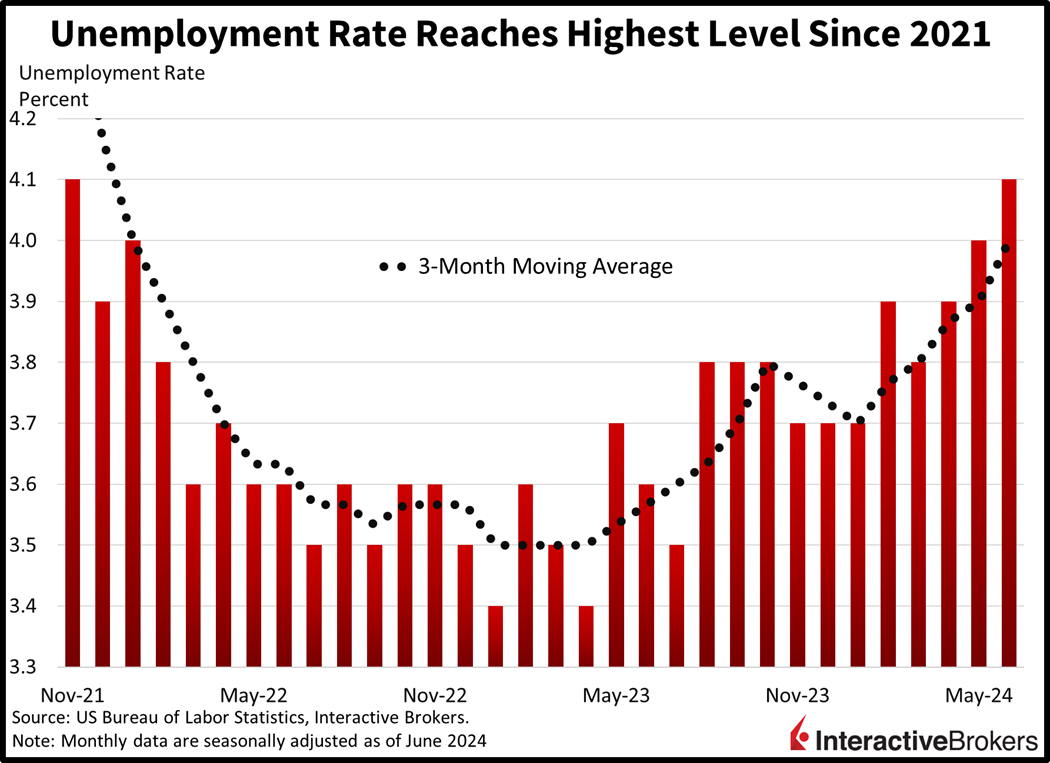

Investors are cautious on today’s Jobs Friday as a headline beat on payrolls contrasts with three consecutive monthly upticks in the unemployment rate. Traders are certainly assessing if the Fed will have time to respond to the potential for further labor market deterioration, preferring large-cap tech over cyclicals and small-caps, despite rates plunging following this morning’s print. Interestingly enough, the unemployment rate hit the highest level since November 2021, aligning with continuing unemployment claims reported last Wednesday, which reached their tallest heights since the same month.

