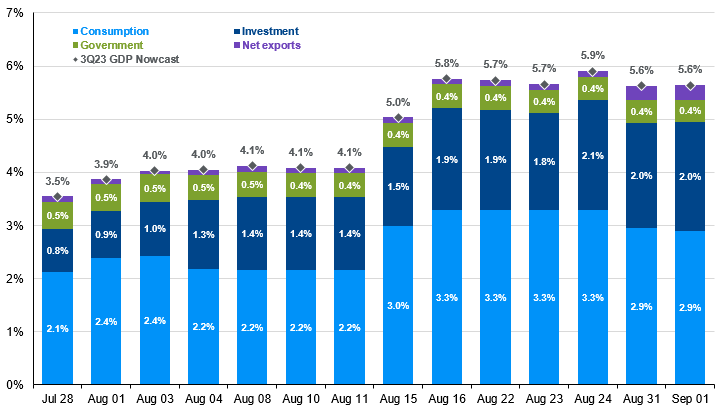

Contribution to Atlanta Fed's GDP Nowcast by component

Percentage point contribution to 3Q23 GDP growth, q/q at a seasonally adjusted annual rate

Sources: Federal Reserve Bank of Atlanta, J.P. Morgan Asset Management.