Written by: David Waddell | Waddell and Associates

If markets seem confused, it’s because they are. Without clarity on Trump’s legislative agenda, the pathways forward for fiscal policy, monetary policy, and currency policy are largely unknowable. Fortunately, the economy has shown remarkable growth resilience and should continue to, while each of these major inputs seeks “new normals”. So don’t read too much into current market gyrations because until Trump codifies his transformative legislative agenda, 2025 hasn’t even started yet.

The Full Story:

The Trump “bump” for the stock market began as betting markets started pricing in Don’s victory. Between early August and late November, the S&P 500 large cap index rallied more than 15% while the Russell 2000 small cap index rallied more than 20%.

Stock markets react quickly. Other markets react more slowly.

This past month, the 10-year Treasury yield rose by 13%, oil prices per barrel rose by 11%, and the US Dollar index rose by 3%. The “catch-up” appreciations in interest rates, oil, and the US dollar have capped further appreciations for stocks. I know of very few reliable truths in investing, but when interest rates, oil, and the US Dollar rise simultaneously, stocks do not. This explains the recent weakness in equities, making it more of a moment for digestion and less of a moment for apprehension. Nonetheless, 2025 presents more questions than answers for investors. Here are the major ones driving market anxieties:

Fiscal Policy?

Donald Trump swept the ballot box on promises of faster economic growth, lower consumer inflation, and more fiscal accountability. Fiscal policy can either be economically expansionary or contractionary. For 2024, the US government received roughly $5 trillion and spent $7 trillion, driving a fiscal deficit of nearly $2 trillion—that’s more than 6% of our nation’s GDP. Traditionally, US fiscal deficits average around 3% of GDP. At 6%, President Biden’s fiscal policy has been highly expansionary, as our economic growth attests.

Trump campaigned on slashing spending while using tax cuts to increase economic growth even further. These missions seem slightly at odds as tax cuts (in the short run) increase deficits while spending cuts reduce them. Depending on the relative size of both reductions the deficit could either expand (stimulus) or contract (constraint). Relying on foreign tax receipts through tariffs may neatly solve the math problem, but historically, spirited tariff tournaments have created several others.

It’s unclear, at this moment, what legislation will follow and, therefore, whether we will have fiscal expansion or fiscal contraction. But we do have some Trump budget experience to draw upon. During the first Trump administration, the fiscal deficit rose from 3.4% of GDP to 4.6% of GDP (pre-COVID). This was decidedly expansionary, even as inflation fell. Unfortunately, this time around, fiscal expansion would start with deficit levels at 6%+. Bond markets could protest deeper deficits with Treasury downgrades and/or higher yield demands on Treasury issuance. This could weigh on economic growth prospects just as reductions in deficits at the hands of the DOGE committee might.

Until we gain greater clarity on Trump’s legislative intentions, fiscal policy’s 2025 contribution/deduction from GDP is largely… unknowable.

Monetary Policy?

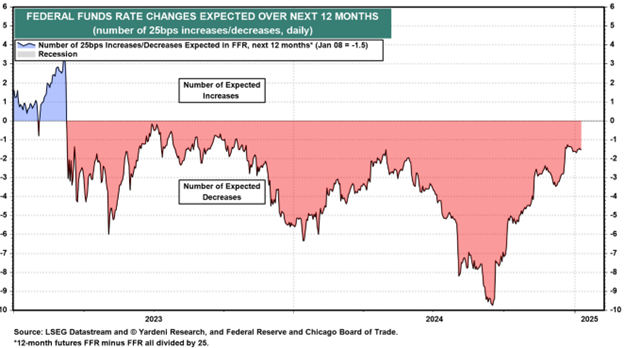

This time last year, the US Federal Reserve projected that the overnight US interest rate would end 2025 at 3.6%. In their most recent summary of economic projections, they forecast year-end rates of 3.9%. Clearly, the Fed has become more dovishly hawkish with most of the attitude adjustment arriving recently. Note that just a few months ago, investors forecast nearly 10 rate cuts for 2025 , compared with expectations for 1.5 rate cuts today:

Is this an inflation warning? Not really. Inflation expectations have risen marginally, but the 5-year breakeven rate forecasting future inflation levels sits well within its normal range between 2 and 2.5%. What this reversal of Fed cut forecasts likely signals is higher levels of confidence in US economic growth prospects. Consider the following:

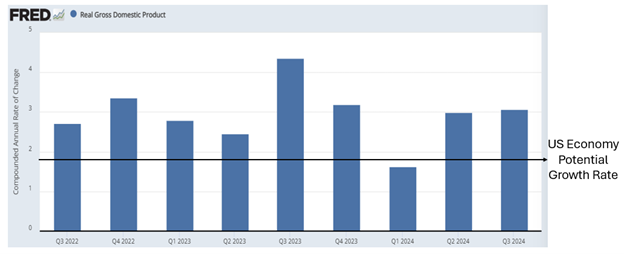

Source: Federal Reserve Bank of St. Louis https://fred.stlouisfed.org/graph/fredgraph.png?g=1CNHc

The Fed projects US economic growth potential lies around 1.8%. Over the last nine quarters, the US economy has averaged GDP growth of nearly 3%. Government largess can explain some of this, but technological productivity enhancements can as well. What we don’t know is how Trump’s expansionary fiscal policy will affect our economic growth rate that’s performing well above potential. Any acceleration could reignite inflation fears. Any deceleration could reignite recession fears or goad Trump into doubling down on stimulus measures.

Oh, and just to confuse things further, the Fed continues to sell down its balance sheet to tighten monetary conditions. The market expects them to conclude the program mid-year, but given the conditions highlighted above, they may not, further complicating rate projections. In sum, until we gain greater clarity on Trump’s legislative intentions, monetary policy’s 2025 contribution/deduction from GDP is largely… unknowable.

Currency Policy?

I will save a longer form of this discussion for our upcoming annual outlook, but as a preview, the largest and most important market in the world isn’t the equity or bond market, but the currency market. Trump’s tariff agenda infers a stronger dollar. Trump’s vocal agenda demands a weaker dollar. Clearly, Trump wants to raise revenues from offshore sources to finance lower fiscal deficits. What he hasn’t discussed – but his Treasury secretary nominee certainly understands – is that if you want foreign tax receipts and a weaker currency, you don’t tax foreign goods; you tax foreign investment. But doing that disincentivizes foreign fund flows into the US, which we need to finance our deficits.

For now, the markets have decided that the MAGA agenda is a strong dollar agenda, but this could change quickly. In sum, until we gain greater clarity on Trump’s legislative intentions, currency policy is largely… unknowable.

Sources: LSEG Datastream and Yardeni Research, Federal Reserve Bank of St. Louis, CBO and US Dept. of Treasury

Related: 3 European Stock Market Giants You Can’t Afford to Ignore