Adapt or die.

That was the tough choice facing many small businesses when COVID-19 hit.

It was truly survival of the fittest.

The good news is millions of American entrepreneurs rose to the occasion.

According to CNBC, a record 4.3 million new business applications were processed last year. And 77% of those were online businesses!

Meanwhile, millions of existing mom-and-pop shops rapidly retooled to do business on the internet.

As regular RiskHedge readers know, “entrepreneur stocks” made this possible.

Entrepreneur stocks help small companies set up and grow online. They’ve been lucrative investments since the pandemic struck.

Shopify (SHOP) helps businesses set up and run online stores. It has rallied 226% since April 2020.

Square (SQ) helps small businesses accept payments online. It has surged 355% over the same period.

Etsy (ETSY) gives artists and creators a marketplace to sell custom crafts. It has soared 243% since the March 2020 COVID crash.

But the biggest game-changer for small businesses has been the rise of “cloud computing for the little guy”…

In a nutshell, cloud computing lets companies access powerful software over the internet without paying a fortune.

Cloud computing stocks aren’t new. But most well-known cloud computing platforms, like Amazon Web Services and Microsoft’s Azure, are geared toward large enterprises.

I’m more interested in cloud computing companies that help little companies… simply because the untapped potential is huge.

Small- and medium-sized businesses employ 60 million people in the US. They also make up 99.9% of all registered companies.

But until COVID, almost none of them were online.

A recent Bloomberg study found only half of small businesses have websites. Even fewer have ever sold anything online!

Meanwhile, the huge benefits of moving to the cloud make it a no-brainer for most companies...

Deloitte found that small businesses that use the cloud grow 26% faster than ones that don’t.

That same study found 69% of companies plan to increase spending on cloud computing in the next three years.

Despite all this, most small companies haven’t moved to the cloud yet. A study by McKinsey confirms most companies only have about 20% of their workflows happening on the cloud.

In other words, there’s hypergrowth potential for cloud computing companies that focus on small businesses...

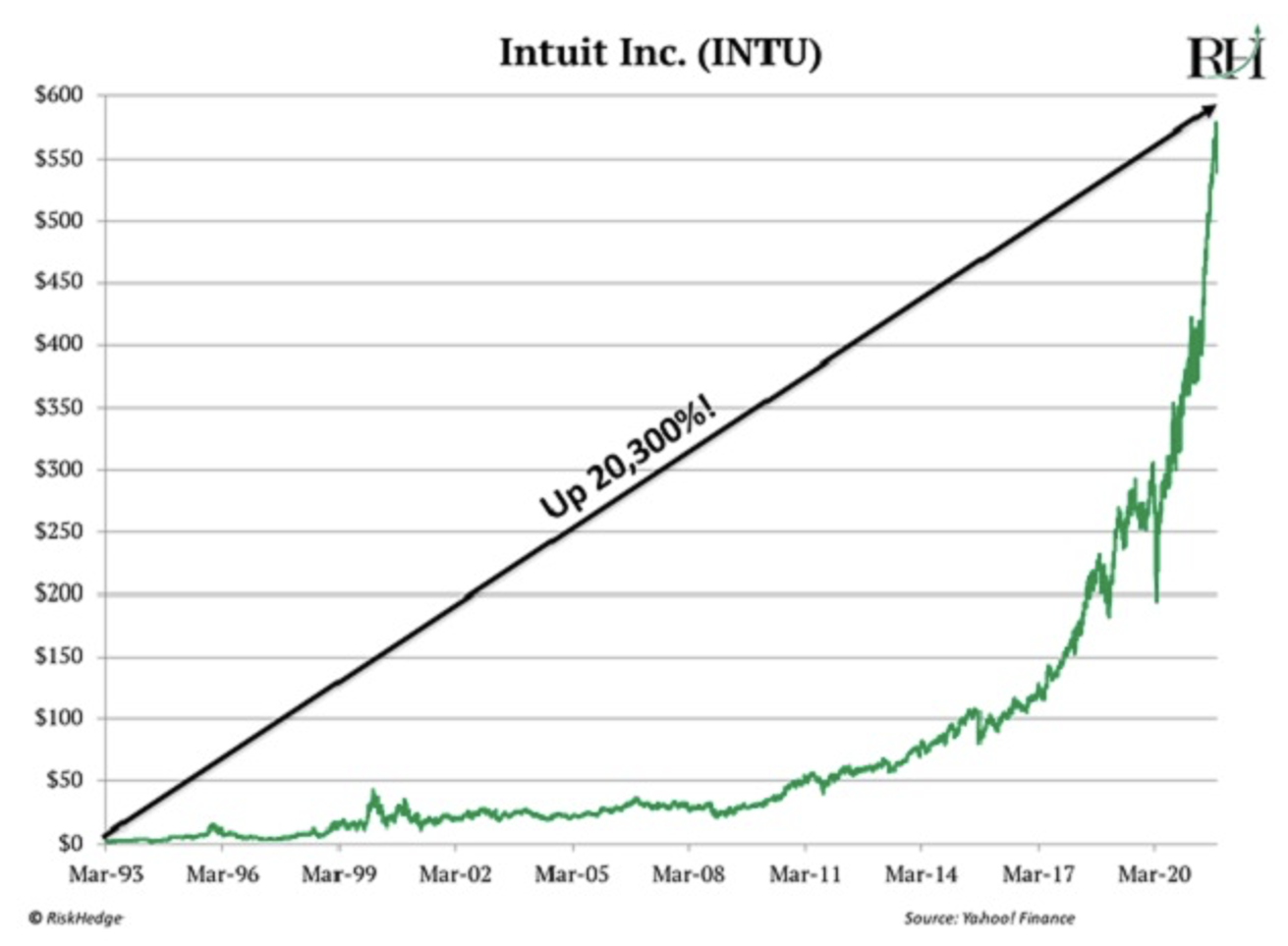

Consider Intuit (INTU)…

Intuit isn’t exactly a household name. But many small businesses couldn’t live without this company. It owns the credit score–tracking company Credit Karma and budget-tracking company Mint.

