Written by: Tom Nakamura | AGF

The U.S. dollar (USD)’s standing as the world’s dominant reserve currency may seem in jeopardy following reports that Brazil, Russia, India, China and South Africa (i.e., the BRICS) want to create an alternative currency for use by them (as well as other nations) in international trade settlements and global financial operations. But “de-dollarization” is nothing new and even if the trend were to accelerate from here, it is unlikely to have much impact on the greenback’s investment value in the foreseeable future.

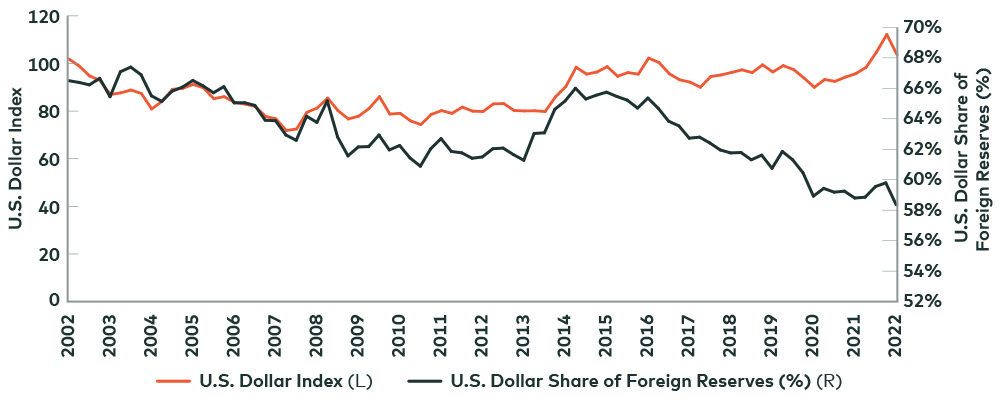

In fact, this may already be evident (see chart 1). Take the U.S. dollar’s share of foreign exchange reserves, for example. It has steadily declined for the better part of the past two decades, yet over that same period, the U.S. Dollar Index – which ranks the greenback against a basket of six other currencies – has remained relatively stable and increased since 2010.

U.S. Dollar’s Share of Foreign Exchange Reserves Has Fallen but the U.S. Dollar Index Has Not

Source: Bloomberg LP. as of April 17, 2023.

That doesn’t mean recent efforts to limit the influence of the U.S. dollar should be ignored. In addition to the BRICS’ alternative currency plans, separate agreements between China and Brazil to settle trades in Chinese yuan, as well as Saudi Arabia’s openness to peg their oil prices to something other than the greenback raise the spectre of a very different landscape for currency markets going forward –especially as it relates to a country’s foreign exchange (FX) reserve policy.

The general theory with reserve management is that the stock of reserves should reflect net foreign obligations, including covering imports. In turn, the more that trade is invoiced in non-USD currencies, the less reason for reserve managers to hold U.S. dollars.

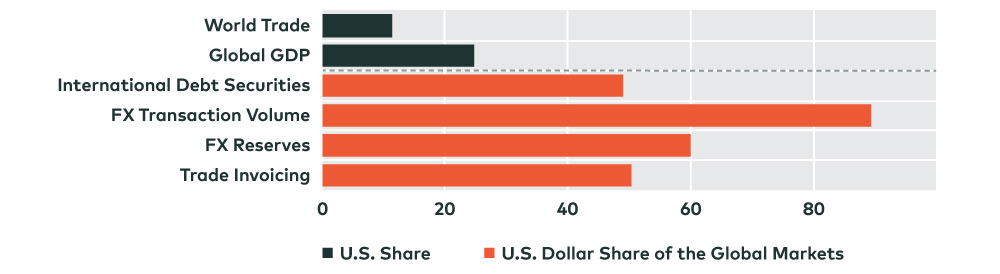

Still, trade is not the only consideration for holding reserves of one currency over another (see chart 2). Liquidity – or how quickly investment securities can be turned into cash – is a principal factor as well. So too is the convertibility of cash into a particular set of currencies that may be needed.

The International Role of the U.S. Dollar

Source: Bank for International Settlements as of December 5, 2022

And while these two factors have arguably become less favorable for the U.S. dollar in relation to countries that have faced sanctions (or fear facing sanctions in the future), no other global currency remains as liquid or convertible as the greenback, which, in our opinion, is also beyond reproach in terms of trust and credibility.

Ultimately, the U.S. dollar’s role as the world’s reserve currency seems secure and its value is unlikely to erode solely because of recent geopolitical developments in support of “de-dollarization.”

Moreover, any future decrease in the greenback’s importance would likely happen over a long period of time and would first require a serious competitor to emerge on the world stage – an eventuality that is much talked about these days, but far from certain and may not exist for some time still to come.

Related: Big Tech Earnings Out This Week: What Investors Are Looking For