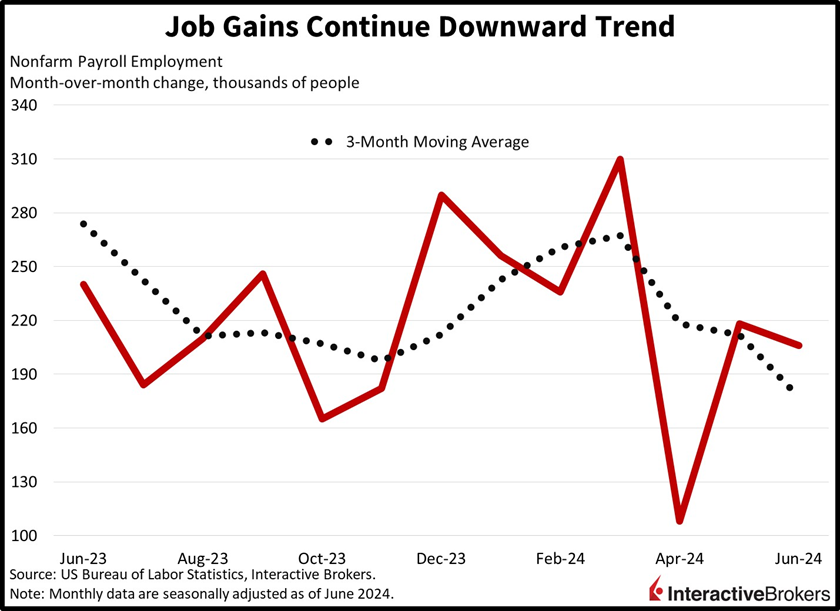

Hiring Expansion Continues Slowing

The US labor market decelerated last month, but June job gains still sported an impressive 206,000 figure, slightly above projections calling for 200,000 and below May’s downwardly revised 218,000. Workers continued to enjoy wage bumps, with average hourly earnings rising 0.3% month over month and 3.9% year over year, in-line with the median estimate. But while headcount additions and rising paychecks remained robust, there was certainly some weakness under the hood.

Last month’s roster expansion featured yet another non-cyclical tilt, while three economically sensitive sectors lost employees. Indeed, payrolls declined in the professional/business services, retail trade and manufacturing segments by 17,000, 8,500, and 8,000. Additionally, over half of the progress was derived from the private education/health services and government groups, which added a combined 152,000. Temporary help was down a massive 48,900 in June, the most since April 2021, indicating reduced labor demand.

Elsewhere, growth was led by construction, other services and wholesale trade, which added 27,000, 16,000 and 14,000. Financial activities, transportation/warehousing, leisure/hospitality, information and utilities all added below 10,000 while mining/logging was unchanged during the period.

Unemployment Hits Multi-Year High

Perhaps most concerning, however, is the steady rise in unemployment, which rose for the third consecutive month to 4.1%, the loftiest level since November 2021. The increase in joblessness is not a favorable development for folks that clock-in and individuals seeking work, but if the trend continues, it will certainly provide the nation with interest rate relief. Market players are responding by raising the odds of the Fed dishing out a September cut to 72%. After all, what the central bank wants is a gradual and controlled cooling of the employment market, hoping that the development will serve to quell inflationary pressures. The labor force participation rate rose 10 basis points (bps) to 62.6%, erasing half of the previous month’s decline while the average hourly workweek remained steady.

The Canadian economy also saw an uptick in joblessness, as the nation lost 1,400 workers and its unemployment rate increased 20 bps to 6.4%, climbing above the consensus expectation of 6.3%.

Jobs Report Suppresses Yields

The rise in joblessness is leading to an increase in risk-off market movements, as traders appear unsure about stocks while they scoop up Treasurys to lock in the yields of today. The major US equity indices are mixed, with the Nasdaq Composite and S&P 500 benchmarks up 0.8% and 0.3% while the Russell 2000 and Dow Jones Industrial Average lose 0.6% and 0.1%. Sectoral participation is mixed with communication services, consumer discretionary and consumer staples leading the gains; they’re up 1.5%, 0.5% and 0.4%. Energy, industrials, and materials are leading the downside with losses of 1.2%, 0.7% and 0.3%. Treasurys are catching bids with the 2- and 10-year maturities changing hands at 4.61% and 4.29%, 8 and 6 bps lighter on the session. The Dollar Index is down 16 bps as the greenback loses ground versus the euro, pound sterling, franc, yen and Aussie dollar. The US currency is gaining against the yuan and Canadian dollar though. Commodity majors are all up, benefitting from upside demand prospects on the back of reduced borrowing costs. Silver, copper, gold, lumber and crude oil are up 2.6%, 1.4%, 1.2%, 0.4% and 0.4%.

Most Consumers Depend on Paychecks

Consumer spending, particularly among lower- and middle-income households, depends on the labor market continuing to provide job opportunities. The current slowdown will be interesting to focus on against the backdrop of a fresh earnings season right around the corner. Margins will be in focus, as businesses contend with a combination of revenue deceleration and sticky cost pressures. Finally, a persistent up-tick in the unemployment rate raises the odds of the nation entering a downturn.