It also owns the tax-preparation company TurboTax and accounting software QuickBooks. And it recently acquired MailChimp to help small businesses with email marketing.

If there were a stock market Hall of Fame, Intuit would be a shoo-in. It’s returned over 20,300% since it IPO’d in March 1993. That’s enough to turn every $1,000 into $203,300.

Then there’s HubSpot (HUBS). Like cloud computing pioneer Salesforce (CRM), HubSpot helps businesses find, engage, and convert customers. Unlike Salesforce, HubSpot focuses on helping smaller companies.

HubSpot has rallied 77% this year and 2,500% since it went public.

I’m expecting even bigger returns out of stocks like these in the years to come.

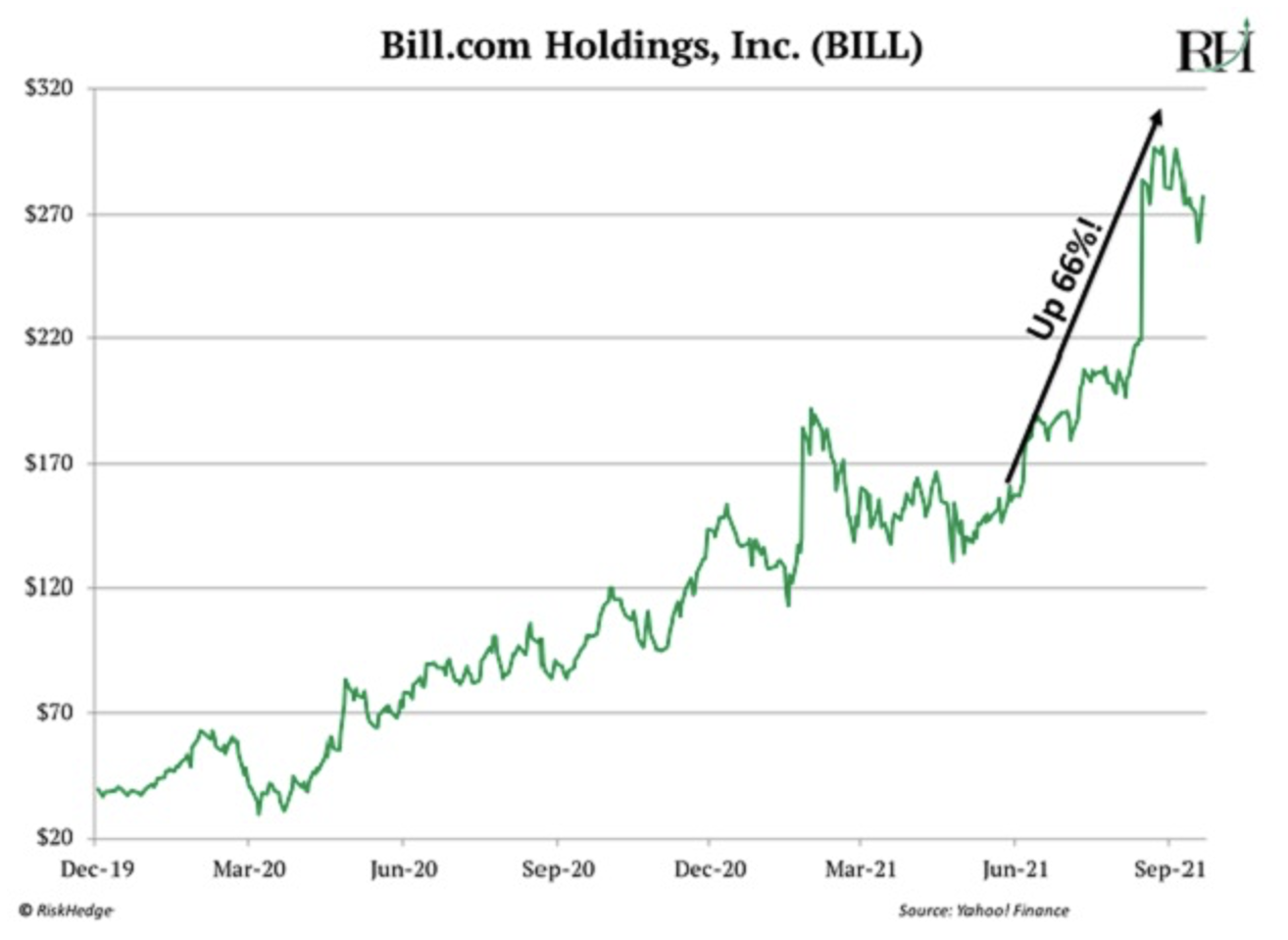

This is why I recently recommended Bill.com (BILL)…

Bill.com helps small businesses simplify payments with a solution that is automated, digital, and cloud-based.

Bill has surged 1,070% since it went public on December 12, 2019, and 66% since I encouraged my subscribers to buy it in June.

Bill continues to look like a market leader. However, there’s a strong possibility it will trade a little choppy until the broad market gets back on track. So, I’d like to see more confirmation of strength before I recommend buying more shares.

But companies like Bill.com will continue to thrive… because it’s never been more important for small businesses to operate on the cloud.

Keep your eyes on the cloud software stocks helping the little guys—that’s where the biggest profits will be found.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.